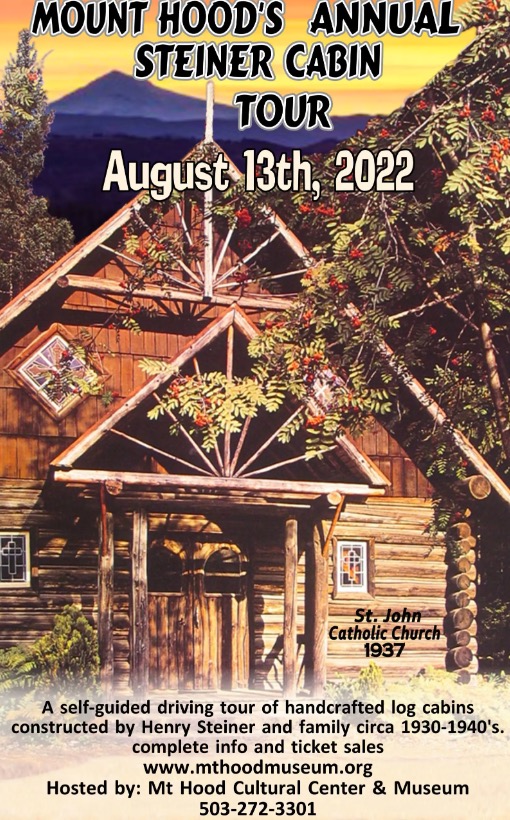

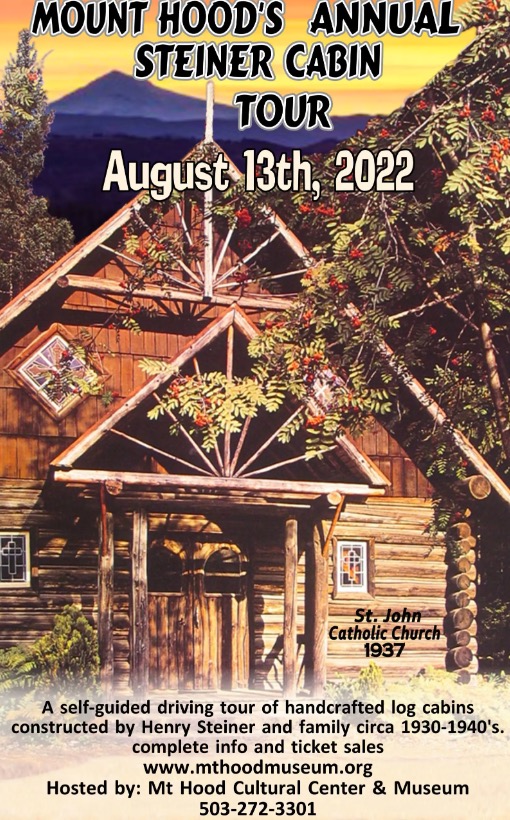

Steiner Log Home Tour

Direct from the Mt. Hood Museum Website:

St. John Catholic Church to be Featured on Steiner Cabin Tour This Year

Displaying blog entries 41-50 of 369

Direct from the Mt. Hood Museum Website:

St. John Catholic Church to be Featured on Steiner Cabin Tour This Year

|

||||||||||||||||||

It appears there are increasing problems not only in the Mt. Hood area but in Hood River also. This information recently appeared concerning bears in the Hood River area and some tips from ODFW

Oregon Fish and Wildlife ODFW responds to garbage bear problems in Hood River area; Residents reminded it is against the law to feed wildlife in Oregon Black bears June 24, 2022 HOOD RIVER, Ore. – ODFW is urging residents in the Hood River area and other towns along the Cascades to take steps to prevent bear problems. The bears have torn down bird feeders, gotten into trash cans and a smoker, damaged fences and dug up gardens. The bears have been repeatedly seen around homes during the day and appear undeterred by efforts to haze them such as setting off car alarms or using other noise-making techniques. "Black bears are moving through neighborhoods in the Hood River area looking for a free meal," said Jeremy Thompson, ODFW district wildlife biologist based in The Dalles. "Garbage cans left unsecured and bird feeders are the main attractants that we’ve seen this spring." Once a bear gains access to human food or garbage and becomes habituated it can lose its natural fear of humans, which can lead to a variety of safety problems for both people and bears.

ODFW will not relocate bears it considers habituated, because these bears simply return or repeat the behavior elsewhere. "It’s unfortunate to have to put down a bear that is a public safety risk simply because it got easy access to food from people," added Thompson. It is illegal to either directly or indirectly feed bears (ORS 496.730) and can result in a criminal citation (Class A misdemeanor) by Oregon State Police.

Some basic safety tips include: Never feed bears. Store garbage cans in a garage or shed or purchase bear-resistant garbage cans if possible. Put garbage cans out just before pick-up. Keep pet food inside. Remove bird feeders. Keep BBQ grills and smokers clean or in garage. Clean up fruit under fruit trees. Keep all food stored outdoors (patio refrigerators, etc.) locked As bears are in the area,

ODFW also shares advice for what to do if you encounter a bear: STOP: Never approach a bear at any time for any reason. If you see bear cubs, leave the area. GIVE IT SPACE: Give any bear you encounter a way to escape. STAY CALM: Do not run or make sudden movements. Face the bear and slowly back away. AVOID EYE CONTACT: Don't make eye contact with the bear. DON'T RUN: It may encourage the bear to chase you. FIGHT BACK: In the unlikely event you are attacked, fight back, shout, be aggressive, use rocks, sticks and hands.

|

Although it's hard to believe as we sit under storm clouds and record breaking rain we are approaching our fire season on Mt. Hood. After power shut downs from past fires locals are way more prepared for what will come our way. I don't know any one who doesn't own a generator. This article from Fox 12 details new rules for power shut down notifications during wildfires.

