Mt. Hood Sales for January 2011

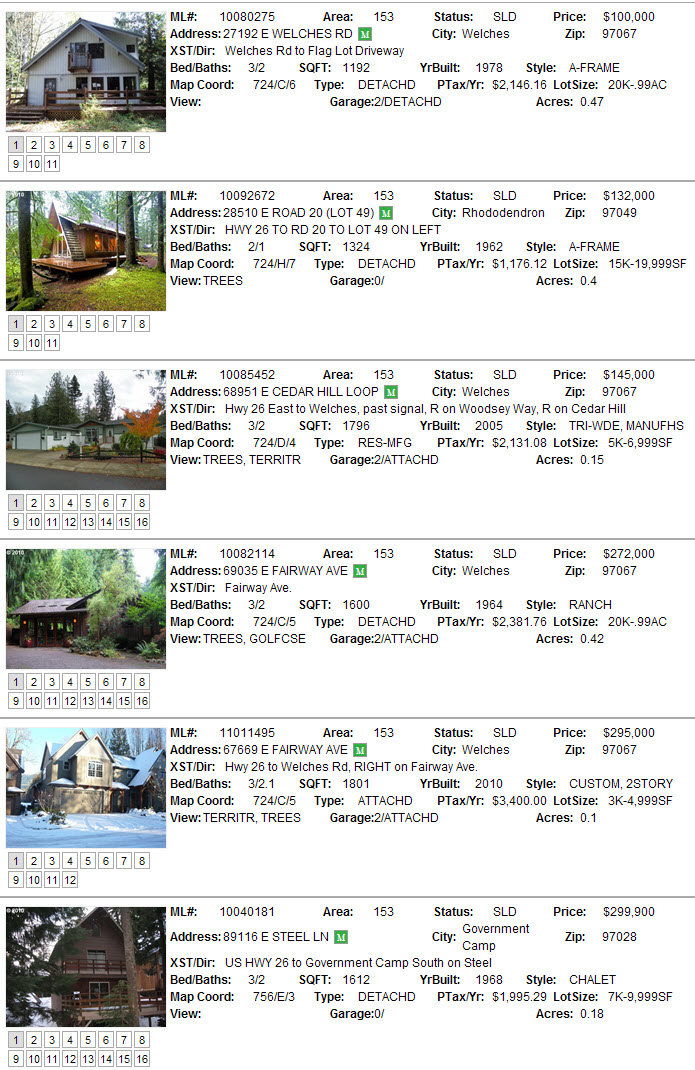

The numbers are in for January 2011. Six sales closed this past month. Only one foreclosure in the group. Most sales this month were second home buyers.

Displaying blog entries 721-730 of 847

The numbers are in for January 2011. Six sales closed this past month. Only one foreclosure in the group. Most sales this month were second home buyers.

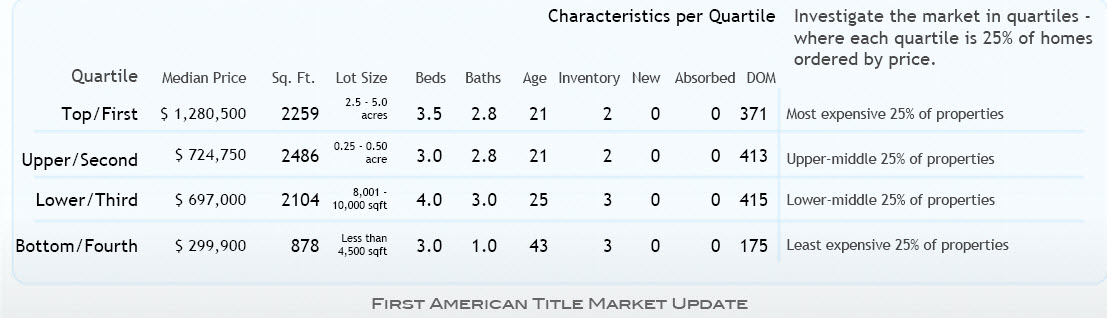

The Government Camp real estate market is a total buyer's market. Here are statistics from First American Title for the past week's round up. Extended marketing times of over 400 days for most price ranges indicate a need for movement downward to sell. The most plentiful of choices come at Collin's Lake where condos are offered in the low $200,000 range. Although many of these offerings are bank foreclosures-most are located along Hwy 26 with a level of noise many buyers are not willing to accept. Difficulty in securing financing on Condo units should continue to crowd this market with additional inventory causing prices to dip further.

