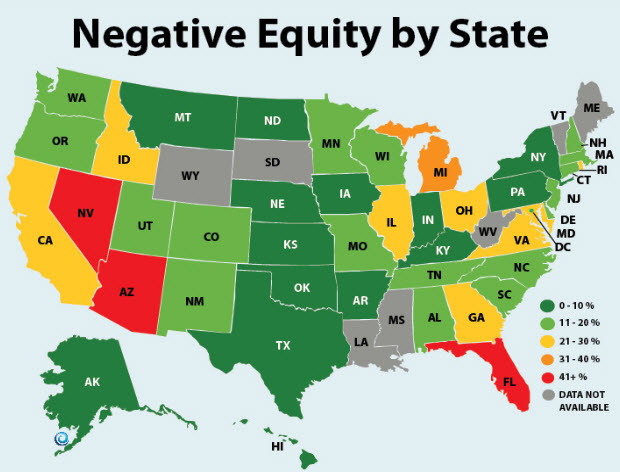

Negative Equity in Oregon

This map shows the negative equity state by state.

Displaying blog entries 311-320 of 428

This map shows the negative equity state by state.

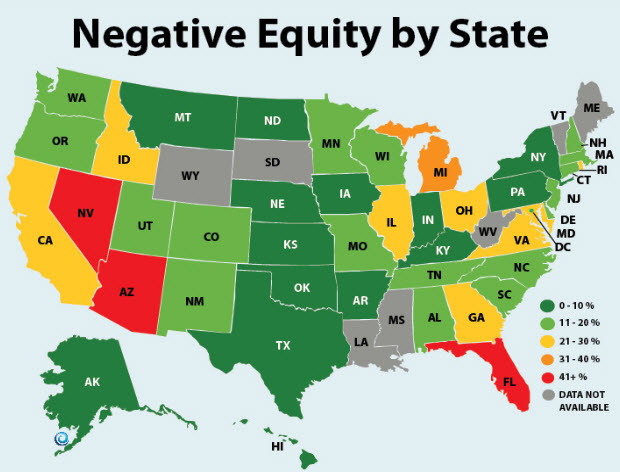

Today's rates brings the greatest time to purchase a home or cabin in history! Check out this chart showing how low rates are just over the past 20 years. The yearly average has been 8.74% and we are below half that rate right now.

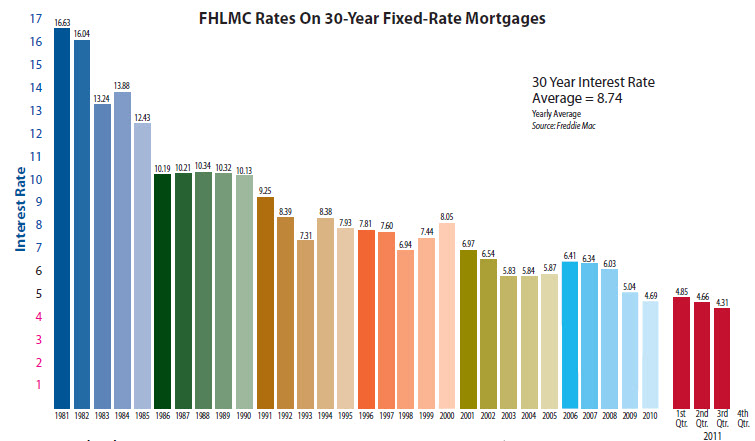

Real estate sales for Mt. Hood were excellent in September with nine closings for the month. These sales were likely put together in July and August for a September closing. Here are the numbers from the multiple listing service showing year to date results for Government Camp, Welches, Brightwood, and Rhododendron.

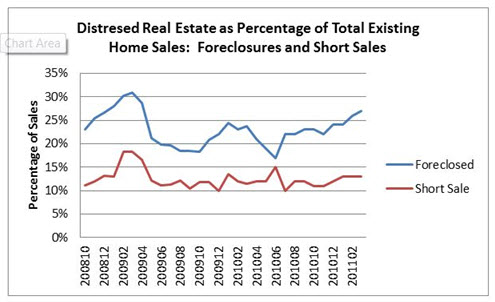

Ever wonder about what percentage of total sales are foreclosures or short sales in Welches, Government Camp, Rhododendron and Brightwood? As of today there have been 69 sales on the mountain. Twenty five of those sales were REO/bank owned properties and four were completed short sales. That's a total figure of 42% of total sales.

