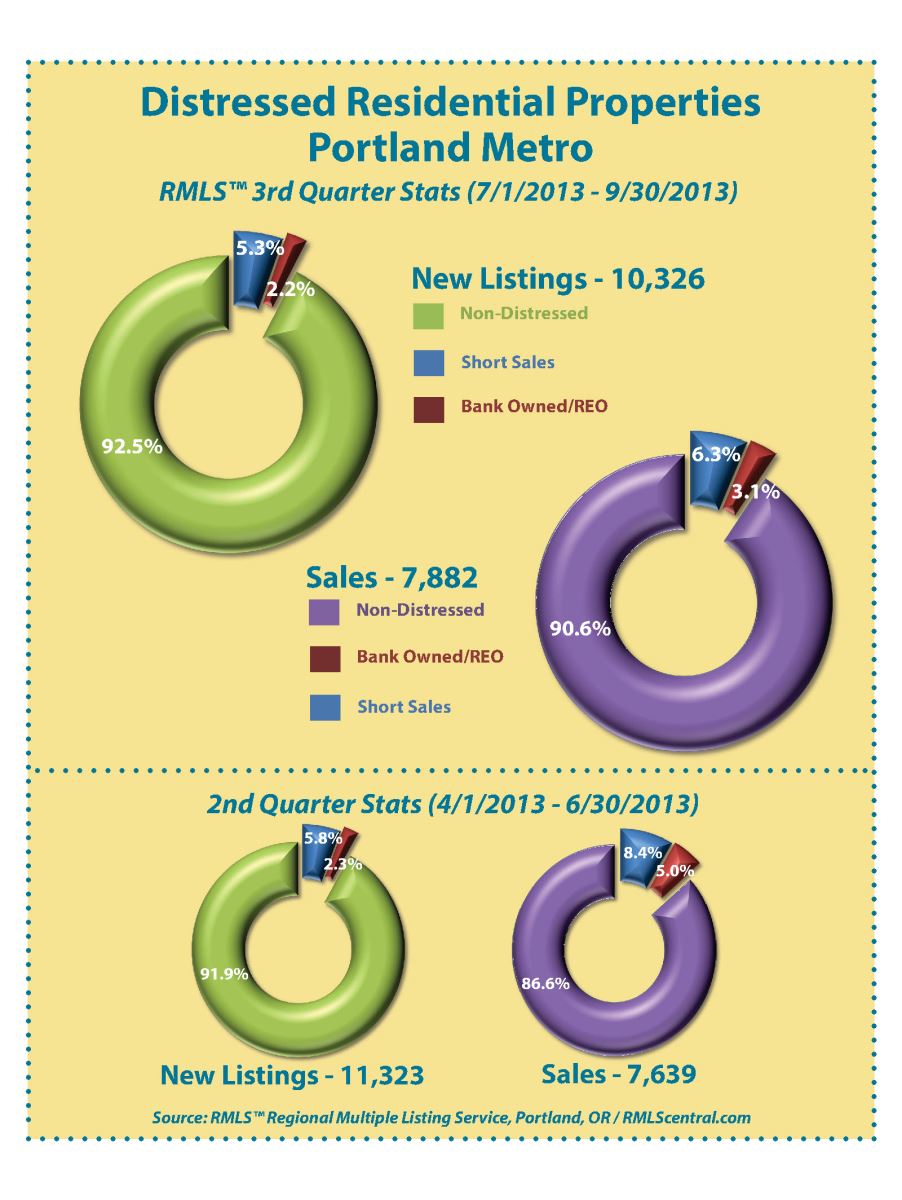

Portland Metro Area Distressed Property Numbers from RMLS

Displaying blog entries 301-310 of 428

If you are a first time home buyer or a buyer with minimum down payment pay attention to recent news concerning Fannie Mae. Currently you can get a mortgage with 3% down. Many buyers have applied for a conventional loan with 3% down vs. an FHA loan due to the high upfront PMI (Private Mortgage Insurance) required by FHA. FHA loans have been losing out to Fannie Mae conventional loans due to PMI.

This November Fannie Mae will be increasing their down payment requirement to 5% instead of 3%. If you get your approval now and close by March 15th you can still get the 3%.

The mortgage insurance on Fannie Mae loans tends to be lower than the FHA insurance but that is dependent upon your credit scores.

So, the bottom line is if you are buying and want to get the best deal for a 3% down payment, you need to act NOW. See your mortgage professional for addition details.

If you're currently in a transaction in the Mt. Hood area, or starting one, and are getting an FHA, VA, USDA or conventional loan, you might be wondering what the current government shut down is doing to your loan and transaction. Read about NAR's summary of the delays for each loan and the impact it will have on your purchase. Which government services are having an impact on your loan? The IRS and social security divisions are needed for many types of loans so this "might" cause delays. USDA loans are dead in the water. Current processing times for USDA are already three weeks out so this could cause even more of these loans to have long delayed closings!

