How To Make Sure Your Mt. Hood Sale Crosses the Finish Line

How To Make Sure Your Sale Crosses the Finish Line

If there was one simple step that could help make your home sale a seamless process, wouldn't you want to know about it?

There’s a lot that happens from the time your house goes under contract to closing day. And a few things still have to go right for the deal to go through. But here’s what a lot of sellers may not know.

There's one part of the process where some homeowners are hitting a road bump that’s causing buyers to back out these days. But don’t worry. The majority of these snags are completely avoidable, especially when you understand what’s causing them and how to be proactive.

That’s where a great agent (and a little prep) can make all the difference.

What’s Causing Some Buyers To Back Out

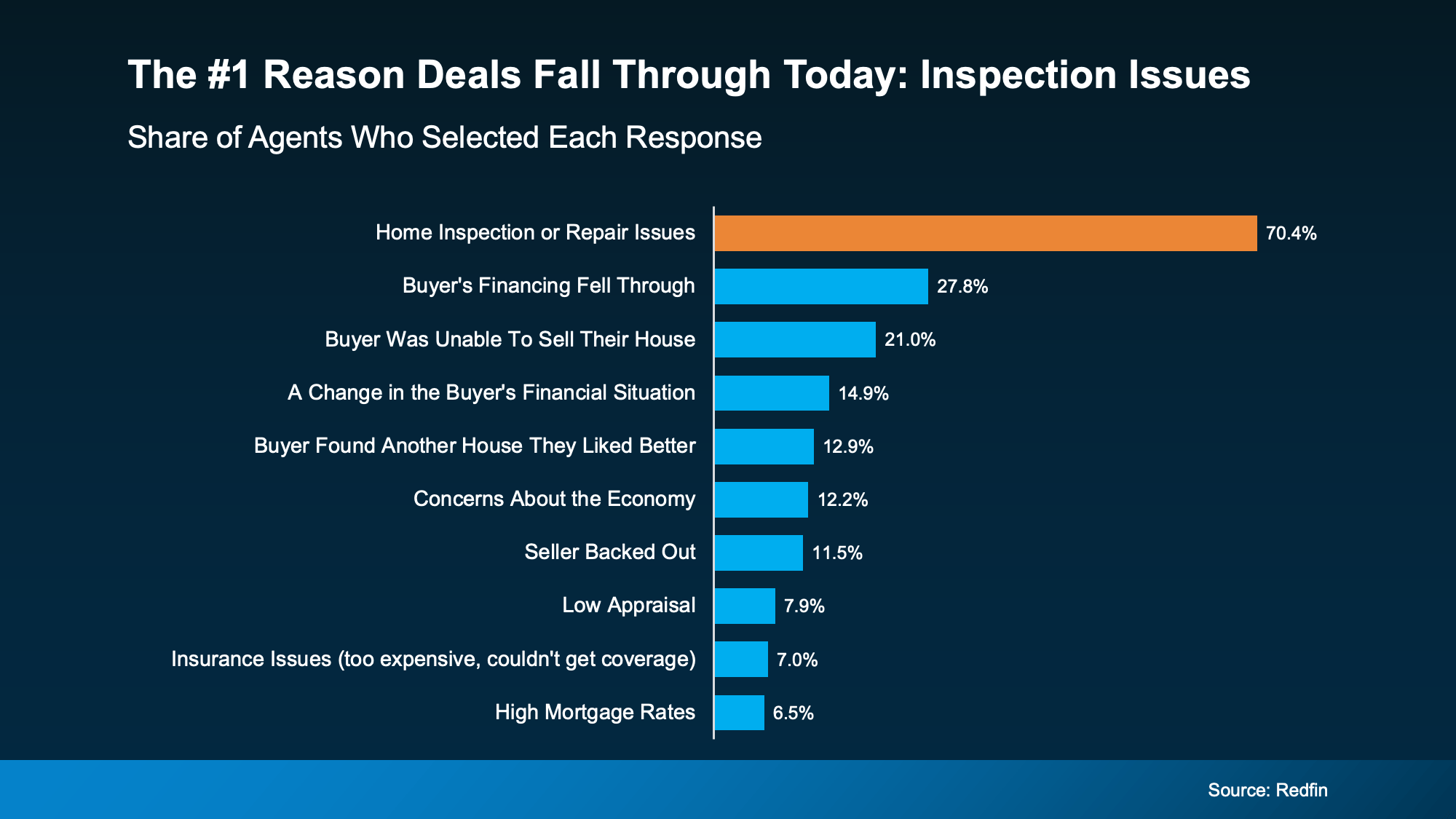

