Oregon Foreclosures July 2010

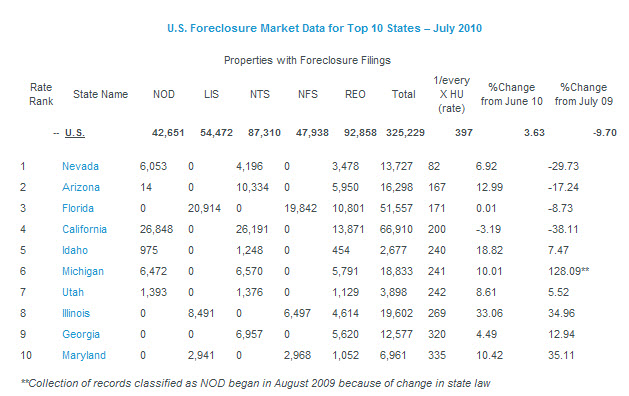

Great news! According to RealtyTrac Inc. Oregon has slipped out of third place in foreclosure activity in July. Here are the top ten numbers for the month of July.

Displaying blog entries 21-30 of 31

Great news! According to RealtyTrac Inc. Oregon has slipped out of third place in foreclosure activity in July. Here are the top ten numbers for the month of July.

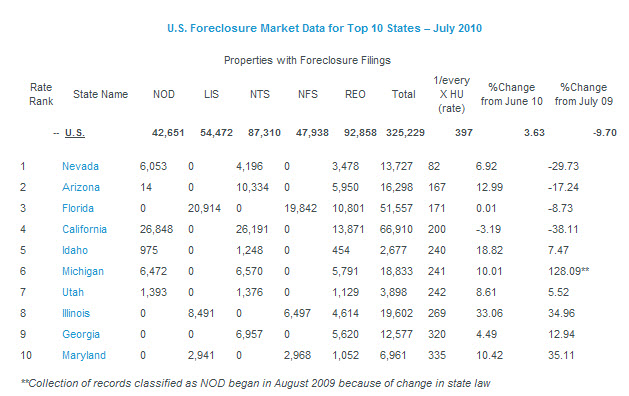

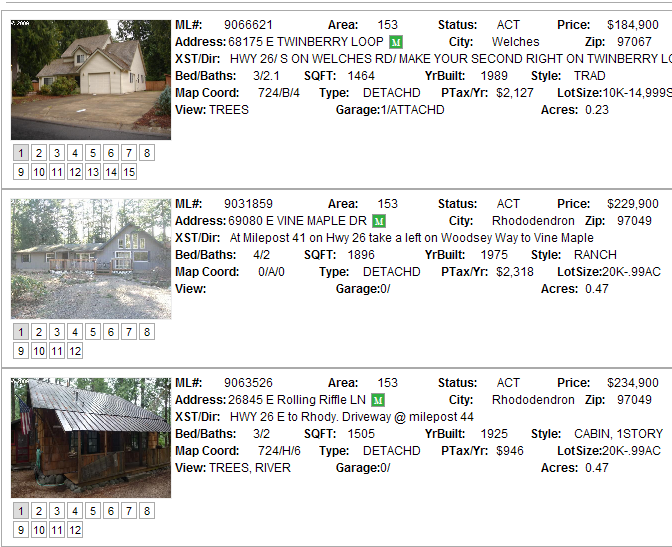

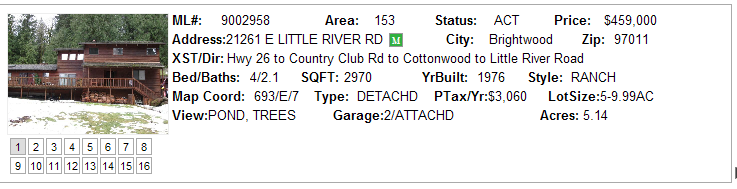

Here are Mt. Hood foreclosures for Government Camp, Welches, Rhododendron, and Brightwood. These are actively listed foreclosures near Mt. Hood. Don't miss the three condos at Collins Lake in Government Camp!

