Happy Thanksgiving!

Thank You for Your Support

Displaying blog entries 351-360 of 847

There are a lot of questions right now regarding the real estate market as we head into 2022. The forbearance program is coming to an end and mortgage rates are beginning to rise.

With all of this uncertainty, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we’ll continue to see a rash of troublesome headlines over the next few months. To make sure you aren’t paralyzed by a headline, turn to reliable resources for a look at what to expect from the housing market next year.

There are already alarmist headlines starting to appear. Here are two recent topics you may have seen in the news.

There are a number of headlines circulating that call out the rising foreclosures in today’s real estate market. Those stories focus on an overly narrow view on that topic: the current volume of foreclosures compared to 2020. They emphasize that we’re seeing far more foreclosures this year compared to last.

That seems rather daunting. However, though it’s true foreclosures have been up over the 2020 numbers, it’s important to realize that there were virtually no foreclosures last year because of the forbearance plan. If we compare this September to September of 2019 (the last normal year), foreclosures were down 70% according to ATTOM.

Even Rick Sharga, an Executive Vice President of the firm that issued the report referenced in the above article, says:

“As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase. But it's increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties, or loans in foreclosure prior to the pandemic.”

Homeowners who have been impacted by the pandemic are not generally the ones being burdened right now. That’s because the forbearance program has worked. Ali Haralson, President of Auction.com, explains that the program has done a remarkable job:

“The tsunami of foreclosures many feared in the early days of the pandemic has not materialized thanks in large part to the swift and decisive foreclosure protections put in place by government policymakers and the mortgage servicing industry.”

And the government is still making sure homeowners have every opportunity to stay in their homes. Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB), issued this statement just last week:

“Failures by mortgage servicers and regulators worsened the impact of the economic crisis a decade ago. Regulators have learned their lesson, and we will be scrutinizing servicers to ensure they are doing all they can to help homeowners and follow the law.”