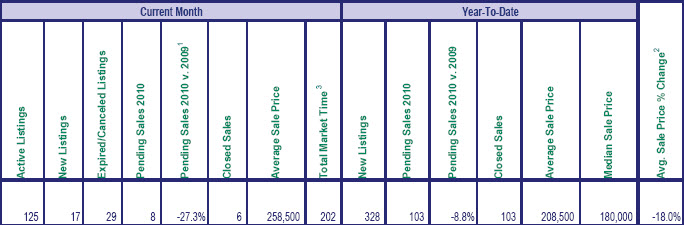

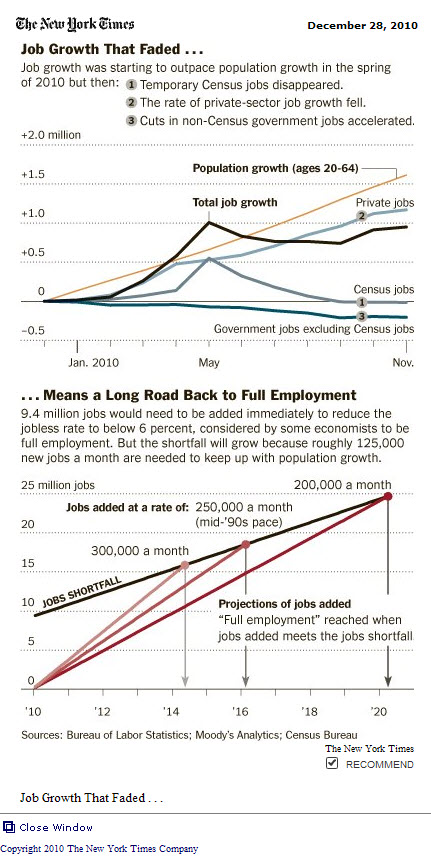

Don't forget, real estate is LOCAL. Nationally the news is that sales were up around 12% nationally for the month of December. We can see that is not the case in the Mt. Hood area although activity has picked up for January. Pending sales compared to last year at this time is down 27%. Overall for the year, sales are down nearly 9%.

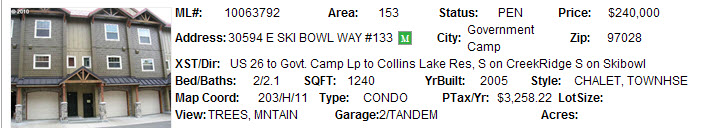

Collins Lake foreclosures are dominating the market in Government Camp. Here is a recent new listing that just became available today.

Another foreclosure unit went pending today, listed at $240,000

The last two sales closing in Collins Lake were also foreclosures. Once closing at $207,000 and another at $234,000.