Foreclosures and Bank Owned Properties on Mt. Hood

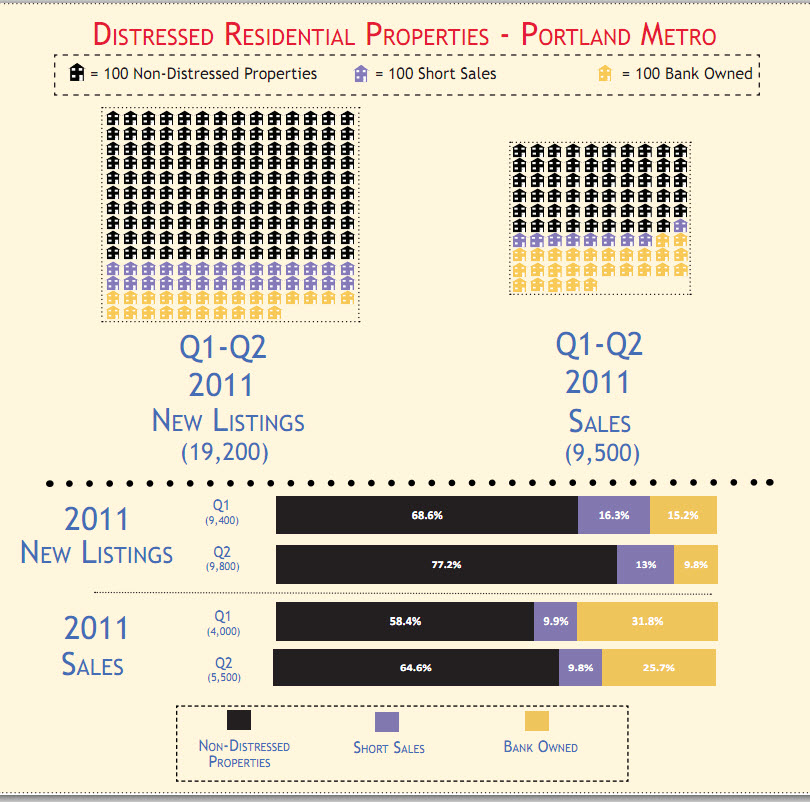

How does the Portland Metro area compare to our area? Here are numbers for the first two quarters.

If you are facing a Mt. Hood foreclosure you may want to pay attention to this recent article in the Oregonian concerning a delay of many foreclosures going to court. This could delay your foreclosure for a while and as the court reviews these cases, some of our Oregon laws could make you liable for the difference in what you owe to the lender and what your home actually sells for.

How did this happen? Well, last year Federal judges started blocking foreclosures because the lenders did not follow procedures properly. If your mortgage was sold many times (and most have- through MERS*) the requirement is that each sale of that mortgage is to be recorded in the County that the sale takes place. MERS eliminated that "recording" process and these Federal judges are calling that process invalid because they did not follow the law's requirements.

Call your lender and be sure of the dates for foreclosure because you may be premature in your move out of your home.

*What is MERS and what does it mean to me in an Oregon foreclosure?

Oregon VA Home Guaranty Loan Program

Purchasing a home is an exciting step in life, and one of the most important options you have to consider is how to finance the home. If you are a veteran or an active military member, a VA Home Loan is certainly a financing option to look into. The VA loan program offers benefits that no other loan program can match, which makes it one of the most advantageous loans on the market. While a VA Loan may not be the best option for every service member, it is important to understand the benefits when compared to conventional financing options.

VA Loan Benefits:

How Much Can I Borrow?

In the Mount Hood area, the VA loan amount is set at $417,000 (this is typical for most counties). With a VA Loan, you are able to refinance a current single-family home, purchase a new home, or VA-approved Condo as well. (In terms of purchasing, the home or condo must be your primary residence).

There are many more options when using your VA home loan benefit, so it is important to speak with a knowledgeable VA approved lender, like VA Mortgage Center, before you moving too far forward.

Eligibility

To be eligible a service member must have served on active duty for three months during wartime or 181 days during peacetime. A service member is also eligible after serving in the National Guard for at least six years; however, service members with a dishonorable discharge do not qualify for the program.

For more information on using your VA home loan benefits and finding the home of your dreams contact Liz Warren or a VA approved lender today!

Matt Polsky is a blogger associated with VA Benefit Blog, a blog focused on providing veterans and service members with current news and information on the VA benefits they have earned through serving our country.

Tracking distressed sales on the mountain in the area from Government Camp to Brightwood shows that short sales and foreclosures make up 40-50% of our area sales over the past several months on average. Nationally, these numbers match. Here is a chart showing the short sales and foreclosure movement.

