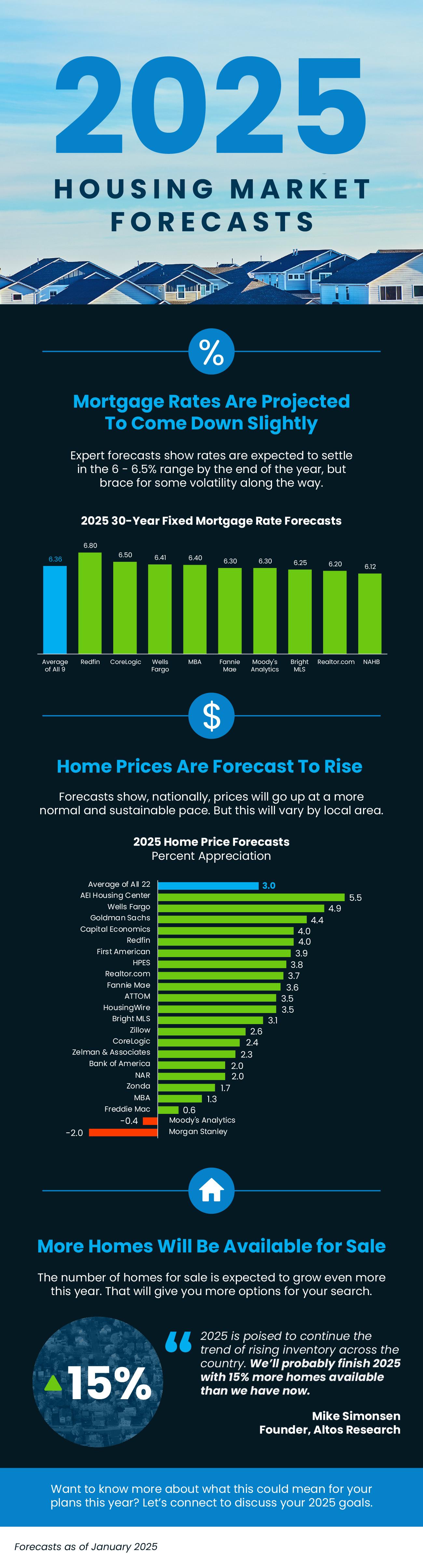

How Much Does It Cost To Sell My House on Mt. Hood?

If you’re toying with the idea of selling your house, you’re probably wondering how much it’ll cost. To be honest, the final number will depend on several factors like the offer you accept, if you help with your buyer’s closing costs, how many repairs you tackle, and more.

