Uncertainty Is Impacting Mortgage Rates

How Global Uncertainty Is Impacting Mortgage Rates

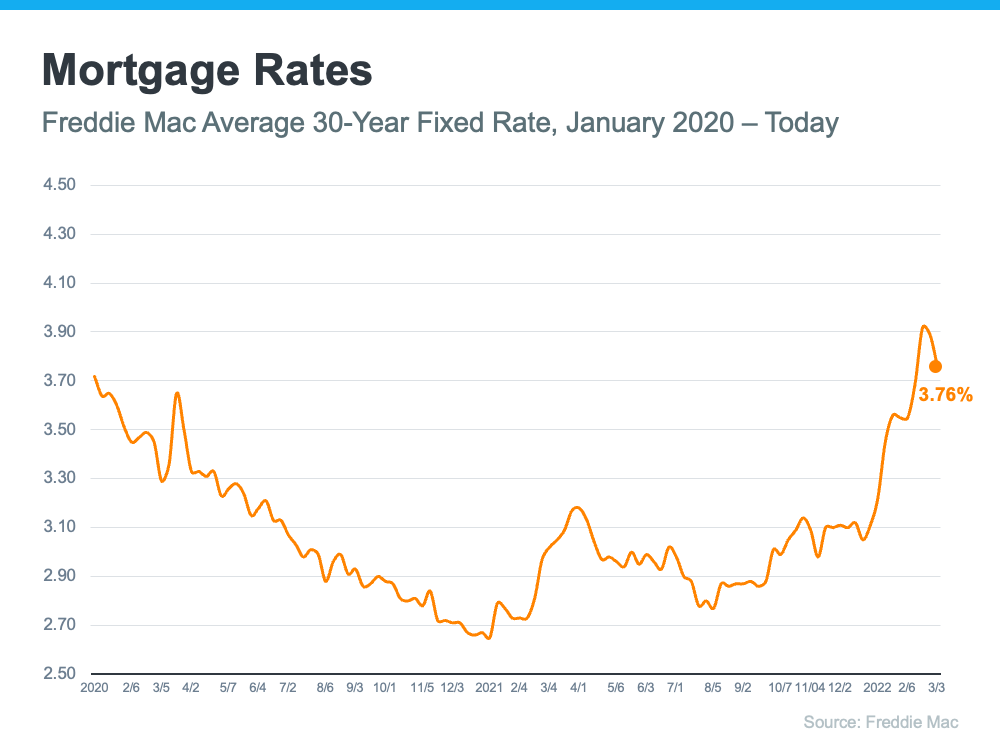

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

.jpeg)

.jpeg)

.jpg)

![The Difference Between Renting and Owning [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/24130106/20220225-MEM-1046x2279.png)