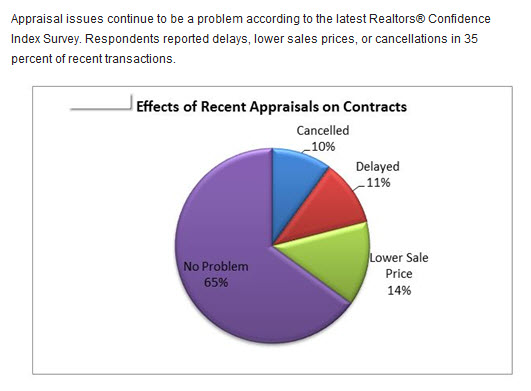

Recent area transactions for Welches, Government Camp, Rhododendron and Brightwood bring challenges if using a bank to obtain a mortgage. One of the many pieces of the puzzle is the appraised value of the property. Lenders send out the appraiser to determine the value of the property they plan on lending on.

Today's appraisals are conservative in nature as all banks are trying to reduce risk in lending after the recent bubble fiasco.

Did you know that 35% of appraisals run into issues? Here is some information breaking down the numbers from NAR.

March fell short of the prior two months in total sales on the mountain. Five sales were closed this past month and all were distressed. Two of the sales were FHA financed, two cash and one conventional mortgage.

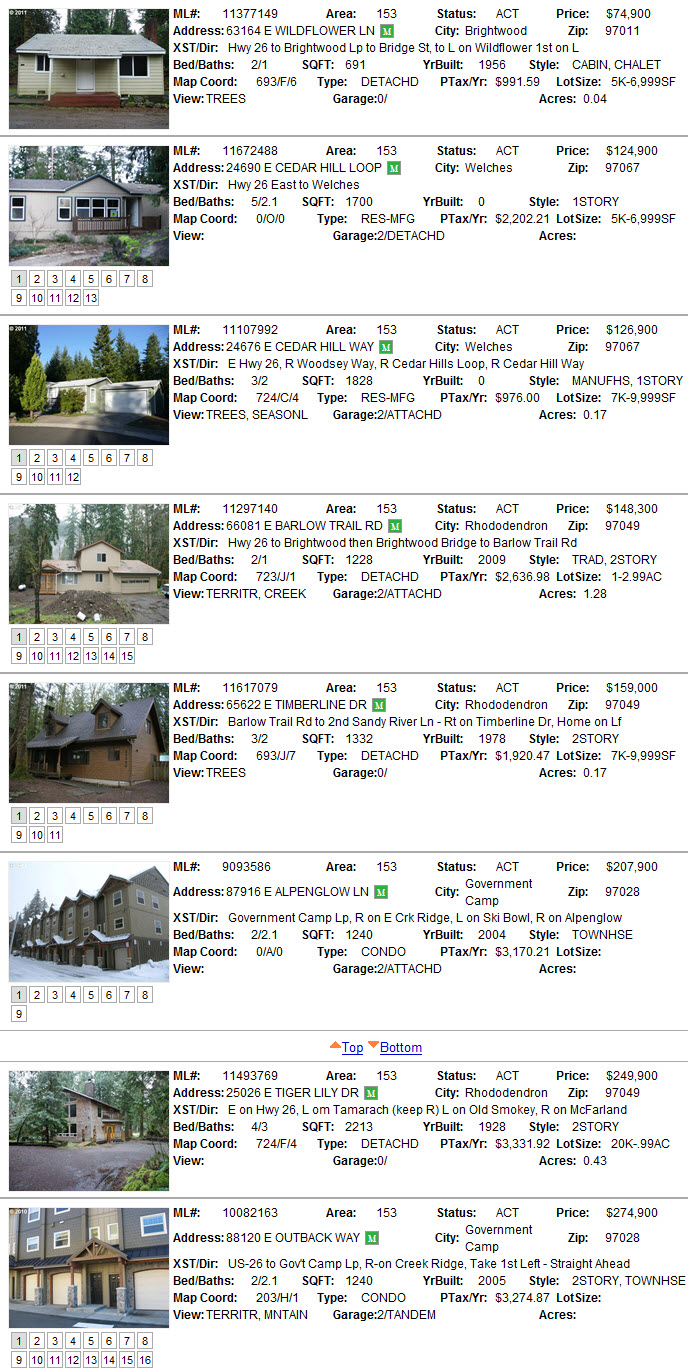

Weekend shoppers will love today's foreclosures in the Mt. Hood area located in Government Camp, Welches, Brightwood, Rhododendron!

Take advantage of 25 to 40% discounts by purchasing a foreclosure!

Displaying blog entries 311-320 of 428