Home Insurance Costs Are Rising: What Buyers Should Plan For

Home Insurance Costs Are Rising: What Buyers Should Plan For

Buying a home is one of the biggest purchases you’ll ever make. And homeowner’s insurance is what protects that investment. Think of it as your safety net. NerdWallet explains it:

- Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, it helps pay for repairs and possibly even a full rebuild, if that’s deemed necessary.

- Protects Your Belongings: It can also cover personal items like furniture, electronics, jewelry, and clothing if they’re stolen or damaged.

- Provides Liability Coverage: And, if someone gets injured on your property, your policy can help cover medical bills or legal expenses.

But that peace of mind does come with a cost, and lately those costs have been rising.

Why Home Insurance Premiums Are Going Up

There are a number of factors causing insurance premiums to rise today. But, in the simplest sense, here’s what’s driving prices up according to the Insurance Research Council (IRC).

Severe weather events and natural disasters are happening increasingly often, leading to more claims. At the same time, homebuilding materials and labor are more expensive. So, when it comes time to work on those claims, insurers have to manage higher costs to repair or rebuild the affected homes.

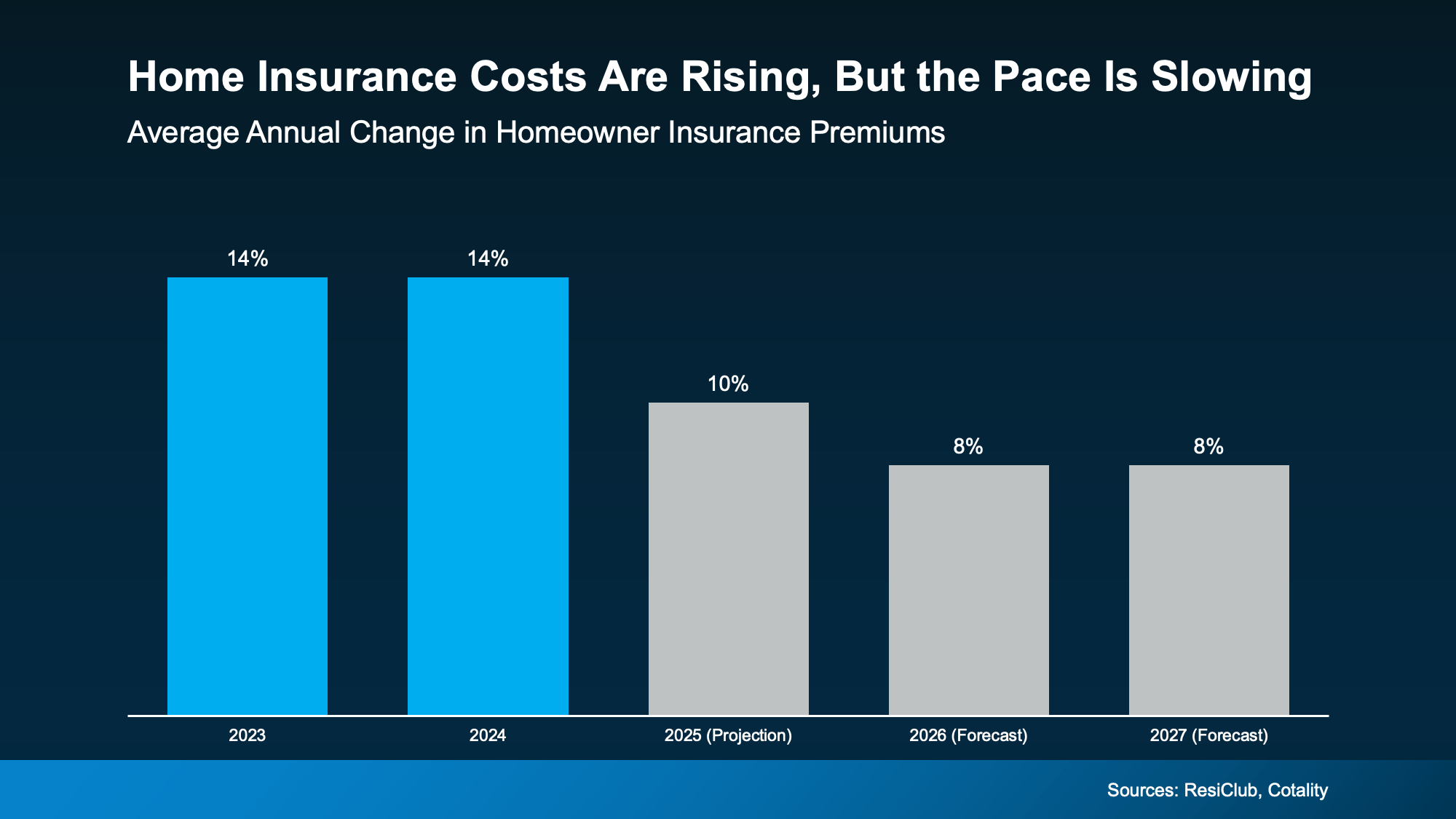

That combination adds up to higher premiums. You can see how it’s climbed recently in the graph below. Each bar marks the percentage increase in insurance costs for that calendar year.

