How Are Land Sales on Mt. Hood?

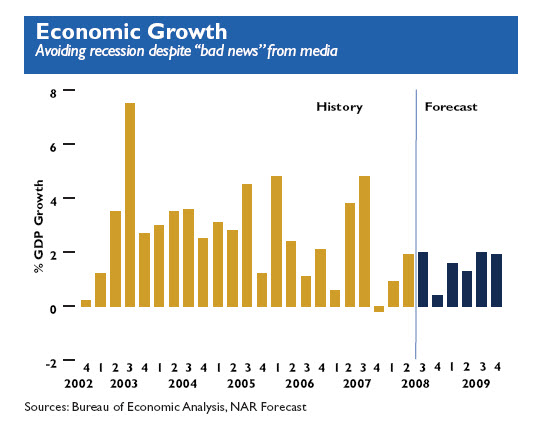

How were land sales on Mt. Hood over the 2008 year? Well, slowing to a snail's pace for the second half of the year! Sales totaled eight from Government Camp to Brightwood. Two sales closed in Government Camp with a high of $258,000 and the other at $186,900. As the economy went into a slump starting in July, there has been only one land sale for the second half of 2008.

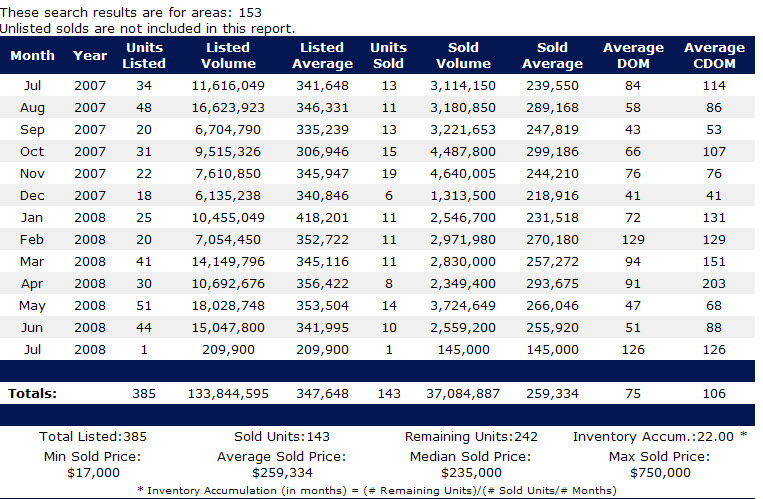

There is only one pending sale for land in area 153. This is a Summit Meadows lot listed at $75,000 and well covered by tons of snow at the moment.

There are 43 parcels and lots currently offered for sale in our area! There are motivated sellers out there and deals to be had. Take advantage of today's opportunities and get your lot before they are all gone. With Portland's increasing population coming, there won't be any land left to purchase so now is the time to make your investment!