Is the Housing Market Starting To Balance Out?

Is the Housing Market Starting To Balance Out?

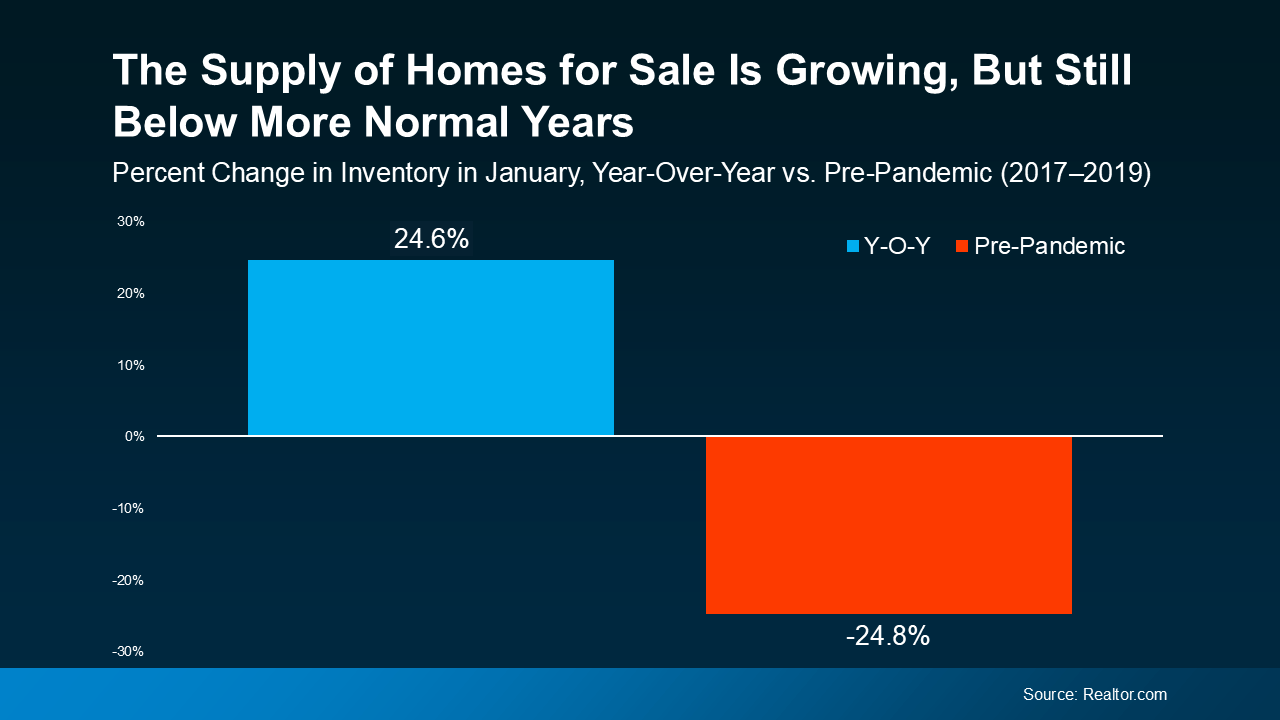

For years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things are starting to shift in many areas.

So, is the market finally balancing out? And does that mean buyers will have it a bit easier now? Here’s what you need to know.

What Makes It a Buyer’s Market or a Seller’s Market?

It all comes down to how many homes are for sale in an area compared to how many buyers want to buy there. That’s what ultimately determines who has the most leverage.

- A Seller’s Market is when there are more buyers than homes available, so sellers hold the power. This leads to rising prices, multiple offers, and homes selling quickly – often above the asking price – because there isn’t enough to go around.

- A Buyer’s Market is when there are more homes than buyers. In this case, the tables turn. Sellers may have to offer concessions and incentives, or negotiate more to get a deal done. That’s because buyers have more choices and can take their time making decisions.

You can see this play out over time using data from the National Association of Realtors (NAR) in the graph below:

Where the Market Stands Now

Where the Market Stands Now

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years. And that’s thanks to how much inventory has grown lately. As Lance Lambert, Co-Founder of ResiClub, explains:

"Among the nation’s 200 largest metro area housing markets, 41 markets ended January 2025 with more active homes for sale than they had in pre-pandemic January 2019. These are the places where homebuyers will be able to find the most leverage or market balance in 2025."

Here’s a look at some of the strongest seller’s markets and buyer’s markets today, according to that research:

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Clever strategies can make buying in a seller’s market easier – and vice versa. And that’s exactly why you need to hire a pro. A local real estate agent knows their market like the back of their hand. They’re super familiar with what the supply and demand balance looks like and how to help their clients get a deal done either way. So, as long as you have a skilled pro by your side, it doesn’t really matter if your town is on the list or not.

With their expertise, you’ll be able to plan ahead and buy (or sell) no matter what the market looks like.

Bottom Line

With inventory rising, the market may be starting to balance out – but it all depends on where you want to buy or sell.

Are you wondering if buyers or sellers have the upper hand in our area? Let’s connect so you can find out.