The latest data from Redfin says 15% of pending home sales are falling through. And that’s not wildly higher than the 12% norm from 2017-2019. But it is an increase.

That means roughly 1 in 7 deals today don’t make it to the closing table. But, at the same time, 6 out of 7 do. So, the majority of sellers never face this problem – and odds are, you won’t either. But you can help make it even less likely if you know how to get ahead.

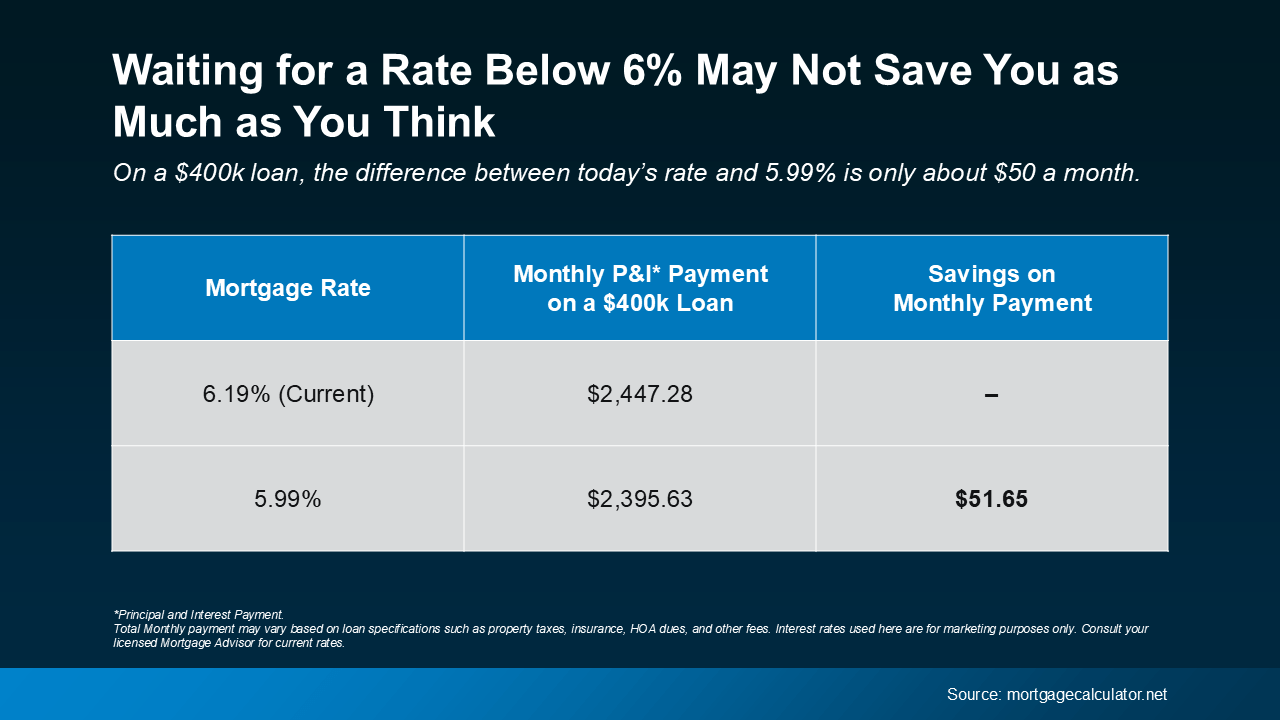

You might assume the main reason buyers are backing out today is financing. But that’s actually not the case. The most common deal breaker today, by far, is inspection and repair issues (see graph below):

Here’s why that’s a sticking point for buyers right now:

Here’s why that’s a sticking point for buyers right now:

- Buyers are already stretched thin from high prices and challenging mortgage rates, so they don’t have the appetite (or budget) for unexpected repairs.