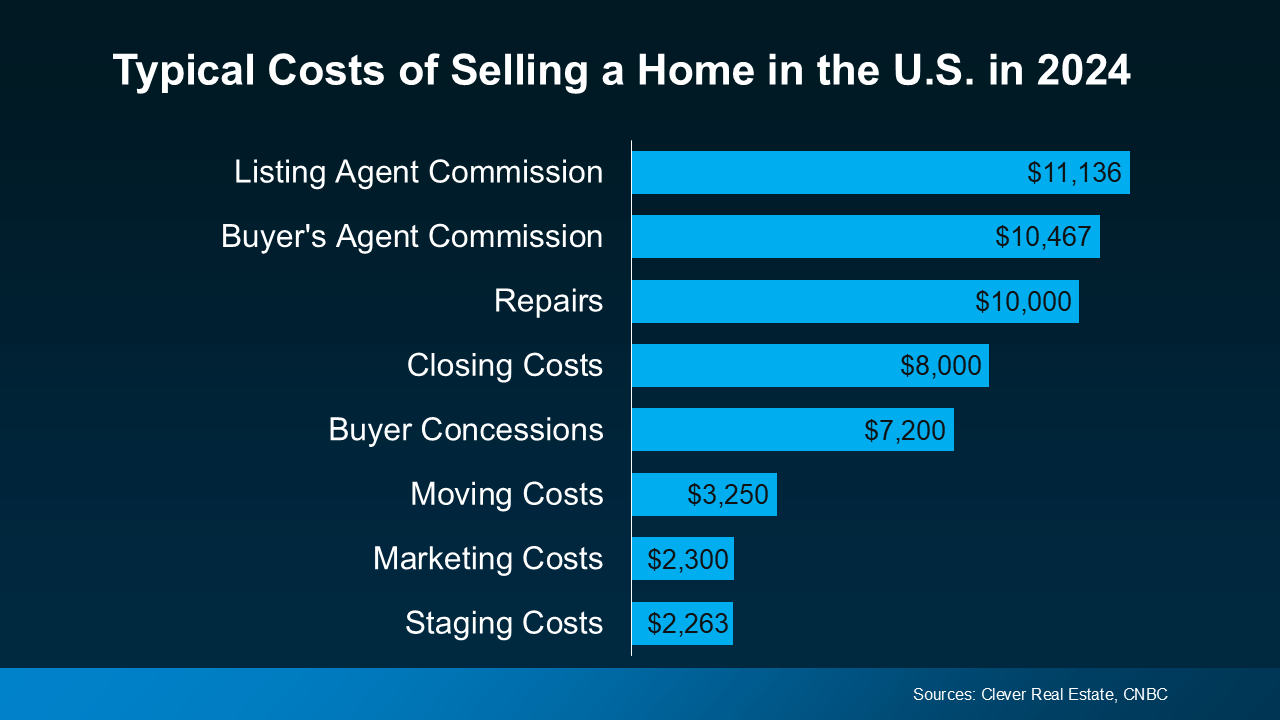

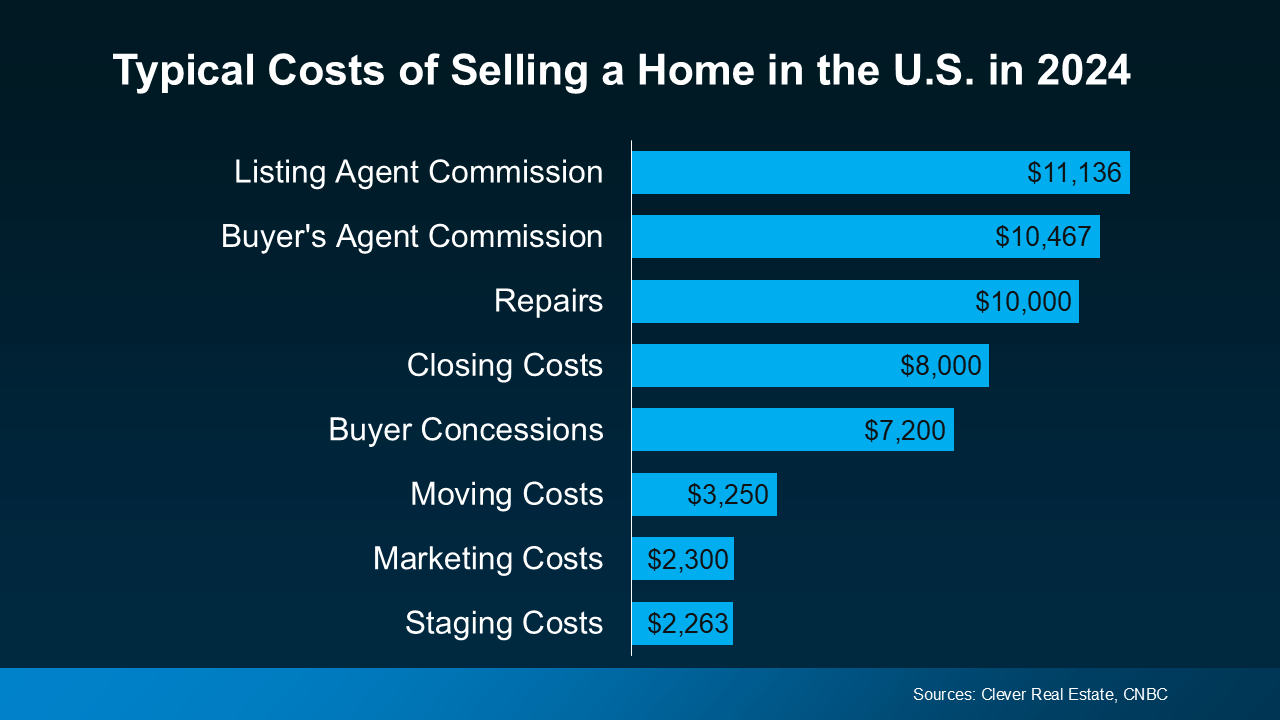

So, to give you a ballpark of what to expect, here’s some information on a few of the expenses you’ll want to be ready for (see graph below):

