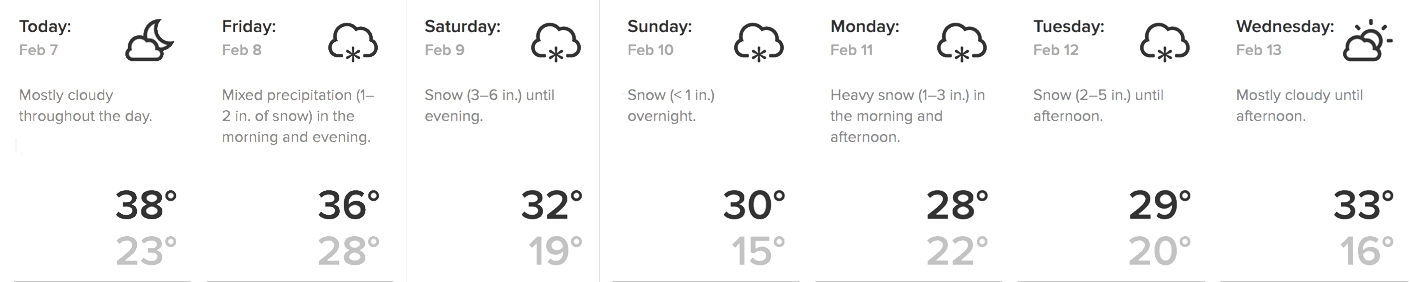

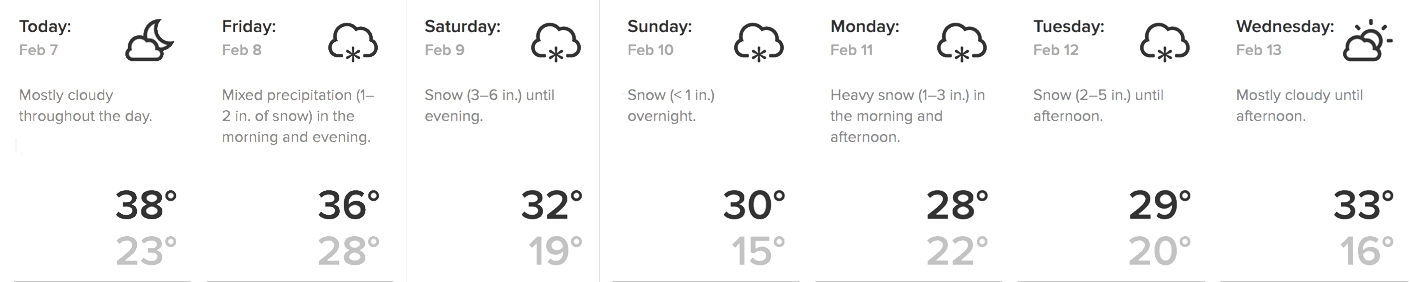

Get ready for plunging temperatures coming to the mountain in the upcoming week. Learn how to protect your pipes from freezing in this article below from HomeAdvisor, NAR.

How to Prevent Freezing Pipes

You CAN keep pipes from freezing, and avoid the costly damage that goes with.

Wicked winter weather can cause plumbing pipes to freeze and possibly burst, causing flooding and costly water damage to your home. Taking preventive measures before winter sets in can reduce and eliminate the risk of frozen pipes and other cold-weather threats.

Related: How to Protect Your Home From Severe Cold

Where the Trouble Lies

“Some pipes are more prone to freezing than others because of their location in the home,” explains Paul Abrams, spokesman for Roto-Rooter.

Pipes most at risk for freezing include:

- Exposed pipes in unheated areas of the home.

- Pipes located in exterior walls.

- Any plumbing on the exterior of the home.

Preventative Measures for Outside

A frozen garden hose can cause more damage than a busted hose; it can actually burst an interior pipe. When the water in the hose freezes, it expands, increasing pressure throughout the whole plumbing system. As part of your regular seasonal maintenance, garden hoses should be disconnected, drained, and stored before the first hard freeze.

If you don’t have frost-proof spigots, close the interior shut-off valve leading to that faucet, open and drain the spigot, and install a faucet insulator. They cost only a couple bucks and are worth every penny. Don’t forget, outdoor kitchens need winterizing, too, to prevent damage.

Exposed Interior Plumbing

Exposed pipes in the basement are rarely in danger of freezing because they are in a heated portion of the home. But plumbing pipes in an unheated area, such as an attic, crawl space, and garage, are at risk of freezing.

Often, inexpensive foam pipe insulation is enough for moderately cold climates. For severe climes, opt for wrapping problem pipes with thermostatically controlled heat tape (from $50 to $200, depending on length), which will turn on at certain minimum temps.

Under-Insulated Walls

If pipes traveling in exterior walls have frozen in the past (tell-tale signs include water damage, mold, and moisture build-up), it’s probably because of inadequate or improperly installed insulation. It might well be worth the couple hundred dollars it costs to open up the wall and beef up the insulation.

“When nothing else works, say for a northern wall in a really cold climate, the last resort is to reroute a pipe,” notes Abrams. Depending on how far the pipe needs to be moved — and how much damage is caused in the process — this preventative measure costs anywhere from $700 on up. Of course, putting the room back together is extra.

Heading South for the Winter?

For folks leaving their houses for an extended period of time in winter, additional preventative measures must be taken to adequately protect the home from frozen pipes.

- Make sure the furnace is set no lower than 55 degrees.

- Shut off the main water supply and drain the system by opening all faucets and flushing the toilets.

In extreme situations (vacation home in a bitterly cold climate), Abrams recommends having a plumber come to inspect the system, drain the hot water heater, and perhaps replace the water in traps and drains with nontoxic antifreeze.

.jpeg)

.jpeg)

.jpeg)

.jpeg)