Renovations on Mt. Hood?

The Best Use of Time (and Money) When It Comes to Renovations on Mt. Hood

In the current sellers’ market, many homeowners wonder what, if anything, needs to be remodeled before they list their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – renovate before selling.

Here are some considerations a professional will guide you through:

1. With current supply challenges, buyers may be willing to take on projects of their own.

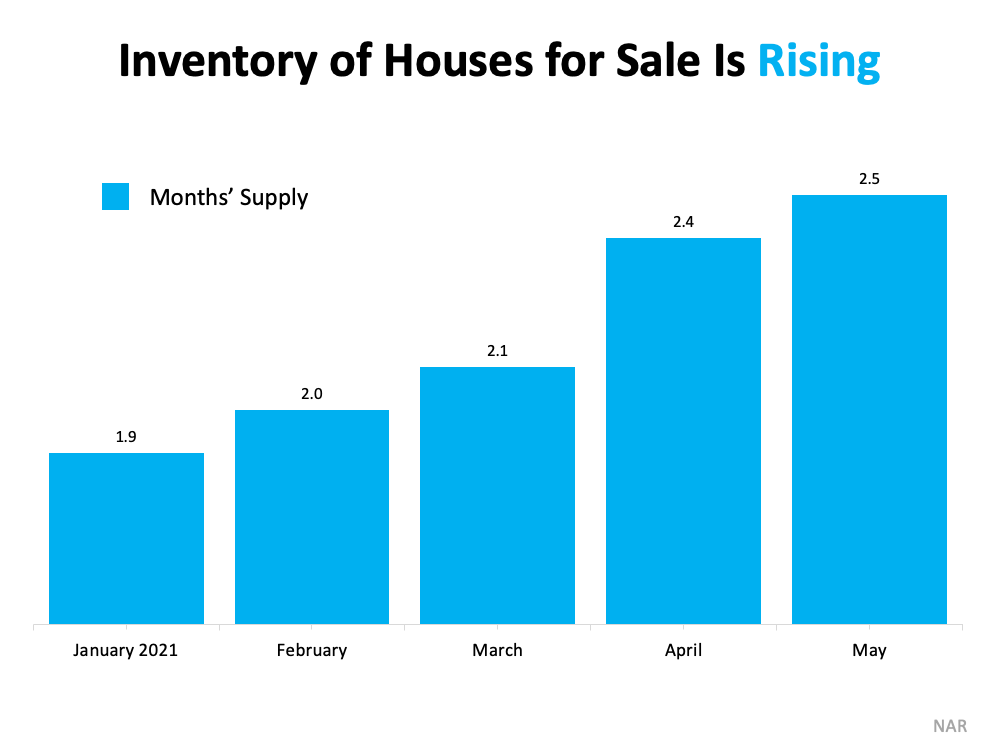

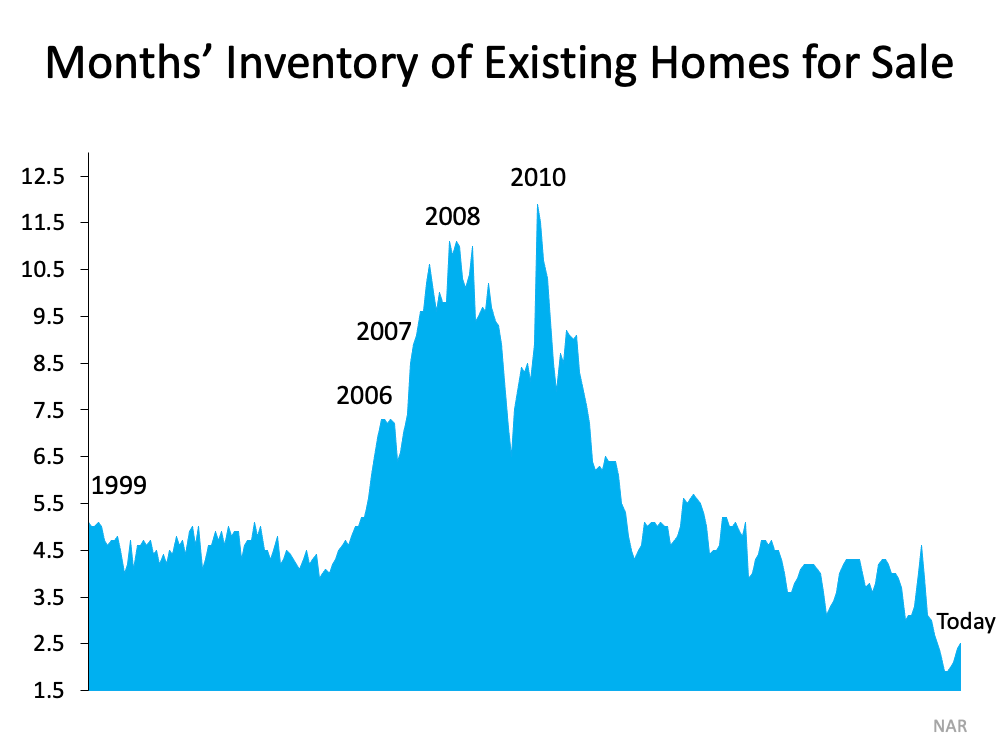

A more balanced market typically sees a 6-month supply of homes for sale. Above that, and we’re in a buyers’ market. Below that, and we’re in a sellers’ market. According to a recent report by the National Association of Realtors (NAR), our current supply of homes for sale, while rising, still remains solidly in sellers’ market territory:

“Unsold inventory sits at a 2.6-month supply at the current sales pace, modestly up from May's 2.5-month supply but down from 3.9 months in June 2020.”

