Mt. Hood Sales Surge This Summer

Wow! If there ever was a great time to sell, this is it. Buyers are moving out of the city and second home buyers are on the prowl for an easy to get to getaway!

Displaying blog entries 71-80 of 360

Wow! If there ever was a great time to sell, this is it. Buyers are moving out of the city and second home buyers are on the prowl for an easy to get to getaway!

Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there are sellers selling them, so the scale is tipped in favor of the sellers.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), total housing inventory is down 18.8% from one year ago. Inventory is well below what was available last year, and the houses that do come to the market are selling very quickly.

Sam Khater, Chief Economist at Freddie Mac notes:

“Simply put, new housing supply is not keeping up with rising demand. We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year. More than half of all states have a housing shortage.”

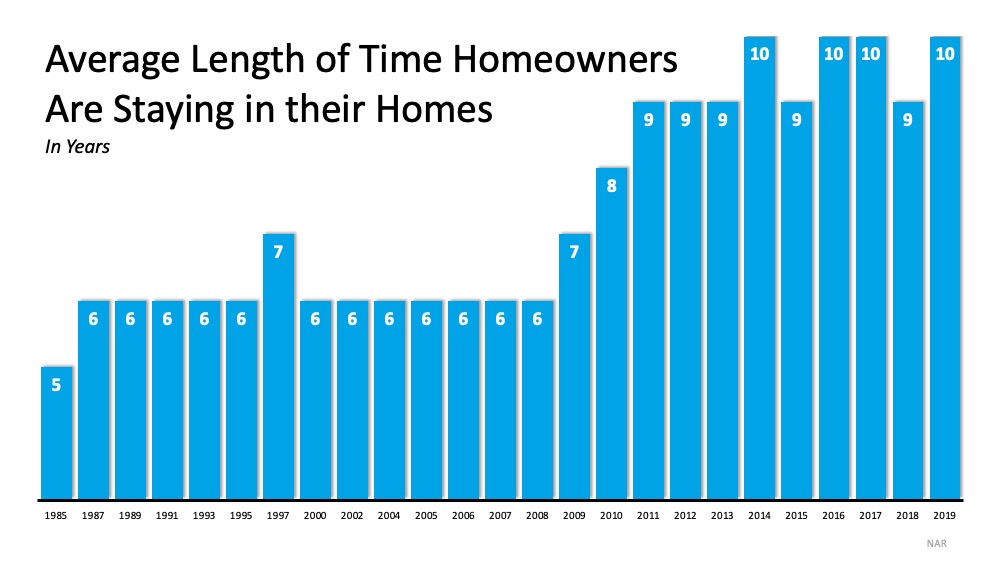

There are many reasons why it’s hard to find a home to buy today, stemming from an undersupply of newly constructed homes to sellers pressing pause on their moving plans due to the current health pandemic. One of the key factors making it even more challenging, however, is the amount of time current homeowners are staying in their homes. There has truly been a fundamental shift in the market that started about 10 years ago: people are staying put longer, and it’s contributing to the shortage of houses for sale.

In the 2019 Profile of Home Buyers and Sellers, NAR explained:

“In 2019, the median tenure for sellers was 10 years…After 2008, the median tenure in the home began to increase by one year each year. By 2011, the median tenure reached nine years, where it remained for three consecutive years, and jumped up again in 2014 to 10 years.”

As shown in the graph below, historical data indicates that staying in a home for 5-7 years used to be the norm, until the housing bubble burst. Since 2010, that length of time has trended upward, toward 9-10 years, largely due to homeowners aiming to recoup their equity: Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

In addition, with today’s historically low interest rates, there’s an opportunity for sellers to maintain a low monthly payment while getting more house for their money. Think: move-up opportunity, more square footage, or finding the features they’re really looking for rather than doing costly renovations. With more new homes poised to enter the market this year, homeowners ready to make a move may have a golden opportunity to do so right now.

The Mt. Hood area has only 30 active listings! Take away three forest cabins on leased land and four mobile homes with monthly rents at the Mt. Hood RV Village gives us 23 deeded properties for sale today! Multiple bids are common place these days so it has never been a better time to put your property on the market!

There are simply not enough houses for sale today. If you’re ready to leverage your equity and sell your house, let’s connect today. It’s a great time to move while demand for homes to buy is extremely high.