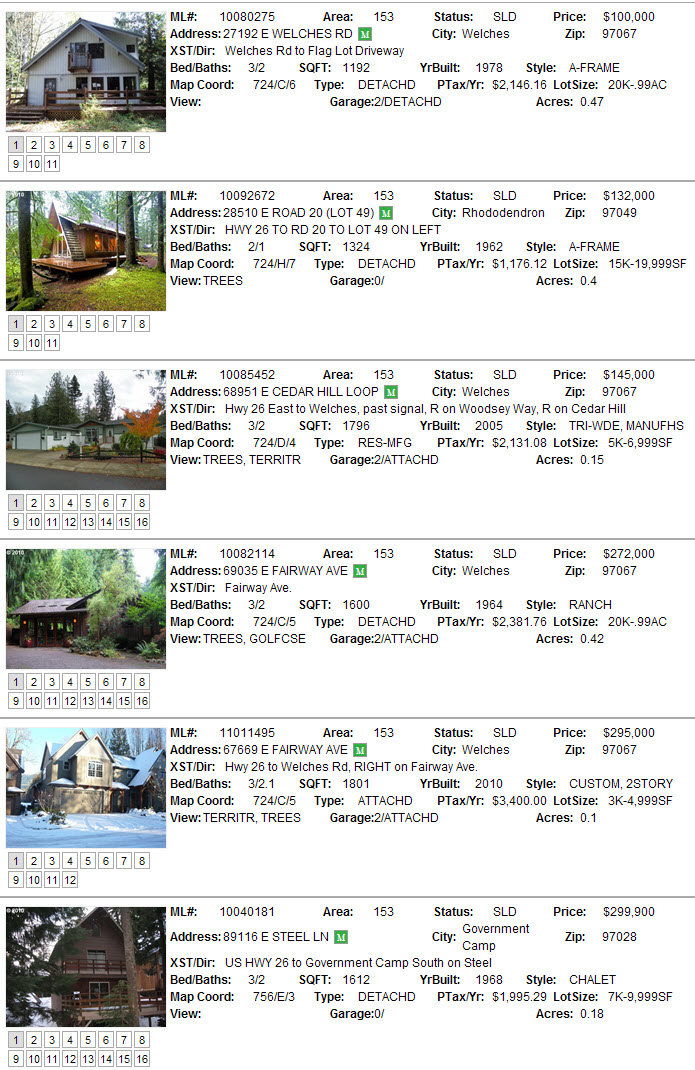

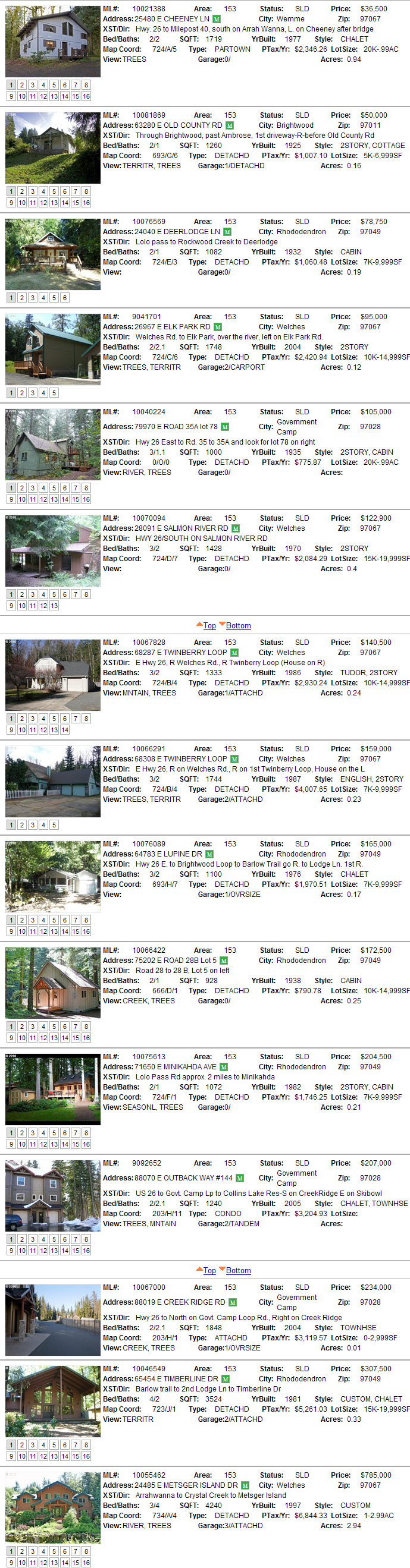

December 2010 saw six closed sales for the month according to multiple listing service. Here are the six sales:

The first two listed are foreclosures. Two properties were in Government Camp. The majority of homes selling at this time are second homes vs. primary residential properties. Three of these sales were cash and three with conventional loans.

