Foreclosure, Short Sale, Deed in Lieu Credit Questions on Mt. Hood

Credit Score Impact of foreclosures, Bankruptcy, and Short Sales

What does a foreclosure, bankruptcy, deed in lieu or short sale do to your credit score?

Foreclosure, or a Deed in Lieu, which has the same effect as a "foreclosure" will drop your credit score between 200 and 300 points.

If you have a Notice of Default (NOD)-a foreclosure is started- this will be reported to credit agencies as a foreclosure in process and it will show up as a foreclosure for credit scores. This will be a 200-300 point hit also.

A mortgage broker in southern California, Catherine Coy said. "The effect on a consumer's credit report -- foreclosure vs. short sale -- is the difference between being hit by a train or a bus," in speaking about borrowers who are a few months in arrears.

What about buying a home again?

Foreclosure will cause a three to five year wait for a new loan.

Bankruptcy is now a four year wait for a new loan.

For a short sale, best case is getting your short sale classified as “settled” from your lender. You may be able to get a loan in two years vs. four years.

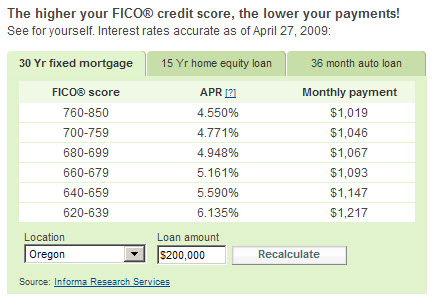

This table shows how your credit score impacts the interest rate you receive on a mortgage:

For more info on how credit and credit scores are determined, download a pamphlet here taken directly from www.myfico.com so you can understand how credit works and what you can do to improve your scores.