Real Estate Information Archive

Blog

Displaying blog entries 1-10 of 10

Home Updates That Pay You Back When You Sell

Home Updates That Actually Pay You Back When You Sell

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that's actually waiting too long to get started by today’s standards.

Buyers have more options than they did a few years ago. So, it's worth it to tackle repairs now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Which Projects Tend to Pay Off?

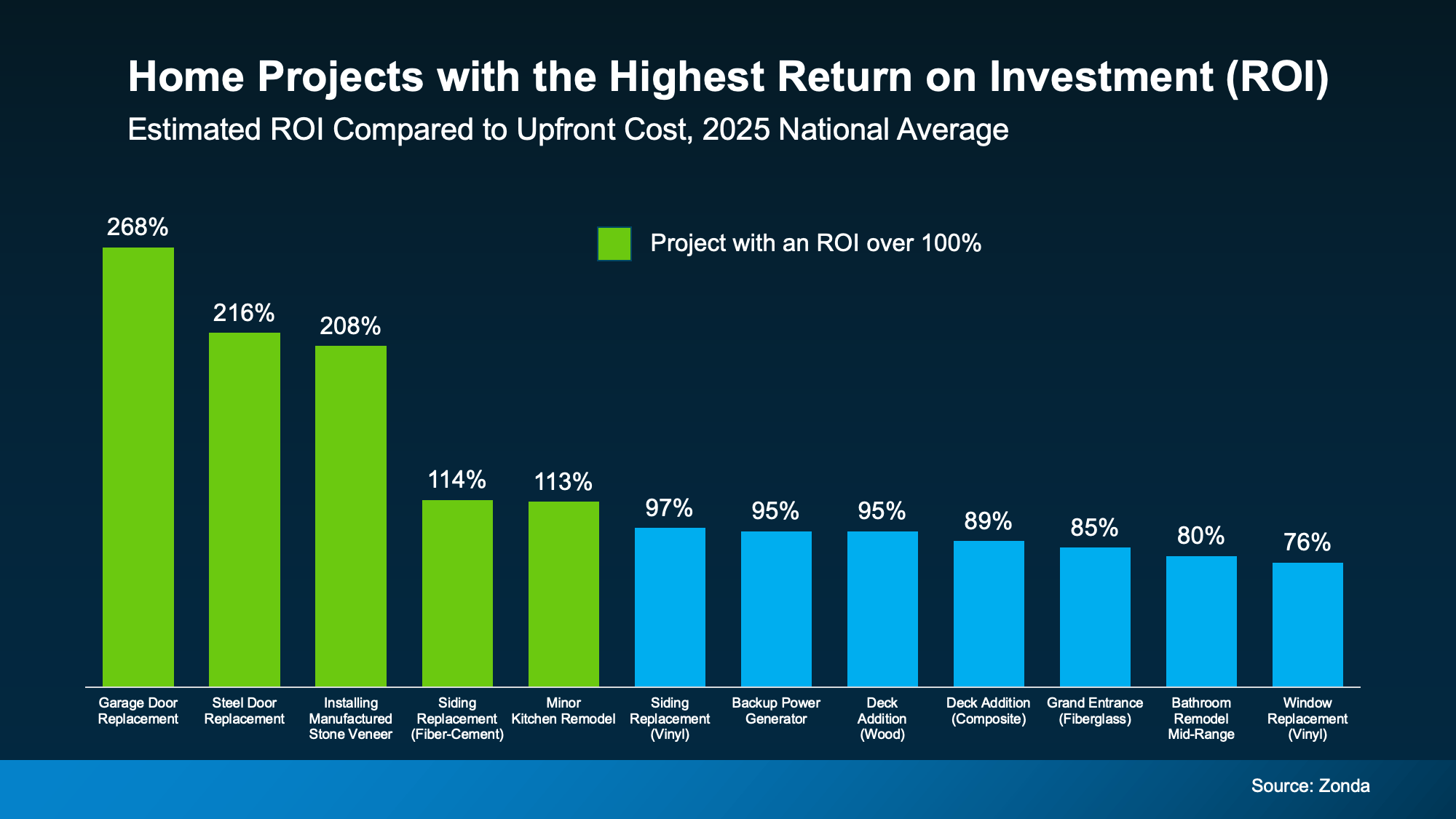

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there's a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do's. They’re just swapping out doors.

While there's a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do's. They’re just swapping out doors.

Small Updates, Big Visual Impact

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

This Chart Is a Starting Point, Not a Strategy

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

- Which updates do buyers in your market expect?

- What can you skip without hurting your sale?

- Where will a small investment make the biggest difference?

- Is it better to update, or sell as-is?

That guidance helps you avoid over-improving and under-preparing.

Bottom Line

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, let’s talk through what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

The #1 Regret Sellers Have When They Don’t Use an Agent

The #1 Regret Sellers Have When They Don’t Use an Agent

Want to know the #1 thing homeowners regret when they sell without an agent? It’s that they didn’t price their house correctly for their current market.

According to the latest data from the National Association of Realtors (NAR), those sellers agree pricing their home effectively was the hardest part of the process.

Top 5 Most Difficult Task for Sellers Who Didn’t Use an Agent:

- Getting the price right

- Preparing or fixing up the house

- Selling within the desired time frame

- Handling all the legal documents

- Finding the time to manage all aspects of the sale

And that makes sense. Pricing isn’t as simple as picking a number from an online estimate or copying what your neighbor got last year. It takes real insight into:

- What buyers are actually willing to pay today

- How much competition you have in your area

- What similar homes nearby are really selling for

- How desirable your area or neighborhood is

- The condition of your house

Without that context, it’s easy to overshoot the mark, especially now that buyers can be more selective. And in today’s market, that’ll backfire.

Overpricing Isn’t a Small Mistake, It Snowballs

Your price is part of what shapes a buyer’s first impression. And when it's too high, a chain reaction begins.

If buyers think you’re asking too much, they’re going to turn the other way. And when buyers bypass your house, you'll get fewer showings. Fewer showings lead to fewer offers. And fewer offers usually mean making a price cut to try to draw buyers back in.

And that’s happening a lot lately, especially on homes sold without a pro.

The same NAR report shows most homes sold without an agent (59%) had to reduce their asking price at least once (see the orange in the graph below).

