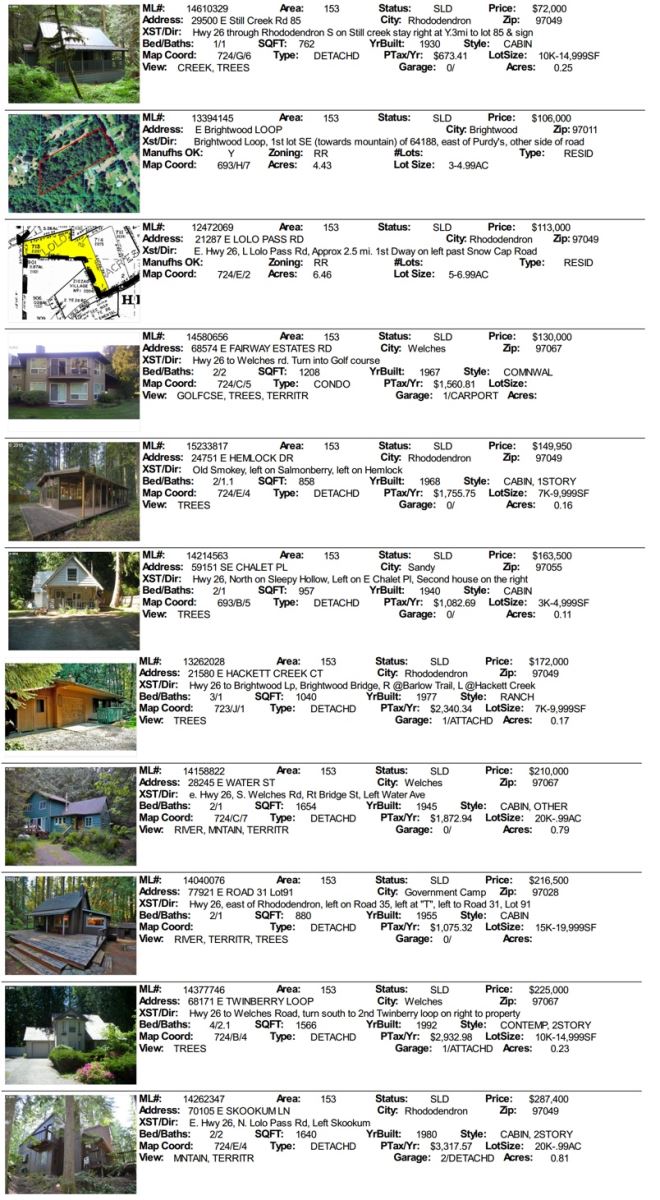

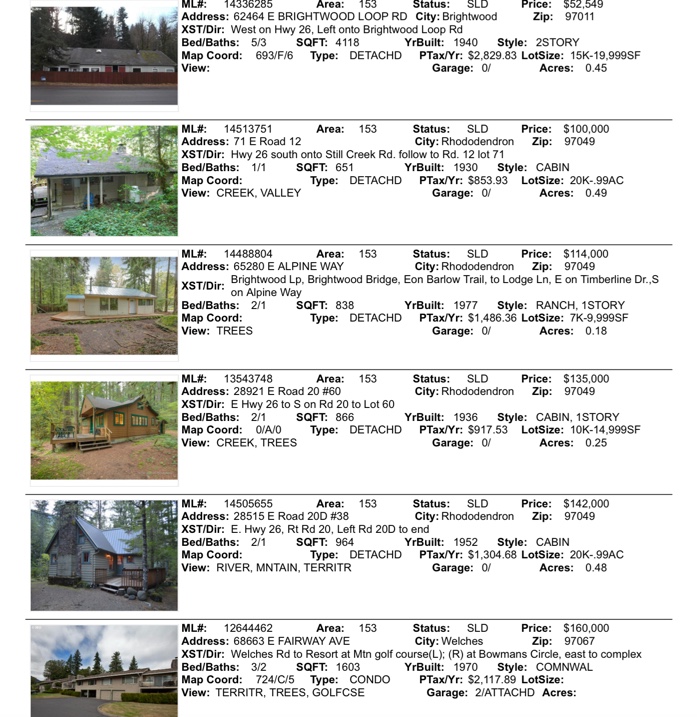

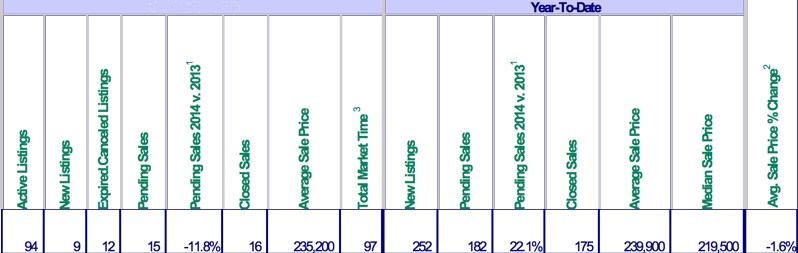

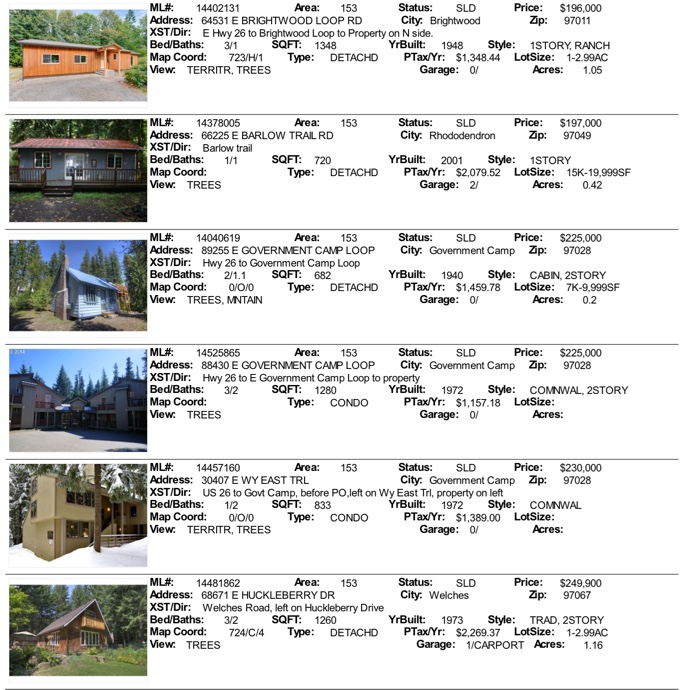

Real Estate Sales on Mt. Hood for March 2015 Summary

Recent numbers came in from RMLS for March 2015 mountain area sales.

.jpg)

Area 153, as defined by RMLS, compromises the Mt. Hood market and is physically a smaller area than probably most as listed in RMLS stretching from Government Camp to the Cherryville Hill area between Brightwood and Sandy. This space stretches around 30 miles as the crow flies from one end of Highway 26 to the other.

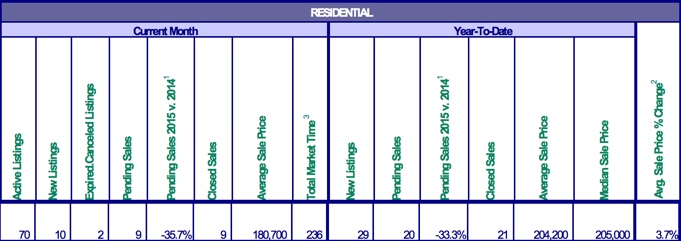

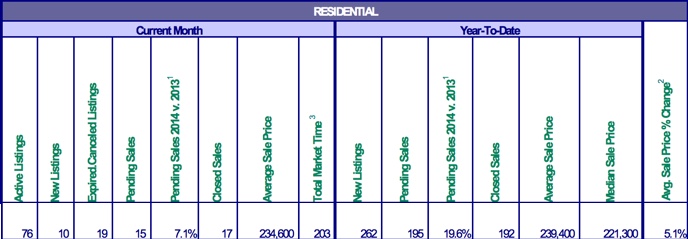

I'm bringing this up because despite what these numbers tell us, our market is hoping and it's not really reflected in the RMLS numbers. The thirteen closed sales is consistent with the numbers we've seen through 2014 for a very strong market.

March stats were a bit surprising considering the amount of activity our office has seen. Pending sales are down nearly 40% from last year from March 2014. Marketing time is improving as inventory that had been sitting for sale a long time is moving out. Nearly a third of the current inventory came to market in March with 26 new listings! Our amazing spring like weather has led sellers to getting started early in the marketing process. We predict a very busy spring of sales.