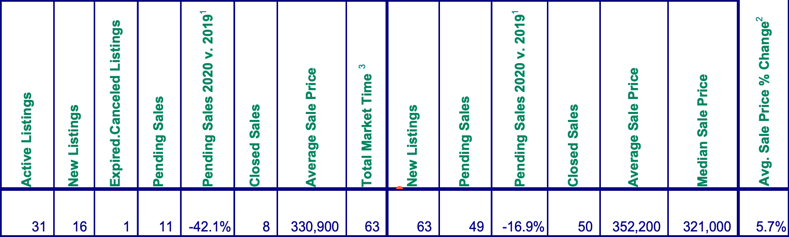

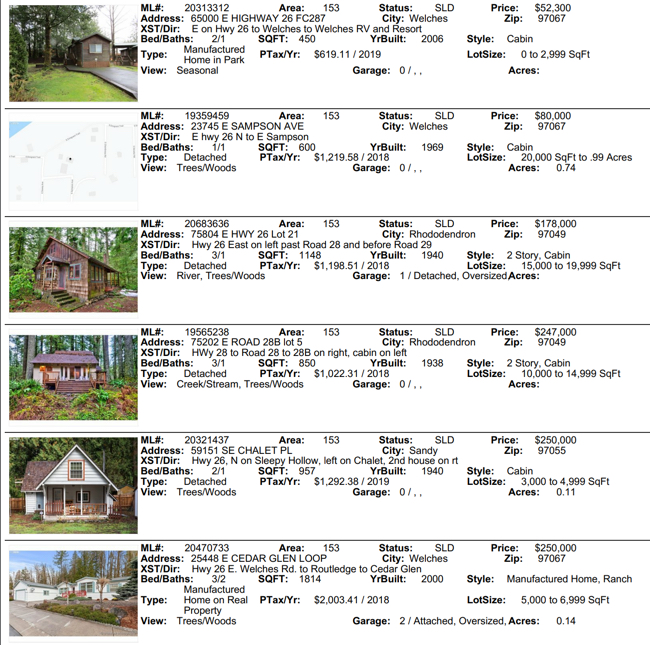

The final numbers for April 2020 sales are out from RMLS. Take a look at these recent numbers:

April had 31 active listings on the market. I've never seen this little inventory on the market in the past 35 years. Pending sales have dropped 42% for April. For 2020 the cumulative pending sales are down just a tad under 17%. April saw a total of 8 sales. On the plus side there are currently 21 pending sales that should be closing eventually.

I know credit is tightening so a good credit score is a must in order to buy in this market. Many lenders are cutting out home equity loans which cuts off a good source of down payments and cash for buyers. It will be interesting to see what effect this tightening of credit will do to our market. All indications are that we will continue with a strong seller's market at this time and hopefully with some opening up we will see more properties hit the market.

With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined by supply as well as the market’s demand for that item.