The Part Sellers Don’t See Coming

The Part Sellers Don’t See Coming

The trouble is, price cuts don’t always fix the problem. They can attract bargain hunters rather than strong, confident buyers. That's because many buyers see a price drop as a sign there’s something wrong with the house. And that assumption can turn buyers away too.

By the time your house finally sells, you may net less than if you’d priced it correctly from the start. Again, the data backs this up.

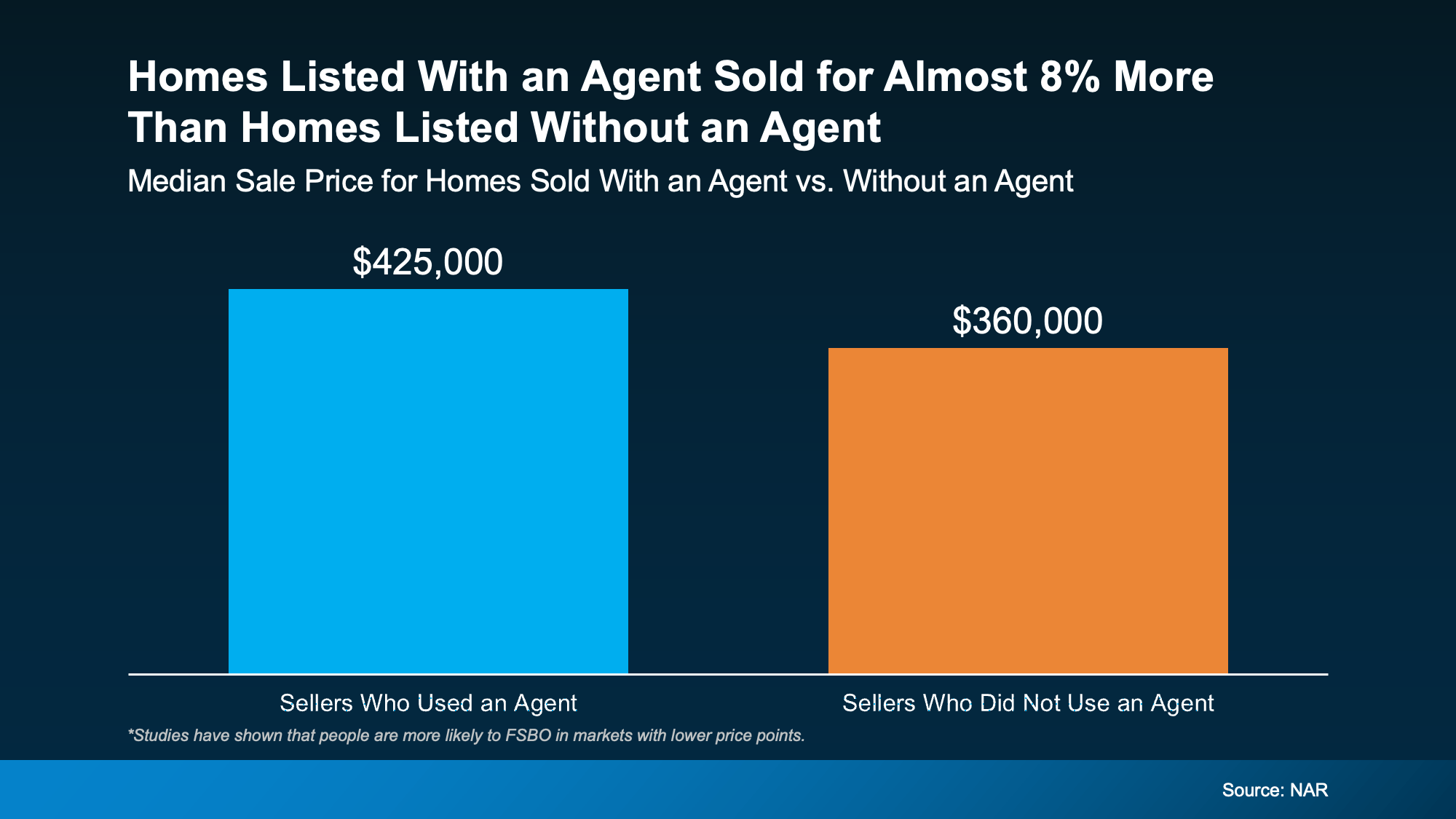

NAR shows that homes sold with an agent sell for nearly 8% more than homes sold without one.

That’s not because agents magically add value. It’s because they have the expertise needed to get it right. The price. The prep. The presentation. And the paperwork.

That’s not because agents magically add value. It’s because they have the expertise needed to get it right. The price. The prep. The presentation. And the paperwork.

Nail all of that from day one, and you'll be set up to get as much money as you can out of your sale.

So, even though you thought selling without an agent meant saving money, that's not necessarily true. The facts show selling on your own can mean selling for less in the long run. And that may be enough to totally change your perspective.

Bottom Line

Today, the biggest risk of selling without an agent isn’t the paperwork or the hassle. It’s the price. And once pricing goes wrong, it’s hard to course correct.

So, if you’re thinking about selling and want to understand what your home would realistically go for in our market today, let's connect. A quick pricing conversation now can save you from bigger regrets later.

Affordability Improving in 2026 According to Experts

Expert Forecasts Point to Affordability Improving in 2026

Wondering what to expect from the housing market in 2026? You’re not the only one. For the past few years, affordability has been the biggest barrier standing between most people and their next move. And a lot of buyers and sellers have been holding their breath waiting for things to get better. The good news? It’s finally happening.

In 2025, affordability was the best it’s been in 3 years. And experts agree the momentum will keep going in 2026. And that’s based on their analysis of the key factors shaping the housing market in the year ahead: mortgage rates, inventory, and home prices.

Lower Mortgage Rates Are Already Here

Mortgage rates have already come down from their peak. By some counts, they dropped by almost a full percentage point over the course of the last year. And that’s a big deal, even if it doesn’t sound like it. But how low will they go? And should you wait for them to come down more? Here’s your answer.

