What about the Jumbos?

Jumbo loans are for properties which have loans greater than $417,000 in Clackamas County. Over the last several years many homeowners have purchased homes in Government Camp, Welches and Rhododendron with these types of loans. Jumbo loans are huge in California and Washington where home values are substantially higher near metro areas and can go over $700,000.

According to Inside Mortgage Finance, a trade publication, between 2002 and 2006 banks originated $557 billion dollars a year in jumbo loans. A mortgage data firm reports that 6.9% of prime jumbo loans were 90 days delinquent in December 2008. As we see continuing job losses across the board, savings continuing to get depleated, and continued softening of the real estate market, I suspect the tax payer will get stuck with these properties as they get foreclosed on. This in turn will push prices down further as the higher end price range dwindles lower.

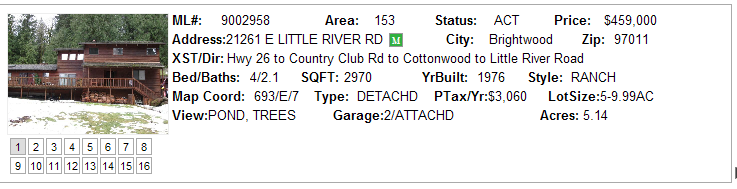

Homes that may qualify for jumbo loans on the mountain (Homes priced over $450,000) are at 27% of the current inventory. In Sandy the homes for sale over $450,000 make up 18% of their inventory.

We will have to see how this story unfolds and if the Feds take any action to help these jumbo loan holders. Many who are trying to refinance are finding that their homes do not meet appraisal values or they do not qualify any longer with revised lending practices!