Homebuyers On Mt. Hood Are Going on a Shopping Spree This Winter

Homebuyers Are Going on a Shopping Spree This Winter

Black Friday and Cyber Monday are over, which means some shoppers have wrapped up their holiday buying. But there’s still a group of buyers that are very active this holiday season – homebuyers.

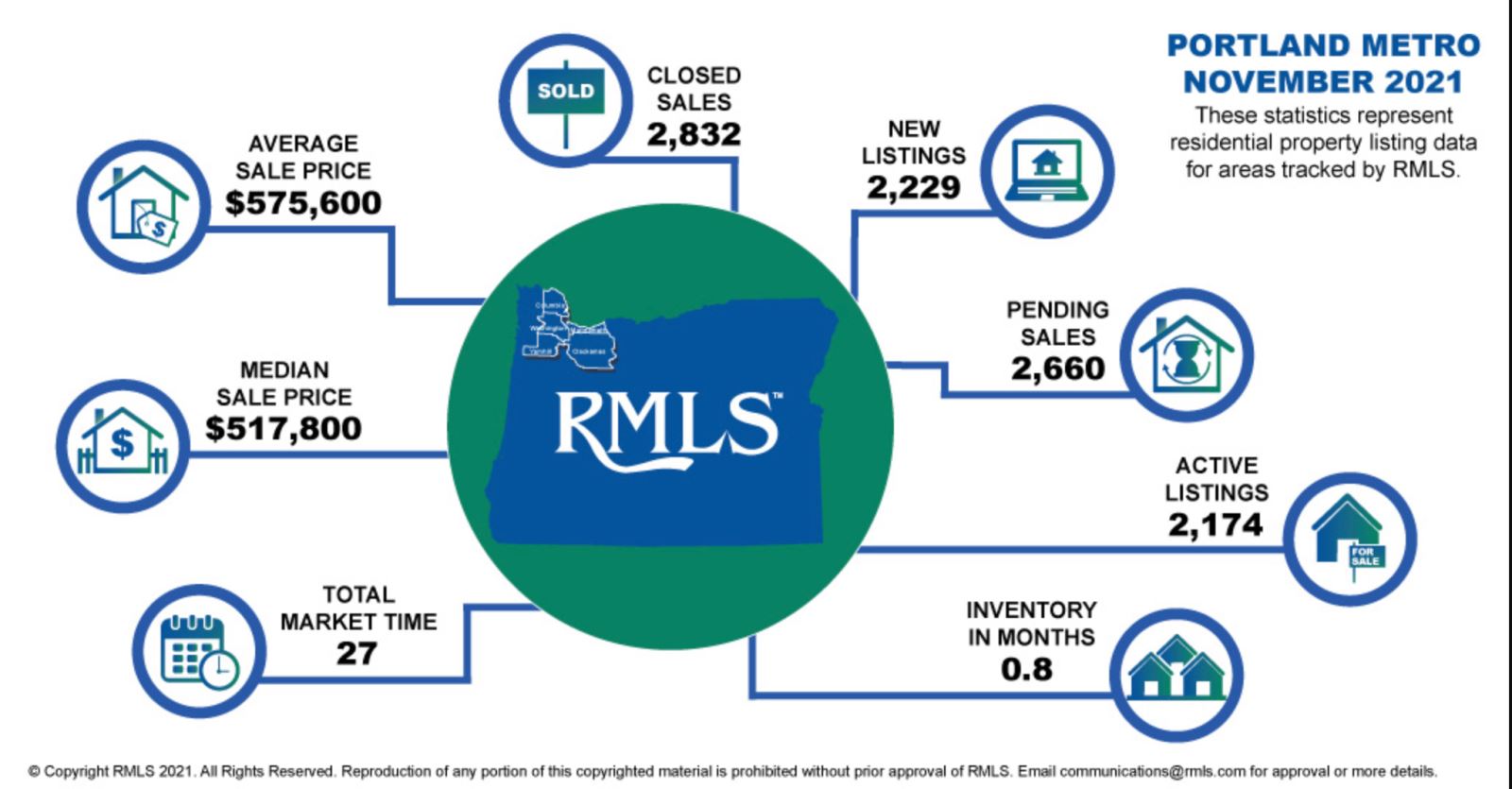

Experts anticipate the real estate market will see a flurry of activity this winter, and that’s great news for today’s sellers. If you’re planning on listing your home, there’s no need to wait until the spring for better conditions – today’s real estate market is already heating up.

Buyers Have Warmed Up to the Idea of Purchasing This Winter

The past 18 months brought about significant lifestyle changes for many of us, including the rise in remote work, job changes, and even early retirement for some. For many people, it’s prompting a search for their next home now rather than waiting for warmer months.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), points out how this winter may see a significant number of sales:

“Compared to other past winter seasons, this winter season’s sales activity will be stronger. . . . This winter, there will be more sales compared to pre-pandemic winters going back all the way to 2006.”

You might be wondering: what does strong sales activity mean for you? It means there are likely to be more buyers active in the market this winter – far more than more normal, pre-pandemic years.

In the same article, Danielle Hale, Chief Economist for realtor.com, puts it in these simple terms:

“Sellers can expect to see plenty of buyers.”

The more buyers there are in the market, the more likely it is your home will get noticed. That can lead to a multiple-offer scenario or a potential bidding war. Receiving multiple offers on your home means you can select the right offer and terms for your situation – so you can truly win as a seller when you list your house this winter.

Bottom Line

If you’re thinking about selling your house, you don’t need to wait until the spring. Buyers are ready now. Let’s connect to discuss why selling this holiday season could be the gift that keeps on giving.

![A Happy Tail: Pets and the Homebuying Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/12/08135318/20211210-MEM-1046x1910.png)

![A Checklist for Selling Your House This Winter [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/12/01091834/20211203-MEM-1046x1572.png)

.jpg)