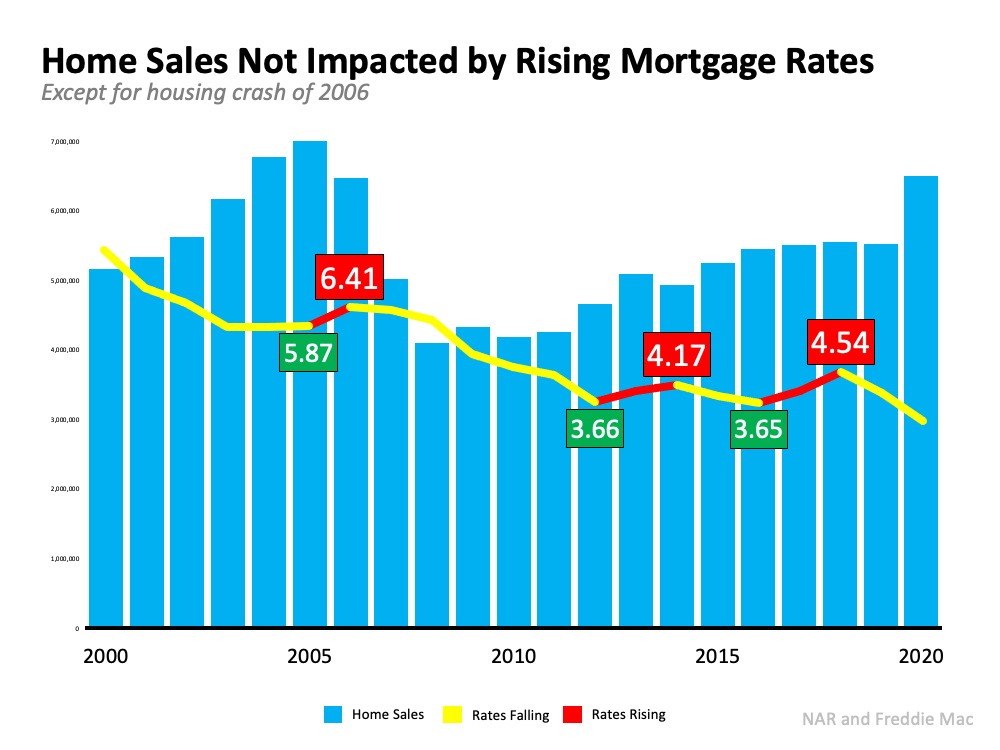

Another topic that’s generating frequent headlines is the rise in mortgage rates. Some people are expressing concern that rising rates will negatively impact the housing market by causing home sales to dramatically decline. The resulting headlines are raising unneeded alarm bells. To counteract those headlines, we need to take a look at what history tells us. Looking at data over the last 20 years, there’s no evidence that an increase in rates dramatically forces sales to come to a halt. Nor does home price appreciation come to a screeching stop. Let’s look at home sales first: The last three times rates increased (shown in the graph above in red), sales (depicted in blue in the graph) remained rather consistent. It’s true that sales fell rather dramatically from 2007 through 2010, but mortgage rates were also falling at the time. The next two instances showed no meaningful drop in sales.

The last three times rates increased (shown in the graph above in red), sales (depicted in blue in the graph) remained rather consistent. It’s true that sales fell rather dramatically from 2007 through 2010, but mortgage rates were also falling at the time. The next two instances showed no meaningful drop in sales.

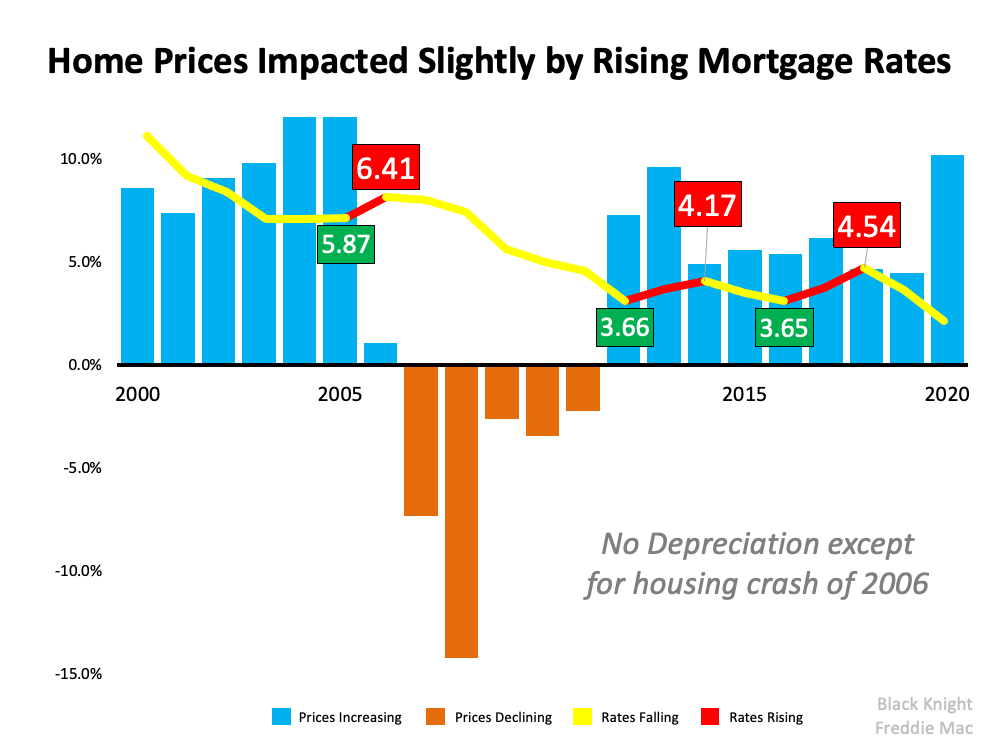

Now, let’s take a look at home price appreciation (see graph below): Again, we see that a rise in rates didn’t cause prices to depreciate. Outside of the years following the crash, prices continued to appreciate, just at a slower rate.

Again, we see that a rise in rates didn’t cause prices to depreciate. Outside of the years following the crash, prices continued to appreciate, just at a slower rate.

There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, let’s connect.

![Your Journey to Homeownership [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/11/18120549/20211119-MEM-1046x2358.png)

Like most industries, residential real estate has a seasonality to it. For example, toy stores sell more toys in October, November, and December than they do in any other three-month span throughout the year. More cars are sold in the U.S. during the second quarter (April, May, and June) than in any other quarter of the year.

