Real Estate Information Archive

Blog

Displaying blog entries 1-10 of 361

More Buyers Moving on Mt. Hood in 2026

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.

That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

Planning To Move in Early 2026? Start with These 4 Steps

If you’re eager to get the ball rolling right away, here's what to tackle first:

- Get pre-approved. A pre-approval gives you a real understanding of your buying power and what your payment could be at today’s rates. But keep in mind, Experian says most pre-approvals are only good for 30-90 days, so this step makes the most sense as you’re ready to get serious.

- Run the numbers. Look closely at all your expenses to come up with your budget. Consider what you’re spending on other bills and what your monthly mortgage payment would be once you buy. That way you go in with open eyes and you don’t stretch too far.

- Define your non-negotiables. Once you know the numbers work, figure out your must-haves. This includes your desired location, commute, layout, school district, lifestyle needs, etc. Getting clear on these now makes decisions easier once you start looking at homes.

- Choose your agent early. Look at reviews online and talk to multiple agents to find one you trust that you also click with. The right agent does more than show homes. They help you understand pricing, competition, timing, and strategy before you ever write an offer.

Thinking about Buying Later in the Year? This Is Still Your Window To Prepare

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

- Work on your credit. While you don't need to have perfect credit to buy a home, your score can have an impact on your loan terms and even your mortgage rate. So, working to bring up your score has its perks. Paying down debt now and making payments on time can help bring your score up.

- Automate your savings. If you have to remember to transfer money into your homebuying savings manually, you may forget to do it. So, you may want to set up automatic transfers to drive consistency and remove the temptation to spend the money elsewhere.

- Lean into your side hustles: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

- Put any unexpected cash to good use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund. You’ll thank yourself later.

The common thread here? The right prep work makes a difference.

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

The Longer A House Sits, The Less It Sells For

Want to find the best deal possible on a home right now? Here’s one way to do it.

Take a look at the homes that have been sitting on the market the longest. Because the longer a house sits, the less it sells for.

And the data proves it. When a home lingers, sellers usually get more flexible.

That’s where buyers are scoring real savings. Even if a house sells for 94% of its asking price, that's roughly $24,000 off of a median priced home.

If you want to stretch your budget and find the deals other buyers overlook, let’s chat.

Why Buying a Home Still Pays Off in the Long Run

Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life.

But here’s the part people don’t talk about enough: renting doesn’t help you build your financial future. Meanwhile, homeowners grow their net worth just by owning a home.

So, if you’ve been wondering whether buying is still worth it, the long-term math is clearer than you might think.

Renting vs. Owning: How the Costs Really Compare

Let’s break down one of the key differences between renting and buying. When you rent, your payment goes to your landlord, and then it’s gone. When you own, part of your payment comes back to you in the form of equity (the wealth you build as the value of your home increases, and you pay down your home loan).

So, while renting may seem more affordable now, you have to remember it comes at a long-term cost: you’re not building your wealth. And it turns out, that’s a bigger miss than you may expect.

