First of all Happy New Year!

What a crazy December on the mountain! Warm temperatures and a serious wind and rain event that blasted through the area have homeowners still in clean up mode. Power outages, land slides and a lack of snow has put a damper on the mountain community as we dig out, clean up and get ready for the new year.

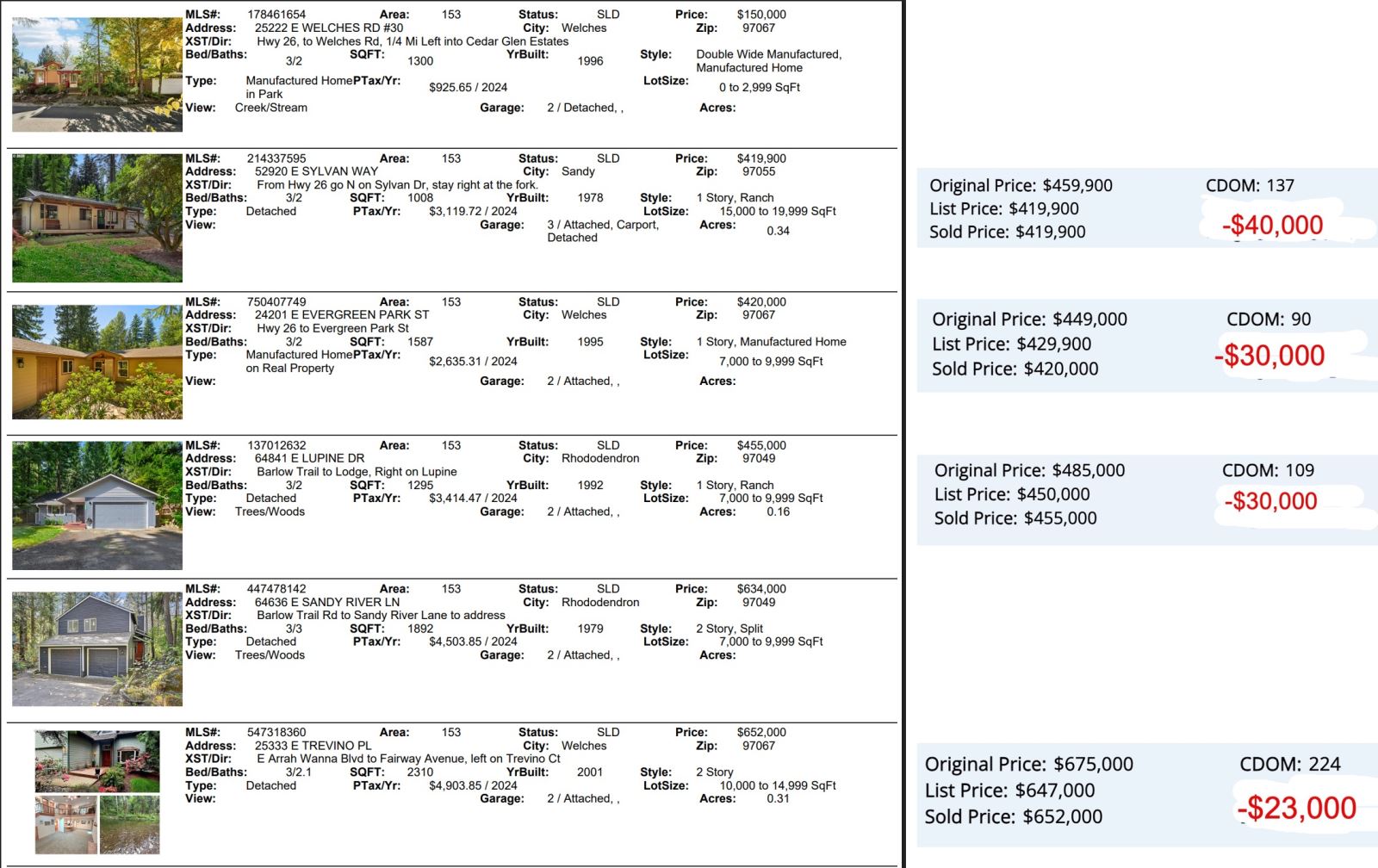

This year saw a significant shift in the market with the most inventory we’ve seen in years. Interest rates, still below historic norms, have delayed buyer purchases