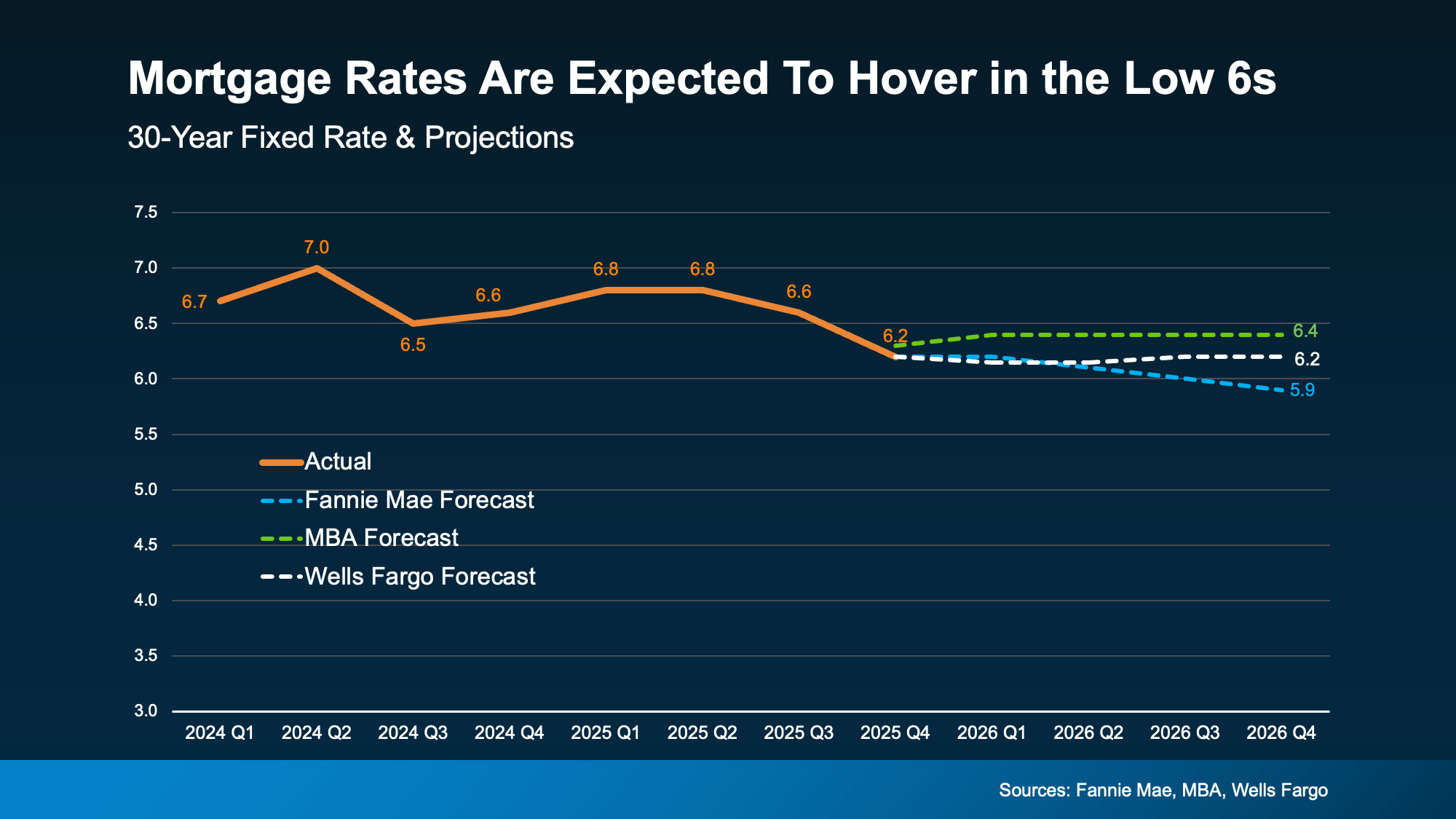

Forecasts suggest they’ll stay pretty much where they are now and hover in the low 6% range throughout 2026 (see graph below):

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

- For buyers: A lower rate reduces monthly payments and increases buying power. And, that combo helps more people qualify for homes that previously felt just out of reach.

- For sellers: It may be time to accept that rates in the 6s are the new normal. And if you need to move, it’s doable, especially with your equity.

Even More Options Are on the Way

In 2025, the number of homes for sale improved by about 15%. As inventory rose, buyers regained things they hadn’t had in years: options, time to consider those options, and negotiating leverage. That helped restore more balance to the housing market.

Not to mention, the inventory gains are a big piece of what’s helped price growth slow down – which in turn improves affordability.

While the inventory gains this year aren’t expected to be as steep, experts at Realtor.com say the supply of homes for sale should grow by another 8.9% this year.

- For buyers: That means even more choice and more negotiating power.

- For sellers: Pricing your house right will be essential to draw in buyers.

