Buying a Home Now is a Winning Play!

Displaying blog entries 71-80 of 846

If you want to sell your house, having the right strategies and expectations is key. But some sellers haven’t adjusted to where the market is today. They’re not factoring in that there are more homes for sale or that buyers are being more selective with their budgets. And those sellers are making some costly mistakes.

Here’s a quick rundown of the 3 most common missteps sellers are making, and how partnering with an expert agent can help you avoid every single one of them.

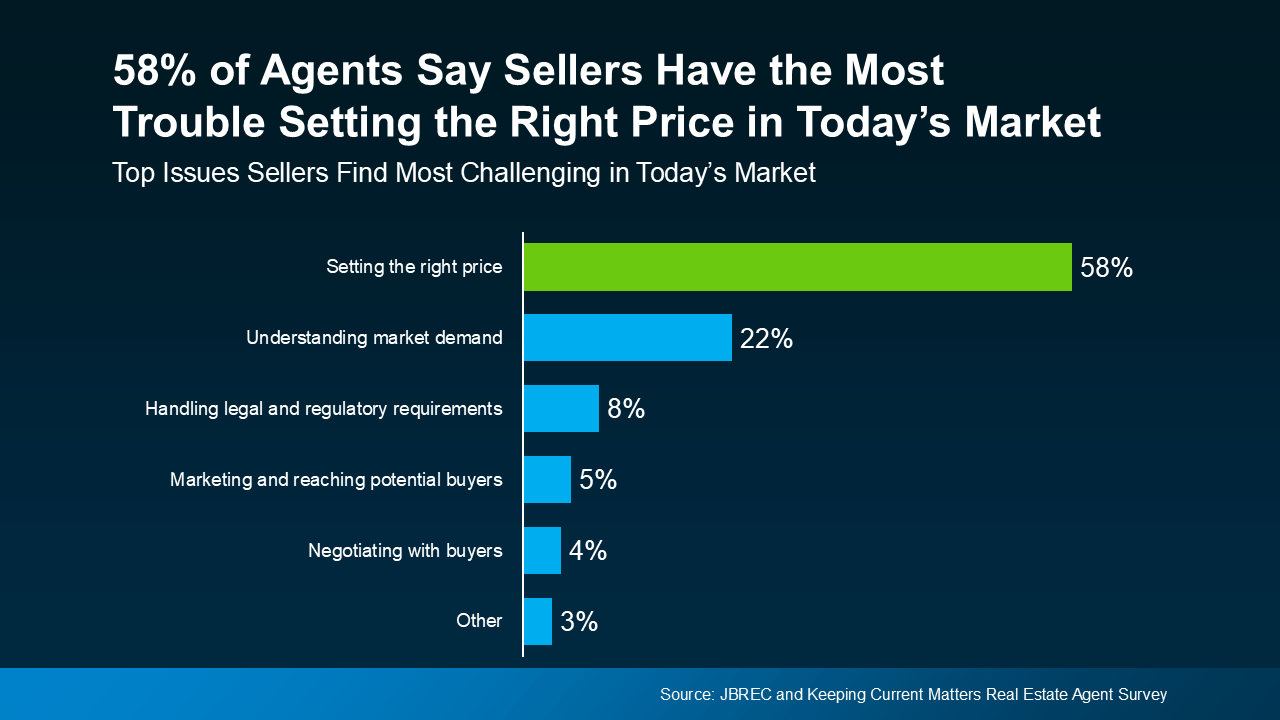

According to a survey by John Burns Real Estate Consulting (JBREC) and Keeping Current Matters (KCM), real estate agents agree the #1 thing sellers struggle with right now is setting the right price for their house (see graph below):

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

Today’s buyers are more cautious due to higher rates and tight budgets, and a price that feels out of reach will scare them off. And if no one’s looking at your house, how’s it going to sell? This is exactly why more sellers are having to do price cuts.

To avoid this headache, trust your agent’s expertise from day 1. A great agent will be able to tell you what your neighbor’s house just sold for and how that impacts the value of your home.

Another common mistake is trying to avoid doing work on your house. That leaky faucet or squeaky door might not bother you, but to buyers, small maintenance issues can be red flags. They may assume those little flaws are signs of bigger problems — and it could cost you when offers come in lower or buyers ask for concessions. As Investopedia says:

“Sellers who do not clean and stage their homes throw money down the drain. . . Failing to do these things can reduce your sales price and may also prevent you from getting a sale at all. If you haven’t attended to minor issues, such as a broken doorknob or dripping faucet, a potential buyer may wonder whether the house has larger, costlier issues that haven’t been addressed either.”

The solution? Work with your agent to prioritize anything you’ll need to tackle before the photographer comes in. These minor upgrades can pay off big when it’s time to sell.

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you want to see. Don’t take it personally. Instead, focus on the end goal: selling your house. Your agent can help you negotiate confidently without letting emotions cloud your judgment.

At the same time, with more homes on the market, buyers have options — and with that comes more negotiating power. They may ask for repairs, closing cost assistance, or other concessions. Be prepared to have these conversations. Again, lean on your agent to guide you. Sometimes a small compromise can seal the deal without derailing your bottom line. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Avoid these common mistakes by starting with the right plan — and the right agent. Let’s connect so you don’t fall into any of these traps.