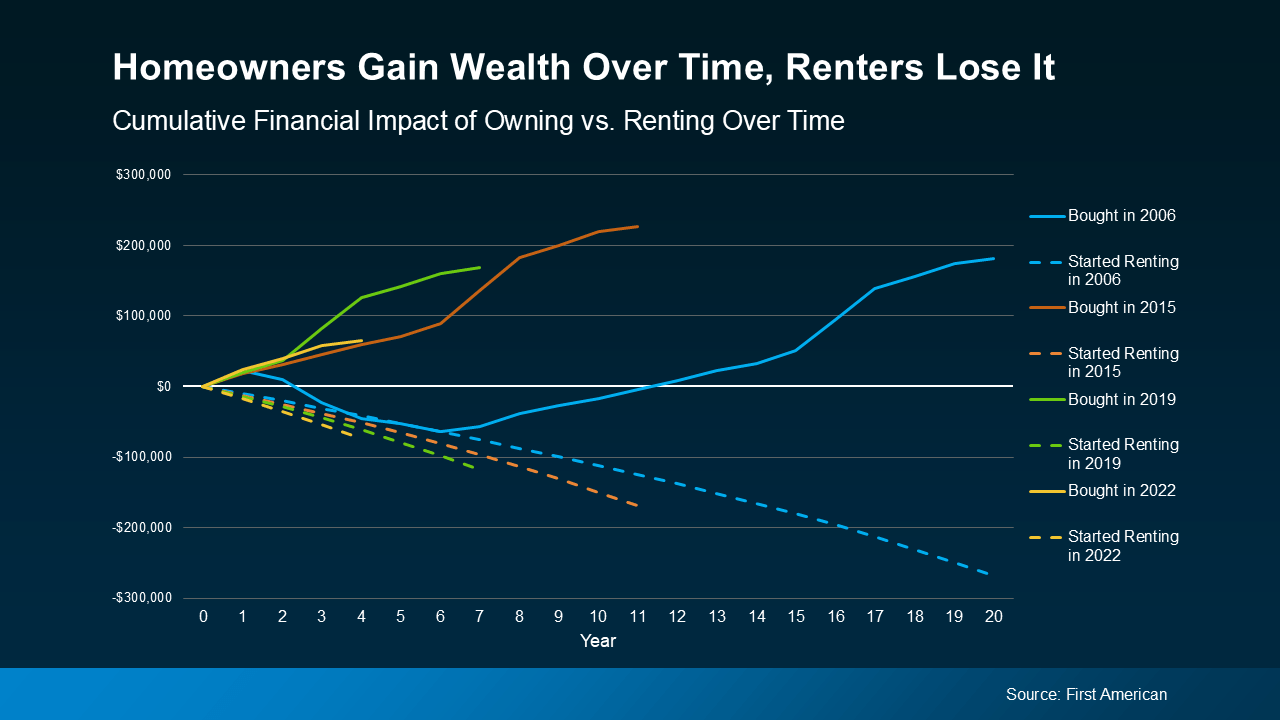

First American recently analyzed the long-term financial impact of renting versus owning a home. They compared mortgage payments, property tax, insurance, repairs, and maintenance against the equity gained through home price appreciation and paying down the mortgage. And they did that during several different time frames to see if it tells a consistent story:

- 2006: the start of the housing bubble

- 2015: 10 years ago

- 2019: just before the pandemic (the last normal years in the market)

- 2022: when mortgage rates jumped

In each time frame, two things were true: renters ended up losing money over time. And homeowners gained it.

Here’s some data so you can see this play out. Each color represents one of the key time frames. The solid lines show the buyer’s investment over time and how their net worth actually grew the longer they lived in their home. The dashed line represents the renter’s investment. In the end, they sank more and more cash into renting without gaining any financial benefit.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

Basically, homeowners come out ahead. And the analysis shows that’s even after you factor in the other expenses that come with homeownership, like insurance, repairs, and property taxes. And that's the case for every time frame First American looked into.

On the flip side, renters spent money on their rent, but didn’t gain any long-term financial benefit. That’s true no matter what window of time you look at in the study.

Now, that doesn’t mean buying always beats renting in the short term. But the longer you own, the wider the wealth gap becomes.

Affordability Is Starting To Improve

You might still be thinking, “Okay, but buying feels out of reach for me right now.” Fair.

The past few years haven’t been easy for buyers. But things are starting to shift. Mortgage rates have come down this year, home prices are softening, and incomes have been rising. And according to Zillow, typical monthly payments have gotten a little easier compared to this time last year. Not by a lot, but enough to make a difference.

No, buying isn’t suddenly easy. But it is easier than it was just a few months ago. And in the long run, history shows it’s worth it.

Bottom Line

Renting may feel less expensive today, but owning is what builds real wealth over time. And with affordability starting to improve, the path to homeownership may be opening up more than you think.

If you’re curious what buying could look like for you, let’s connect. We can figure out your next move, pressure-free.

Is the Housing Market Going To Crash? Here’s What Experts Say

Is the Housing Market Going To Crash? Here’s What Experts Say

If you’ve seen headlines or social posts calling for a housing crash, it’s easy to wonder if home values are about to take a hit. But here’s the simple truth.

The data doesn’t point to a crash. It points to slow, continued growth.

And sure, it’s going to vary by local area. Some markets will see prices rise more than others. And some may even see small, short-term declines. But the big picture is: home prices are expected to rise nationally, not fall, over the next 5 years.