What This Means for You

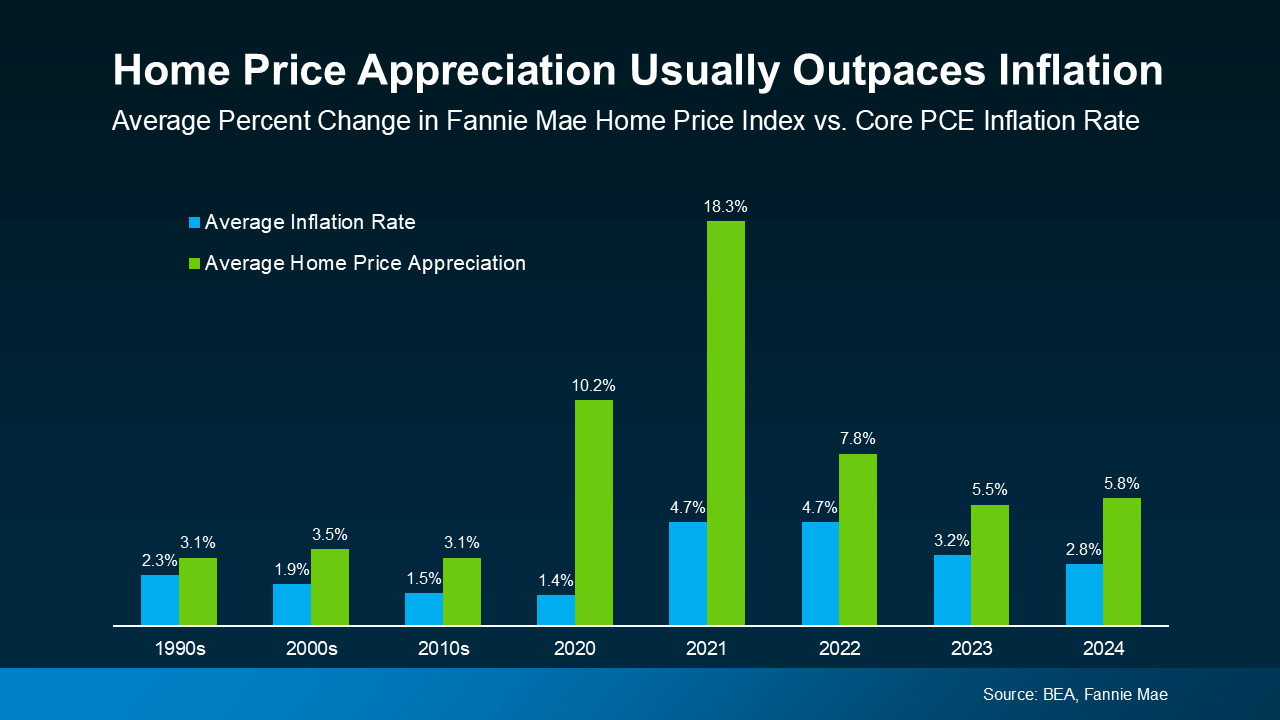

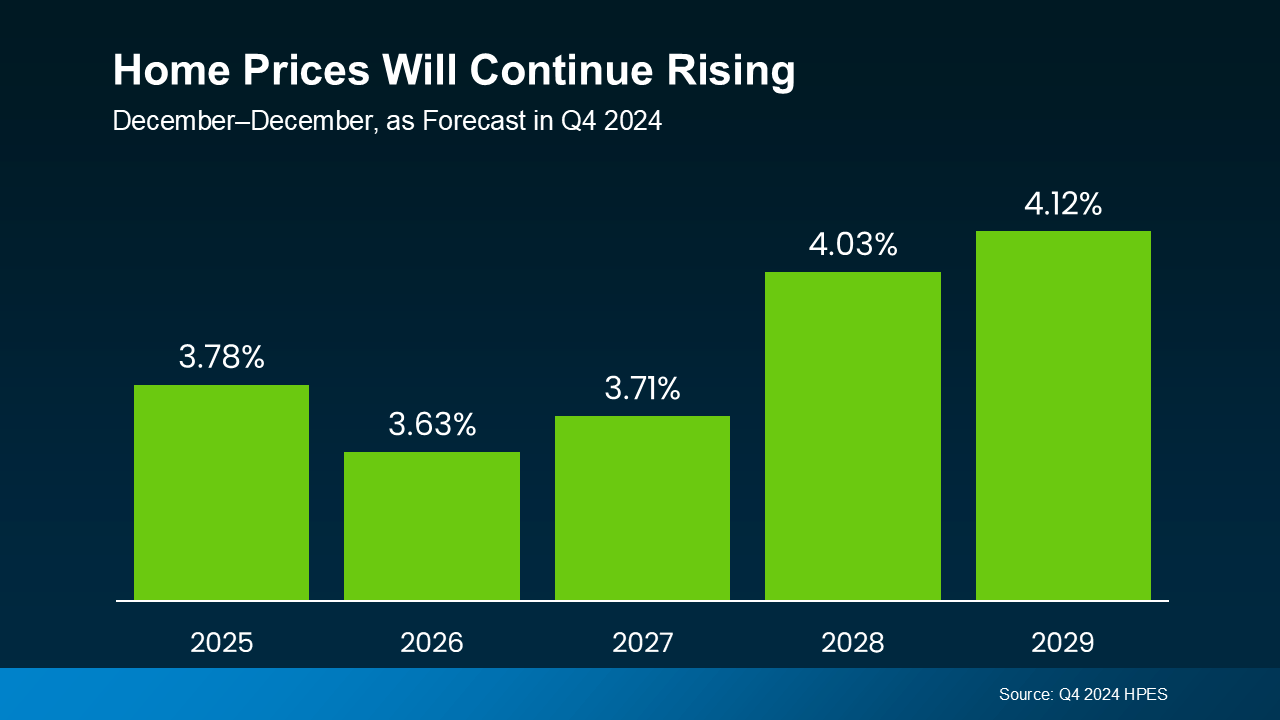

What This Means for You Why Aren’t Prices Dropping? It’s All About Supply and Demand

Why Aren’t Prices Dropping? It’s All About Supply and Demand