The past few years have been challenging for homebuyers, especially with higher home prices and mortgage rates. And if you’re trying to buy a home, it’s easy to worry you won’t be able to find something in your budget.

But here’s what you need to know. The number of homes for sale has grown a whole lot lately and that’s true for both existing (previously lived-in) and newly built homes. Here’s a look at those two bright spots for buyers right now and why they may make it a bit easier to find the home you’re been looking for.

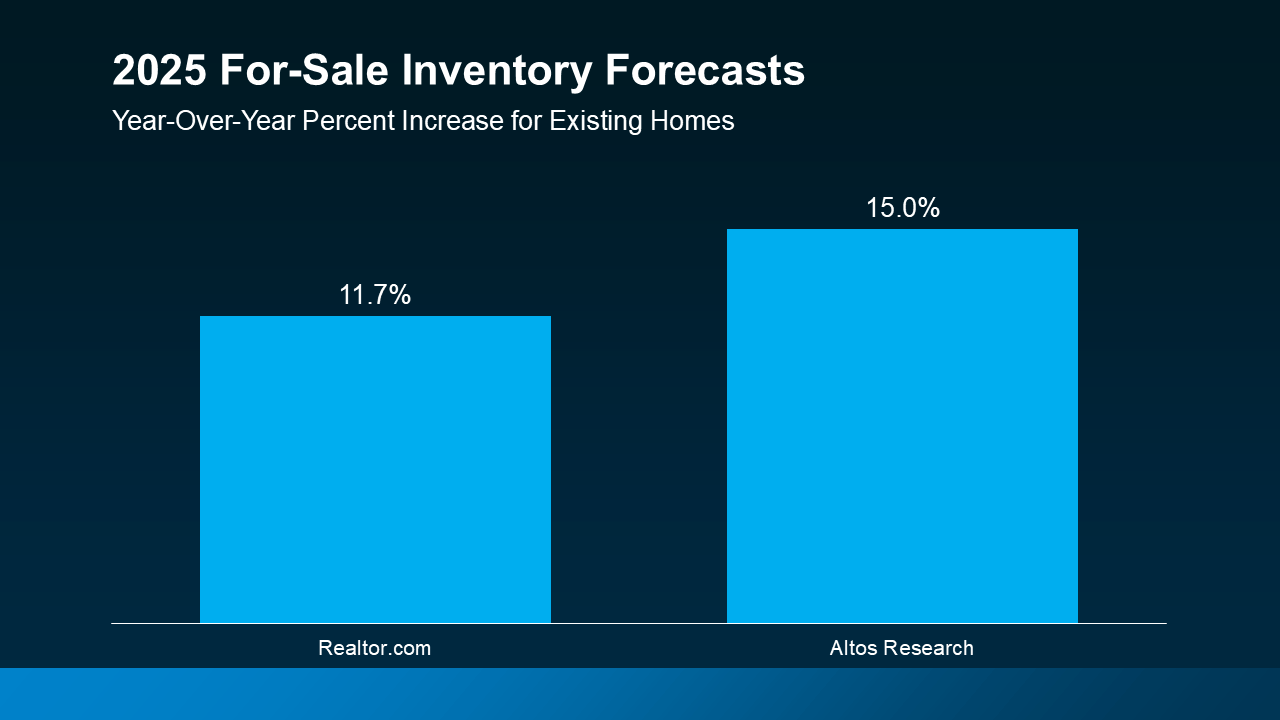

Data from Realtor.com says the number of existing homes for sale improved by an impressive 22% in 2024. And experts say your pool of options is expected to get even better this year. Forecasts show inventory is projected to grow another 11-15% by the end of this year (see graph below):

Here’s why this is so good for your search. If you haven’t seen a house with all the features you need, just know that, as the number of homes for sale grows, you’ll have more options to choose from. That means a better chance of finding a home that checks all your boxes. As Ralph McLaughlin, Senior Economist at Realtor.com, says:

Here’s why this is so good for your search. If you haven’t seen a house with all the features you need, just know that, as the number of homes for sale grows, you’ll have more options to choose from. That means a better chance of finding a home that checks all your boxes. As Ralph McLaughlin, Senior Economist at Realtor.com, says:

“It could be a particularly good time to get out into the market . . . you're going to have more choice. And that's not something that buyers have really had much over the past several years.”