Call me for any addtional information you might need!

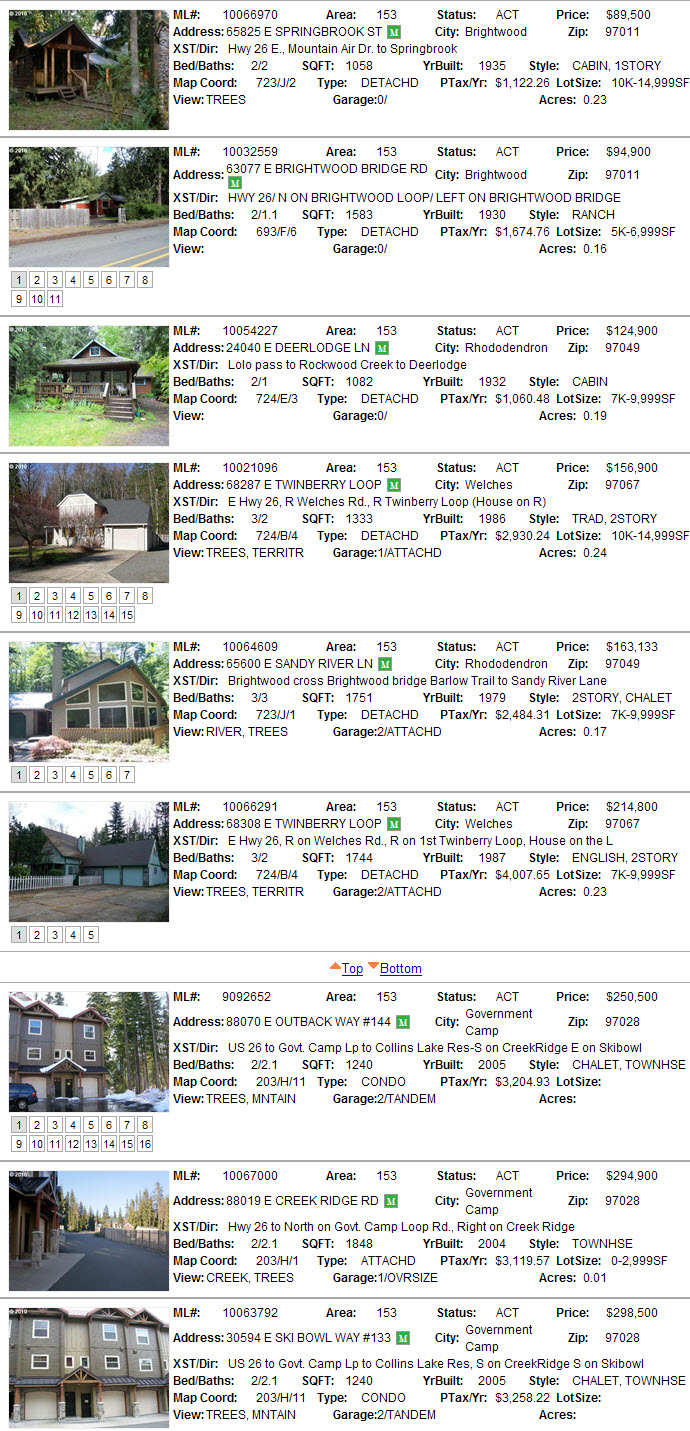

The National Association of Realtors has published some interesting information on Oregon foreclosures for 2009. Our state has been in the news recently at number three in the country for foreclosures. Here is the breakdown of home ownership and home foreclosures based on the type of loan the homeowner received. Prime loans are the biggest percentage of foreclosures in 2009 reflecting the high unemployment rate in Oregon.

