There are five factors to watch in housing over 2011 and the impact they will have on our housing nationally and locally.

1. Good news on mortgage rates. They should stay under 5% for the balance of 2011. Four out of five current mortgage applications are for refinancing homes.

2. Nationally, housing prices will possibly bottom out in the first half of 2011. Locally, it may take longer due to our "lagging behind" nationally in Oregon. The second half of the year may see a slight stabilization.

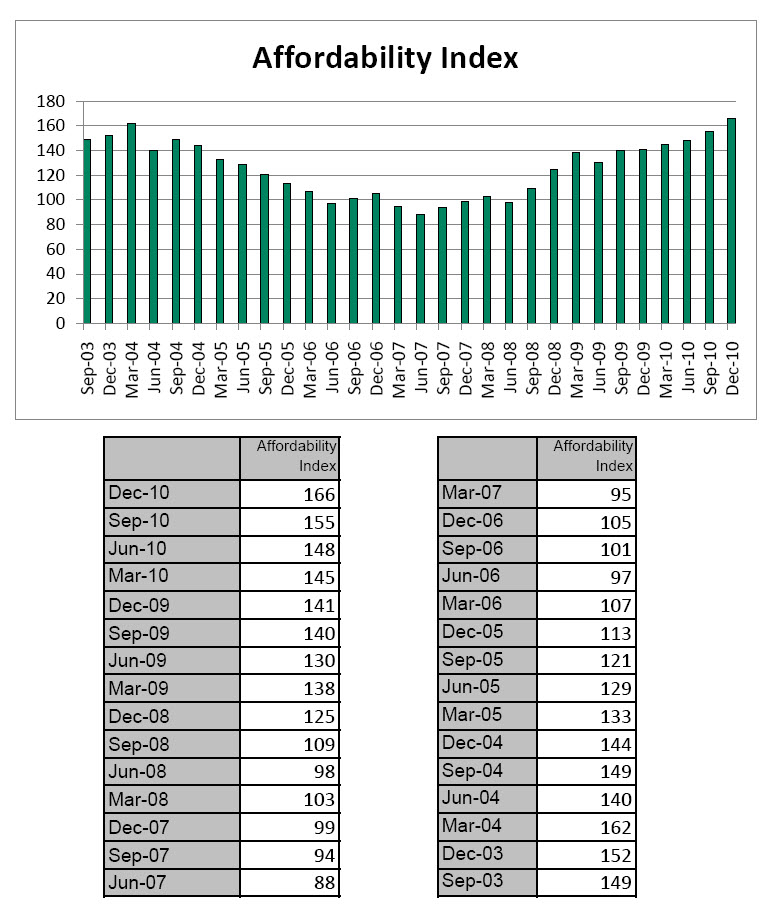

3. Affordability: The affordability index started in 1971. The home affordability has never been better since the inception of the index. There has never been a better time to purchase a home. This could cause an increase in sales for 2011!

4. Fewer mortgage originations: Well, if most people have already financed over the past year and four out of five will be refinancing now, there will be less mortgages taken out over 2011. Estimates are, because of tightening credit and low credit scores that nearly a third of Americans cannot qualify for a mortgage.

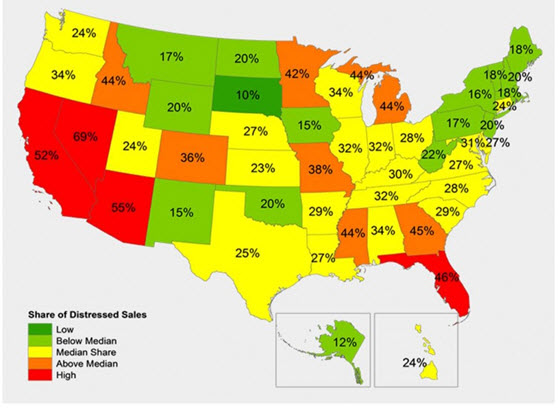

5. Gradually lower delinquent rates on mortgages. As the foreclosure mass comes to the market this year there will be lower delinquent rates due to some stabilization in employment. Bernanke predicts 4 to 5 years before employment returns to "normal" rates.

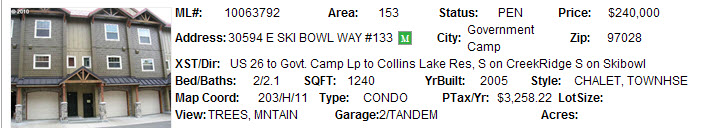

So, with a large inventory of homes and cabins in the Mt. Hood area, super low intersest rates, motivated sellers left and right and many foreclosures to choose from it is a perfect time to buy!