Sunday, December 20, 2009

by Liz Warren

The time frame for the land swap in Government Camp could take at least two to five years to complete according to the USFS. This was swap was passed in the Wilderness Bill by the Obama administration this year but the 64 steps of paperwork could take a long time.

Sen. Ron Wyden, Rep. Earl Blumenauer and Rep. Greg Walden are trying to get the head of the Forest Service to speed up the process. A "speedy" process at the Forest Service is two to three years. It will take around $2,000,000 to complete the process and the issue is money to do the work and fulfill the 64 steps the agency needs to complete.

For anyone who does not know what the land swap is, this is a trade between Mt. Hood Meadows LLC who own 770 acres near Cooper Spur, for 120 acres adjacent to the existing Government Camp boundaries to environmentally protect sensitive areas near Cooper Spur. This debate had been going on for over 20 years.

For details on the process visit this article in the Oregonian.

This link will take you to the 27 page GAO report by the Government on the land swap and their investigation of the process back in 2006.

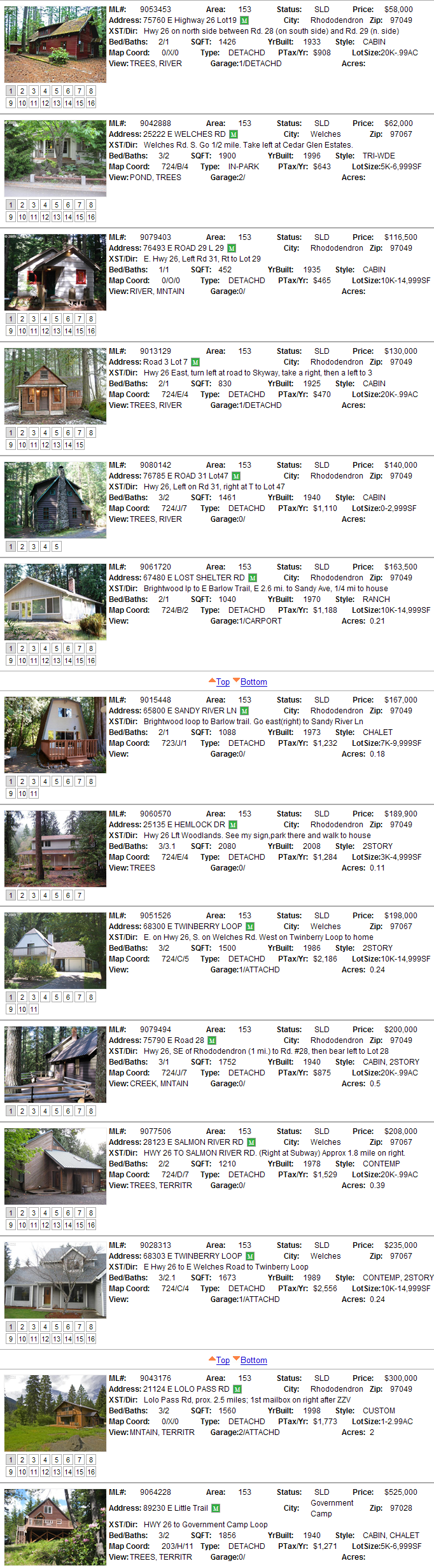

Eventually, there will be more land for building either single family or multifamily units in the Government Camp area as Mt. Hood Meadows acquires this land for development. The question is, how long will this process take and how quickly will Mt. Hood Meadows start the process for development.