January sales hit eight for the month. A drastic decline from December 2025 but as you can see nationally from this graph that as interest rates slowly improved the buyer activity picked up.

Incomes are up so this helps too! See home prices compared to incomes over the past couple of years. 2020 and 2021 home prices surged as COVID impacted home prices.

Affordability is the word of the day. Once monthly payments get below 30% of monthly income buyers will buy.

Renters are even jumping in but it's regionally based according to a recent Redfin report. The West lags behind but the Midwest is calling the buyers in.

Here are the current statistics from RMLS for January.

Sellers are gearing up for the spring market and I anticipate March will see a barrage of homes hit the market. Realtor.com reported in January that our recent market has seen more price adjustments in history as the market adjusts to attract buyers. Many sellers chose to delist their properties and sit on the side lines. Nationally price reductions were common and the Portland metro area saw 16.6% of sellers with at least three price adjustments. That wasn't as bad as Austin Texas though, which hit 22% of sellers. Moving forward this should increase the number of sales as both buyers and sellers realize current market conditions.

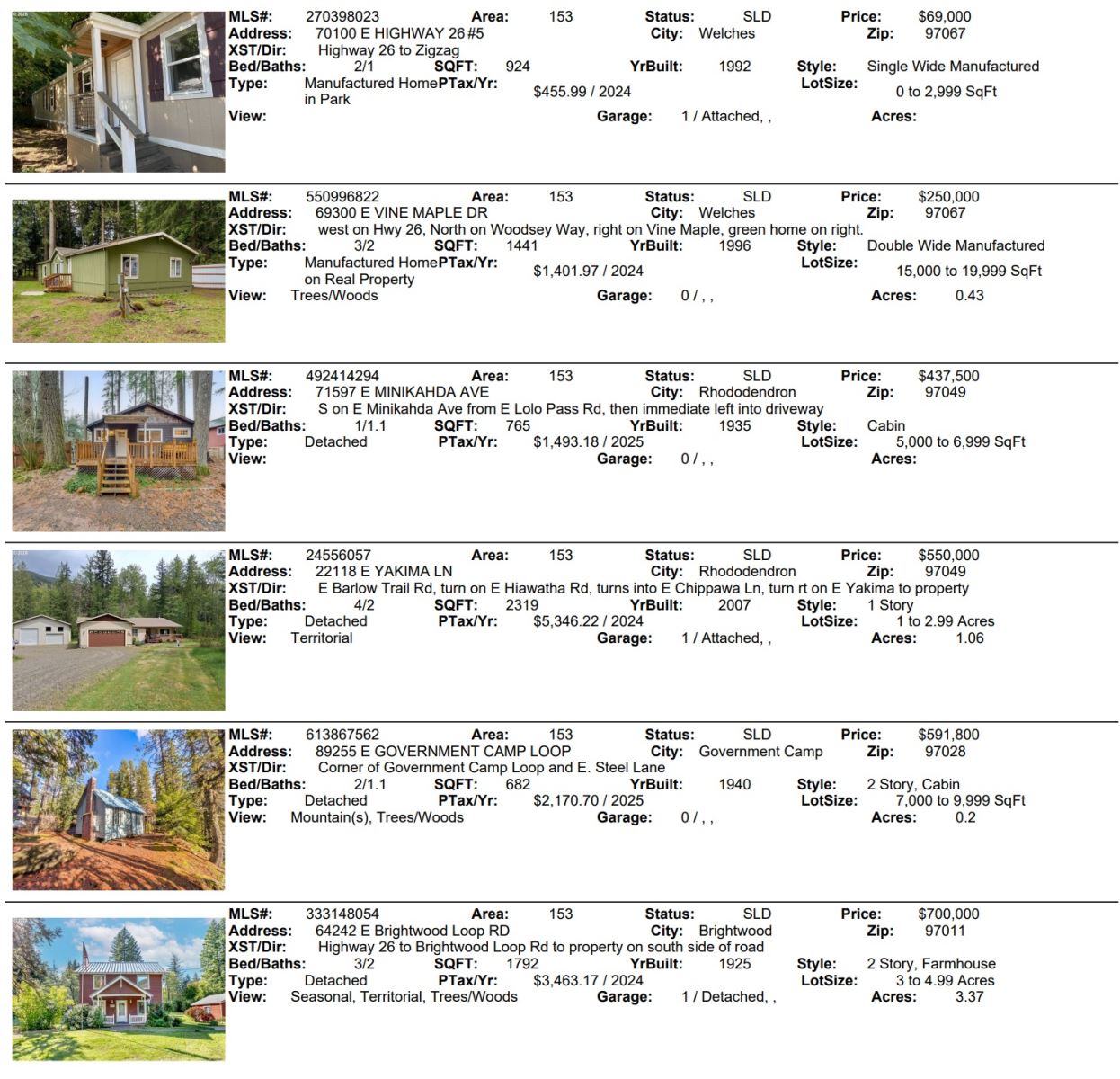

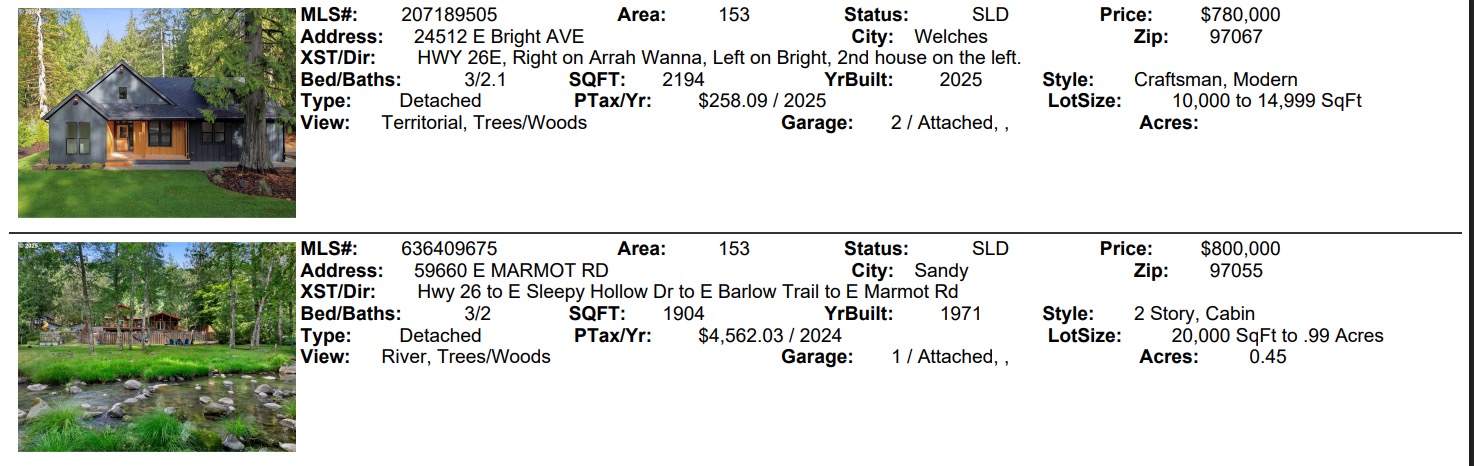

Listed below are the eight sales for January.