Interesting Foreclosure Numbers

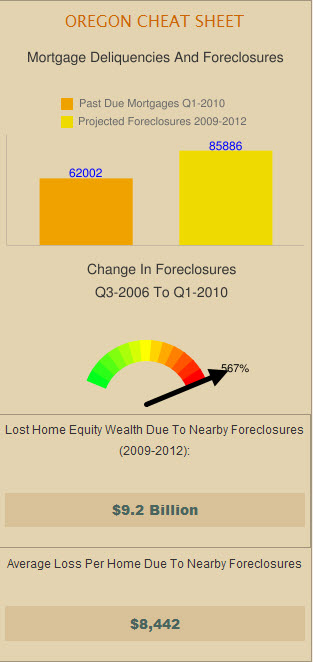

Here are some interesting foreclosure numbers from RealtyTrac concerning 2010's numbers:

*2.87 million homes received foreclosure filings in 2010

*Foreclosure notices were up 1.67% from 2009

*They were up 23.23% from 2008

*1 in every 45 homes in the United States received a foreclosure filing

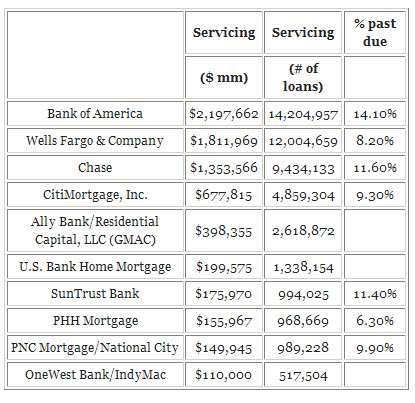

*Five states accounted for half of foreclosures: California, Florida, Arizona, Illinois and Michigan

*In California, 1 in every 25 homes received a foreclosure filing

*In Nevada, 1 in every 11 homes received a foreclosure filing

*In the 4th quarter of 2010, foreclosures slowed due to documentation issues

*1 million homes were foreclosed on in 2010

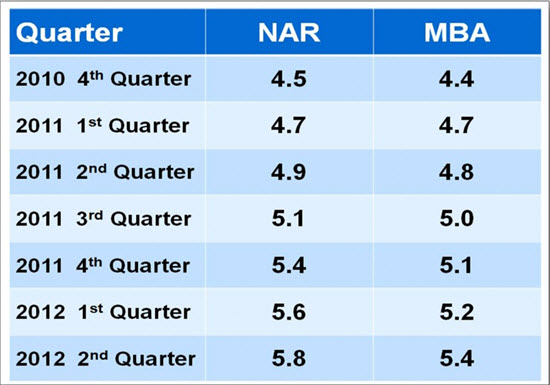

*The documentation delay will push foreclosures into 2011 for a projected 1.2 million foreclosures

*2011 should be the peak of the market downturn