Home Price Growth Is Slowing to a More Sustainable Pace

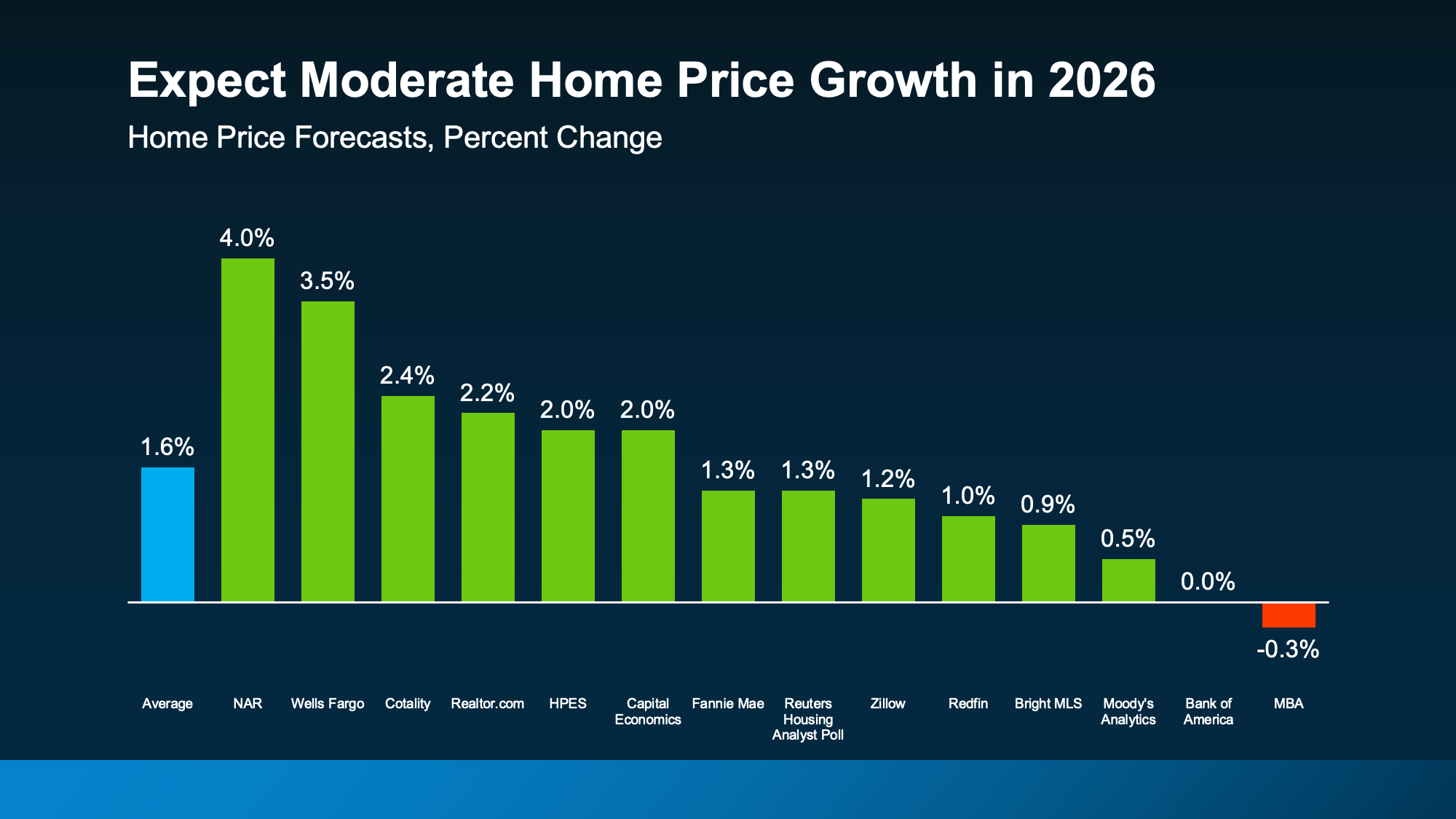

With more homes for sale, there isn’t as much upward pressure on prices right now. And we’ve seen that shake out over the past year. Even so, the overwhelming majority of experts say, nationally, prices will continue rising in the year ahead – just at a slower pace. On average, they say prices will rise by 1.6% in 2026 (see graph below):

And that's reassuring if you've been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

And that's reassuring if you've been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

So, lean on a local agent for the latest on what’s happening where you are. Some markets will see prices rise more than this. Others may see prices come down slightly. It really all depends on conditions in your local market

But overall, prices will continue to rise at the national level. And that’s good for the market as a whole. As Realtor.com explains:

“For homebuyers and sellers, the shift signals a more balanced market—one where price growth steadies, rate relief offers breathing room, and negotiating power tilts subtly toward buyers.”

- For buyers: Expect more moderate price growth, not the sudden and intense spikes just a few short years ago. That gives you fewer surprises and more predictability, which makes budgeting a whole lot easier.

- For sellers: This slower price growth restores balance without putting your equity at risk. And that’s a win.