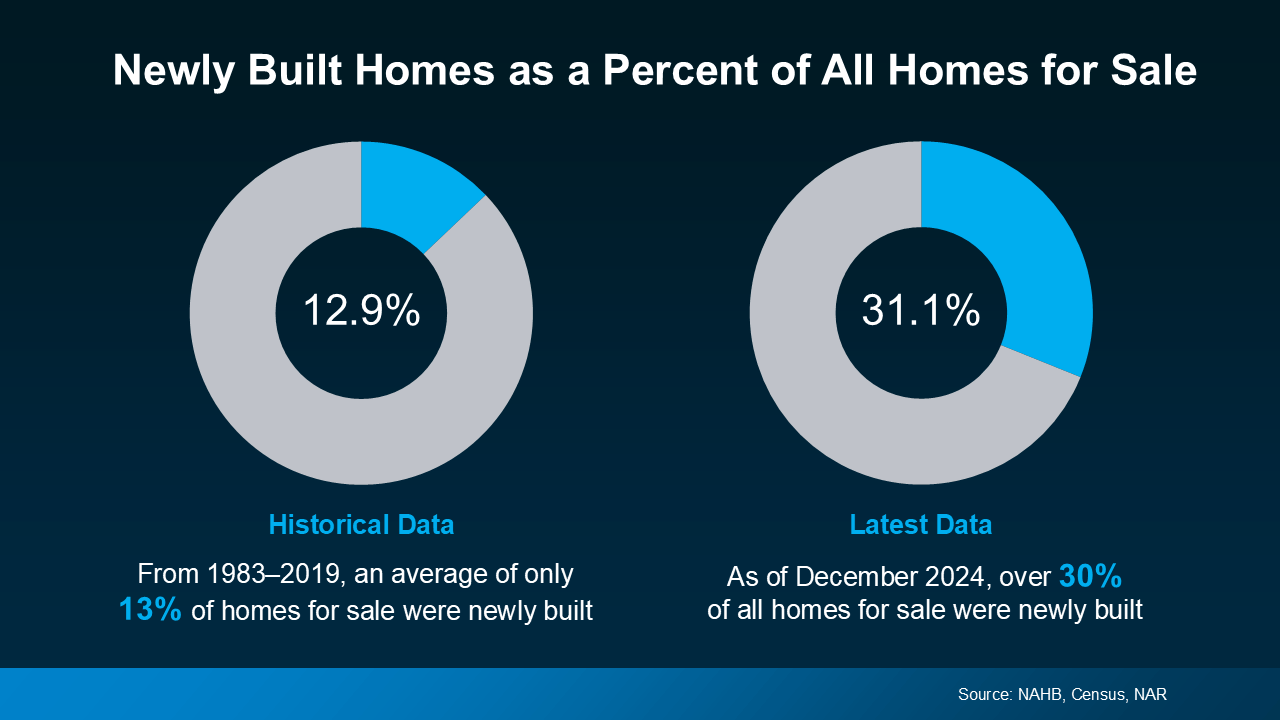

According to data from the Census and the National Association of Realtors (NAR), 31.1%, or roughly 1 in 3, homes on the market right now are newly built homes. That’s more than the norm (see charts below). But don't worry, that's not because builders are overdoing it – it’s just that they’re trying to catch up after years of underbuilding.

And the best part is, since builders have been focusing on smaller homes with lower price points, you may actually find out new builds are less expensive than you’d expect. So, while a lot of people write off new construction because it’s easy to assume the costs are way higher, lately, that price gap isn’t as big as you’d think. As CNET says:

And the best part is, since builders have been focusing on smaller homes with lower price points, you may actually find out new builds are less expensive than you’d expect. So, while a lot of people write off new construction because it’s easy to assume the costs are way higher, lately, that price gap isn’t as big as you’d think. As CNET says:

“If you live in an area where there's a lot of new construction happening . . . you might be able to purchase a new house for a price similar to or even less than a pre-owned one.”

If you haven’t been able to find a home that’s in your budget, it’s time to ask your agent about new builds. If you don’t, you may have been cutting your pool of options by about a third.

More choices could be the key to unlocking your homebuying goals in 2025. Reach out if you want to see what’s available in and around our area.

What features are you looking for in your next home? Let me know and I’ll put together a list of homes you’d love.

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?”

But here’s the thing, no one knows for sure where mortgage rates will go from here, and waiting could mean facing more competition, higher prices, and a lot more stress.

What if buying now — before the spring rush — might actually give you the upper hand? Here are three reasons why that just might be the case.

The winter months tend to be quieter in the real estate market. Fewer people are actively looking for homes, which means you’ll likely face less competition when you make an offer. This makes the process feel less rushed and less stressful.