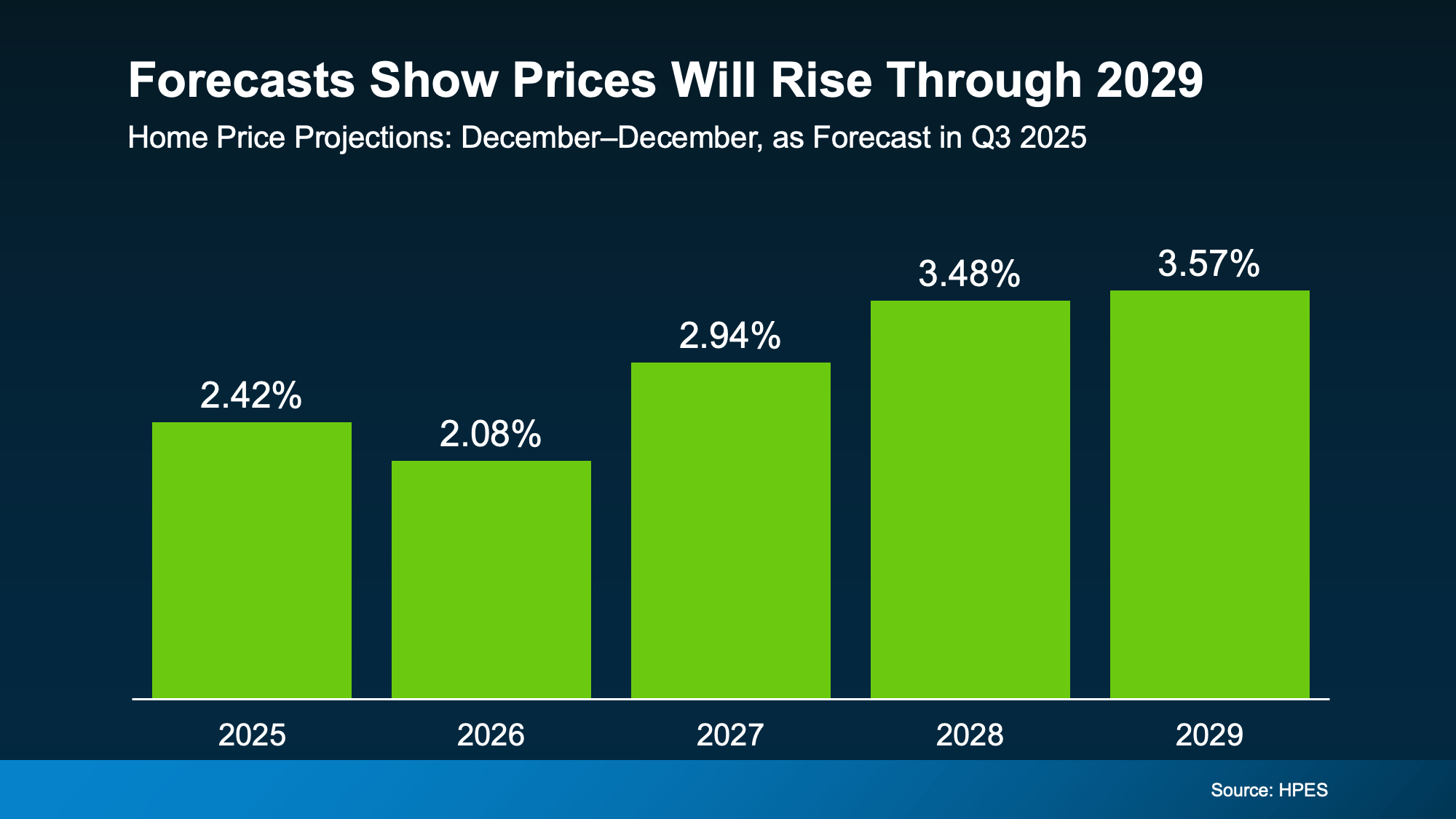

The Real Story Is in the Expert Forecasts

In the Home Price Expectations Survey (HPES) from Fannie Mae, each quarter over 100 leading housing market experts weigh in on where they project home prices will go from here. And in the report that was just released, the experts agree prices are projected to climb nationally through at least 2029 (see graph below):