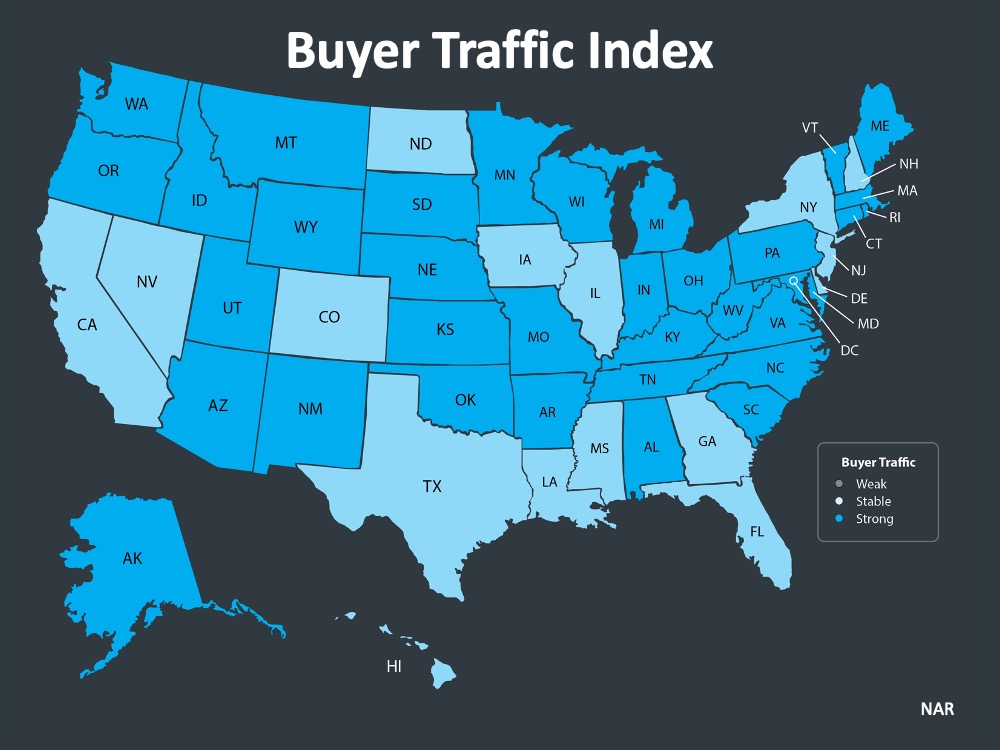

Each month the National Association of Realtors (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for the REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand) during this pandemic.

The map below was created after asking the question: “How would you rate buyer traffic in your area?” The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

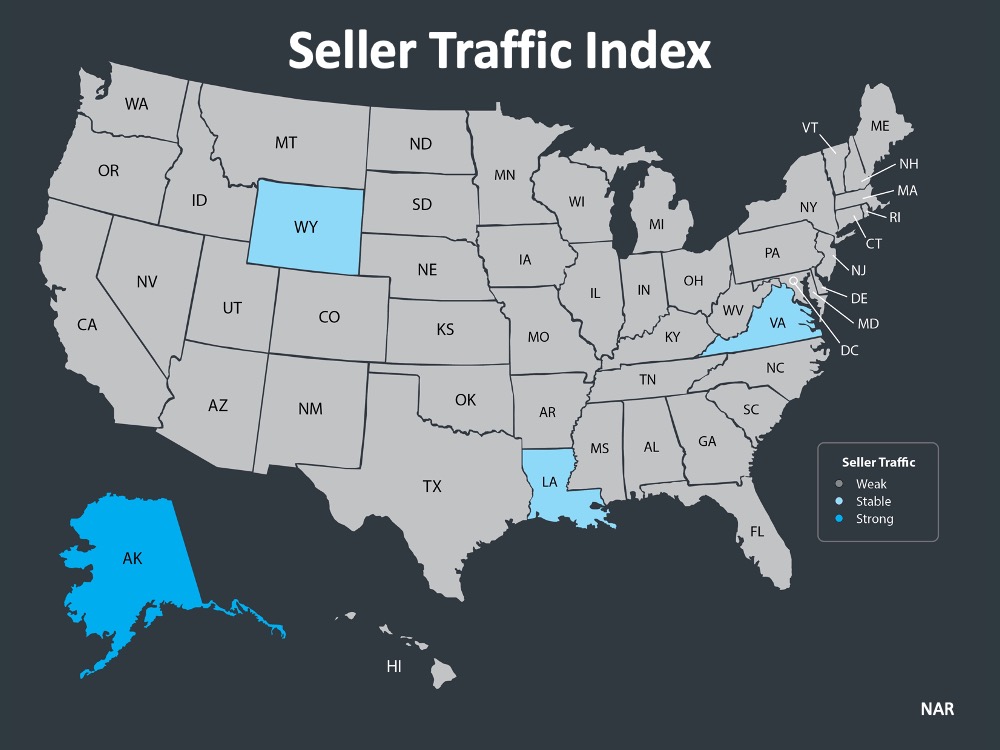

The index also asks: “How would you rate seller traffic in your area?” As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

With demand still stronger than supply, home values should not depreciate.

Here are the thoughts of three industry experts on the subject:

“We note that inventory as a percent of households sits at the lowest level ever, something we believe will limit the overall degree of home price pressure through the year.”

Mark Fleming, Chief Economist, First American:

“Housing supply remains at historically low levels, so house price growth is likely to slow, but it’s not likely to go negative.”

“Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand.”