Real estate is very similar. The number of homes sold in the spring is almost always much greater than at any other time of the year. It’s even labeled as the spring buying season. Historically, the number of buyers and listings for sale significantly increase in the spring and remains strong throughout the summer. Once fall sets in, the number of buyers and sellers typically drops off.

Last year, however, that seasonality didn’t happen. The outbreak of the virus and subsequent slowing of the economy limited sales during the spring market. These sales were pushed back later in the year, and last fall and winter saw a dramatic increase in home sales over previous years. The only thing that held the market back was the extremely limited supply of homes for sale.

Some experts thought we’d return to the industry’s normal seasonality this winter with both the number of purchasers and houses available for sale falling off. However, data now shows that neither of those situations will likely occur. Buyer demand is still extremely strong, and it appears we may soon see a somewhat uncharacteristic increase in the number of homes coming to the market.

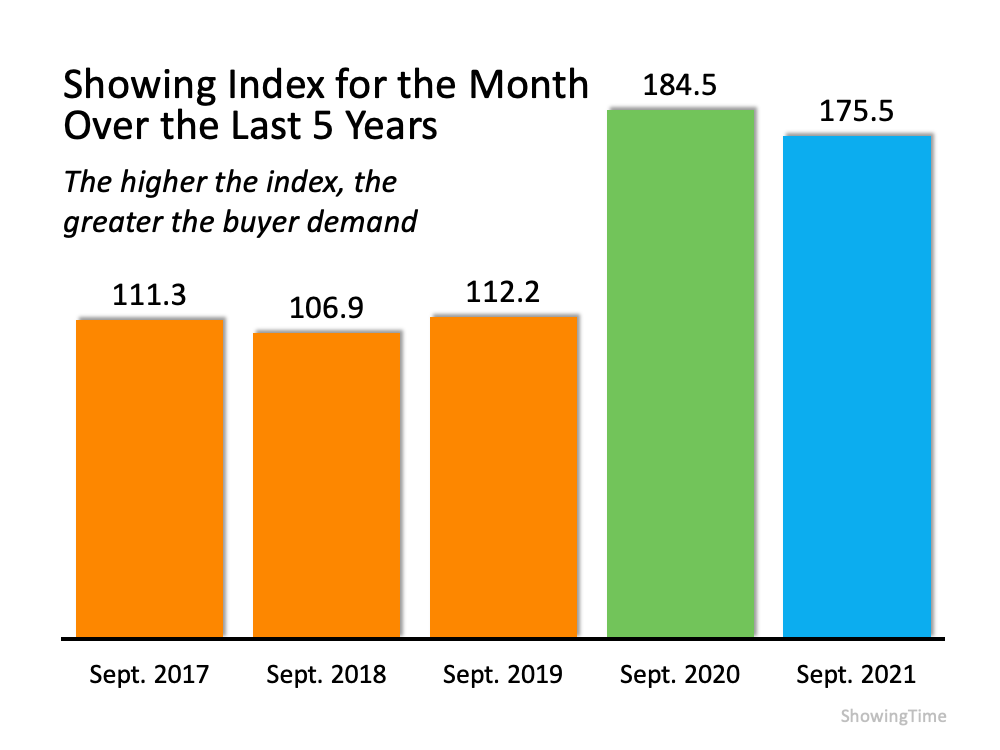

The latest Showing Index from ShowingTime, which tracks the average number of monthly showings on available homes, indicates buyer activity was slightly lower than at the same time last year but much higher than any of the three previous years (see chart below): A report from realtor.com confirms buying activity remains strong in the existing home sales market:

A report from realtor.com confirms buying activity remains strong in the existing home sales market:

“New housing data shows 2021's feverish home sales pace broke a yearly record in October, . . . with last month marking the eighth straight month of buyers snatching up homes more quickly than the fastest pace in previous years. . . .”

Buyer activity for newly constructed homes is also very strong. Ali Wolf, Chief Economist for Zonda, recently reported that Stuart Miller, the Executive Chairman of Lennar, one of the nation’s largest home builders, said this about demand:

“There is still a great deal of demand at our sales centers with people lining up and not enough supply.”