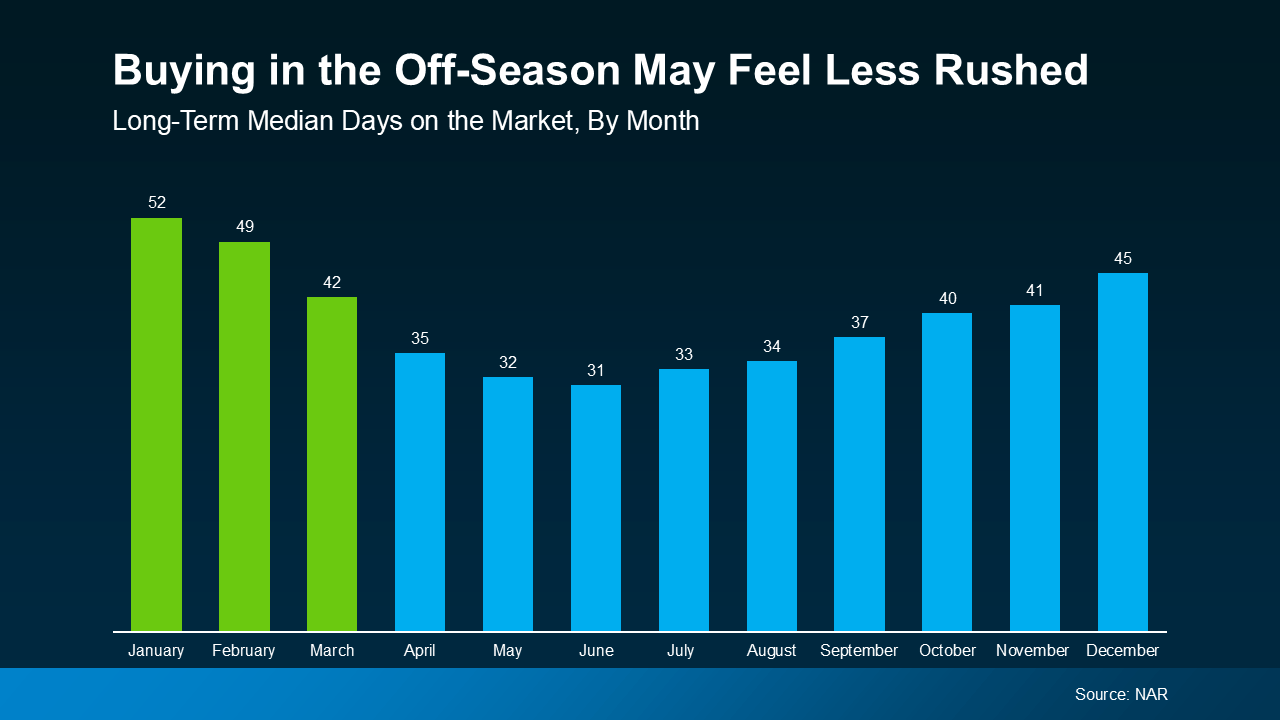

According to the National Association of Realtors (NAR), homes sit on the market longer in winter compared to spring and summer (see graph below):

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

“A significant benefit of buying a home in winter is the reduced competition. Because of the perceived benefits of spring, many buyers delay the start of their house hunt. As a result, you will find fewer people competing for the same properties during winter. Less demand can translate into more negotiating power as sellers may be more willing to entertain offers or agree to concessions to get a deal closed quickly.”

With homes staying on the market longer, sellers may be more willing to negotiate. This can lead to better deals for you as a buyer, whether that means a lower price or added incentives, like sellers covering closing costs or making repairs. As Chen Zhao, an Economist at Redfin, points out:

“. . . buying during the off season means less competition from other buyers. That means potentially negotiating a better deal.”

Plus, when demand is lower, sellers often feel more pressure to work with serious buyers. This could give you an edge to negotiate terms that work best for your situation.

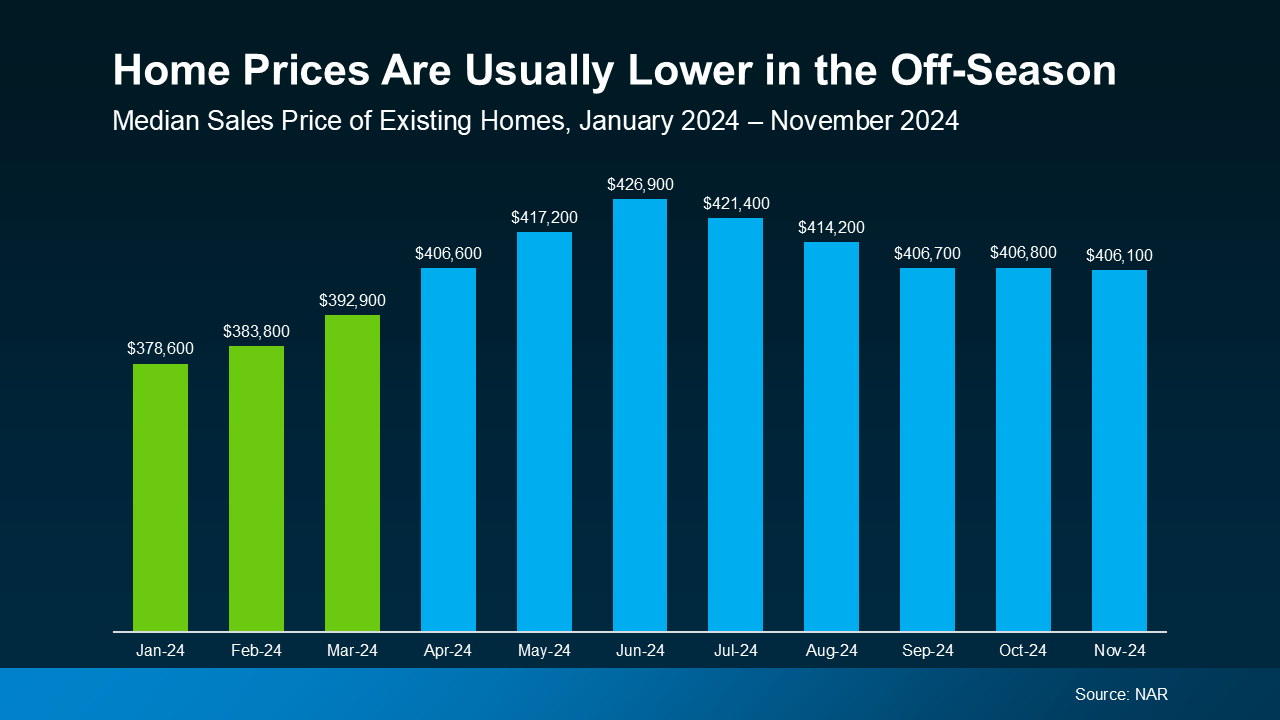

Historically, home prices tend to be at their lowest point in the winter months, too. According to data from NAR, home prices last year were at their lowest in January, February, and March — right before the spring buying season kicked in (see graph below):