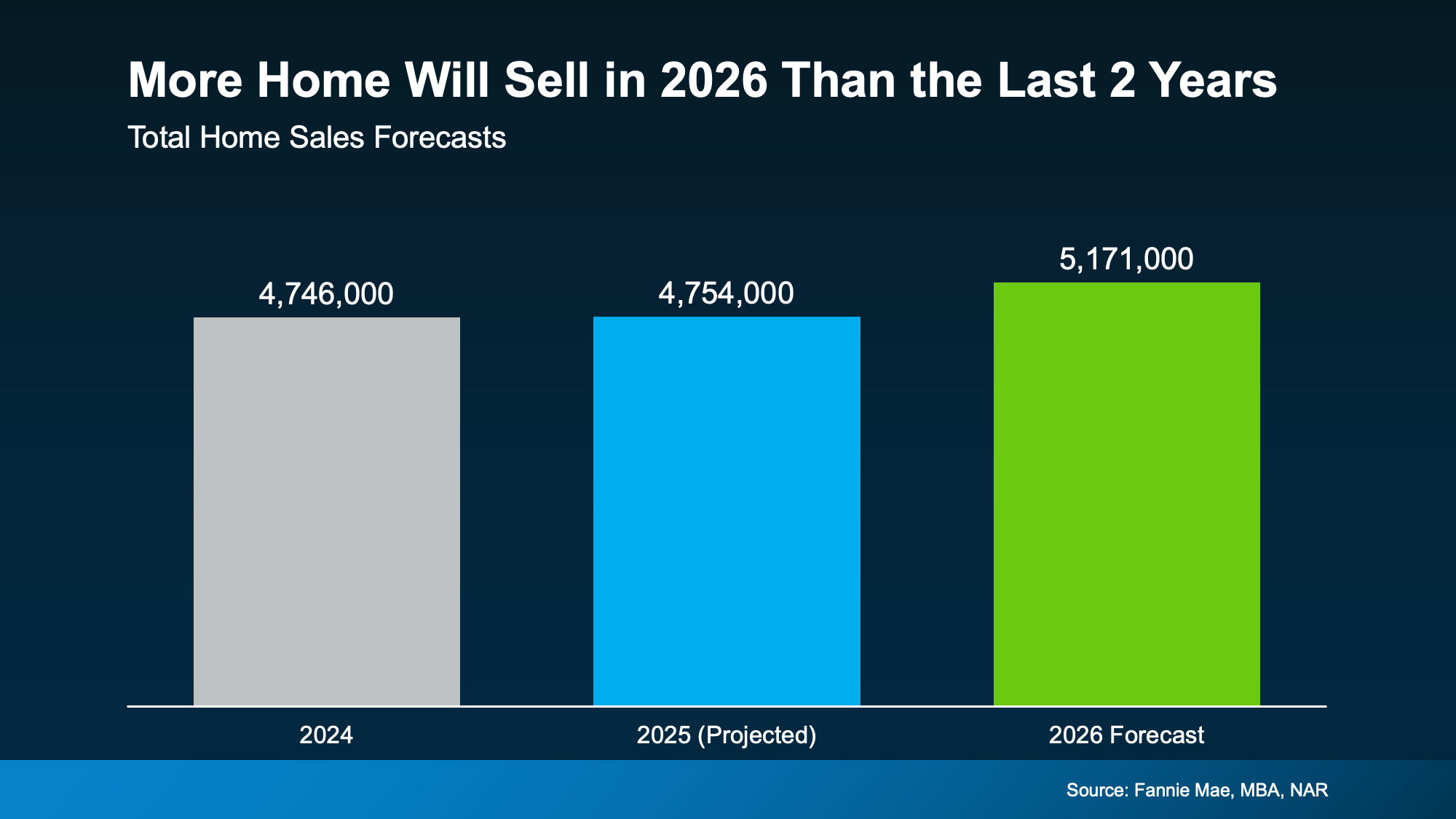

More Homes Will Sell

All of this adds up to a better affordability equation in 2026. And that’s exactly why experts are saying we should see more homes sell (and more people buy) this year.

As Mischa Fisher, Chief Economist at Zillow, says:

As Mischa Fisher, Chief Economist at Zillow, says:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

The bottom line is, more people are finally going to be able to make their move this year. So, the question is: will you be one of them? The market is giving you an opportunity you haven’t had in a while. Maybe it’s time to take advantage of it.

Bottom Line

Affordability won't change suddenly overnight. But, with several key trends working together, it should slowly and steadily improve in the months ahead.

That’s exactly why, in 2026, you should see a market with more balance, more predictability, and more breathing room than you’ve had in years.

Want more information about the opportunities unlocking in our local market?

Let’s chat.

Thinking about Selling Your House As-Is on Mt. Hood?

Thinking about Selling Your House As-Is? Read This First.

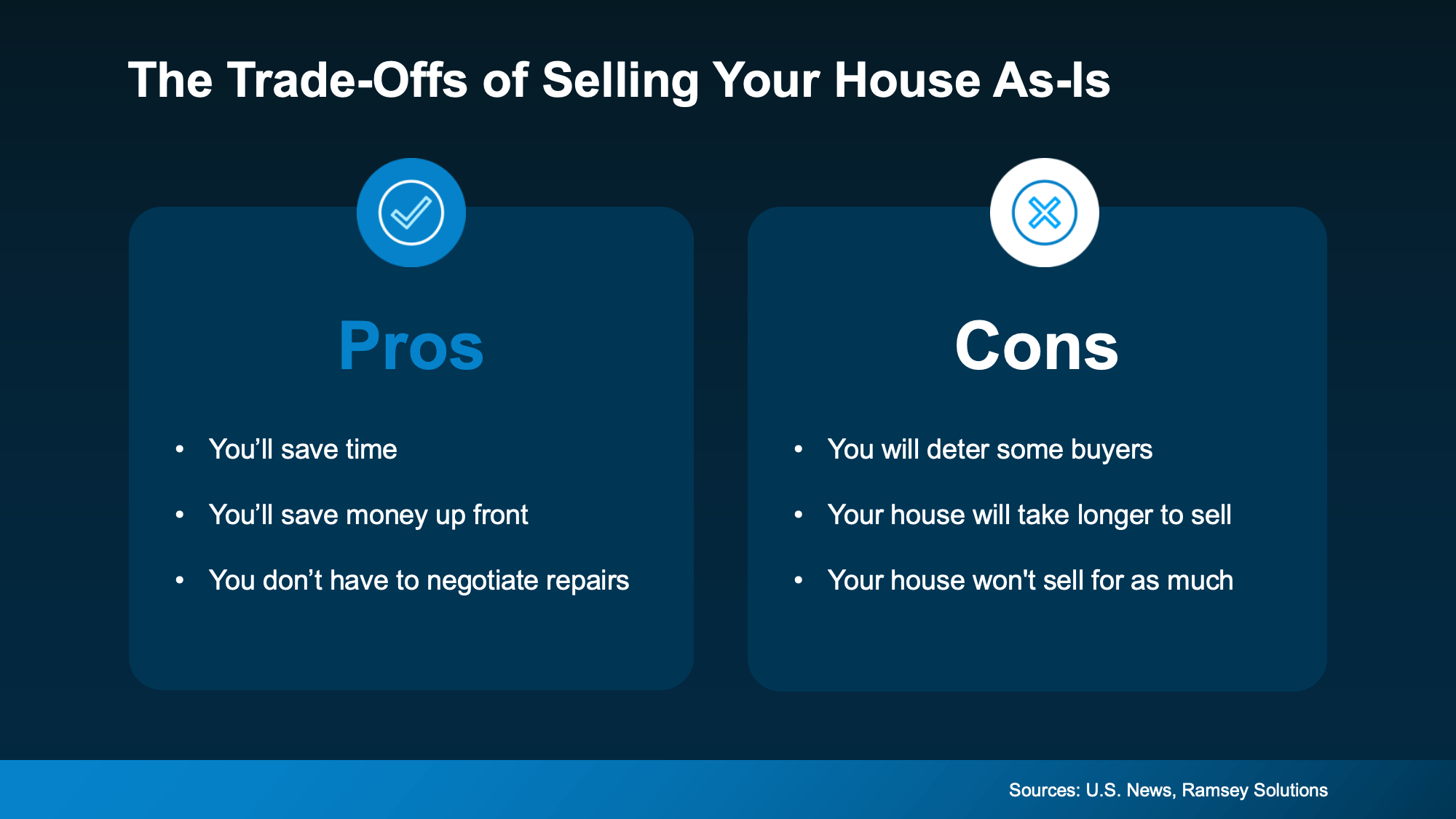

If you’re thinking about selling your house this year, you may be torn between two options:

- Do you sell it as-is and make it easier on yourself? No repairs. No effort.

- Or do you fix it up a bit first – so it shows well and sells for as much as possible?

In 2026, that decision matters more than it used to. Here’s what you need to know.

More Competition Means Your Home’s Condition Is More Important Again

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

That’s one reason most sellers choose to make some updates before listing.