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

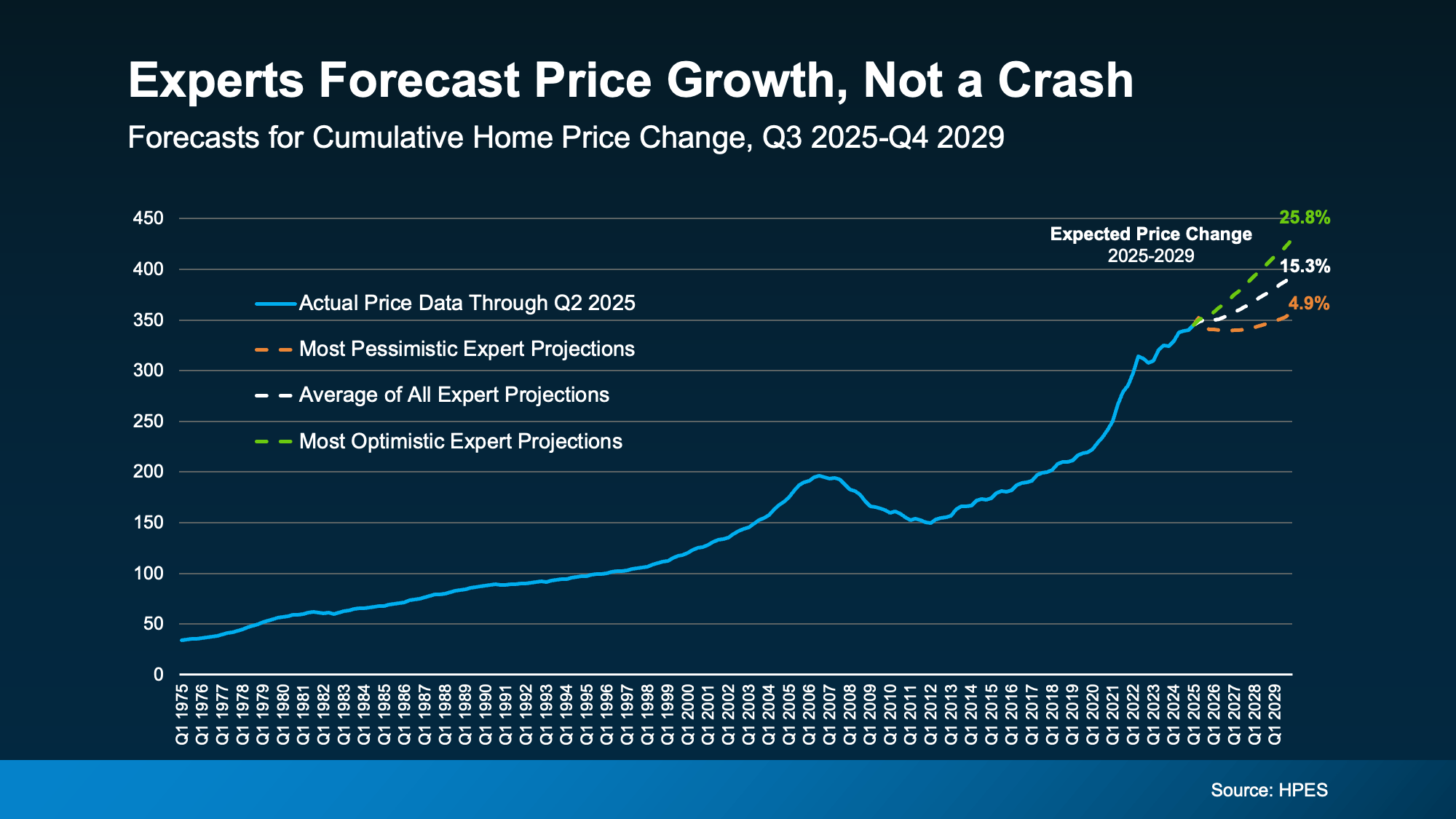

And to further drive this home, let’s look at another view of where prices are and where they’re expected to go. In this version, the expert forecasts are broken into 3 categories: the overall average, the most optimistic projections, and the most pessimistic projections (see chart below):

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

- Overall, prices are expected to rise about 15% from now through the end of 2029.

- The optimists say we’ll beat that and see a roughly 26% increase.

- And even the pessimists anticipate prices will go up by 5% during that period.

What sticks out the most? None of these groups who study the market are forecasting a crash, or even a decline, over the next 5 years.

How This Compares to “Normal” for the Market

Now, focus back on the first graph. The projections call for 2-3.5% price increases in each of the next five years. For context, the average rate of appreciation for the last 25 years was closer to 4-5% annually.

So, while that’s slightly below the historical average, it’s much more sustainable and typical than where the market was in 2020, 2021, and 2022.

Back then, prices rose too much, too fast based on record-low supply and record-high demand. Some places even saw prices climb by 15-20%.

So, while it may feel like prices are stalling compared to those pandemic-era surges, what’s really happening is that the market is finally finding balance again.

Why Prices Aren’t Expected To Crash

A lot of the chatter about home prices today is based on that rapid rise and the old saying that what goes up, must come down. But historically, that’s not really true. Home prices almost always rise.

And the main reason we’re not heading for a repeat of 2008 is simple: supply and demand.

Even though affordability challenges have made it harder for some people to buy over the past few years, there still aren’t enough homes for everyone who wants one. And that ongoing shortage is keeping upward pressure on prices nationally.

That’s why experts across the board can confidently agree: we’re not headed for a price collapse, but for steady, long-term appreciation.

And just in case it’s the economy that’s got you worried, remember this. Over the past 50 years, there have been plenty of economic events that have impacted the market. And one thing that’s consistently been true throughout time is the housing market always recovers. And we’re coming through that turn right now and going into a recovery.

Bottom Line

If you’ve been waiting to buy or sell because you’re worried about a crash, it’s time to look at the data – not the headlines.

The question isn’t if home prices will rise, it’s by how much.

Let’s connect so you know what’s happening in our local market and what these forecasts mean for your next move.

Why 50% of Homes are Selling for Under Asking and How to Avoid It

Why 50% of Homes Are Selling for Under Asking and How To Avoid It

If your selling strategy still assumes you’ll get multiple offers over asking, it’s officially time for a reset. That frenzied seller’s market is behind us. And here are the numbers to prove it.

From Frenzy to “Normal”

Right now, about 50% of homes on the market are selling for less than their asking price, according to the latest data from Cotality.

But that isn’t necessarily bad news, even if it feels like it. Here’s why. The wild run-up over the last few years was never going to be sustainable. The housing market needed a reset, and data shows that’s exactly what’s happening right now.