Looking at these maps and listening to the experts, it seems that prices will remain stable throughout 2020. If you’re thinking about listing your home, let’s connect to discuss how you can capitalize on the somewhat surprising demand in the market now.

Mt. Hood real estate sales for March 2020 came in with a total of twelve closings. The sales run the gamut from a Mt. Hood Village cottage, two forest service cabins and two Government Camp chalets closing. The Covid-19 shut down will hugely impact our April sales. Many sellers are holding off putting their homes on the market till things open up a bit more. Current inventory sits at 33 properties for sale.

The twelve sales are listed below.

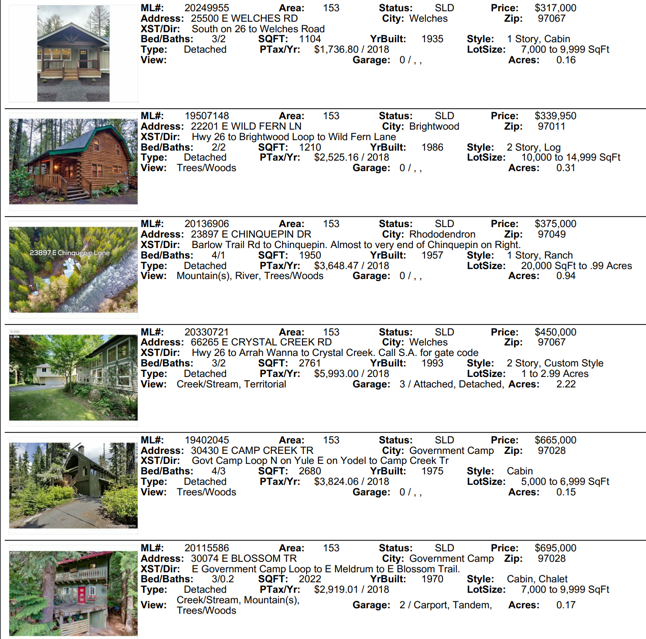

As our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human toll may forever change families, but the economic impact will rebound with a cycle of downturn followed by economic expansion like we’ve seen play out in the U.S. economy many times over.

Here’s a look at what leading experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus. It starts with a forecast of U.S. Gross Domestic Product (GDP).

According to Investopedia:

“Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of the country’s economic health.”

When looking at GDP (the measure of our country’s economic health), a survey of three leading financial institutions shows a projected sharp decline followed by a steep rebound in the second half of this year: A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