See Mt. Hood Area Foreclosures here

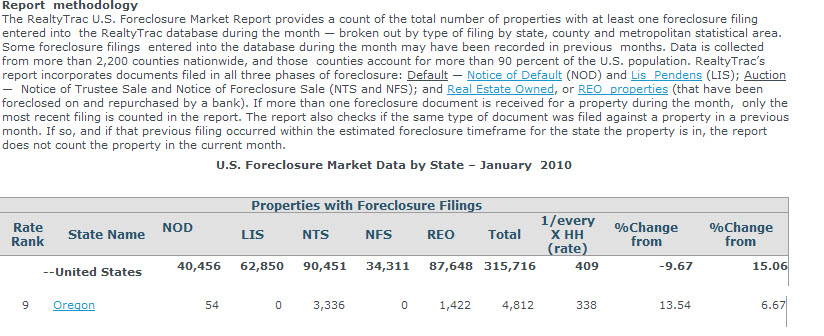

Oregon is currently ninth in the nation in foreclosures according to a leading foreclosure site RealtyTrac. Here are the numbers and charts:

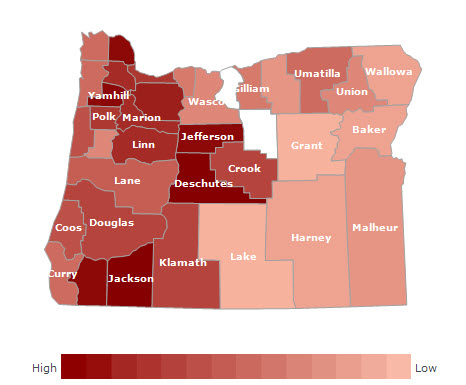

Take a look at this map of Oregon to see the foreclosure meter.

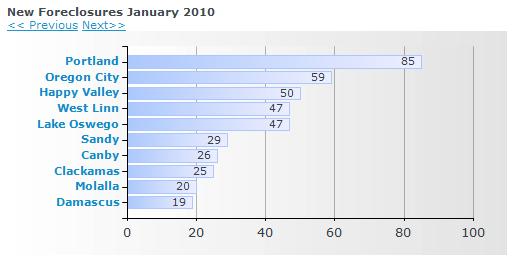

What areas have the highest foreclosures according to RealtyTrac for January 2010? Here is a chart showing where they are:

For information on foreclosures in our Mt. Hood area of Government Camp, Welches, Brightwood and Rhododendron, check available properties here.

Timberline Rim is a subdivision in our Mt. Hood area that wraps around the Sandy River. It was originally platted in the 1960's and is nearly fully developed except for a few scattered lots that are still vacant. Parts of the subdivision are in Brightwood and others in Rhododendron. The entire area is on sewer and water and the homeowners enjoy a lodge, swimming pool in the summer, tennis courts, basketball hoops, party room in the lodge and other rec facilities, walking paths to the Sandy River and other amenities. It's location is only 45 minutes to an hour from Portland.

Most of the homes are occupied with full time residents and some second home owners scattered throughout the subdivision.

Naturally, some of the benefits of living in this area are its close proximity to the Mt. Hood National Forest with zillions of miles of hiking trails, 15 minutes to ski areas, cross country skiing, snowshoeing, golf, and a multitude of waterways to enjoy from the Sandy River to Salmon and Zig Zag Rivers threaded throughout our area.

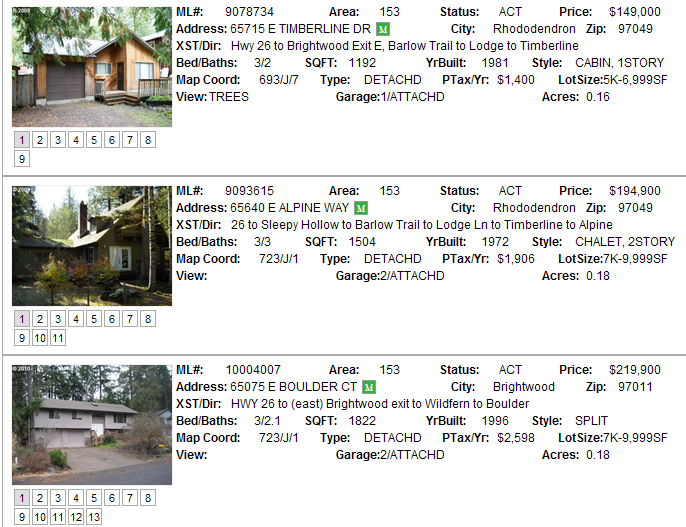

Some of the best buys available in Timberline Rim are the foreclosures currently on the market. Today there are three available and here are the details:

