Time Closing in on Tax Credit

Time is ticking away if you're a first time home buyer and want to use the tax credit. The dead line to have your tranaction in place is April 30th so don't delay in getting that property now.

Displaying blog entries 771-780 of 847

Time is ticking away if you're a first time home buyer and want to use the tax credit. The dead line to have your tranaction in place is April 30th so don't delay in getting that property now.

Is this a great time to purchase a home or what? According to the S & P Case Shiller Pricing Index home values have adjusted to August 2003 levels. You may be paying 2033 prices but you are actually getting a greater value! Why, because interest rates are 1% less than they were in 2003! On a loan balance of $200,000 that would save you $145.00 per month.

Take advantage of today's great buying opportunities!

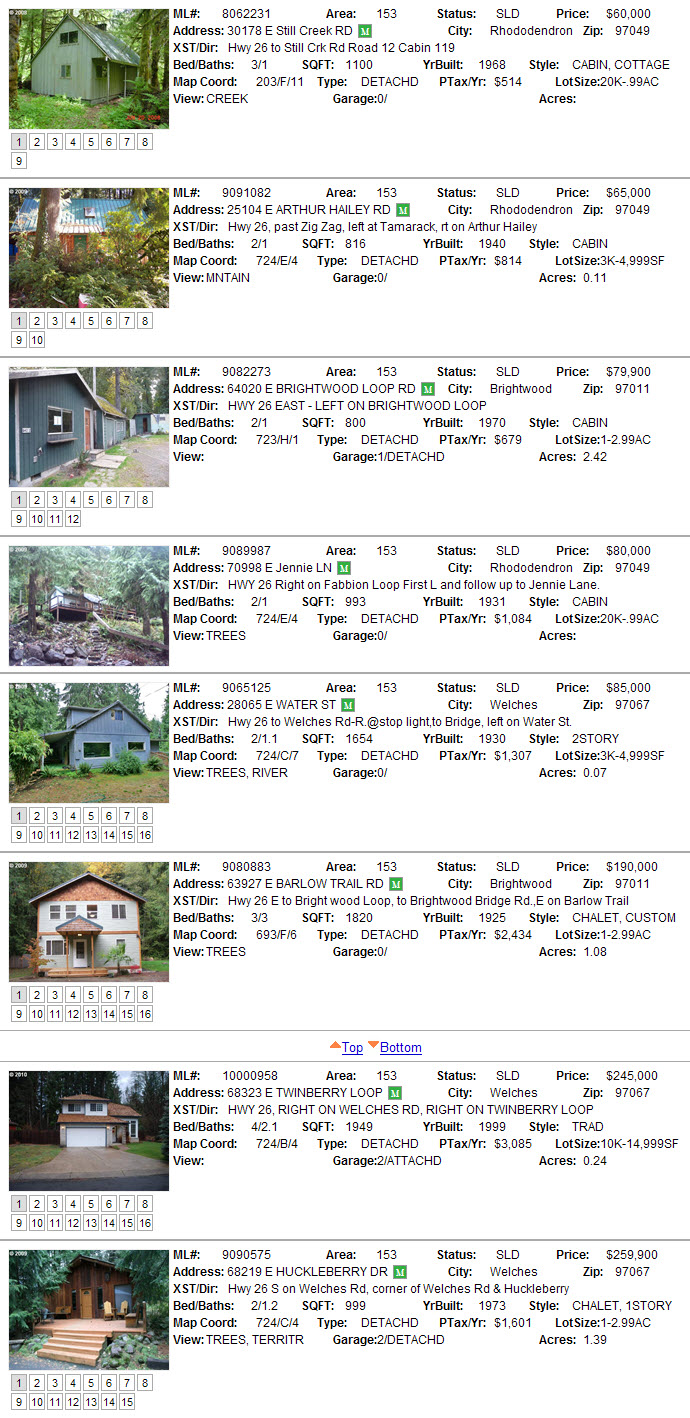

Here is a list of the sold properties for March 2010 taken from Multiple Listing service. Four of these properties were foreclosures and five of the eight were sold for less than $100,000.

April sales are shaping up in a similar fashion. In a similar fashion I mean the foreclosures and distressed properties are selling. Of the four sales listed for April up to this point, three are foreclosures and one was a distressed sale heading into foreclosure.

Sadly, even more foreclosures are coming on the market. According to RealtyTrac there were more foreclosures in the first quarter of 2010 than there have since they have been tracking-since 2005. Leader states in foreclosures are California, Florida, Arizona and Nevada for the first quarter. Why so many now? The banks are finally getting through the glut of processing. RealtyTrac reports that there will be approximately one million foreclosures in 2010 and around four million fillings for foreclosures this year.