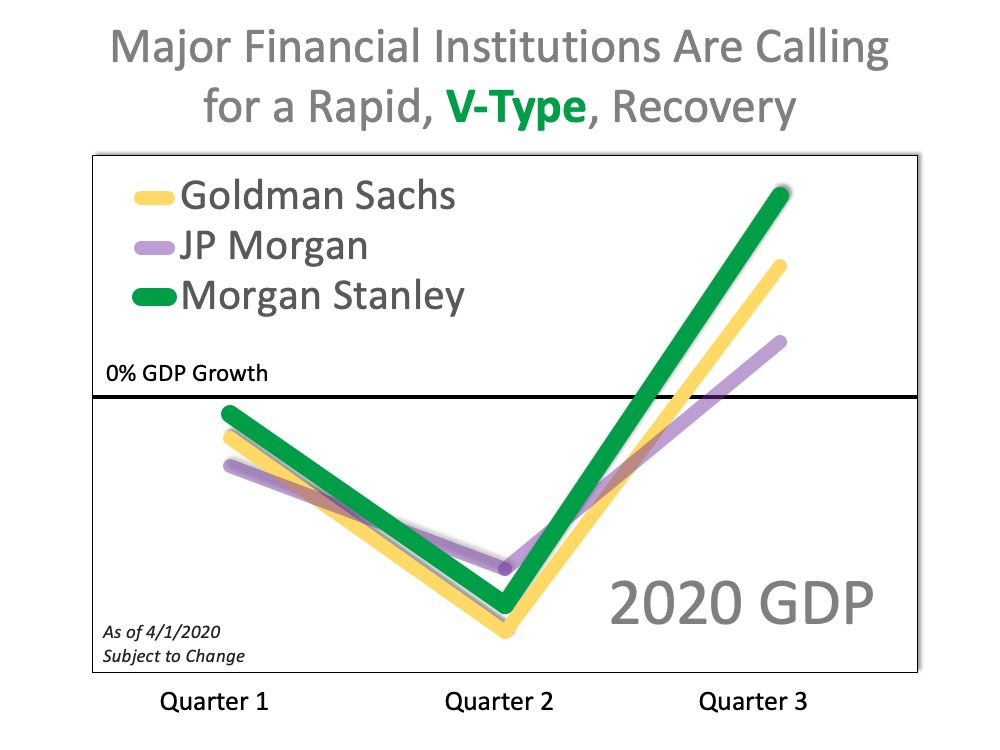

With this historical analysis in mind, many business owners are also optimistic for a bright economic return. A recent PricewaterhouseCoopers survey shows this confidence, noting 66% of surveyed business owners feel their companies will return to normal business rhythms within a month of the pandemic passing, and 90% feel they should be back to normal operation 1 to 3 months after: From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

The Mt. Hood real estate market has seen a major slow down with few showings and sales. Only the most serious buyers will venture out and look for property. With the lockdown, most future sellers are taking this time to prepare their homes for sale once things are opening up again. I've had three sales fail with the probable underlying reason being the uncertainty of things right now. The second quarter will take a heavy toll but by June, as the experts are predicting, things will take off like a rocket, hopefully!

Lives and businesses are being impacted by the coronavirus, but experts do see a light at the end of the tunnel. As the economy slows down due to the health crisis, we can take guidance and advice from experts that this too will pass.

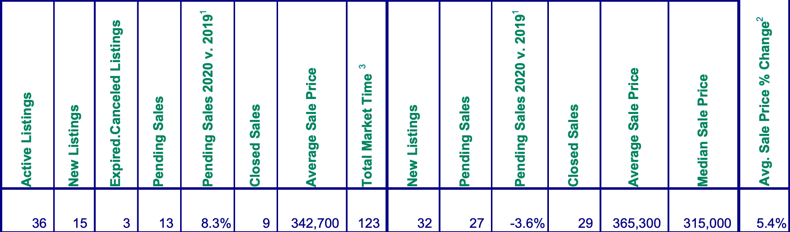

February saw nine sales close for the month. I expect March sales to be fairly around that same number. Lack of inventory has still kept a lid on the numbers due to lack of choices for the buyers. February had only 36 properties for sale and that was with 15 new listings.

The average sales price hit $342,700 with a marketing time averaging 123 days. This could be because of the pricing point in our area these days. As of today, two thirds of active listings on the market are greater than $300,000!

The current pause in the market should be interesting. As we slowly head towards the spring market we should see listings pick up the pace. I expect the second quarter to show few sales as a result of today's slow down but hopefully by summer we will crawl our way out of this.

The Clackamas County Board of Commissioners will hold a public hearing on draft regulations for short-term/vacation rental properties in unincorporated Clackamas County at the Board business meeting scheduled for 6 p.m., Thursday, Jan. 30, on the 4th floor of the Public Services Building, 2051 Kaen Road, Oregon City.

The draft regulations are available for public review at www.clackamas.us/planning/str. People who have comments but are not able to attend the Jan. 30 hearing are welcome to submit their comments by email or US Mail to Senior Planner Martha Fritzie at [email protected] or Planning & Zoning, Development Services Building, 150 Beavercreek Road, Oregon City, OR 97045.

A second public hearing on the draft regulations and Board action is planned for the Board Business Meeting at 10 a.m., Thursday, Feb. 13.

Clackamas County defines a short-term rental, or vacation rental, as a dwelling unit, or portion of a dwelling unit, that is rented to any person or entity for lodging or residential purposes, for a period of up to 30 consecutive nights.

The draft regulations include provisions for short-term rental owners to register with the county and pay a fee, and for enforcement of the regulations to be carried out by either the Sheriff’s Office or Code Enforcement, depending on the issue. Key components of the proposed regulations include rules regarding maximum occupancy, off-street parking, garbage pick-up, quiet hours, and fire and safety requirements. The regulations would only apply outside of city limits in unincorporated Clackamas County.

More information is available on the project website at https://www.clackamas.us/planning/str.

Displaying blog entries 71-80 of 360