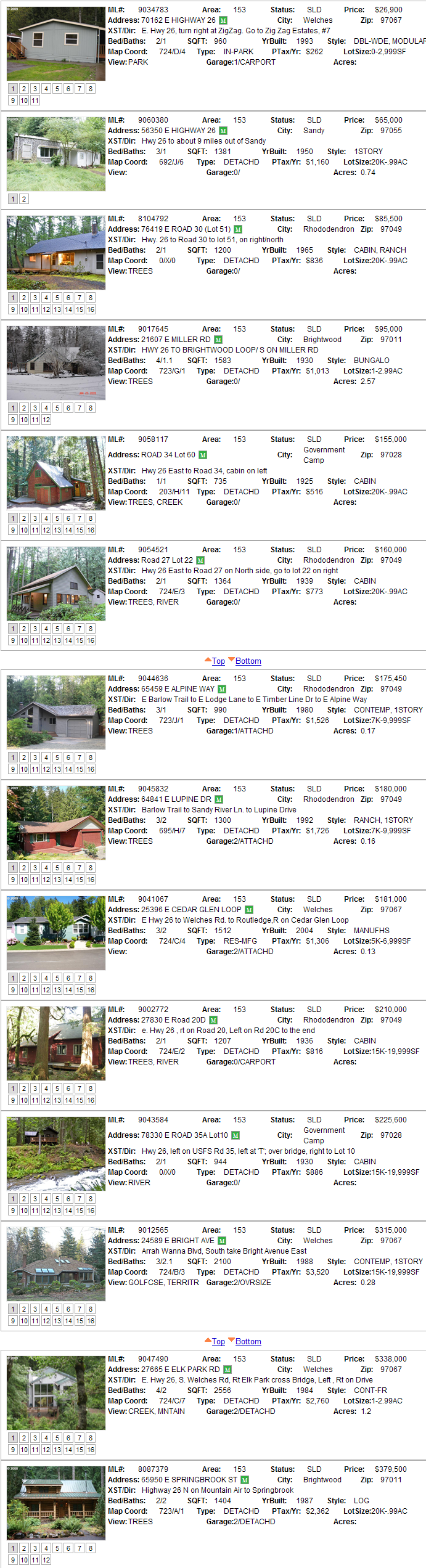

New Zig Zag Riverfront Cabin on Market

NEW ON MARKET $187,500

Great sturdy knotty pine cabin on the Zig Zag River only eight minutes to premium ski slopes! Located in the pristine setting of the Mt. Hood National Forest and about an hour from Portland. This cabin was finished in 1935 and built during the depression on weekends by the original owner. The current owner has had the cabin for 35 YEARS! But, it's time to travel and they hate to sell it but the time has come.

There is one bedroom on the main level and it's BIG! Your guests can enjoy their own private bedroom upstairs plus there is a loft area with multiple beds. Original wood floors are in the living room and the kitchen/dining area boasts a big woodstove and a vintage refrigerator! Sit back in front of the fireplace after a day on the slopes or read a great book on the riverside deck.

The Mt. Hood National Forest boasts a pristine setting with tall firs and roaring rivers yet close to all the amenities of a full service community. This cabin is on leased land. Email for details.