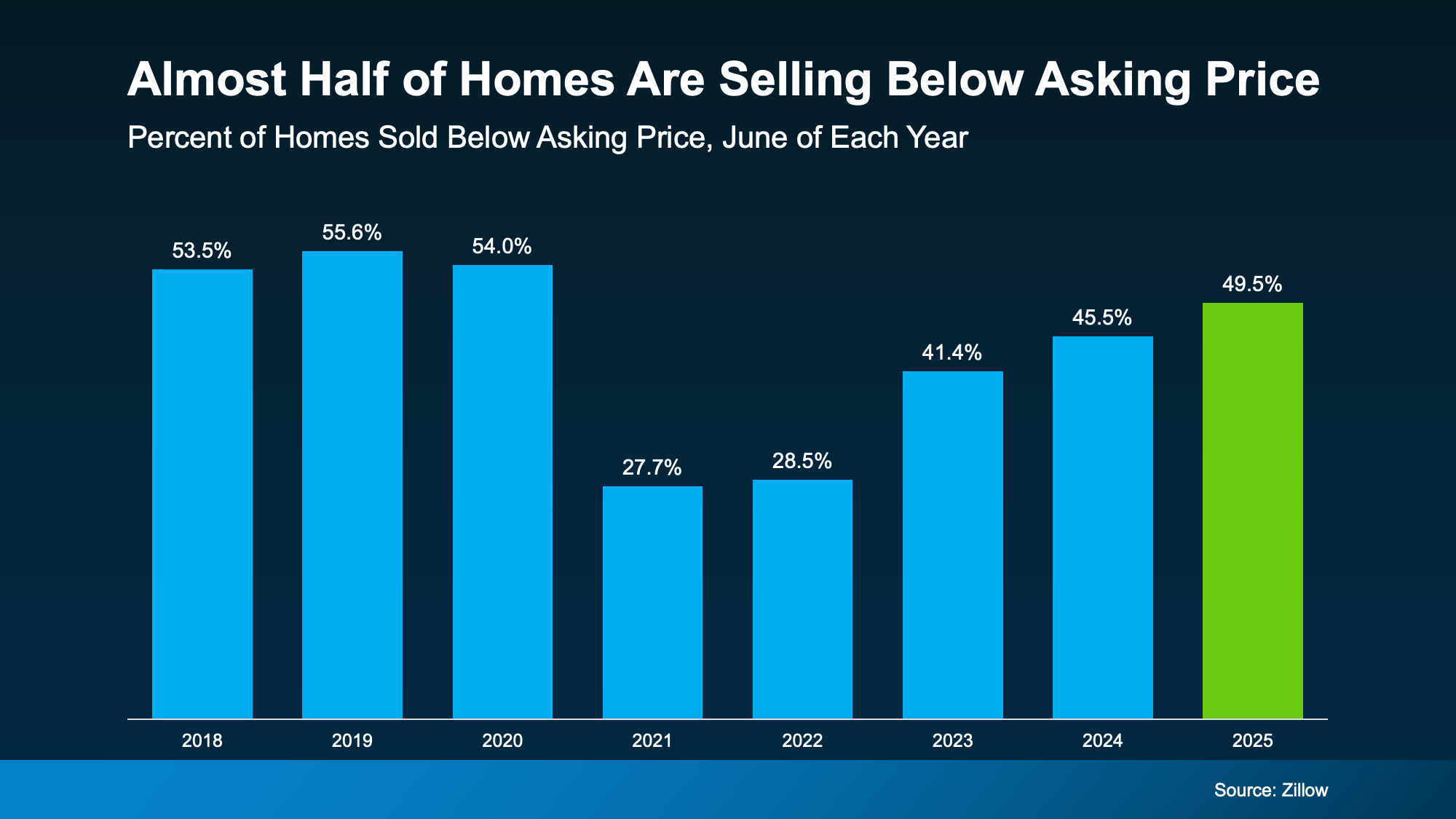

The graph below uses data from Zillow to show how this trend has shifted over time. Here’s what it tells us:

- 2018–2019: 50–55% of homes sold under asking. That was the norm.

- 2021–2022: Only 25% sold under asking, thanks to record-low rates and intense buyer demand.

- 2025: 50% of homes are selling below asking. That’s much closer to what’s typical in the housing market.

Why This Matters If You’re Selling Your House

Why This Matters If You’re Selling Your House

In this return to normal, your pricing strategy is more important than ever.

A few years ago, you could overprice your house and still get swarmed with offers. But now, buyers have more options, tighter budgets, and less urgency.

Today, your asking price can be make or break for your sale, especially right out of the gate. Your first two weeks on the market are the most important window because that’s when the most serious buyers are paying attention to your listing. Miss your price during that crucial period, and your sale will grind to a halt. Buyers will look right past it. And once your listing sits long enough to go stale, it’ll be hard to sell for your asking price.

The Ideal Formula

Basically, sellers who cling to outdated expectations end up dealing with price cuts, lower offers, and a longer time just sitting on the market. But homeowners who understand what's happening are still winning, even today.

Because that stat about 50% of homes selling for under asking also means the other half are selling at or above – as long as they're priced right from the start.

So, how do you set yourself up for success? Do these 3 things:

- Prep your house. Tackle essential repairs and touch-ups before you list. If your house looks great, you’ll have a better chance to sell at (or over) your asking price.

- Price strategically from day one. Don’t rely on what nearby homes are listed for. Lean on your agent for what they’ve actually sold for. And price your house based on that.

- Stay flexible. Be ready to negotiate. And know that it doesn't always have to be on price. It may be on repairs, closing costs, or some other detail. But know this: today’s serious buyers expect some give-and-take.

If you want your house to be one that sells for at (or even more than) your asking price, it’s time to plan for the market you’re in today – not the one we saw a few years ago. And that’s exactly why you need a stand-out local agent.

Bottom Line

You don’t want to fall behind in this market.

So, let's talk about what buyers in our area are paying right now. With local expertise and a strategy that gets your house noticed in those crucial first two weeks, anything is possible.

Want to know what your house would sell for?

Happy New Year!