So, what’s that mean for you? If you’re a seller trying to decide whether or not to renovate, this is especially important because it’s indicative of buyer behavior. When there aren’t enough homes for sale, buyers may be more willing to purchase a home that doesn’t meet all their needs and renovate it themselves later.

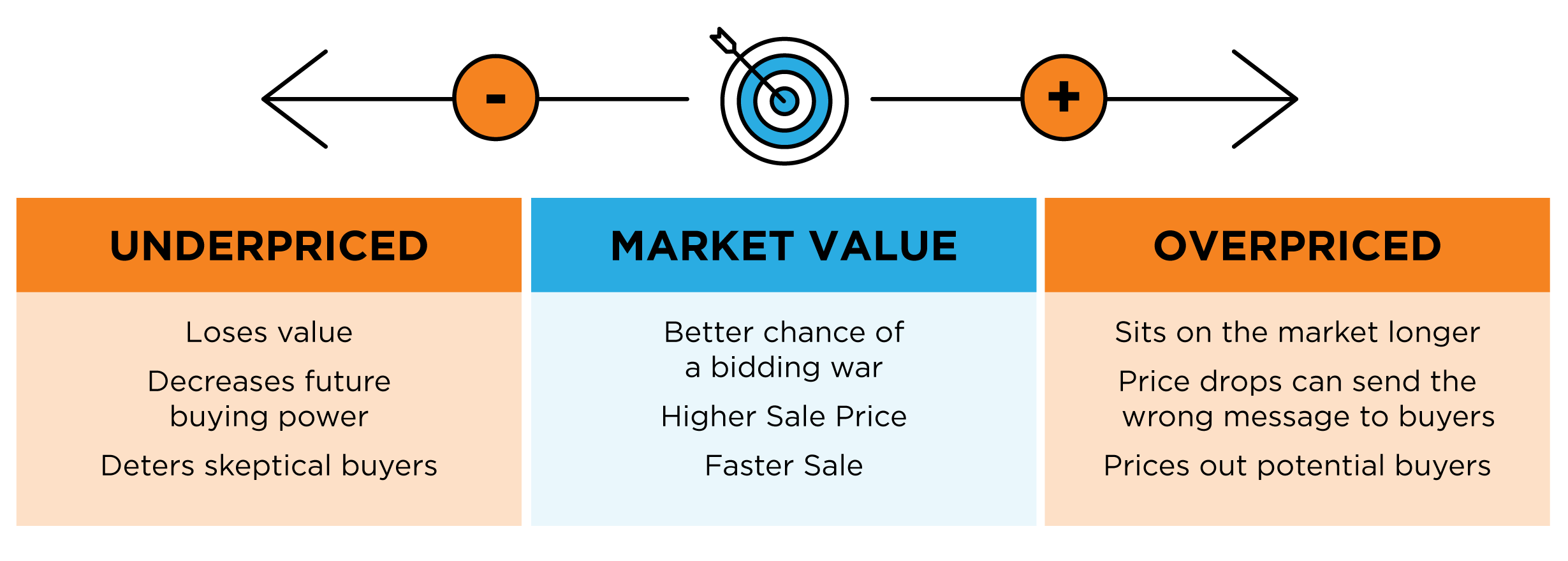

2. Not all renovation projects are equal.

You don’t want to spend time and money on a project that isn’t worth the cost or is too niche design-wise for some homebuyers. According to an article by Renofi.com, basing home updates on what’s trendy right now can be a costly mistake:

“The last thing you as a homeowner want to do is center your home design around a passing fad - even worse, one thats design quality won’t last a good while.”

Before making any decisions, talk to your real estate advisor. They have insight into what other sellers are doing before listing their homes and how buyers are reacting to those upgrades. Don’t spend the time and money to be trendy – if your buyer wants to upgrade to the newest fad later, they can.

3. If you’ve already made upgrades this past year, your agent can help spotlight them.

If you have already completed some renovations on your house, you’re not alone. The pandemic kept people at home last year, and during that time, many homeowners completed some home improvement projects. HomeAdvisor’s 2021 State of Home Spending Report found:

“35% of households that completed an improvement project undertook some type of interior painting, while 31% completed a bathroom remodel and 26% installed new flooring.”

Let your real estate professional know if you fall in this category. They can highlight any recent upgrades you’ve made in your house’s listing.

Bottom Line

What homes sell the quickest on Mt. Hood? Homes with updates.

When it comes to renovations, your return-on-investment should be top of mind. Let’s connect today to talk through any upgrades you’ve already made and to find out what you should prioritize before you sell to maximize your house’s potential.