Here are some interesting foreclosure numbers from RealtyTrac concerning 2010's numbers:

*2.87 million homes received foreclosure filings in 2010

*Foreclosure notices were up 1.67% from 2009

*They were up 23.23% from 2008

*1 in every 45 homes in the United States received a foreclosure filing

*Five states accounted for half of foreclosures: California, Florida, Arizona, Illinois and Michigan

*In California, 1 in every 25 homes received a foreclosure filing

*In Nevada, 1 in every 11 homes received a foreclosure filing

*In the 4th quarter of 2010, foreclosures slowed due to documentation issues

*1 million homes were foreclosed on in 2010

*The documentation delay will push foreclosures into 2011 for a projected 1.2 million foreclosures

*2011 should be the peak of the market downturn

There are five factors to watch in housing over 2011 and the impact they will have on our housing nationally and locally.

1. Good news on mortgage rates. They should stay under 5% for the balance of 2011. Four out of five current mortgage applications are for refinancing homes.

2. Nationally, housing prices will possibly bottom out in the first half of 2011. Locally, it may take longer due to our "lagging behind" nationally in Oregon. The second half of the year may see a slight stabilization.

3. Affordability: The affordability index started in 1971. The home affordability has never been better since the inception of the index. There has never been a better time to purchase a home. This could cause an increase in sales for 2011!

4. Fewer mortgage originations: Well, if most people have already financed over the past year and four out of five will be refinancing now, there will be less mortgages taken out over 2011. Estimates are, because of tightening credit and low credit scores that nearly a third of Americans cannot qualify for a mortgage.

5. Gradually lower delinquent rates on mortgages. As the foreclosure mass comes to the market this year there will be lower delinquent rates due to some stabilization in employment. Bernanke predicts 4 to 5 years before employment returns to "normal" rates.

So, with a large inventory of homes and cabins in the Mt. Hood area, super low intersest rates, motivated sellers left and right and many foreclosures to choose from it is a perfect time to buy!

The unemployment figures are important to buyers and sellers in today's market and is a major component of home values and purchases. In a prior blog post on unemployment

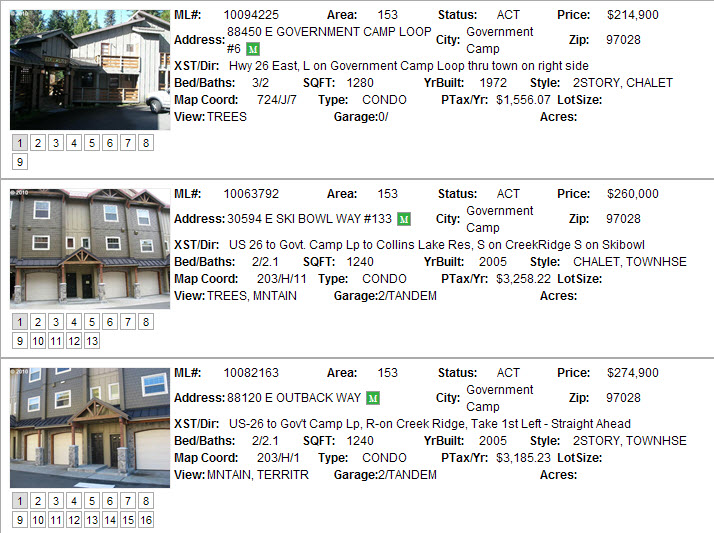

Looking for a foreclosure in Government Camp? Look no more. Three units are on the market as 2010 ends. Two are Collins Lake Units and one Eidelweiss unit is currently available. Here are the details below.

November 2010 saw an increase in sales for the month! Fifteen sales closed from Government Camp, Welches, Brightwood, and Rhododendron. Mt. Hood real estate sales are picking up and this month proves it.

Here are the fifteen sales in November direct from multiple listing. SEVEN of these sales were bank owned properties including two Collins Lake Condos in Government Camp.

Displaying blog entries 721-730 of 847