The good news is, the annual pace of the increase may be starting to ease according to ResiClub and Cotality. By their count:

The good news is, the annual pace of the increase may be starting to ease according to ResiClub and Cotality. By their count:

- In 2023 and 2024, insurance costs went up 14% a year.

- In 2025, they rose about 10%.

- And in 2026 and 2027, it’s expected to go up about 8% each year.

That’s still an increase, but at least the pace is slowing down. And here's another silver lining.

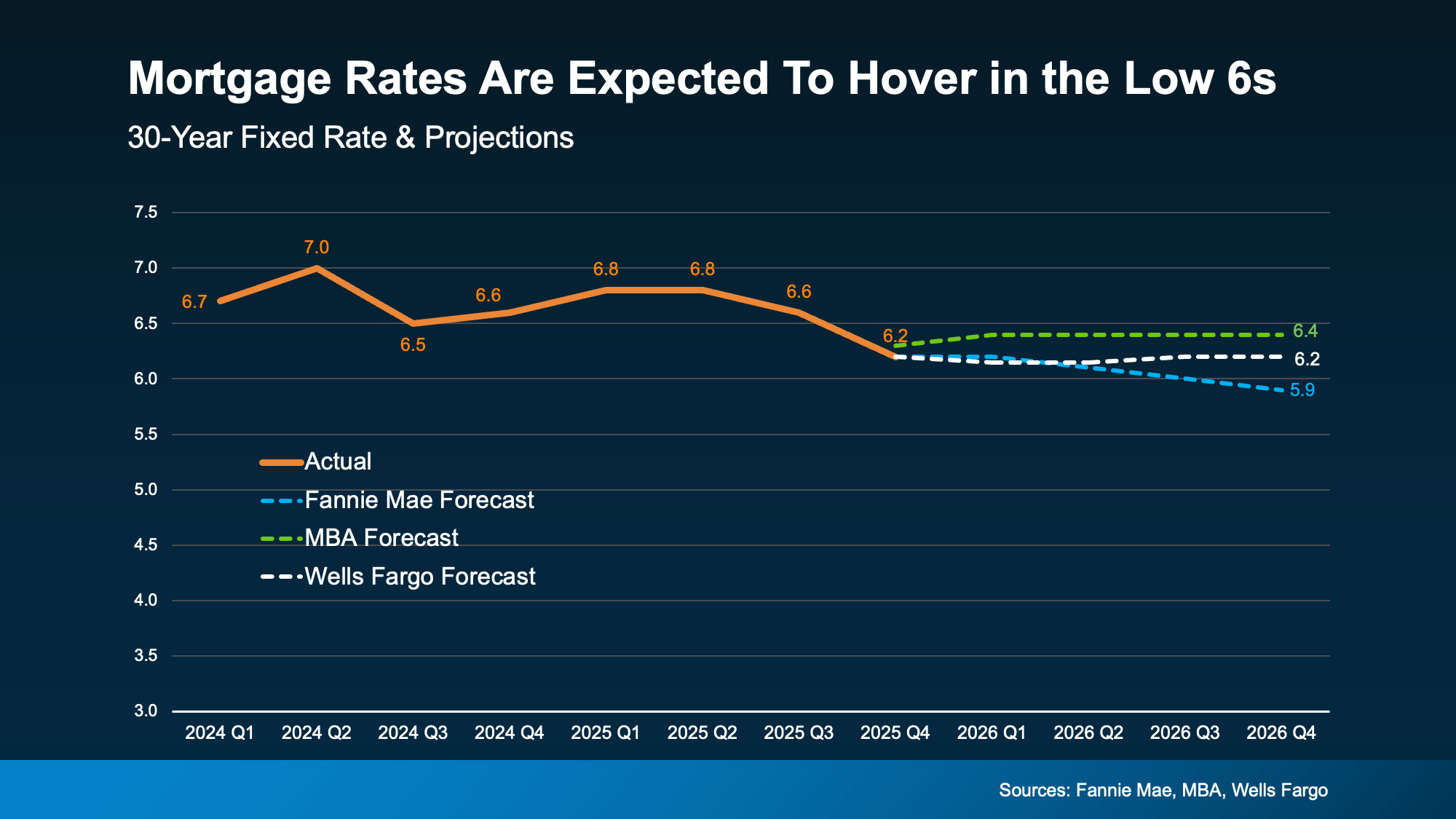

While insurance costs are rising, mortgage rates are falling. And that can help offset some of this expense. As Michael Gaines, Senior VP of Capital Markets, Cardinal Financial, explains:

“Rising taxes and insurance do create pressure, but they don’t erase the benefits of a lower rate . . . A small rate improvement, paired with the right loan program and smart planning, can still make homeownership possible . . . It’s less about one factor canceling another out, and more about helping buyers layer the right solutions together.”