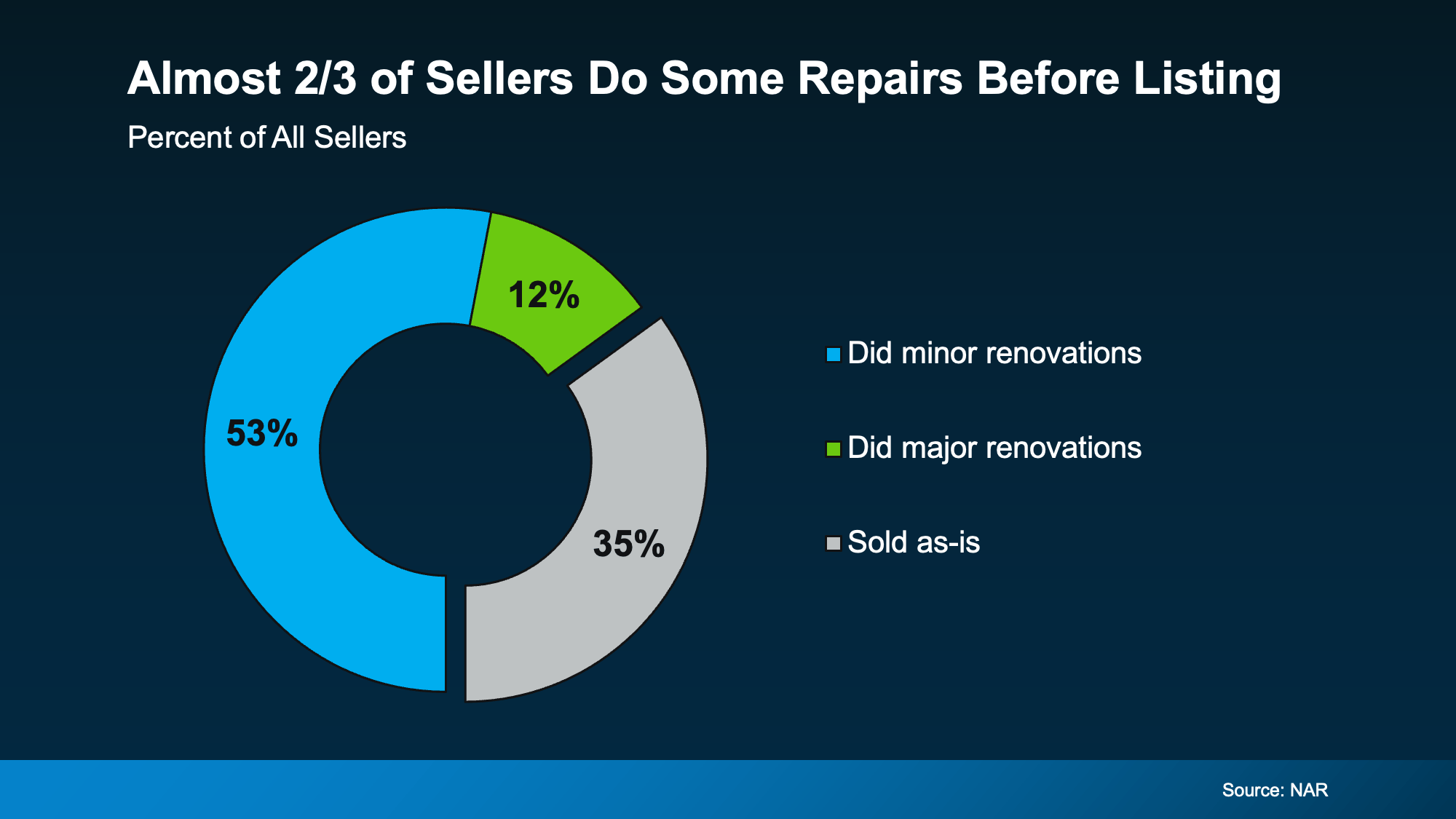

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

What Selling As-Is Really Means

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

How an Agent Can Help

So, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

- If you choose to sell as-is: They’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just the projects.

- If you decide to make repairs: Your agent can pinpoint what's really worth the time and effort based on your budget and what buyers care about the most.

The good news is, there's still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

Bottom Line

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, let's have a quick conversation about your house.

Storm Damage on Mt. Hood

Mt. Hood Storm Damage

Winds and massive amounts of rain came to Mt. Hood. Power outages for days, downed power lines, toppled trees and landslides hit the area. Saturated ground caused many trees to fall over in the winds. The biggest slide was near the intersection of Salmon River Road and Welches Road. Salmon River Road is now open but it may be a while before Welches Road is cleared. Here are a few photos of the damage.

Welches Road sign near Salmon River Road

House that was on Mt. View Drive that was destroyed.

Debris Flow From Land Slide

Welches Road with Salmon River Road to the elevated right with orange markers

Repair work from slide on the East side of Salmon River Road.

Repair work

Summary of Sales on Mt. Hood for November 2025

First of all Happy New Year!

What a crazy December on the mountain! Warm temperatures and a serious wind and rain event that blasted through the area have homeowners still in clean up mode. Power outages, land slides and a lack of snow has put a damper on the mountain community as we dig out, clean up and get ready for the new year.