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

On top of that, home prices generally appreciate over time, meaning they tend to go up year after year. That means if you’re ready to buy and you can make it happen, you’re not only taking advantage of what might be the lowest prices of the year, but you’re also locking in today’s price before it increases in the future.

While spring may seem like the obvious time to buy, moving before the peak season can give you significant advantages, like less competition, more negotiation power, and lower prices.

If you’re ready to explore your options, let’s connect.

It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more cost-effective options in an unexpected place: new home communities.

Since smaller homes typically come with smaller price tags, buyers have turned their attention to homes with less square footage — and builders have shifted their focus to capitalize on that demand. As U.S. News notes:

“The combination of higher home prices and mortgage rates has strained a lot of people's budgets. And that's something builders recognize. To this end, they may be leaning toward smaller spaces . . .That, in turn, can lead to savings for buyers.”

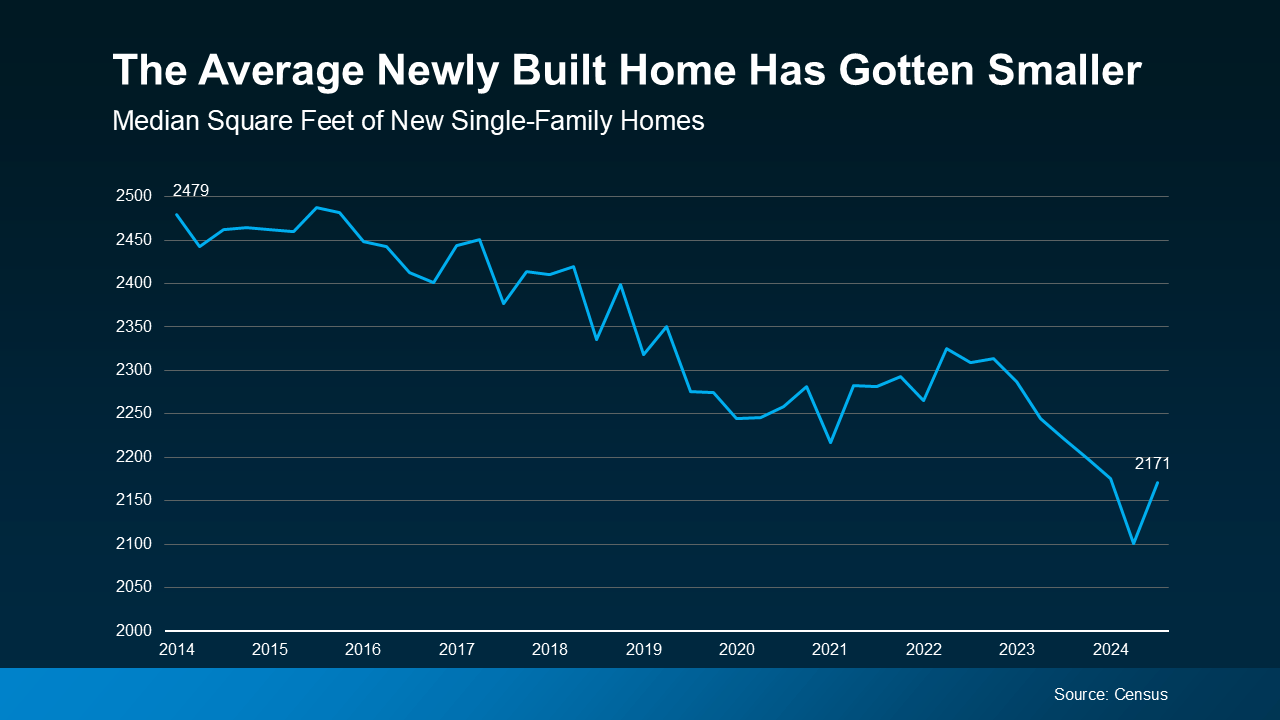

Data from the Census shows the overall builder trend toward smaller, single-family homes has been over the last couple of years (see graph below):

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

At the end of the day, builders want to build what they know will sell. And the number one thing homebuyers are looking for right now is less expensive options to help offset today’s affordability challenges. As Multi-Housing News notes:

“The growing trend toward smaller homes is evident. These homes are less expensive to build and more attainable for many middle-income families, meeting both housing needs and modern lifestyle preferences.”

So, if you’re having trouble finding a home in your budget, it might be worth exploring newly built homes with a smaller footprint.

Not to mention, since newly built homes come with brand new everything, they have fewer maintenance needs and some of the latest features available, like energy-efficient appliances and HVAC. That’ll help you save on repair costs and your monthly utility bills. Sounds like an all-around win.