The only question heading into this winter is whether the number of listings available could come close to meeting this buyer demand. We may have just received the answer to that question.

Instead of waiting for the normal spring buying market, new research indicates that homeowners thinking about selling are about to put their homes on the market this winter.

Speaking to the release of a report on this recent research, George Ratiu, Manager of Economic Research for realtor.com, said:

“The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.”

Here are some highlights in the report:

Of homeowners planning to enter the market in the next year:

The report also discusses the reasons sellers want to move:

Data shows buyer demand remains unusually strong going into this winter. Research indicates the supply of inventory is about to increase. This could be a winter real estate market like never before. Mt. Hood buyers are waiting patiently for the next new listing. We currently have ten properties for sale in the Mt. Hood Village area. Only two are under $500,000.

If you’re thinking of buying or selling, now is the time to have a heart-to-heart conversation with a real estate professional in your market, as things are about to change in an unexpected way.

As a renter, you’re constantly faced with the same dilemma: keep renting for another year or purchase a home? Your answer depends on your current situation and future plans, but there are a number of benefits to homeownership every renter needs to consider.

Here are a few things you should think about before you settle on renting for another year.

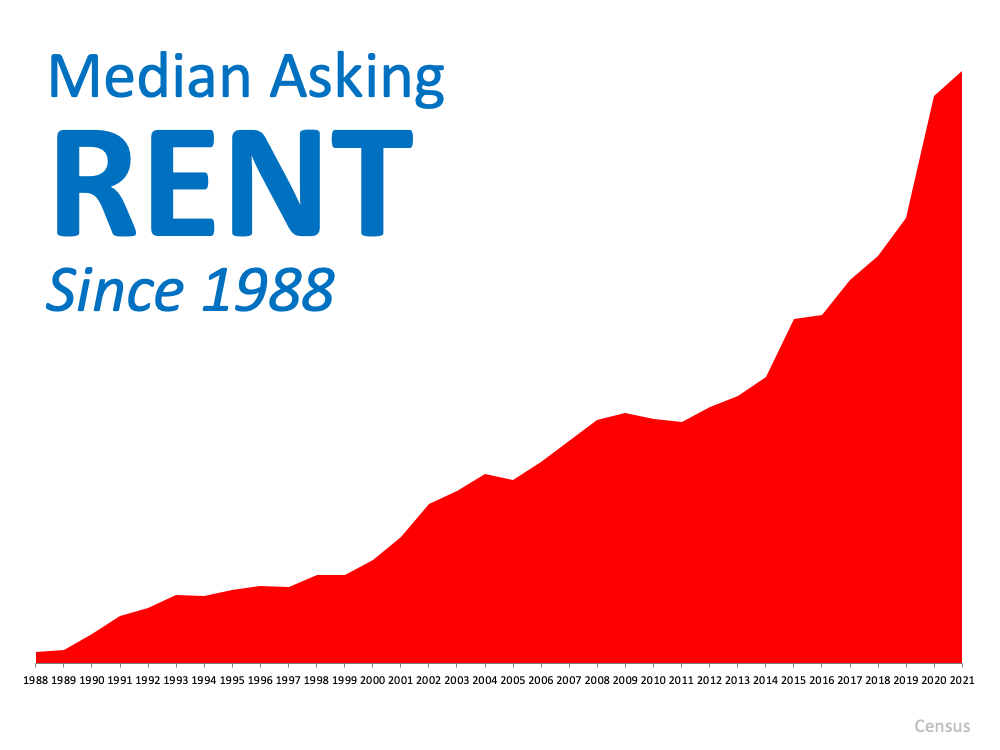

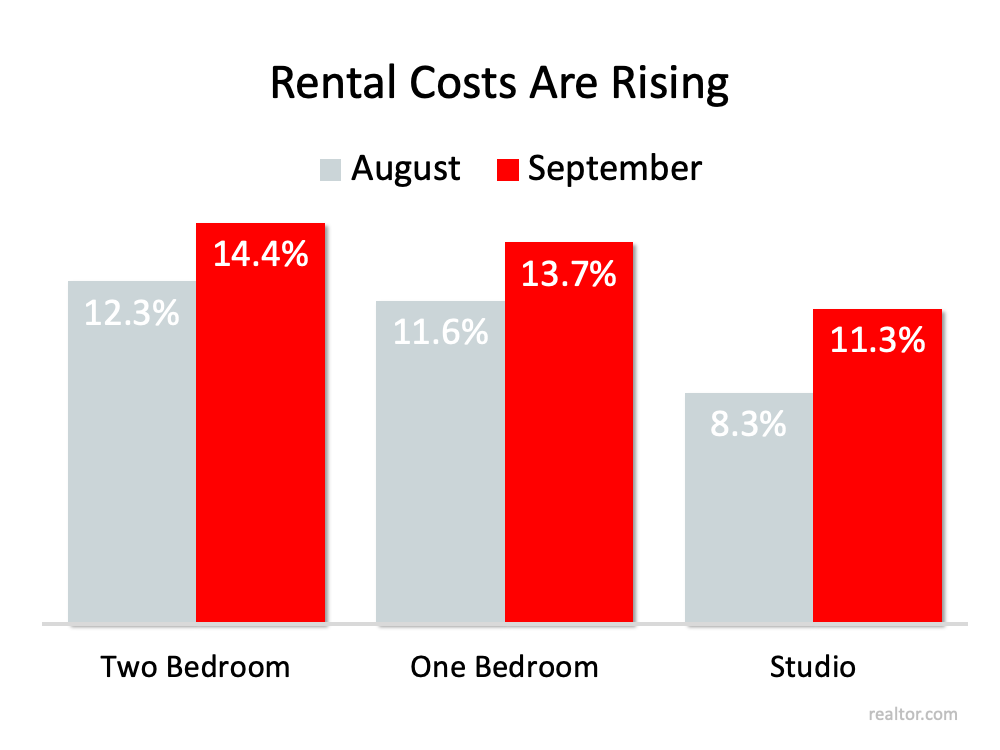

Rent increasing each year isn’t new. Looking back at Census data confirms rental prices have gone up consistently for decades (see graph below): If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below):

If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below): As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

One of the most significant advantages of buying a home is the wealth you build through equity. This year alone, homeowners gained a substantial amount of equity, which, in turn, grew their net worth. As a renter, you miss out on this wealth-building tool that can be used to fund your retirement, buy a bigger home, downsize, or even achieve personal goals like paying for an education or starting a new business.

This is a big decision-making point if you want to be able to paint, renovate, and make home upgrades. In many cases, your property owner determines these selections and prefers you don’t alter them as a renter. As a homeowner, you have the freedom to decorate and personalize your home to truly make it your own.

You may choose to rent because you feel it provides greater flexibility if you need to move for any reason. While it’s true that selling a home may take more time than finding a new rental, it’s important to note how quickly houses are selling in today’s market. According to the National Association of Realtors (NAR), the average home is only on the market for 17 days. That means you may have more flexibility than you think if you need to relocate as a homeowner.

If you are a renter in the Mt. Hood area, you know there are none! If there are, you are paying a pretty price for your rental. Deciding if it’s the right time for you to buy is a personal decision, and the timing is different for everyone. However, if you’d like to learn more about the benefits of homeownership, let’s connect so you can make a confident, informed decision and have a trusted advisor along the way.