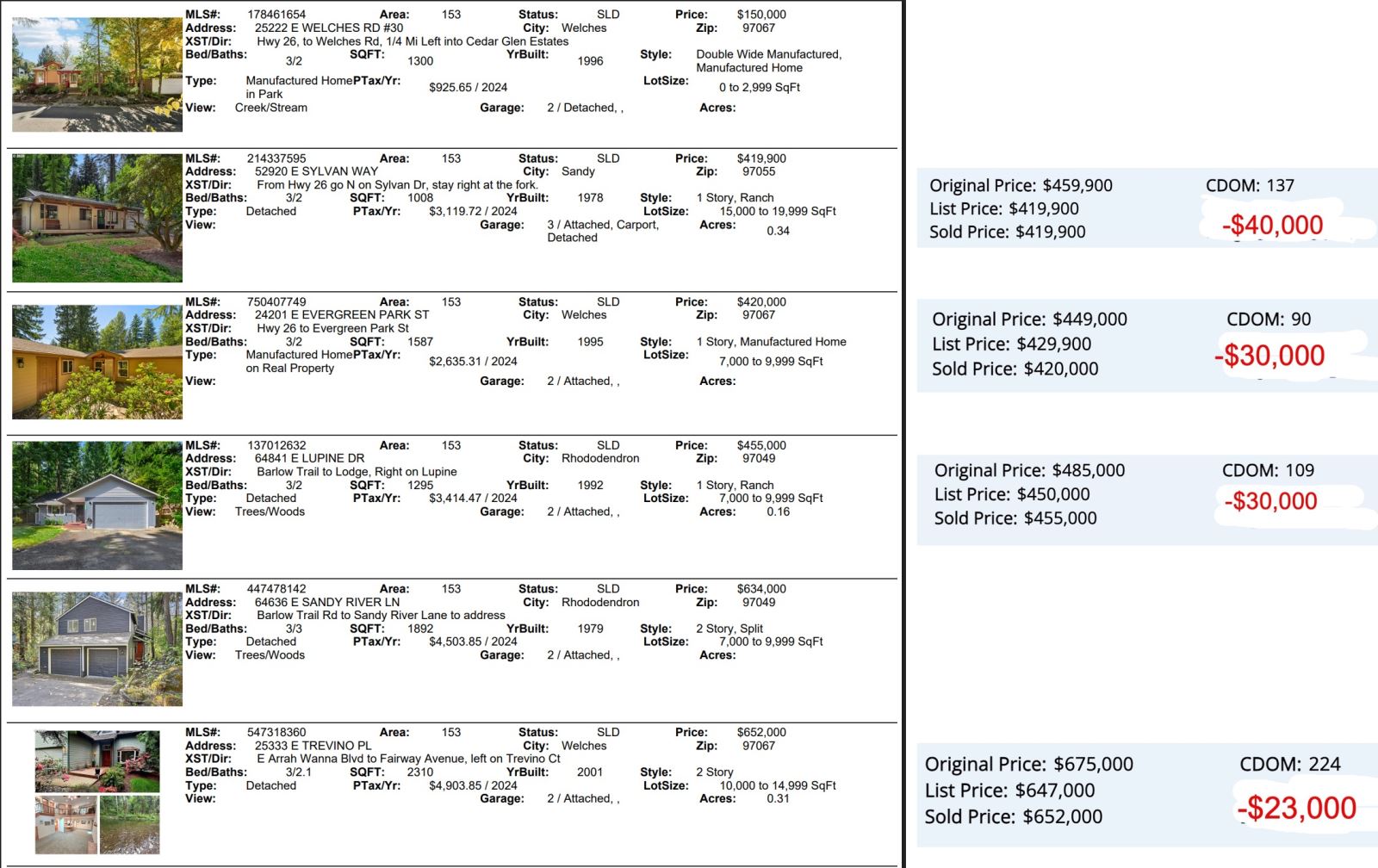

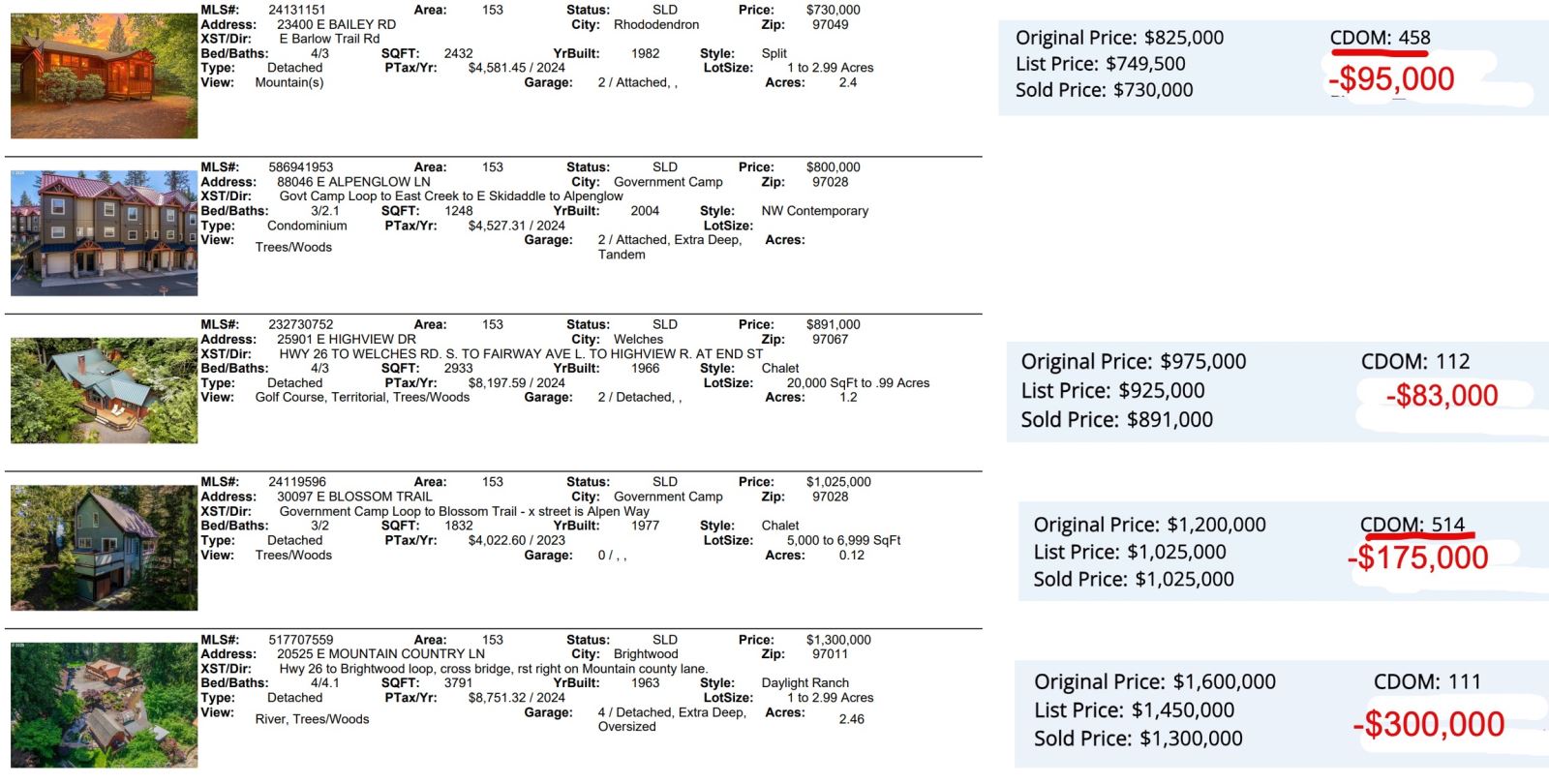

This year saw a significant shift in the market with the most inventory we’ve seen in years. Interest rates, still below historic norms, have delayed buyer purchases along with affordability issues, layoffs and high debt levels. Sellers have reduced prices and made many more concessions than we’ve seen in a long time. The evidence is clear in the November sales listed under the RMLS data. The majority of sales had price reductions from the original list price to final price. Days on market are lengthening.