Today’s builders are focusing their efforts on smaller homes at lower price points. That could give you more opportunity to find something that fits your budget. If you're planning to buy soon, let’s connect to explore what's on the market in your area and get your homeownership goals over the finish line.

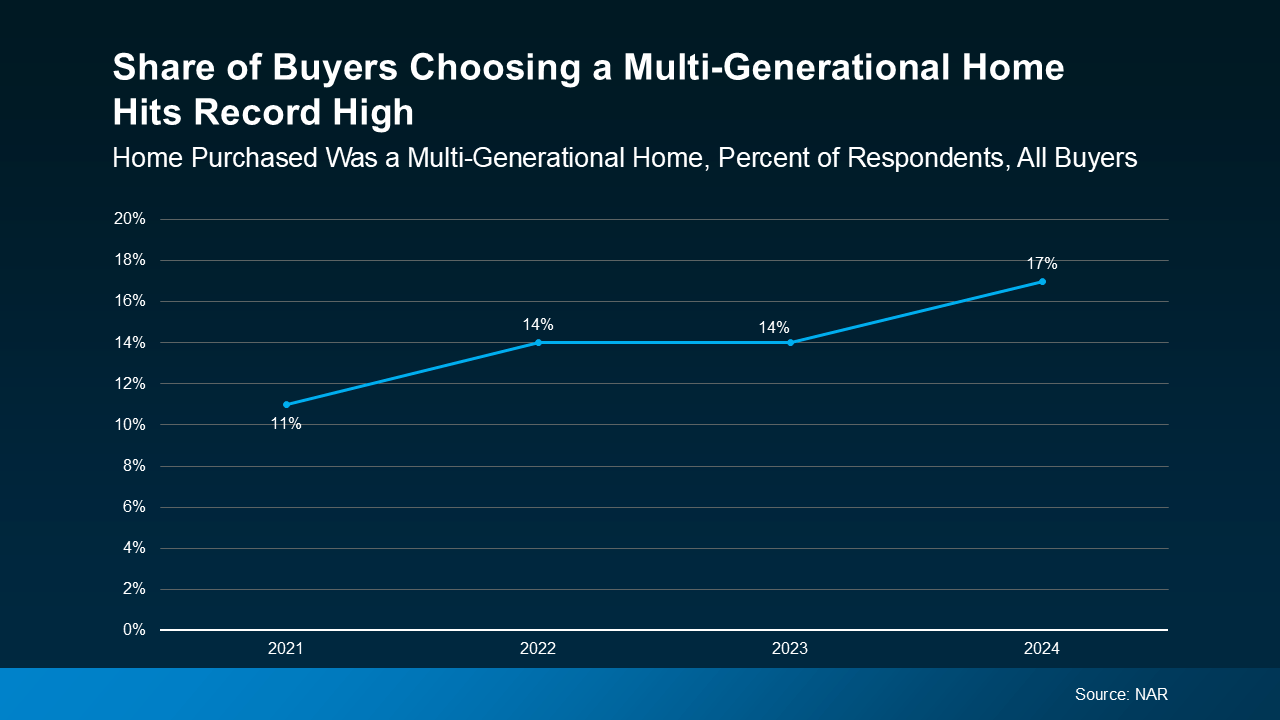

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living?

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational HomeIn the past, homebuyers often opted for multi-generational homes to make it easier to care for their parents. And while that’s still a key reason, it’s not the only one. Right now, there’s another powerful motivator: affordability.

According to the latest data from NAR, cost savings are the main reason more people are choosing to live with family today.

The rising cost of homeownership is making it harder for many people to afford a home on their own. This has led to more families pooling their resources to make buying a home possible.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

You may even find it helps you afford a bigger home than you would have been able to on your own. So, if you need more room, but can’t afford it with today’s rates and prices, this could be an option to still get the space you need.

On top of the financial benefits, it could also bring your family closer together and strengthen your bonds by getting more quality time together.

If you’re considering a move, buying a multi-generational home might be worth exploring – especially if your budget is stretched too thin on your own.

Let’s discuss your needs and find a home that fits your family’s unique situation.

Market Summary November Sales 2024

HAPPY NEW YEAR!

As we head into 2025 here is a brief recap of some stats of the 2024 market. Many real estate sites report that this was a very difficult year with so little inventory and high interest rates. Since the beginning of the year the average market absorption is 2.7 months which is a seller’s market and unbalanced based on all pricing points.

Once I removed the sales for Colton which are mapped into our area through RMLS, we had a total of 136 sales for the year. Here’s a rundown of some of the stats that may be interesting:

13 forest cabins sold

102 detached single family homes sold

11 sales were over $1,000,000

19 sales were in Government Camp

14 condos sold and 9 were in Government Camp

8 sales were in Mt. Hood RV Village with tiny homes

Predictions for 2025 include more inventory coming on the market. We’ll see how that plays out. Currently our mountain market has 36 active listings. There are nine currently pending. So we will see how much the inventory goes up soon after the holidays.

Interest rates, low inventory, and consumer debt are slowing buyers down. Here are predictions for interest rates in 2025. Consensus is that rates will be slightly lower than 2024 but if inventory doesn’t increase, buyers may be paying the same as a todays rates because prices will be higher.