Two reasons for increased foreclosures: high unemployment and declining values making owners "underwater" owing more than their home's market value. This is really causing a domino effect as the foreclosures drag down market values more people will become "underwater".

Once this excess foreclosure inventory is gone, the real estate markets will stabilize.

The Portland metro price decline from last March to this March is 10,9%.

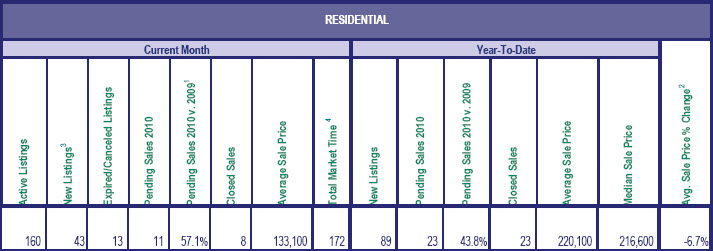

Mt. Hood statistics for March 2010 show a 6.7% decline. Based upon the numbers from March 2009 with minimal sales and March 2010 sales I don't see the 6.7% figure as a realistic gage. From what we are seeing in today's market in pricing the minimum gage we should use for Mt. Hood properties would be the 10.9% number.

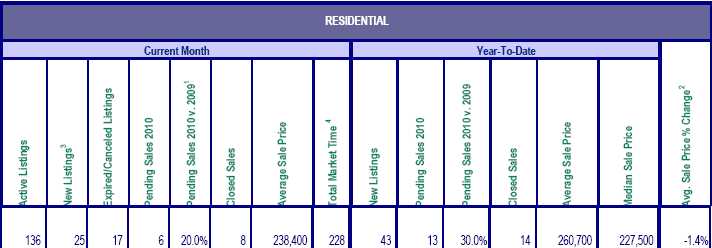

The multiple listing service for the Portland metro area has just come out with the numbers for March 2010 Mt. Hood sales. Here are the numbers:

A huge number of new listings came on the market- this could be the "shadow inventory" or people waiting for the market to improve that have been holding on till economic news has improved. There's another wave of foreclosures coming on to the market so if this is "shadow inventory" the timing may be off. Forty three new properties to come on the market in one month is 25% of the entire market of listings for sale!

Real estate is local. No matter what the national media is saying it doesn't pan out in our local market. Oregon has always been a year behind most "national" real estate trends. We were late in the decline and we will be late for the "recovery".

Trends that are showing up:

1. much longer marketing times

2. serious impact of foreclosure sales on pricing

3. declining average sales price

4. increased pending sales numbers

Although this month's percent of sales price change shows 6.7% from last year, I find our data base is so small it does not give a true picture of what is really happening. Portland metro homes declined in price by 10.9% as an average so I suspect our number is greater than that.