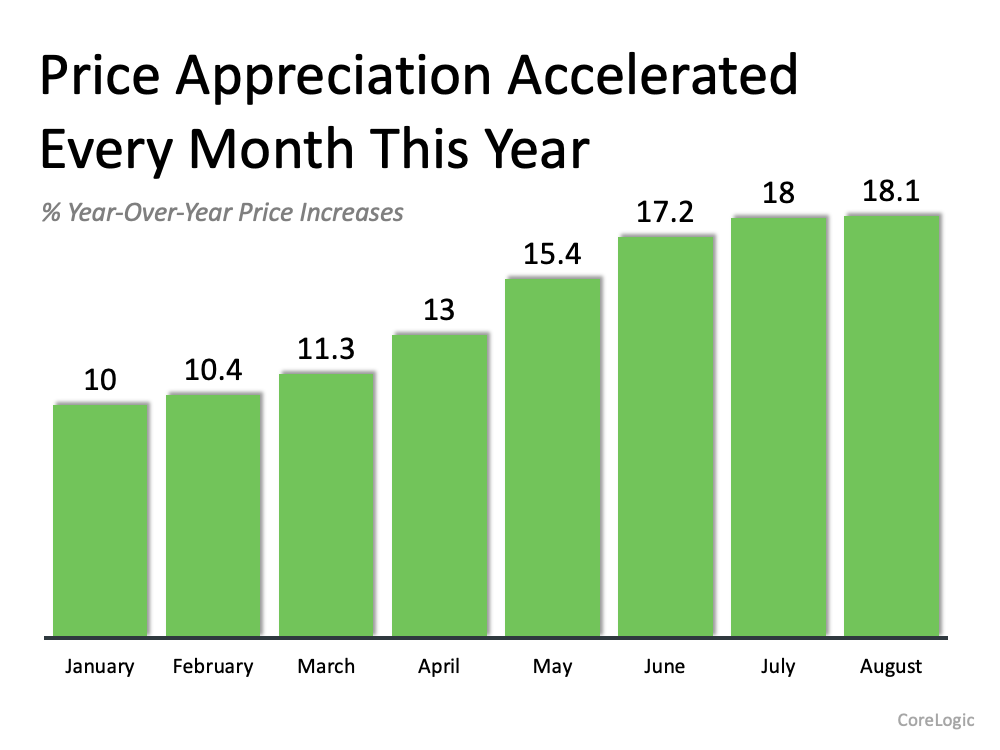

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

According to the latest Home Price Index from CoreLogic, home values have increased by 18.1% compared to this time last year. Additionally, prices have gone up at an accelerated pace for each of the last eight months (see graph below): The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The last year has shown tremendous home price appreciation, which is resulting in a major gain in wealth for homeowners through rising equity.

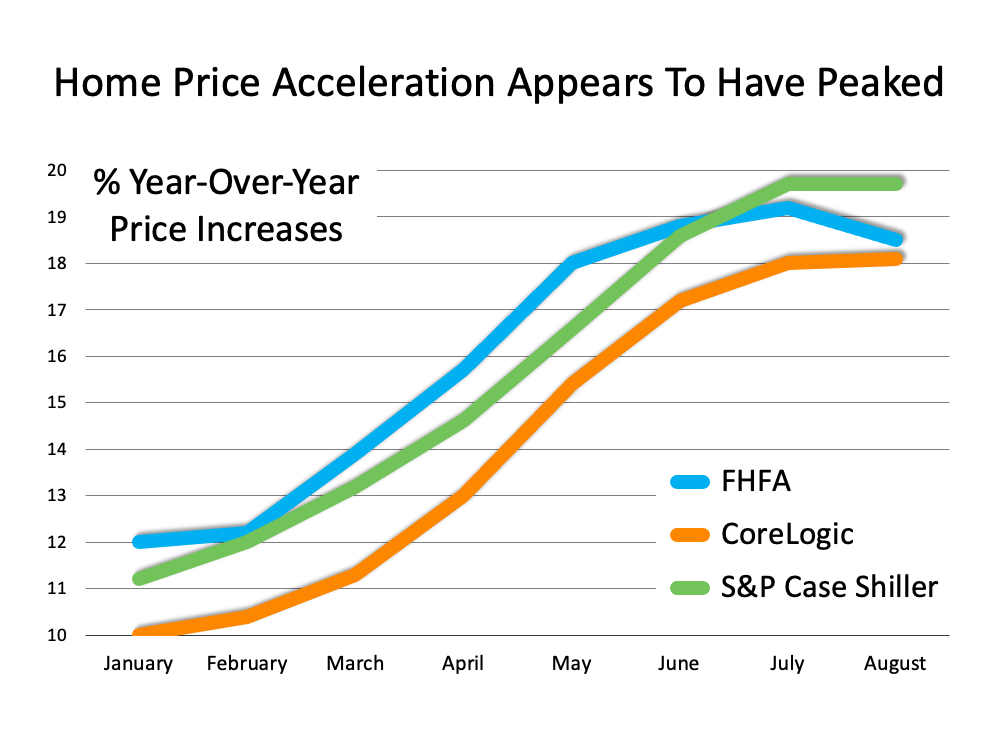

All three indices mentioned above also show that while appreciation is in the high double digits right now, that price acceleration is beginning to level off (see graph below): Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Keep in mind, that doesn’t mean home values will depreciate. It means the rate of appreciation will slow, yet stay well above the 25-year average of 5.1%.