Consumer debt is another obstacle. People are tapped out which makes saving for a home tough.

Consumer Debt

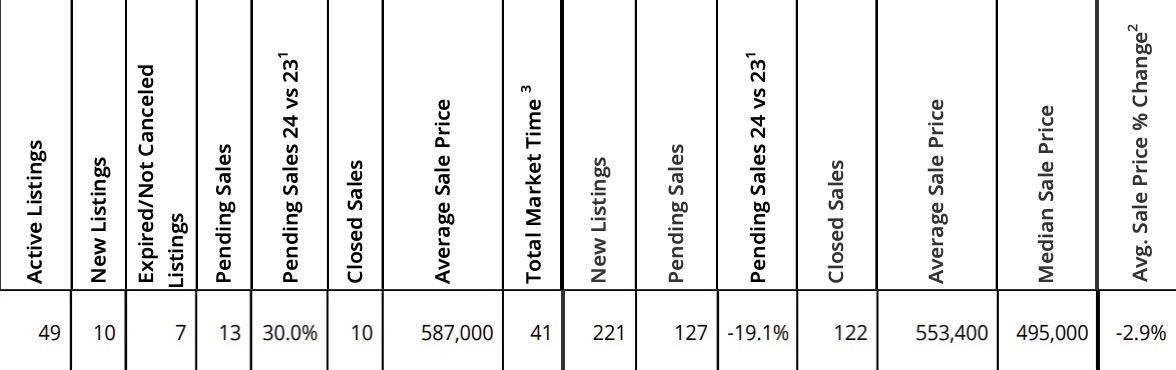

Here are the statistics for November 2024’s market from RMLS.