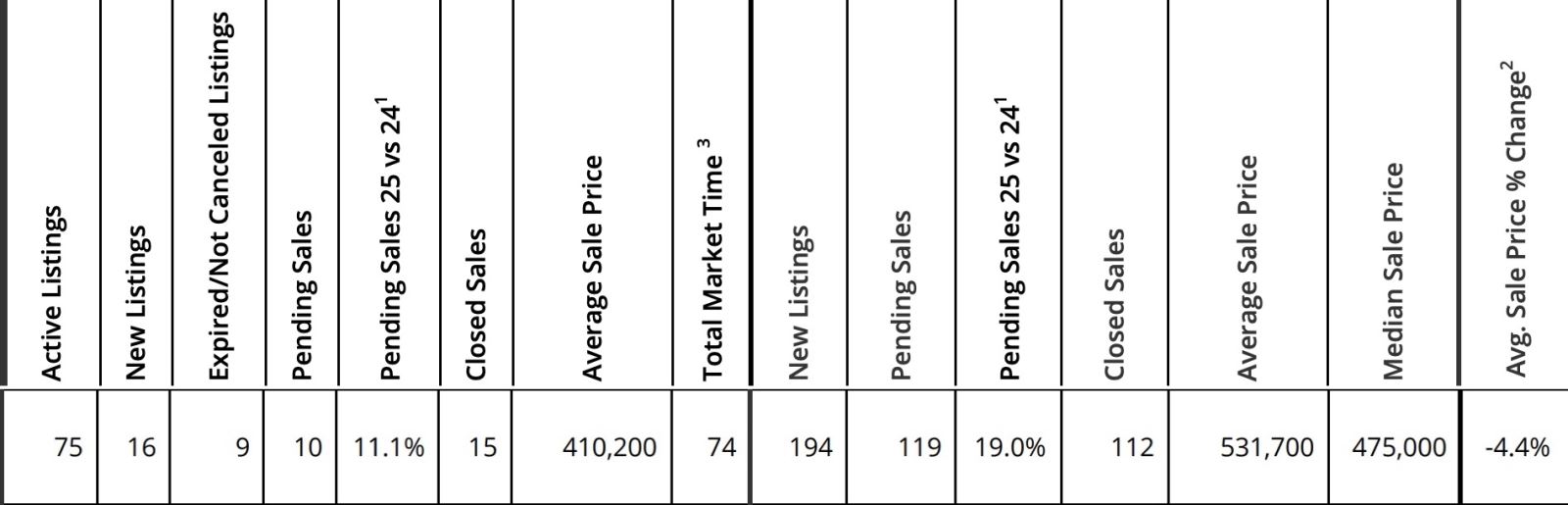

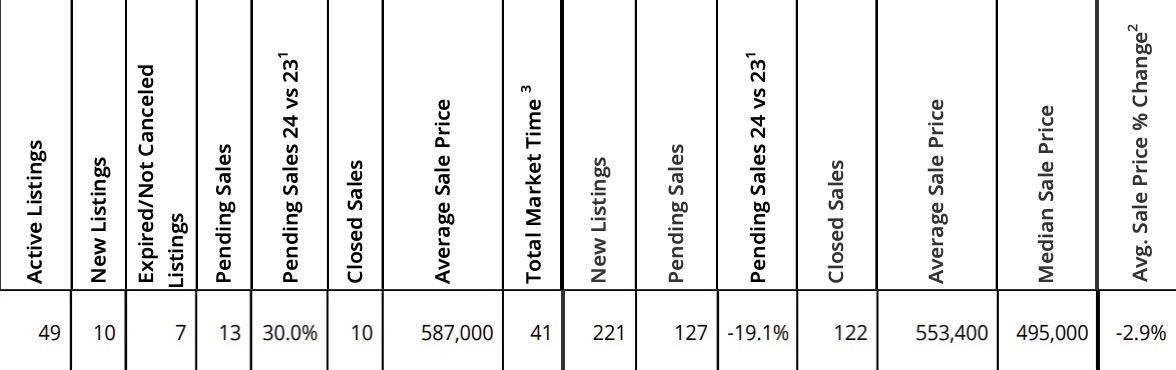

Market Summary November Sales 2024

HAPPY NEW YEAR!

As we head into 2025 here is a brief recap of some stats of the 2024 market. Many real estate sites report that this was a very difficult year with so little inventory and high interest rates. Since the beginning of the year the average market absorption is 2.7 months which is a seller’s market and unbalanced based on all pricing points.

Once I removed the sales for Colton which are mapped into our area through RMLS, we had a total of 136 sales for the year. Here’s a rundown of some of the stats that may be interesting:

13 forest cabins sold

102 detached single family homes sold

11 sales were over $1,000,000

19 sales were in Government Camp

14 condos sold and 9 were in Government Camp

8 sales were in Mt. Hood RV Village with tiny homes

Predictions for 2025 include more inventory coming on the market. We’ll see how that plays out. Currently our mountain market has 36 active listings. There are nine currently pending. So we will see how much the inventory goes up soon after the holidays.

Interest rates, low inventory, and consumer debt are slowing buyers down. Here are predictions for interest rates in 2025. Consensus is that rates will be slightly lower than 2024 but if inventory doesn’t increase, buyers may be paying the same as a todays rates because prices will be higher.

