The Surprising Trend in the Number of Homes Coming onto the Market

The Surprising Trend in the Number of Homes Coming onto the Market

If you're thinking about moving, it's important to know what's happening in the housing market. Here's an update on the supply of homes currently for sale. Whether you're buying or selling, the number of homes in your area is something you should pay attention to.

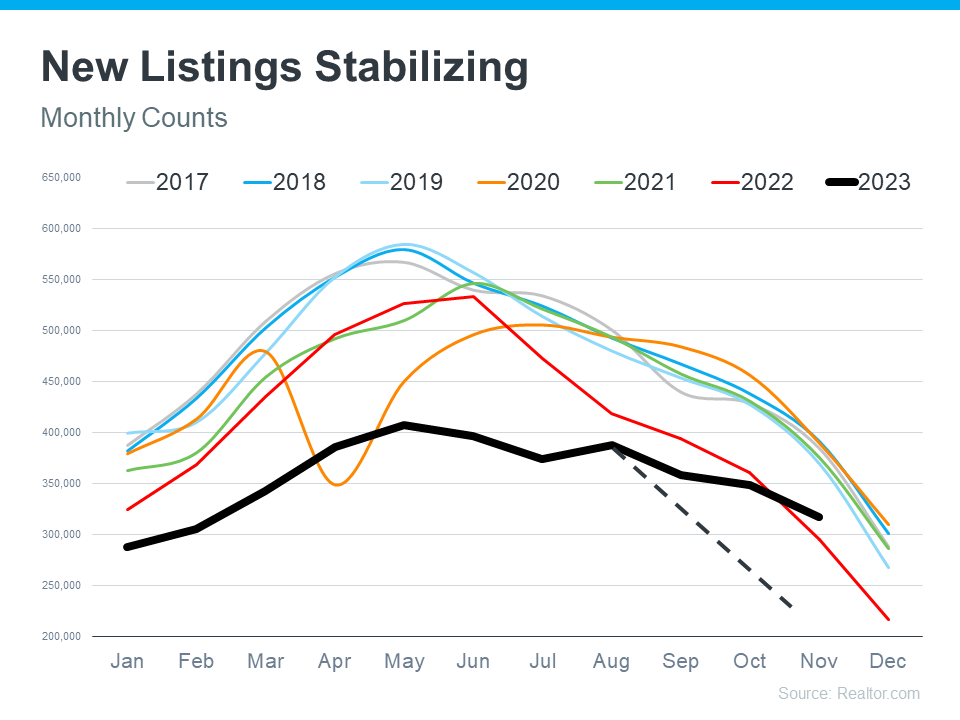

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

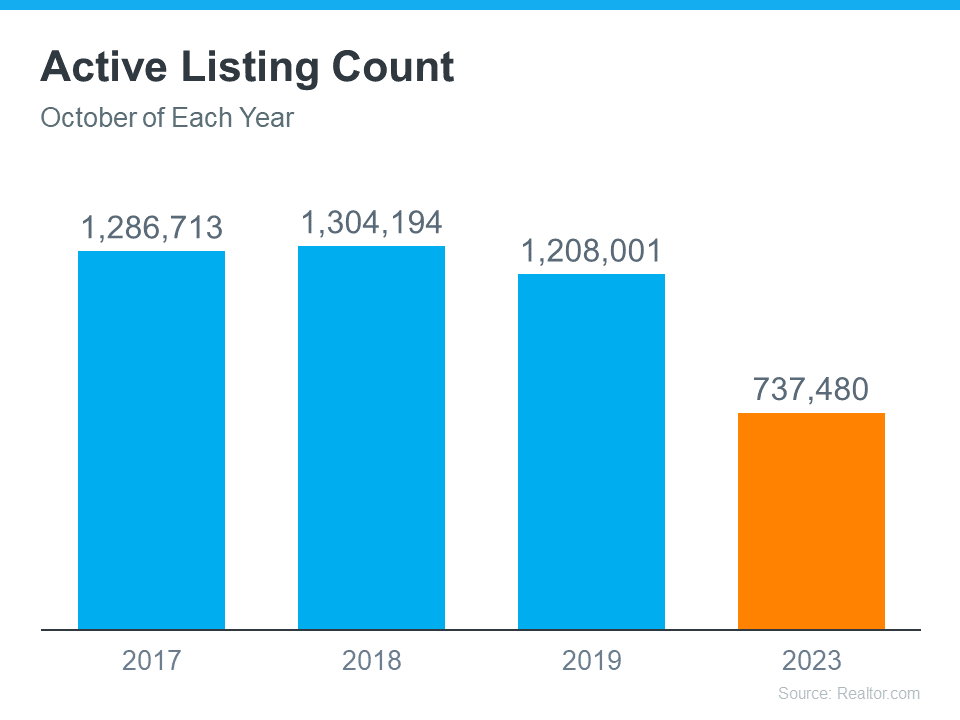

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you're on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move. If you have questions or concerns about the availability of homes in our local area, let’s connect.