It's a great time to buy and take advantage of today's incredible interest rates before they go up!

They're still coming and here is the current list of foreclosued homes in the Mt. Hood Area from Brightwood, Welches, Government Camp and Rhododendron:

We are reading daily about the increasing numbers of foreclosures hitting the market. Take a look at the Mt. Hood area sales since January 1, 2009 for Rhododendron, Government Camp, Welches and Brightwood. There have been 31 total sales and I uncover 2 foreclosure sales and 3 third party approvals or "shortsales". That's about 16% of sales for the Mt. Hood area so far this year. In comparing our area to others our foreclosures and shortsales are substantially lower.

Here are current offerings as of 6/10/09

Call or email for details

What are predictions for the 2009 market on Mt. Hood? Well, it isn’t easy to come up with a steadfast answer on this one. Nationally many experts are predicting things will turn around in the second half of the year.

The Case-Shiller pricing index tells us that in at least 20 metro areas prices are currently at March 2004 levels- down about 18%. More foreclosures than 2008 will hit the market due to adjusting adjustable mortgages. We are seeing a few foreclosures and short sales hit our mountain market.

Here is a short sale that popped up today. Five acres of land, which typically can’t be found for under $200,000 with a large home for less than $500,000

The greatest percentage of sales in our local market is the second home sales. As discretionary income for this purchase, folks have the option to wait and buy at their leisure. Considering the limited amount of land the mountain has to offer for ownership, there couldn’t be a better time to take advantage of this inventory with future population impacts coming to the Portland metro area.

Historically we usually don’t see the unique combination of low home prices and low interest rates so this is an exceptional time to invest in the mountain. Typically interest rates are higher when home prices are low and some buyers are recognizing this fact.

Keep checking back to see how this year unfolds!

Looking to purchase a foreclosure in the Mt. Hood Area? foreclosures are popping up in Welches, Government Camp, Rhododendron and Brightwood.

Foreclosure and Short Sales Info

Over the last 24 months, Oregon went from number 2 to having the 23rd highest foreclosure rate on a national basis. As of September 2008 there have been 2,344 foreclosure filings which equivocate to 1 filing for every 644 housing units. Foreclosure filings are up 26% from August 08 and up 139% from September 2007. The majority of these distressed properties are located in the greater Portland metropolitan area.

In comparison, the state of California, which accounts for ~60% nationally of all foreclosure activity has 69,548 properties with foreclosure filings, equivocating to 1 in every 189 housing units. Washington has 1 foreclosure filing out of every 1,383 housing units.

Below are some comments from our partners that actively work in this arena.

Short Sales - An option for those who have money & the time. A short sale is where a property owner wants to sell their home but they have a higher mortgage debt on the property than the price they can sell the house for. First, seller and buyer must agree on a price and then they go to the lender with comparable homes sales data to support the decline in value plus a compelling story and documentation that proves the seller does not have the funds to pay off the entire mortgage due. Sound simple? Not really. Short Sales on average take 90-120 days to complete if successfully negotiated. Clients and real estate brokers should work with a professional who knows the ropes. Investment property owners who sell under a Short Sale agreement should be aware of the new exclusionary rule coming that will tax all or a portion of the ‘gain’ the home seller realizes from a short sale closing. A big thanks for sharing this information Kim: Kim Dodge at Usher Financial (503) 595.1600

Displaying blog entries 21-30 of 31