The CPFB was created after the Wall Street implosion to help protect consumers from financial transactions including mortgages. In the process, strict mortgage qualifications were developed so loans that would be packaged were solid (no liar loans) and these loans were called Qualified Mortgages. If a qualified mortgage failed it would give the right to the consumer to sue the lender in the event of foreclosure. These rules for qualified mortgages were written by the CPFB.

After the Qualified Mortgage package was passed in January 2013, the director of CPFB, Raj Date, left to "spend more time with his family" and several months later created an investment advisory company called Fenway Summer LLC to make loans to people who did not qualify for the "qualified mortgage". He also hired many former CPFB employees setting his company up to make billions in future loans.

The CPFB didn't raise any alarms at what happened in their own backyard. Read the letter from the Committee of Oversight on Government Reform and the Committee on Financial Services sent out July 31st. to the current chair of the department.

Look for further news on this story in the next several months.

Remember that Big settlement of 8.5 Billion dollars that the big ten banks had to pay for the mortgage mess providing 3.8 Billion back to homeowners who were fraudulently foreclosed on between 2009-2010 ? Did you know as part of the settlement the banks spent 1.5 Billion of the 3.8 Billion dollars on "independent consultants" to figure out how to get the money to the foreclosed homeowners?

After complaints to Ben Bernake that the process was taking way too long, the OCC/Fed is working out how payments are made through the servicers and not using the "independent consultants" after 1.5 Billion dollars! Most of the consulting dollars went to Promontory Financial Group. Guess who runs Promontory Financial Group: the former chairman of the OCC: Gene Ludwig.

More details of the 1.5 Billion loss can be found in this Forbes article.

Recent reports by the FTC are finding that between 10 and 21% of consumers have inaccuracies in their credit reports costing them higher interest rates for any purchases that need credit! That could be 42 Million people! A recent 60 Minutes program brought this to light last Sunday and here is an article from Business Insider that discusses the specifics.

One of the most important issues that came to light is that it is difficult to dispute errors on your report and it is a lengthy process. Be sure and check your free credit report from all three credit agencies at annualcreditreport.com.. If you find an error, take action to remedy the mistake as soon as you can and have patience.

If you’re purchasing a home in the Mt. Hood area this could impact your monthly payment substantially. With the new CFPB Consumer Finance Protection Bureau rolling out their guides for low risk mortgages your credit score will become even more critical in getting the best interest rate for your purchase.

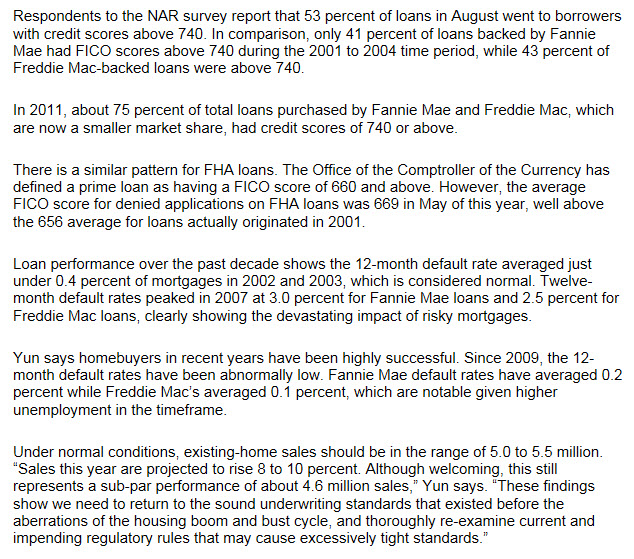

Now that housing is starting to stand on its wobbly legs after years of uncertainty, Lawrence Yun, chief economist of NAR, the National Association of Realtors, is asking for some loosing up on lending standards to keep this housing recovery on its way. Here is an except from an article from NAR on credit scores and lending practices. You can see that most recent loans only go to buyers with the most stellar credit. In 2011, around 75% of loans purchased by Fannie Mae and Freddie Mac, had credit scores of 740 or above!

Tax deductions for vacation homes vary greatly depending on how much you use the home and whether you rent it out. Read

.

Copyright 2012 NATIONAL ASSOCIATION OF REALTORS®

If you had your bank loan from Bank of America, Wells Fargo JP Morgan Chase, Citigroup, or Ally Financial and were foreclosed on between 2008 and 2011 you might be eligible for a settlement of up to $2000 through a recent foreclosure settlement.

If your loan was owned or backed by Fannie Mae and Freddie Mac: they are not part of this deal. Call your bank, listed above to start your initial contact.

Check additional Mt. Hood Foreclosure info here.

Displaying blog entries 301-310 of 428