Costs Are Going To Be Different Depending on Where You Buy

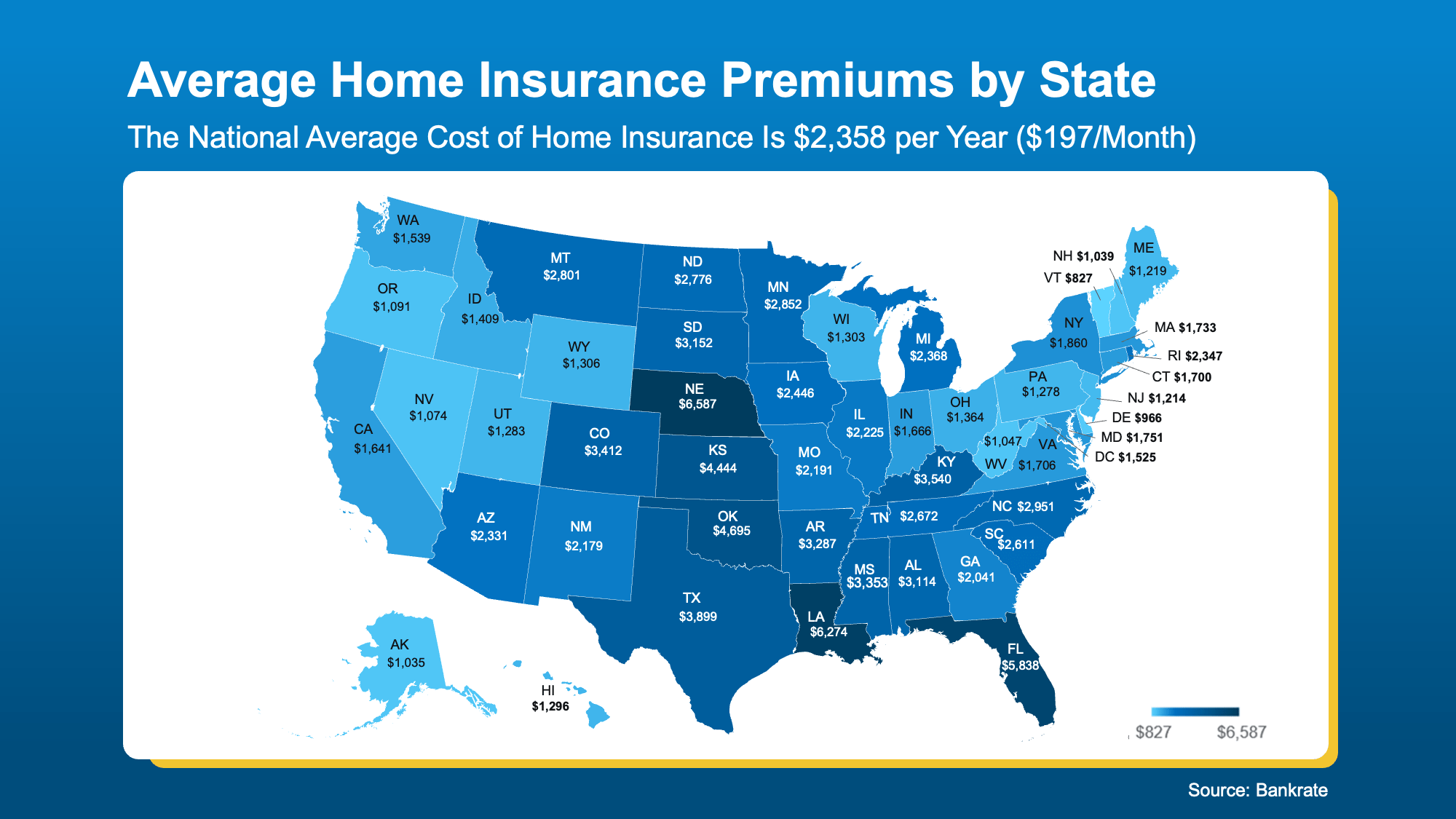

So how much do you need to budget for this? It depends on the price point and location of house, the coverage you need, and more. And just like with everything else in real estate, costs vary by area.

You can get a rough idea of your state’s typical premiums in the map below:

So, What Can You Do About It?

So, What Can You Do About It?

Generally speaking, your first insurance payment will be wrapped into your closing costs. But after that, it’ll become a recurring expense. That’s why knowing these premiums are rising is so important. It helps you factor that into your budget, so you go in with a full picture of what you can comfortably afford.