along with affordability issues, layoffs and high debt levels. Sellers have reduced prices and made many more concessions than we’ve seen in a long time. The evidence is clear in the November sales listed under the RMLS data. The majority of sales had price reductions from the original list price to final price. Days on market are lengthening.

We look forward to 2026 and what it will bring to the market. NAR’s chief economist says the following:

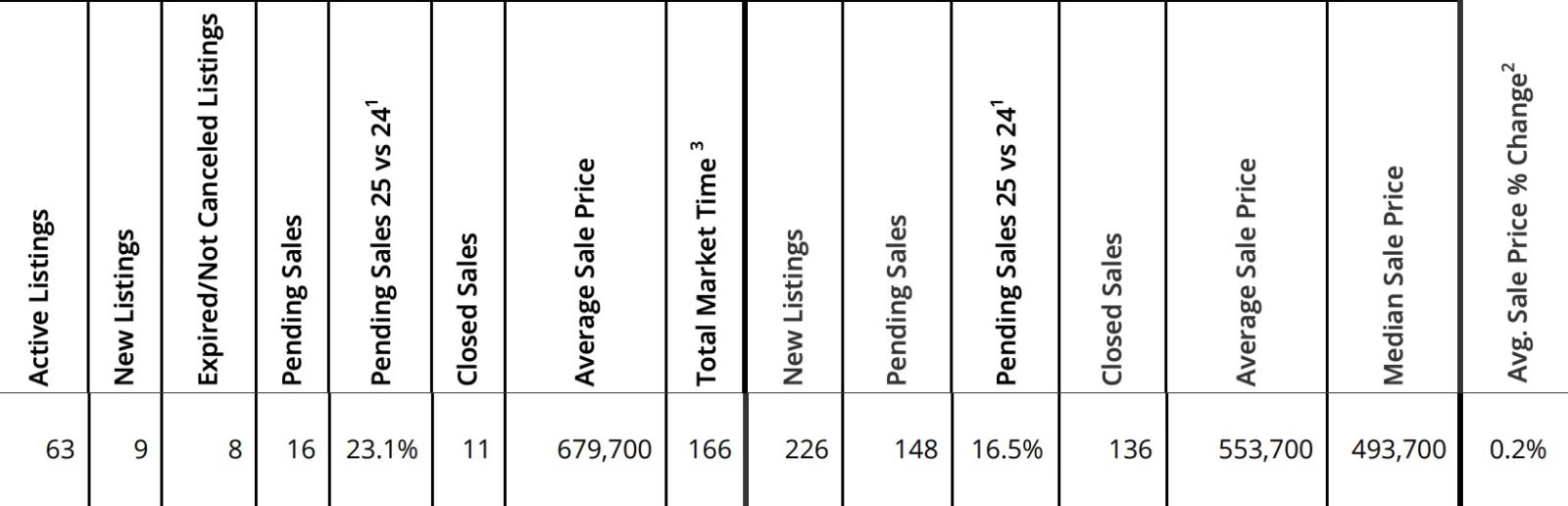

Here are the statistics from RMLS for November 2025.