Here are tips directly from the FEMA website:

The United States Fire Administration promotes simple ways to prevent a fire from affecting your home and community, including:

Be prepared in case you need to evacuate:

Another important thing to consider is buying flood insurance. After a wildfire, flood risk increases due to the inability of charred vegetation and soil to absorb water. Rainstorms after a wildfire lead to increased runoff down slopes and into channels, streams, and rivers. Flooding after fire can be fast, severe, and include mudflows as runoff picks up debris, ash, and sediment from the burn scar. Flood insurance can protect property owners from catastrophic financial impacts of flooding following a wildfire.

Wildfires can develop and spread quickly, leaving little time to get somewhere safe. Know what to do to keep yourself, your family, and your pets safe and take steps now to protect your future.

Last updated March 17, 2021

A recent article in Willamette Week states home prices in Rhododendron were up 47% over last year. Read article here. The article is about folks moving out of Portland for less expensive housing so they can qualify to buy. This seems to be happening everywhere. Notice there are three of our burgs on Mt. Hood listed in the chart below. These numbers are coming from Zillow based on comments in the article.

Recent RMLS statistics for the Mt. Hood area in March 2022 says our year over year for the entire area including Government Camp was 37.3%. If you add in another 10% for the 2020-2021 season, I can see where these numbers are coming from. I thought the Rhododendron comment was a little misleading under the main heading. These stats are for two years of sales vs. one year of sales.

Bears are waking up from hibernation and are becoming active in your area. At this time of year, these hungry bears will be trying to get into every food source they can, including garbage, old grills, birdfeeders, and anything else that smells like food. Take steps to avoid conflict with bears by removing bird feeders and securing attractants. A bear's strongest sense is smell and they can pick up a scent from over a mile away.

Don’t reward bears with easily available food (including birdseed), liquids, garbage and scraps from a barbeque or grill. Intentional or unintentional feeding of bears teaches them to approach homes and people. This is dangerous for humans and bears. Keep Bears Wild by following the BearWise basics above and sharing this information with your neighbors. A community effort will be more effective in preventing conflicts with bears. For more information on living with bears visit https://www.dfw.state.or.us/wildlife/living_with/black_bears.asp

Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream.

Prior to the 1950s, less than half of the country owned their own home. However, after World War II, many returning veterans used the benefits afforded by the GI Bill to purchase a home. Since then, the percentage of homeowners throughout the country has increased to the current rate of 65.5%. That strong desire for homeownership has kept home values appreciating ever since. The graph below tracks home price appreciation since the end of World War II:

The graph shows the only time home values dropped significantly was during the housing boom and bust of 2006-2008. If you look at how prices spiked prior to 2006, it looks a bit like the current spike in prices over the past two years. That may lead some people to be concerned we’re about to see a similar fall in home values as we did when the bubble burst. To help alleviate those worries, let’s look at what happened last time and what’s happening today.

Back in 2006, foreclosures flooded the market. That drove down home values dramatically. The two main reasons for the flood of foreclosures were:

This cycle continued for years.

Here are two reasons today’s market is nothing like the one we experienced 15 years ago.

Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Today, purchasers and those refinancing a home face much higher standards from mortgage companies.

Data from the Urban Institute shows the amount of risk banks were willing to take on then as compared to now.

There’s always risk when a bank loans money. However, leading up to the housing crash 15 years ago, lending institutions took on much greater risks in both the person and the mortgage product offered. That led to mass defaults, foreclosures, and falling prices.

Today, the demand for homeownership is real. It’s generated by a re-evaluation of the importance of home due to a worldwide pandemic. Additionally, lending standards are much stricter in the current lending environment. Purchasers can afford the mortgage they’re taking on, so there’s little concern about possible defaults.

And if you’re worried about the number of people still in forbearance, you should know there’s no risk of that causing an upheaval in the housing market today. There won’t be a flood of foreclosures.

As mentioned above, when prices were rapidly escalating in the early 2000s, many thought it would never end. They started to borrow against the equity in their homes to finance new cars, boats, and vacations. When prices started to fall, many of these homeowners were underwater, leading some to abandon their homes. This increased the number of foreclosures.

Homeowners didn’t forget the lessons of the crash as prices skyrocketed over the last few years. Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has more than doubled compared to 2006 ($4.6 trillion to $9.9 trillion).

The latest Homeowner Equity Insights report from CoreLogic reveals that the average homeowner gained $55,300 in home equity over the past year alone. Odeta Kushi, Deputy Chief Economist at First American, reports:

“Homeowners in Q4 2021 had an average of $307,000 in equity - a historic high.”

ATTOM Data Services also reveals that 41.9% of all mortgaged homes have at least 50% equity. These homeowners will not face an underwater situation even if prices dip slightly. Today, homeowners are much more cautious.

The major reason for the housing crash 15 years ago was a tsunami of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity, the fear of massive foreclosures impacting today’s market is not realistic.

![The Difference Between Renting and Owning [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/24130106/20220225-MEM-1046x2279.png)

Displaying blog entries 41-50 of 369