Mt. Hood numbers for October from RMLS multiple listing shows 30.7% change in home prices from the prior year. The average sale price last month was $534,600! Nearly every home that hits the market has an amazing number of multiple offers. Things don't appear to be letting up and with even less inventory they should continue to escalate into 2022.

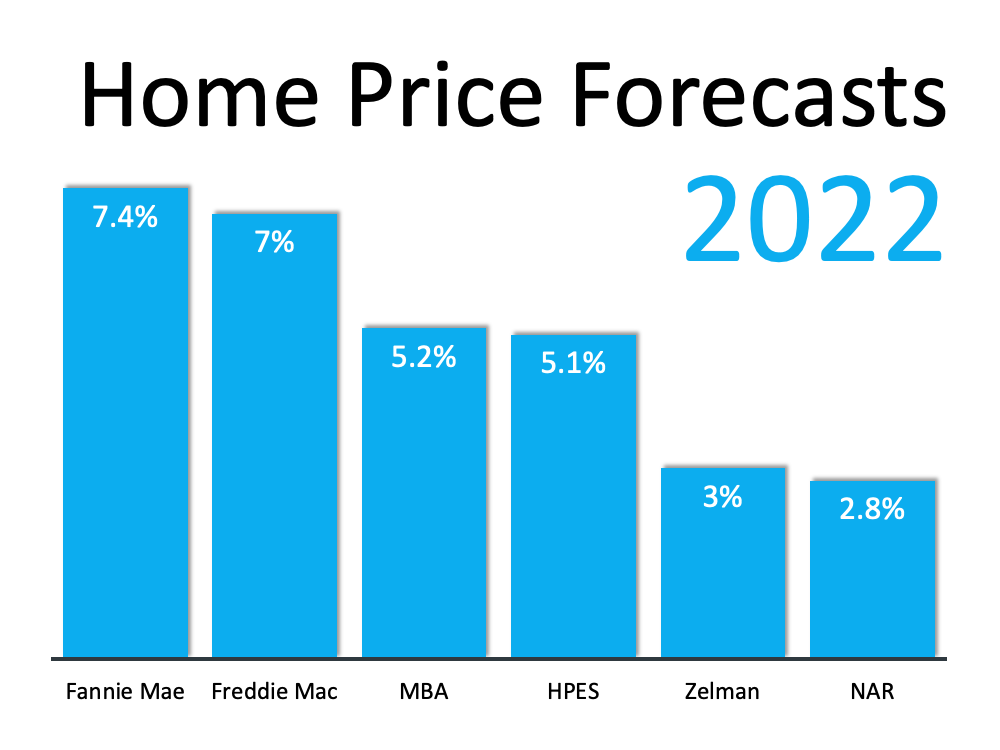

The recent surge in prices is the result of heavy buyer demand and a shortage of homes available for sale. Most experts believe that as more housing inventory comes to market (both new construction and existing homes), the supply and demand for housing will come more into balance. That balance will bring a lower rate of appreciation in 2022. Here’s a look at home price forecasts from six major entities, and they all project future appreciation:

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

There have been historic levels of home price appreciation over the last year. That pace will slow as we finish 2021 and enter into 2022. Prices will still rise in value, just at a much more moderate pace, which is good news for the housing market.