We look forward to 2026 and what it will bring to the market. NAR’s chief economist says the following:

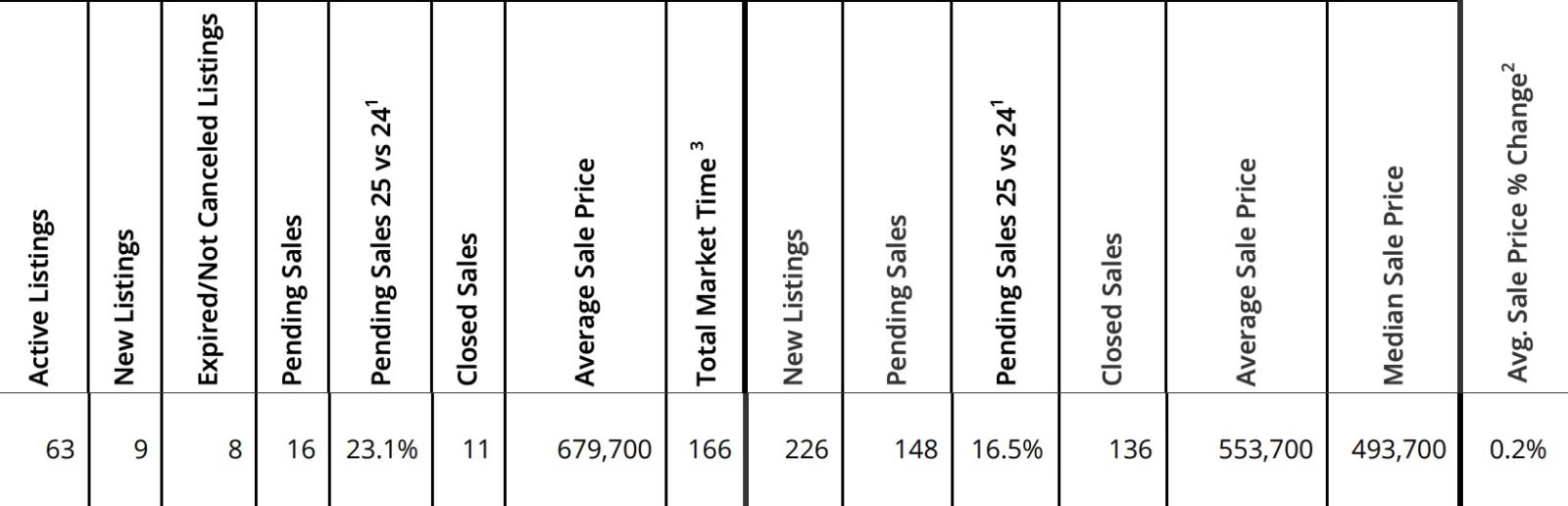

Here are the statistics from RMLS for November 2025.

November Sales 2025

Note two of these properties sold below had excessive marketing times with 458 and 513 days which skews the data in the above chart. CDOM means cumulative days on market. Typically the longer a property is on the market the lower the final selling price will be. Sellers acting quickly will preserve some of the massive equity gains over the past five years. The final price of these properties demonstrate how difficult pricing has been over the past year with this adjustment period. As sales happen and comparable sales are used to price new properties coming on the market things should level out a bit more and hopefully less properties will sit.

More Buyers Moving on Mt. Hood in 2026

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.

That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

Planning To Move in Early 2026? Start with These 4 Steps

If you’re eager to get the ball rolling right away, here's what to tackle first:

- Get pre-approved. A pre-approval gives you a real understanding of your buying power and what your payment could be at today’s rates. But keep in mind, Experian says most pre-approvals are only good for 30-90 days, so this step makes the most sense as you’re ready to get serious.

- Run the numbers. Look closely at all your expenses to come up with your budget. Consider what you’re spending on other bills and what your monthly mortgage payment would be once you buy. That way you go in with open eyes and you don’t stretch too far.

- Define your non-negotiables. Once you know the numbers work, figure out your must-haves. This includes your desired location, commute, layout, school district, lifestyle needs, etc. Getting clear on these now makes decisions easier once you start looking at homes.

- Choose your agent early. Look at reviews online and talk to multiple agents to find one you trust that you also click with. The right agent does more than show homes. They help you understand pricing, competition, timing, and strategy before you ever write an offer.

Thinking about Buying Later in the Year? This Is Still Your Window To Prepare

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

- Work on your credit. While you don't need to have perfect credit to buy a home, your score can have an impact on your loan terms and even your mortgage rate. So, working to bring up your score has its perks. Paying down debt now and making payments on time can help bring your score up.

- Automate your savings. If you have to remember to transfer money into your homebuying savings manually, you may forget to do it. So, you may want to set up automatic transfers to drive consistency and remove the temptation to spend the money elsewhere.

- Lean into your side hustles: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

- Put any unexpected cash to good use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund. You’ll thank yourself later.

The common thread here? The right prep work makes a difference.

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

Displaying blog entries 1-10 of 10

Categories

- (0)

- Government Camp Real Estate (779)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (80)

- Mt. Hood Economic Conditions (849)

- Mt. Hood Local Events (369)

- Mt. Hood Mortgage and Financing Information (428)

- Mt. Hood National Forest Cabins (535)

- Mt. Hood New Properties on Market (311)

- Mt. Hood Sales Information (361)