Consumer debt is another obstacle. People are tapped out which makes saving for a home tough.

Consumer Debt

Here are the statistics for November 2024’s market from RMLS.

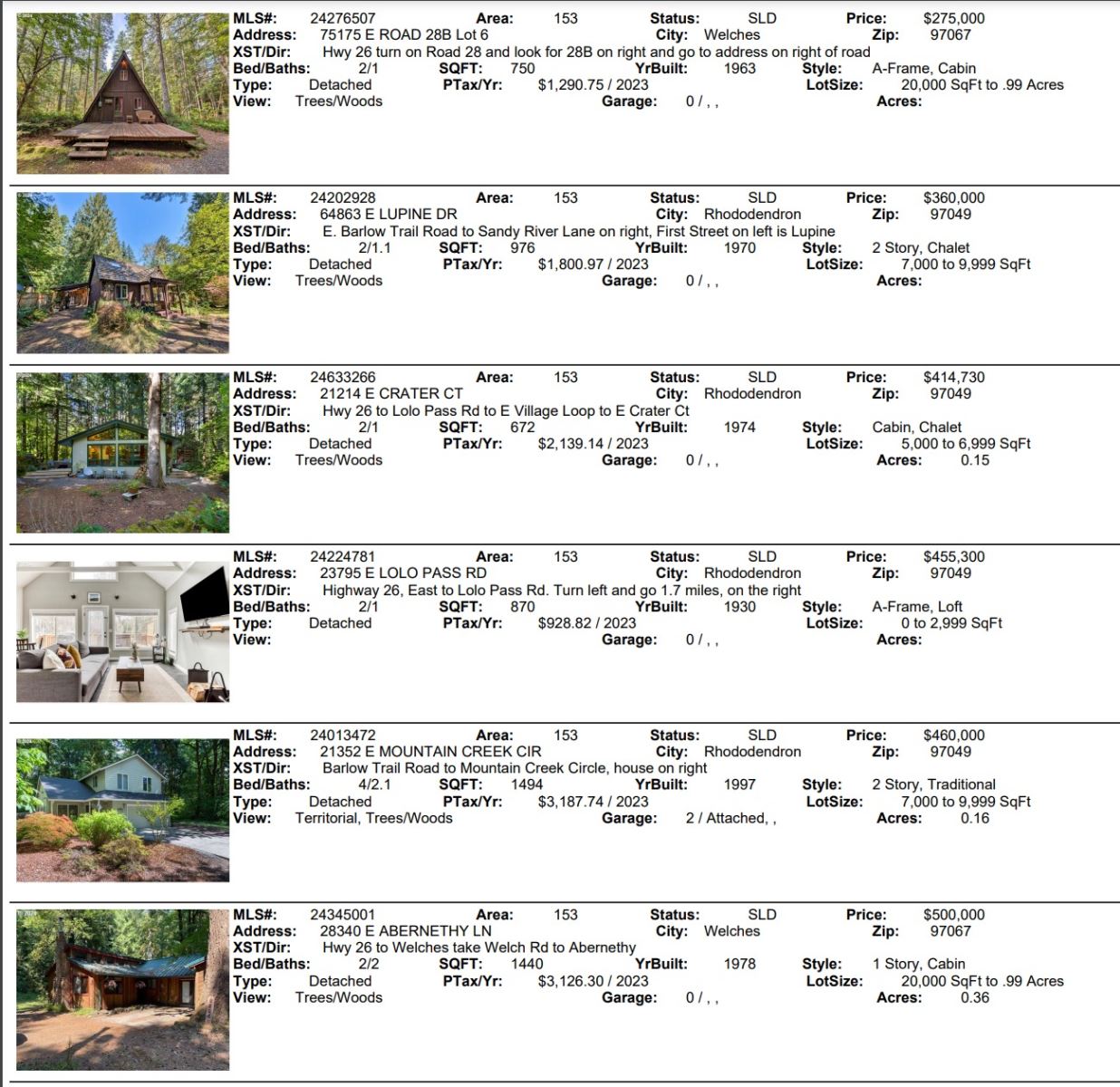

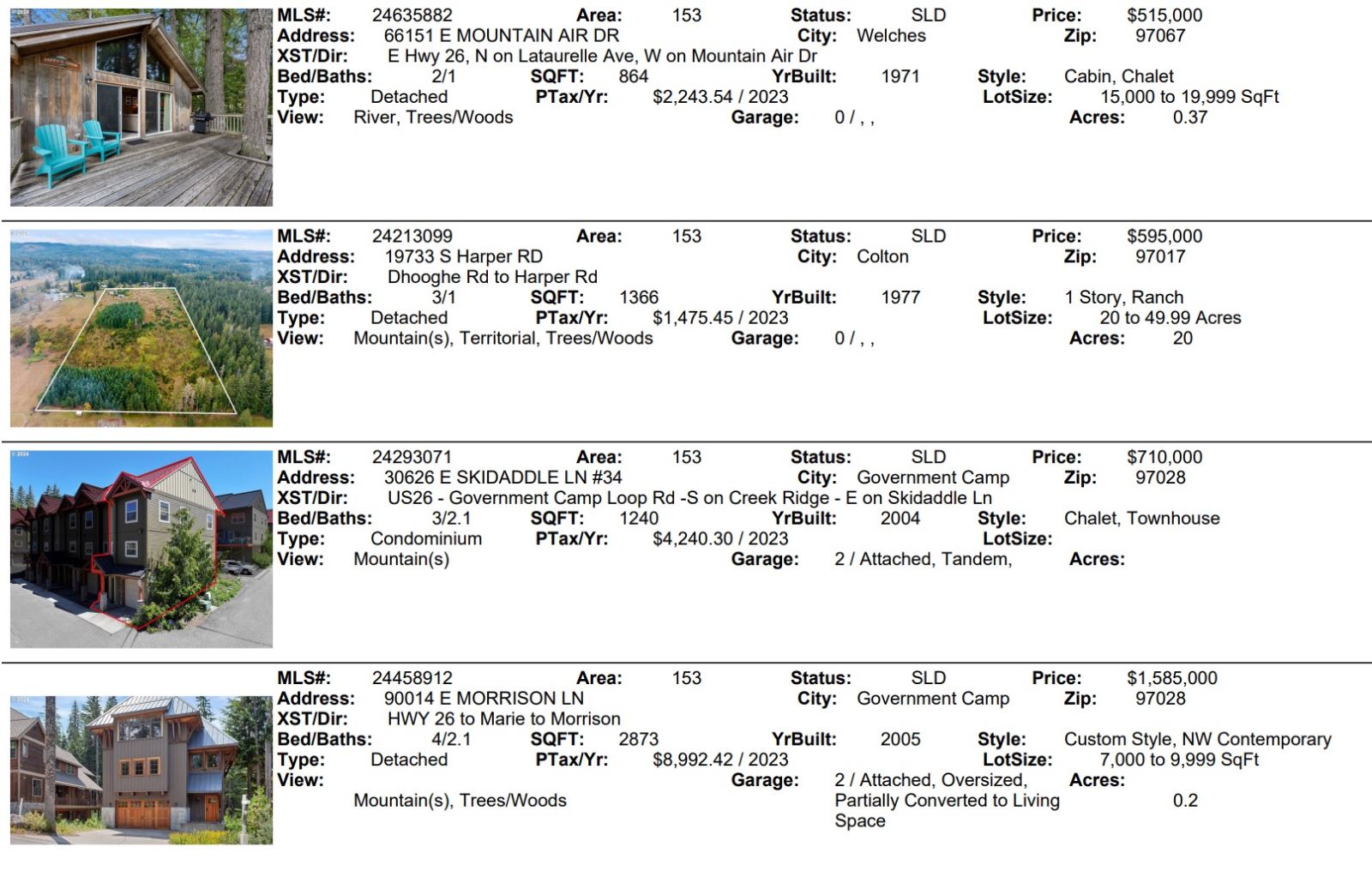

Listed below are the ten sales for November.

December 2024 National Overview

U.S. Real Estate Overview

Note: October 2024 data below are the most recent released by the National Association of Realtors.

Warranties for older homes

New homes come with warranties to protect the buyer in case of the unexpected. But what about existing homes? Fortunately, there are a number of companies today who offer warranties for existing homes. Sellers can now offer their buyers a level of assurance that was previously reserved for new construction, and buyers can buy with confidence! If you are in the market to buy or sell, ask us about the advantages of a home warranty. You might be surprised at how much protection is offered at a very reasonable price.

Seller strategy

Selling your home in today's market requires strategy and execution. Here are some tips to help sellers reduce their time on market while getting excellent value:

- Make it shine. Buyers are attracted to attractive homes. To make your home stand out, mow the lawn, rake the leaves, wash your windows, and clean the carpets. These small things can make a big difference.