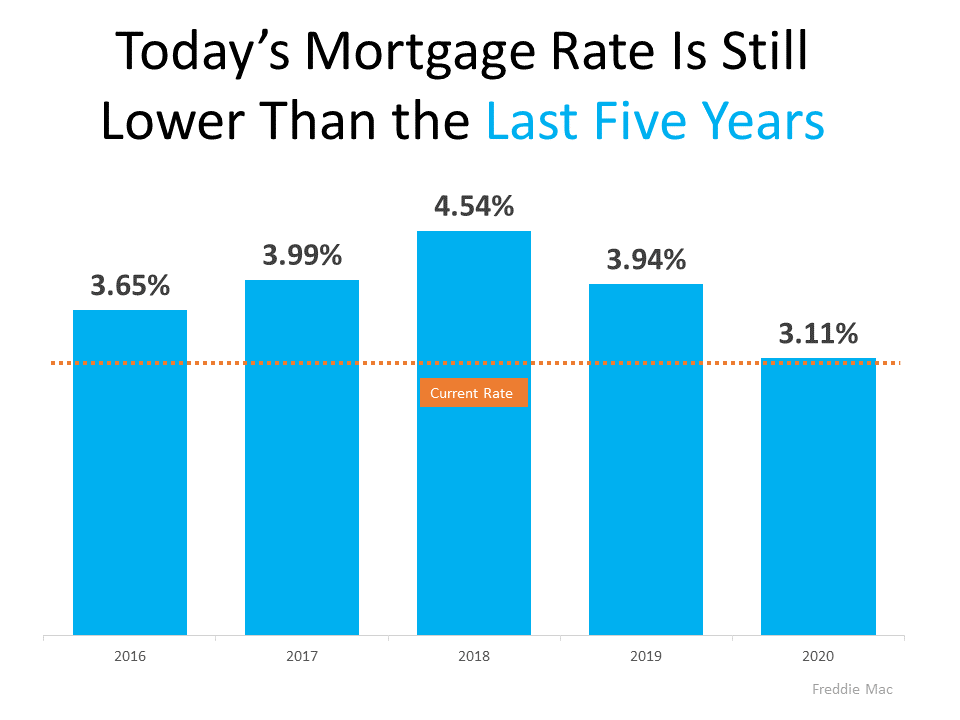

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a homebuyer, what do rates above 3% really mean?

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years: As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

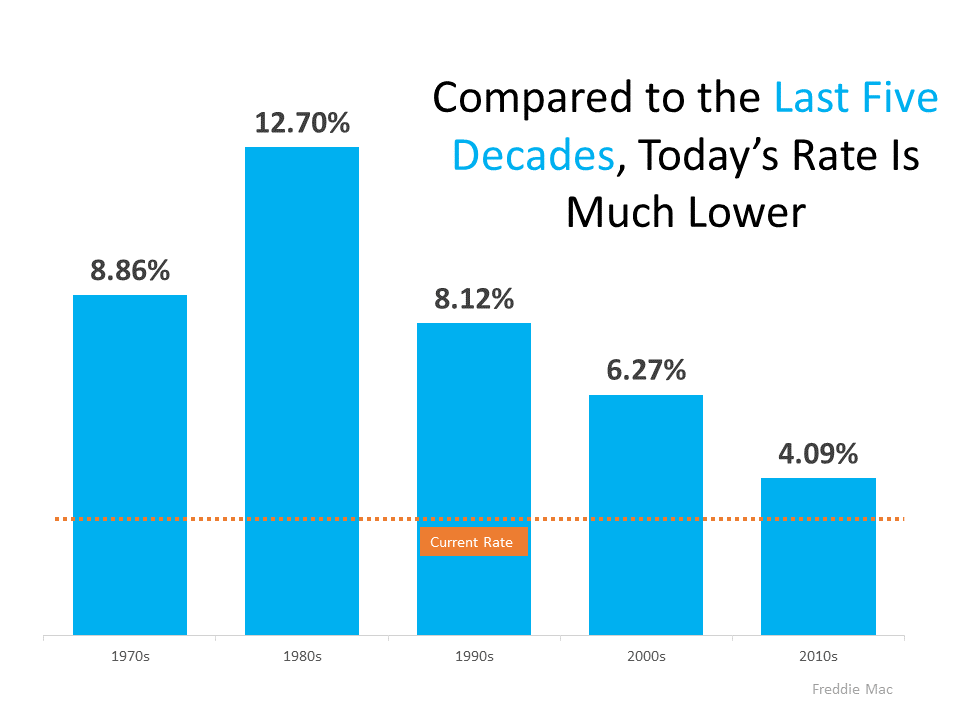

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below): When we look back even further, we can see that today’s rate is truly outstanding by comparison.

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your home buying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

![Numbers Don’t Lie – It’s Still a Great Time To Sell [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/11/04145531/20211105-MEM-1046x2041.png)

Displaying blog entries 351-360 of 847