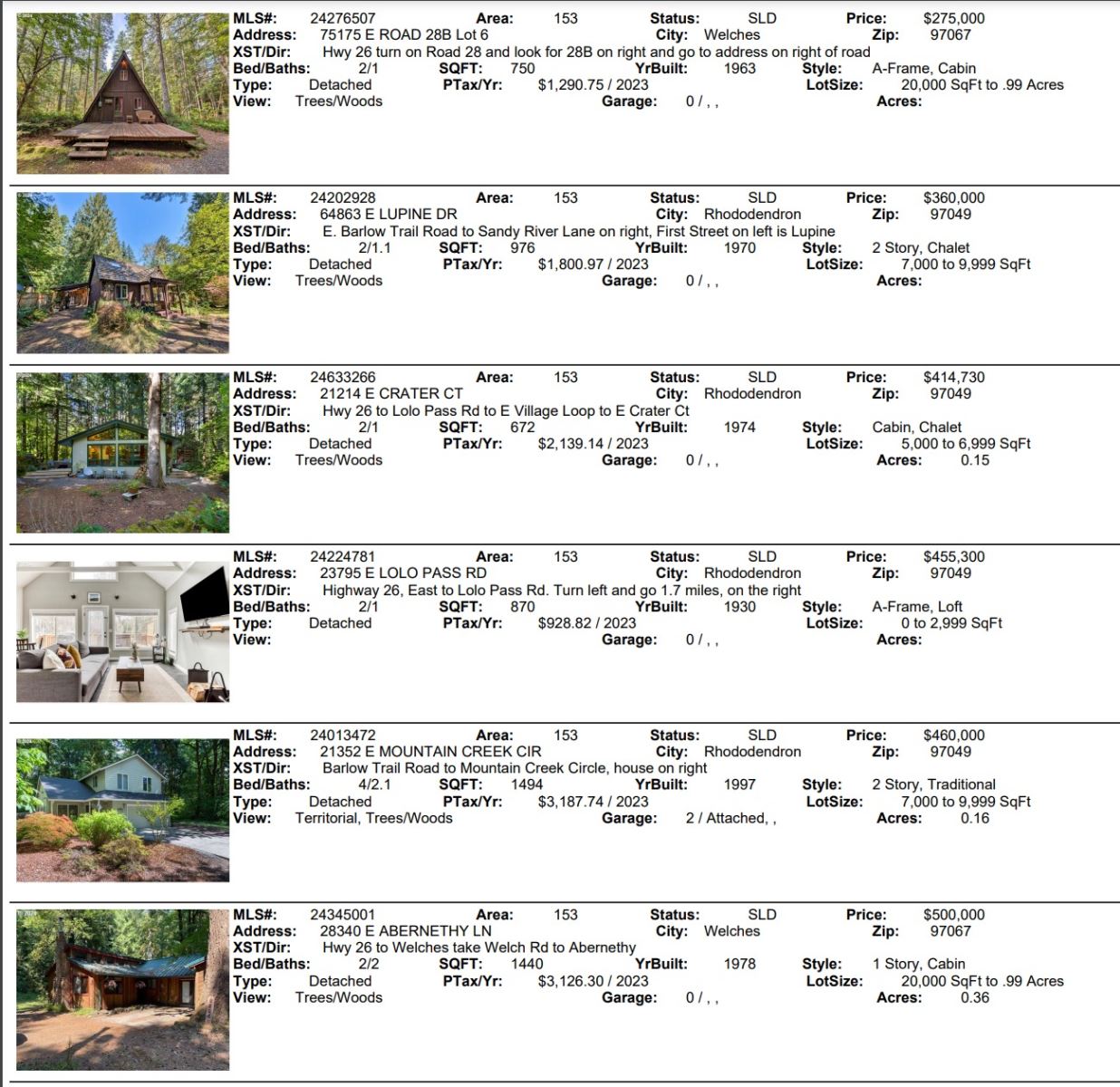

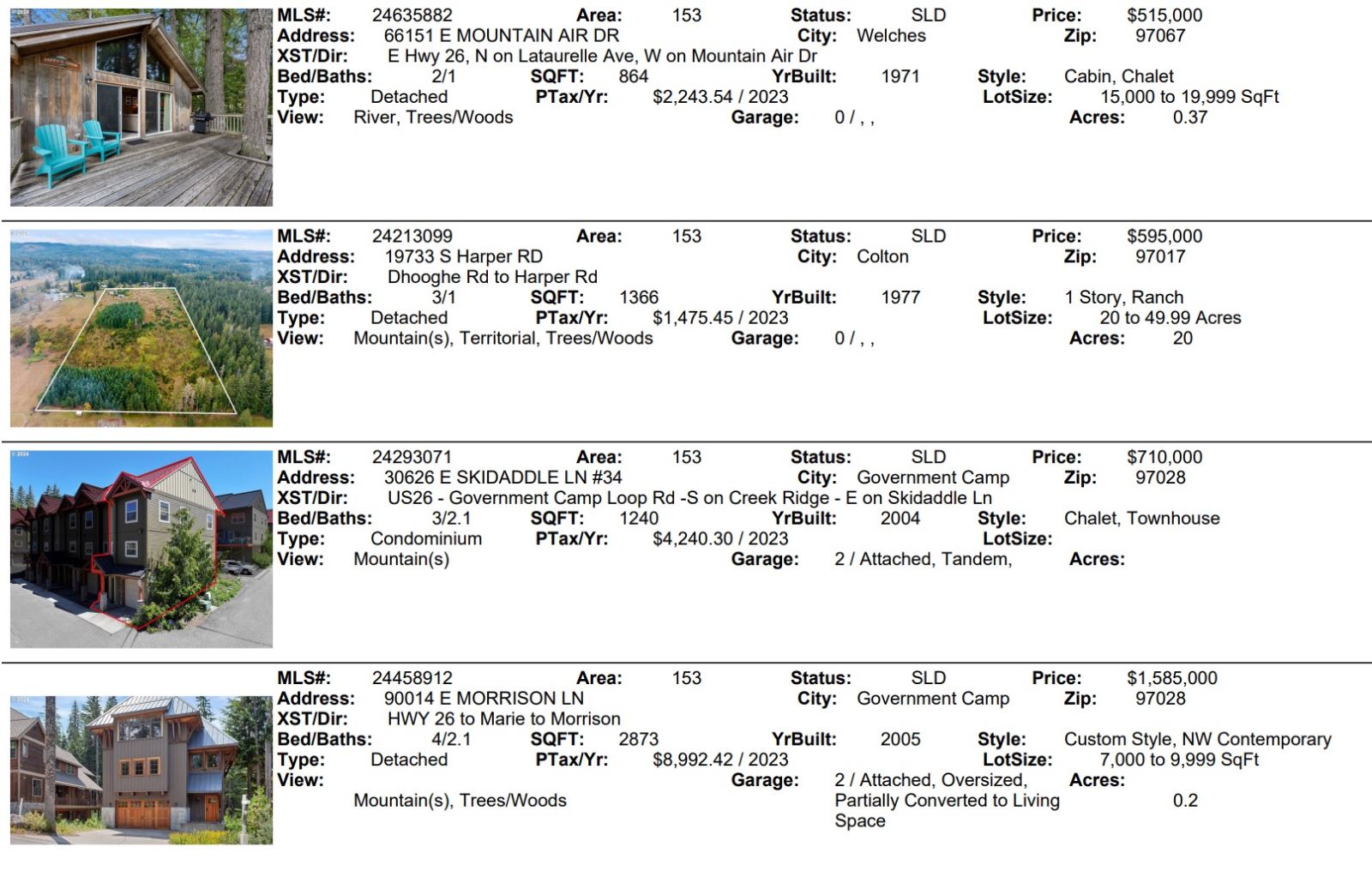

Listed below are the ten sales for November.

December 2024 National Overview

U.S. Real Estate Overview

Note: October 2024 data below are the most recent released by the National Association of Realtors.

Warranties for older homes

New homes come with warranties to protect the buyer in case of the unexpected. But what about existing homes? Fortunately, there are a number of companies today who offer warranties for existing homes. Sellers can now offer their buyers a level of assurance that was previously reserved for new construction, and buyers can buy with confidence! If you are in the market to buy or sell, ask us about the advantages of a home warranty. You might be surprised at how much protection is offered at a very reasonable price.

Seller strategy

Selling your home in today's market requires strategy and execution. Here are some tips to help sellers reduce their time on market while getting excellent value:

These simple tips can help you sell your home and take advantage of our today's market. Please contact us if you have any questions about selling your home. We are here to help!

Displaying blog entries 71-80 of 846