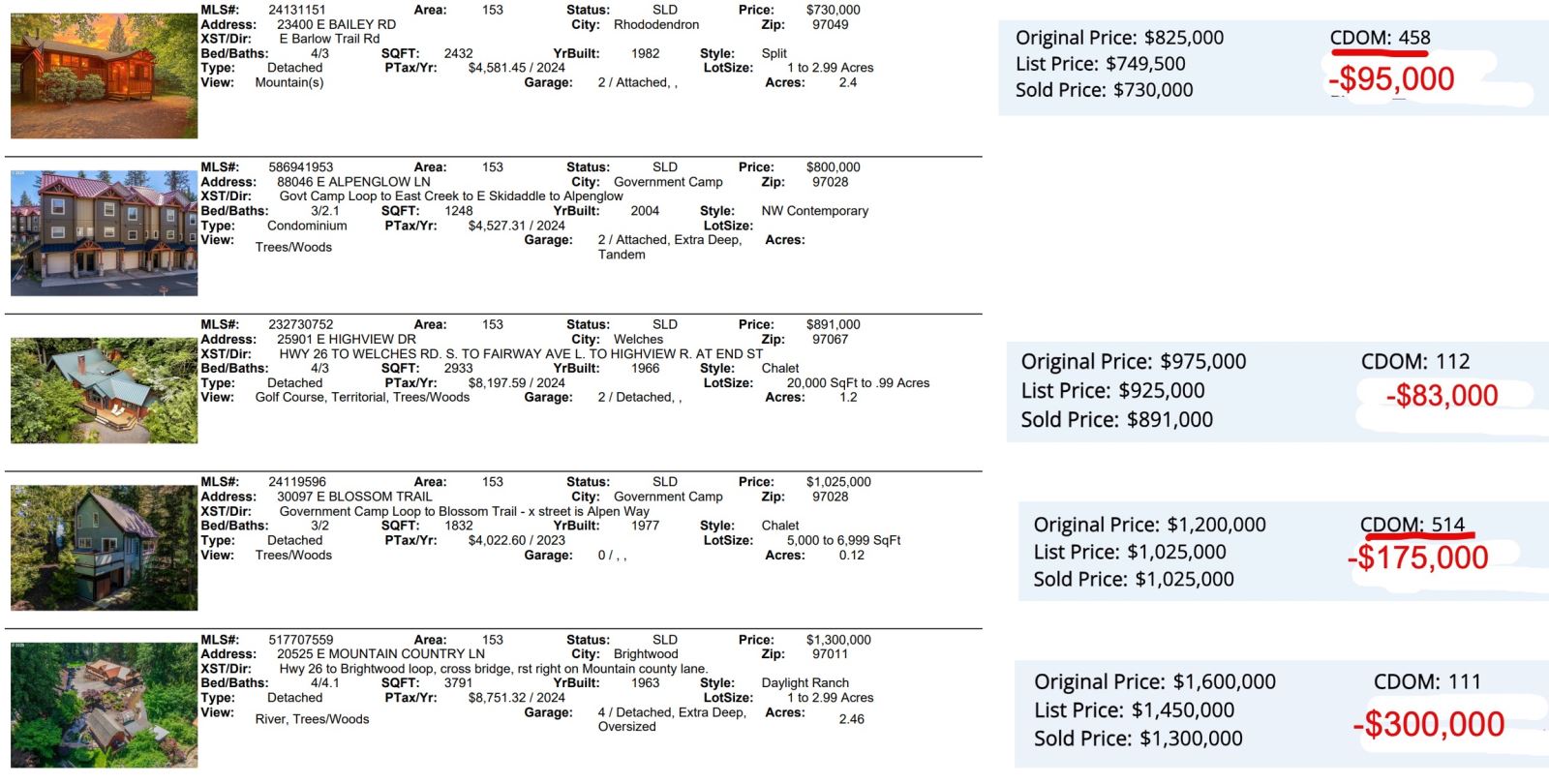

November Sales 2025

Note two of these properties sold below had excessive marketing times with 458 and 513 days which skews the data in the above chart. CDOM means cumulative days on market. Typically the longer a property is on the market the lower the final selling price will be. Sellers acting quickly will preserve some of the massive equity gains over the past five years. The final price of these properties demonstrate how difficult pricing has been over the past year with this adjustment period. As sales happen and comparable sales are used to price new properties coming on the market things should level out a bit more and hopefully less properties will sit.