What Buyers and Sellers Want on Mt. Hood

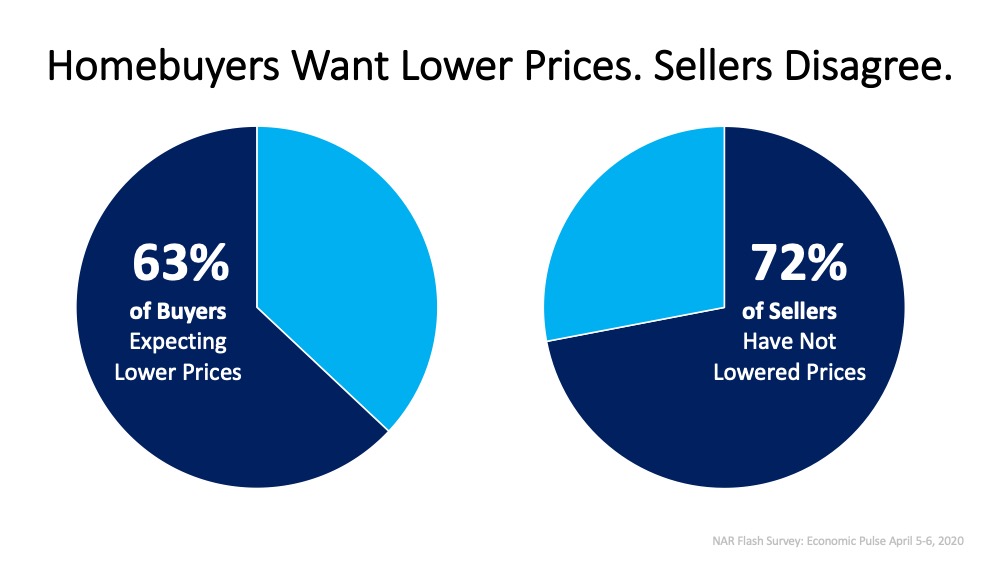

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

The uncertainty the world faces today due to the COVID-19 pandemic is causing so many things to change. The way we interact, the way we do business, even the way we buy and sell real estate is changing. This is a moment in time that’s even sparking some buyers to search for a better deal on a home. Sellers, however, aren’t offering a discount these days; they’re holding steady on price.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

1. “Have any of your sellers recently reduced their price to attract buyers?”

Their answer: 72% said their sellers have not lowered prices to attract buyers during this health crisis.

2. “Are home buyers expecting lower prices now?”

Their answer: 63% of agents said their buyers were looking for a price reduction of at least 5%.

What We Do Know

In today’s market, with everything changing and ongoing questions around when the economy will bounce back, it’s interesting to note that some buyers see this time as an opportunity to win big in the housing market. On the other hand, sellers are much more confident that they will not need to reduce their prices in order to sell their homes. Clearly, there are two different perspectives at play.

Bottom Line

If you’re a buyer in today’s market, you might not see many sellers lowering their prices. If you’re a seller and don’t want to lower your price, you’re not alone. If you have questions on how to price your home, let’s connect today to discuss your real estate needs and next steps.