- Remove clutter. Not only do clean homes show better, but tidy homes offer more to the imagination. One person's treasure is another person's trash. Removing unnecessary clutter will help potential buyers envision their own potential for the home.

- Consider removing art and personal keepsakes. This one is tough for certain people emotionally, but don't take it personally. Some savvy sellers go beyond de-cluttering and remove all (or most) of their personal artwork, family photos and personal mementos to make easier for potential buyers to imagine the home being theirs.

- Pay attention to the market. Work with your agent and price your home to sell. A competitively priced home is the one that sells first, and in this market that counts for a lot. Even in fast-moving markets in many parts of the United States, overpricing your home can lead to selling it for less or incurring greater holding costs than if you had priced the house appropriately in the first place. An experienced agent will help you arrive at the most advantageous price for your home.

These simple tips can help you sell your home and take advantage of our today's market. Please contact us if you have any questions about selling your home. We are here to help!

Displaying blog entries 1-10 of 361

Categories

- (0)

- Government Camp Real Estate (776)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (80)

- Mt. Hood Economic Conditions (846)

- Mt. Hood Local Events (367)

- Mt. Hood Mortgage and Financing Information (425)

- Mt. Hood National Forest Cabins (532)

- Mt. Hood New Properties on Market (311)

- Mt. Hood Sales Information (361)