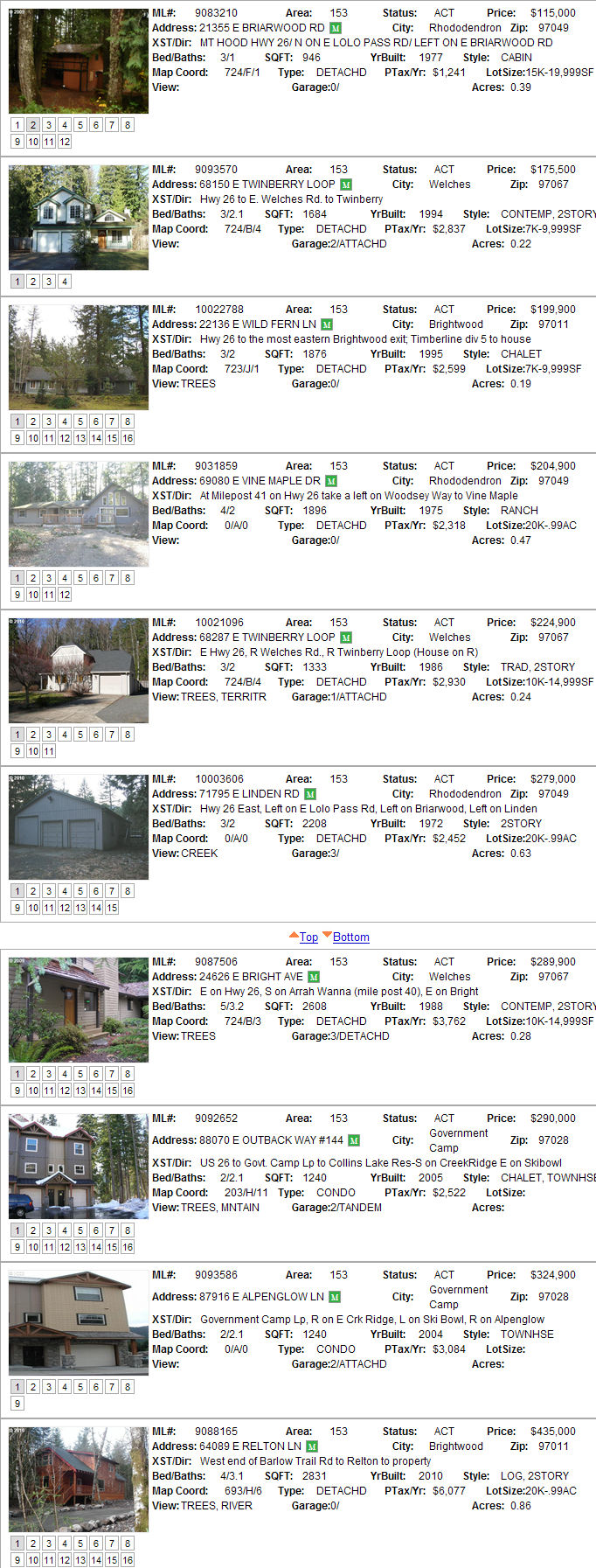

Listed below are the latest Foreclosed Properties on the mountain from Government Camp, Brightwood, Welches and Rhododendron.

There are bargains to be had in this group!

February sales in the Mt. Hood area brought three waterfront properties, one Government Camp sale, one leased land sale, three subdivision sales (two Timberline Rim homes and one Zig Zag Village) and one foreclosure. Reviewing county records, there are more foreclosures on the way.

Second home sales are dominating this month with the highest sale amount hitting $335,000. Activity for waterfront homes and cabins seem to dominate current showing activity for Rhododendron, Brightwood and Welches.

March sales to date are currently hittinga total of five but four out of the five closed sales are under $100,000.

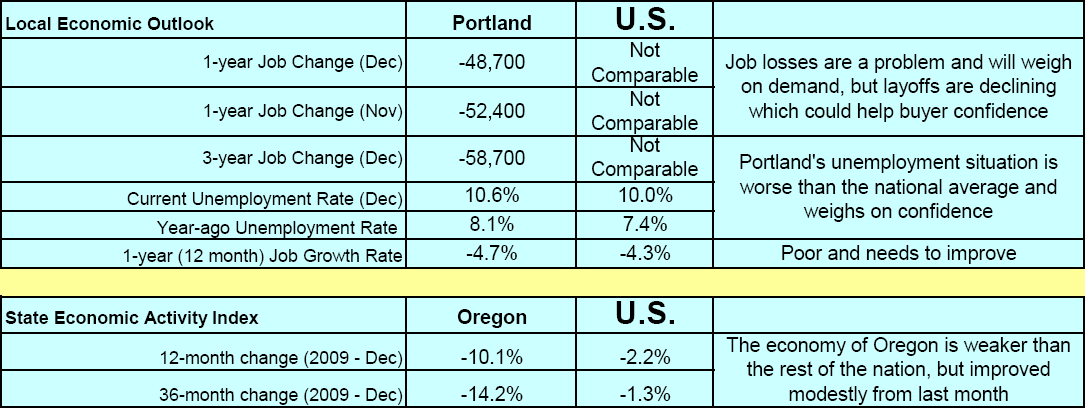

The National Association of Realtors provided this information comparing the Portland Metro area economic conditions with the rest of the US. These numbers were produced from the 4th quarter of 2009. Once we regain jobs our housing market will recover.

Multiple Listing has just released the February sales numbers for the Mt. Hood area from Government Camp, Brightwood, Rhododendron, and Welches. Number of sales are up and prices are down.

Our area saw eight closed sales. Pending sales are up 20% from the same momth in 2009 and 30% up year to date. This is good news. Compared to last year at this time the "number of sales" is a good indicator that 2010 should be a much better year than 2009 when we were still realing from the stock market plunge and credit tightening. Listing numbers are starting to increase. If interest rates stay near their present numbers this bodes well for a better market.

There's lots of credit information/conditions getting tracked by the Federal Reserve Bank of New York. Not only do they track mortgage information but credit card delinquencies, student and auto loan delinquencies and more!

Here are some interesting statistics for Clackamas County from this site:

* 4.2% of all mortgages are delinquent at 90 days or more

* 5.3% of Jumbo mortgages are in foreclosure

* 1.6% of prime loans are in foreclosure

* 1.9% of FHA and VA loan mortgages are in foreclosure

* 92.7% of prime loans are current!

* 9.1% of student loans are 60 days delinquent

If you'd like to check out other Oregon counties or states, visit this web site.

Displaying blog entries 771-780 of 847