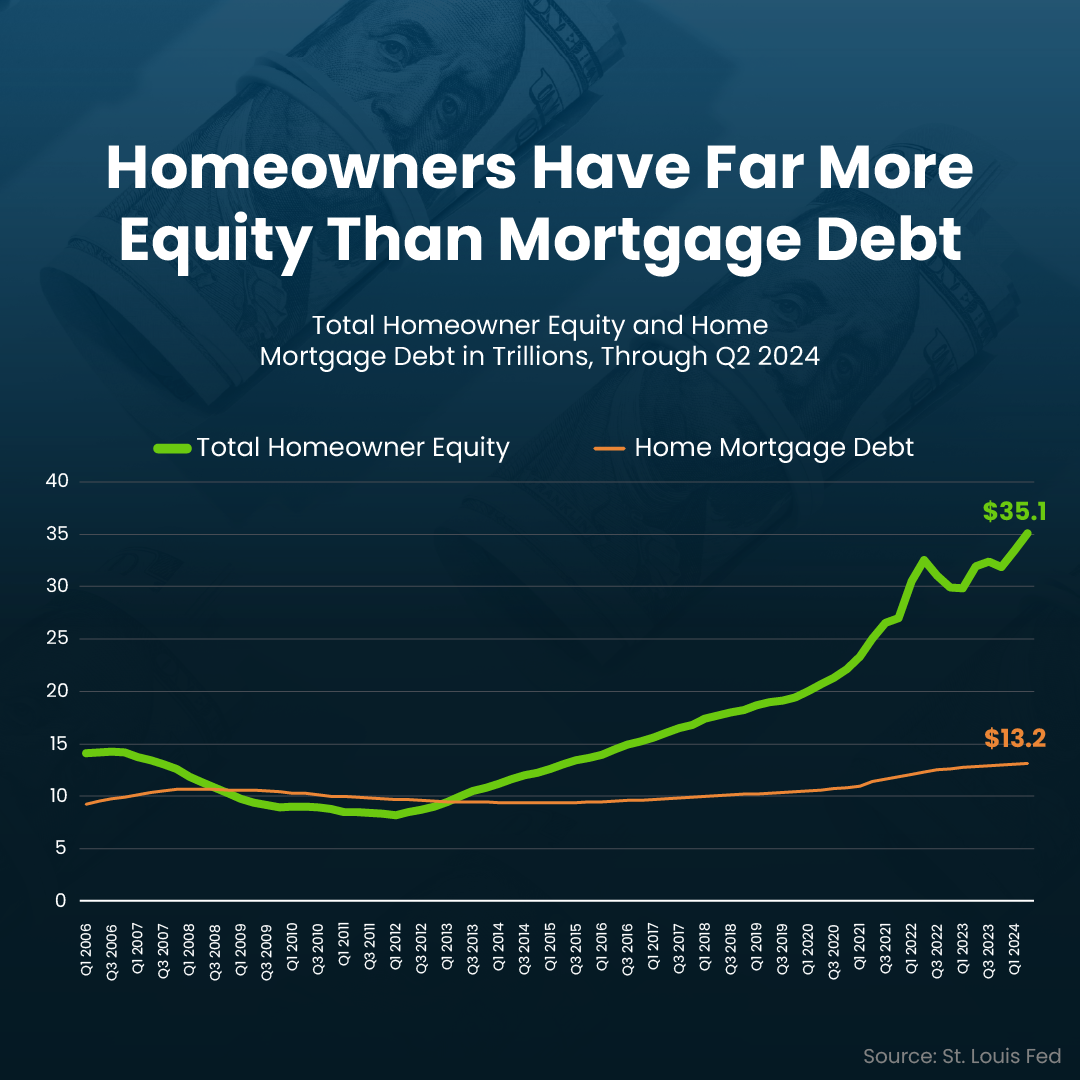

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

Let’s dive into a few of the costs from the graph above, so you have a bit more context on what they include and where you may be able to save some money, when it makes sense.

Closing Costs and Commission

These are the fees you’ll pay at the closing table to cover various aspects of the sale. You’ll have your own closing costs and you may even offer to pay some of the buyer’s as a concession. As U.S. News Real Estate explains:

“Closing costs are fees that are paid to finalize the transaction and transfer ownership of the home to the buyer . . . Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price, this means that closing costs in 2023 for sellers are about $7,740 to $15,480. . .”

Taxes are going to vary by state and agent commissions depend on what you agree upon upfront. And keep in mind, that the numbers in the chart above are just an example, not exact figures. Not to mention, if you put money toward things like your property taxes, mortgage escrow, etc. as part of your current mortgage payments – there's a chance you’ll get a credit back at closing that can help offset some of these selling expenses.

Pre-Listing Inspection and Repairs

One optional step some sellers take is having a pre-listing inspection. It gives you an idea of what may pop up later on in the buyer’s inspection – because those are the items a buyer may ask you to toss in a credit (or concession) to cover later on.

This allows you to get a jump on any repairs and tackle them before you list, so your house is set up to impress from the start.

Again, if you want to skip this step, an agent can help. They’ll be able to give you advice on things like paint colors, small cosmetic repairs, what buyers are looking for, and whether it’s worth tackling anything else ahead of time. This will help make sure you’re spending money on things that are most likely to net you a solid return on your investment.

Home Staging

As inventory grows, you may want to take a few extra steps to make sure your house stands out. Staging is an optional way to make sure your house shows well. It can include bringing in rental furniture if the house is vacant or art to warm up the walls. Some staging can even be done virtually once the photos are taken. But, in general, how much does it cost? According to Bankrate:

“Home sellers typically pay somewhere between $782 and $2,817 in home staging costs . . . but the price tag can vary widely.”

If you want to skip this step, you could opt to lean on your agent’s advice for what looks good and what may feel cluttered. A great agent will suggest things like removing a chair to open up the flow of a room, laying down a rug to add warmth to a space, or taking down photographs to de-personalize strategic areas.

Why Leaning on an Agent Is Key

If you’re looking to cut down on your costs, you have options. But be careful of where you trim. You may be able to skip staging or a pre-listing inspection since those are optional, but you don’t want to skimp and sell without a pro.

An agent is your go-to expert throughout the transaction. They’ll offer customized advice every step of the way, including how to stage the house and what repairs to tackle. This can help you avoid hiring an outside stager or having to pay for a pre-listing inspection.

But that’s not the only way your agent adds value. They’ll also create tailored marketing and pricing strategies that’ll highlight the house’s best assets and any work you did to get the home show ready. And that can actually help your house sell for more in the long run.

Bottom Line

Want a better picture of what you should expect when you sell your house? Let’s have a conversation and walk through it together.

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home