- If they’re going to spend all that money, they want to get something that’s move-in ready. They don’t want to take on another high-cost project themselves.

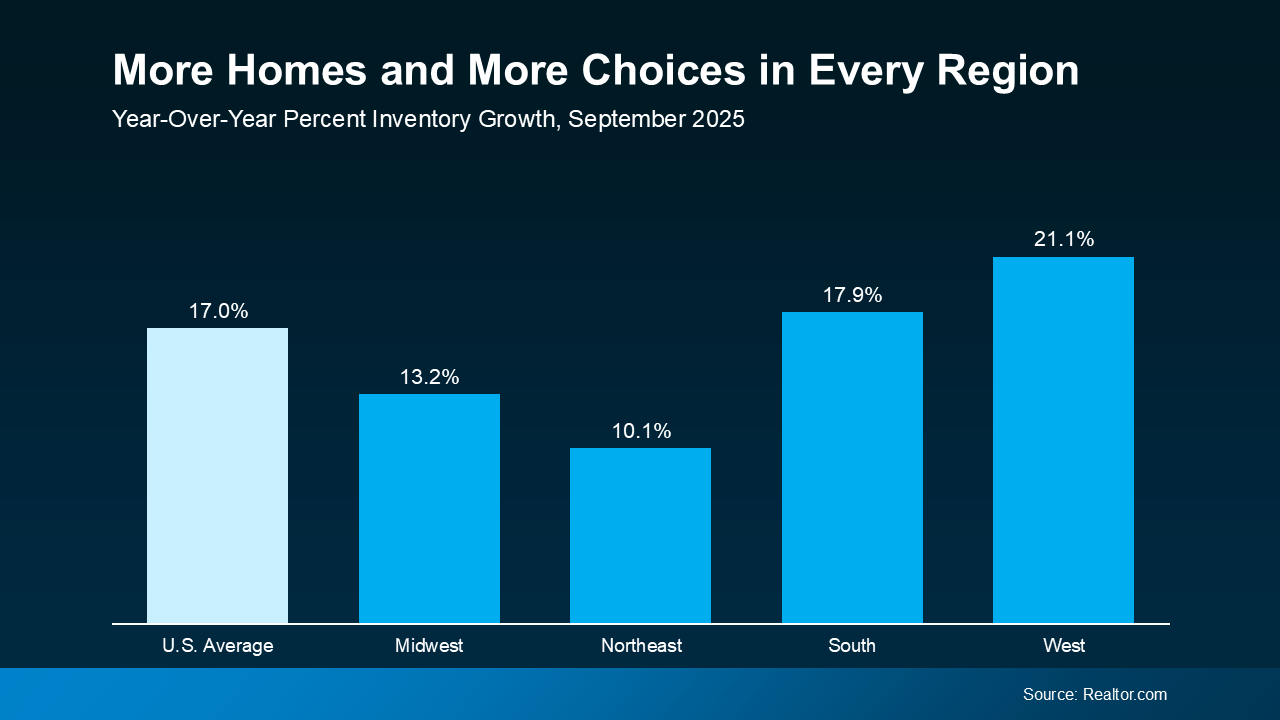

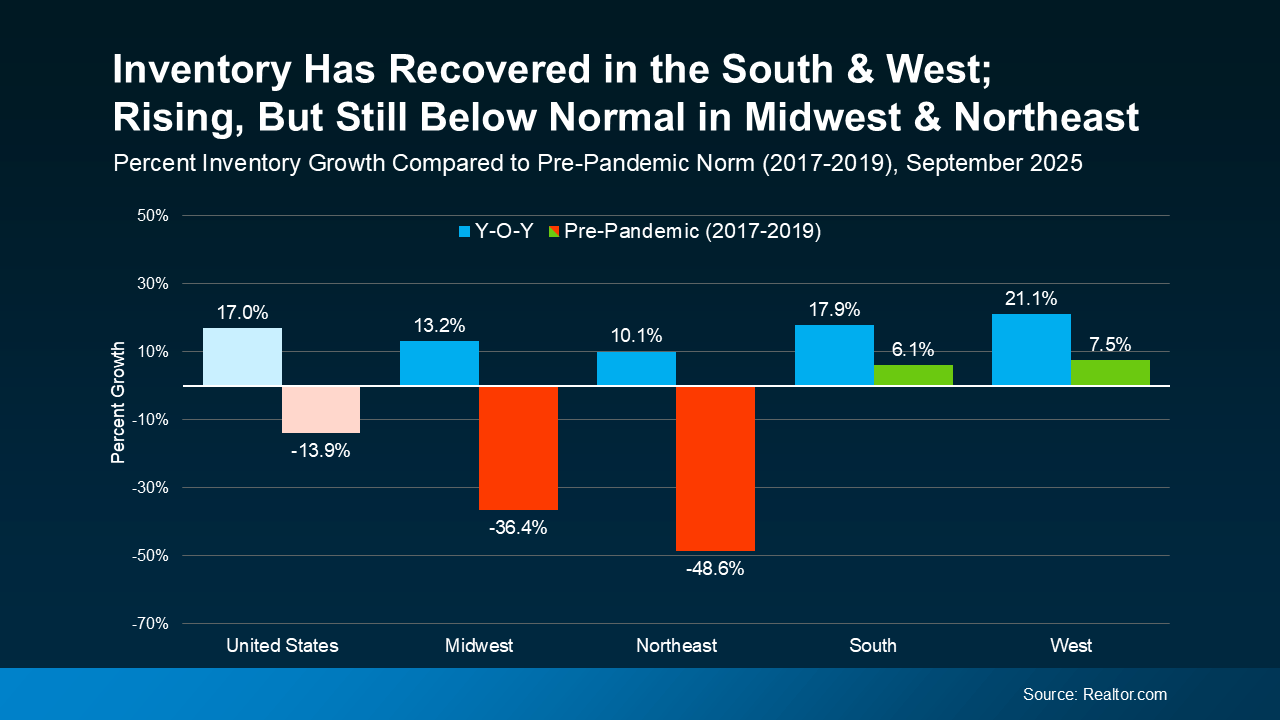

- They have more homes to choose from, so if yours seems like a hassle or if you’re not willing to fix something, they can just move on.

The sellers with the best agents have heard about this shift and they’re doing what they can to go in prepared. Enter the pre-listing inspection.

What’s a Pre-Listing Inspection?

It’s exactly what it sounds like. It’s a professional home inspection you schedule before your home hits the market. And while it’s not required, the National Association of Realtors (NAR) explains why it could be a valuable step for some sellers right now:

“To keep deals from unraveling . . . it allows a seller the opportunity to address any repairs before the For Sale sign even goes up. It also can help avoid surprises like a costly plumbing problem, a failing roof or an outdated electrical panel that could cause financially stretched buyers to bolt before closing.”

Think of it as a way to avoid future headaches. You’ll know what issues could pop up during the buyer’s inspection – and you’ll have time to fix them or decide what to disclose before you put your house on the market.

This way, when the buyer’s inspector walks in, you’re ready. No surprises. No last-minute panic. No deal on the line.

Is It Worth It?

Generally speaking, a pre-listing inspection costs just a few hundred dollars. So, it’s not a big expense. And the information it gives you is invaluable. But before you make that investment, talk to your local agent.

In some markets, it may not be worth it. And in others, it may be the best move you can make. It all depends on what’s happening where you are and what’s working for other local sellers. If your agent recommends getting one, they’ll also:

- Help you decide which issues to fix

- Prioritize repairs based on what buyers in your area are focusing on

- Connect you with trusted professionals to get the work done

- Ensure you understand local disclosure laws

That small step could save your deal (and your timeline).

Bottom Line

So, if there was one simple step that could help make your home sale go according to plan, would you do it?

If you’d rather deal with surprises on your terms (not with the clock ticking under contract), let’s talk about whether a pre-listing inspection makes sense for your house.

It may be worth it so you can hit the market confident, prepared, and in control.