If you’re crunching the numbers and trying to find other ways to save, here are a few tips from Insurify and NerdWallet that can help you get the best insurance price possible:

- Shop Around – Compare quotes from multiple companies.

- Bundle Policies – Combine home and auto for discounts.

- Ask About Discounts – Don’t miss out on savings you may qualify for.

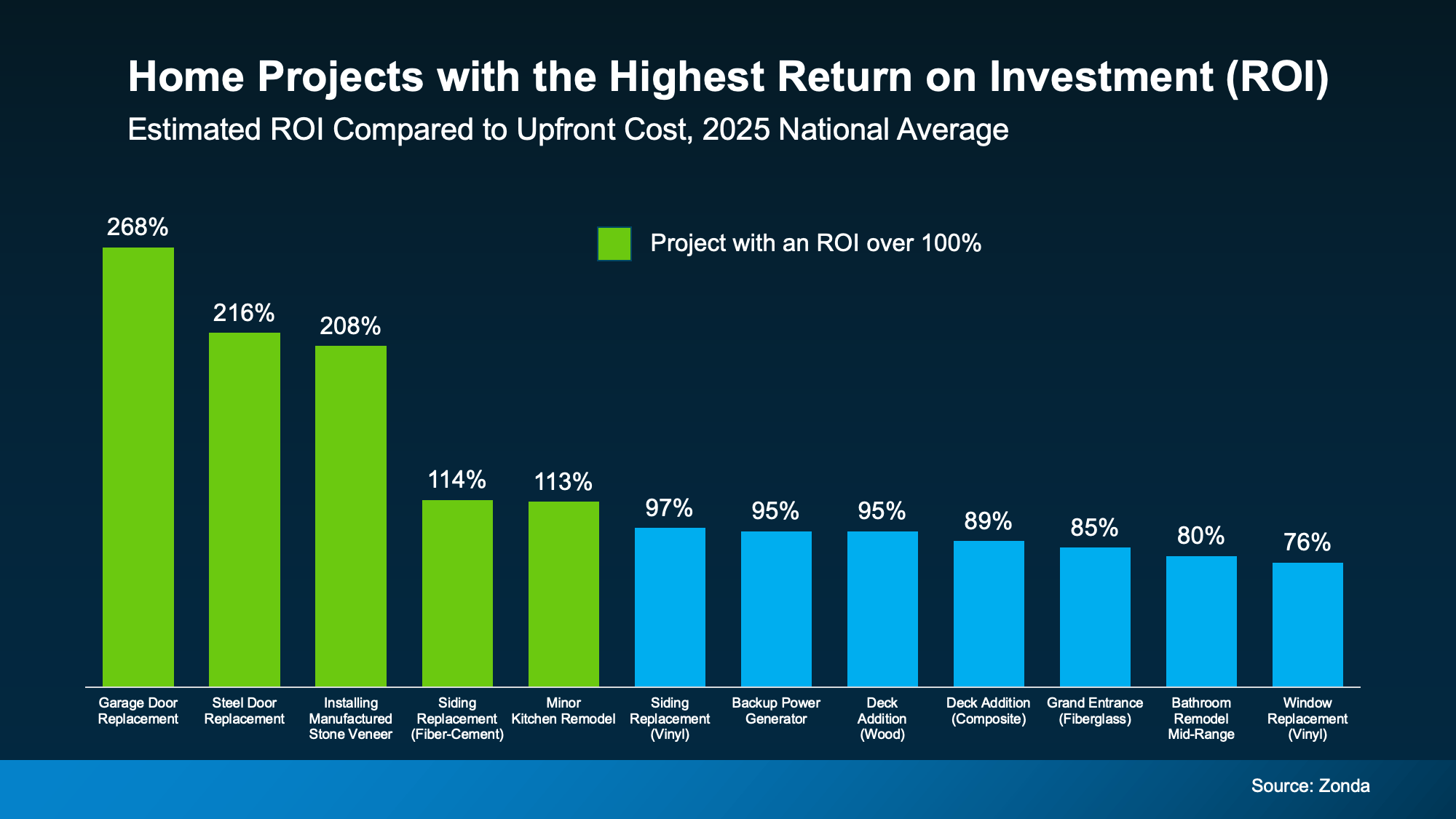

- Highlight Upgrades – Features like a new roof or storm windows can cut costs.

- Improve Your Credit – A stronger credit score can mean better premiums.

Bottom Line

If you’re thinking about buying a home, don’t forget to plan ahead for your homeowner’s insurance.

While costs are rising, knowing what to expect and how to shop around can make a big difference as you’re budgeting for your purchase. Because this isn’t coverage you’ll want to skimp on. It’s your best protection for what’s likely your biggest investment.

The Part Sellers Don’t See Coming

The Part Sellers Don’t See Coming

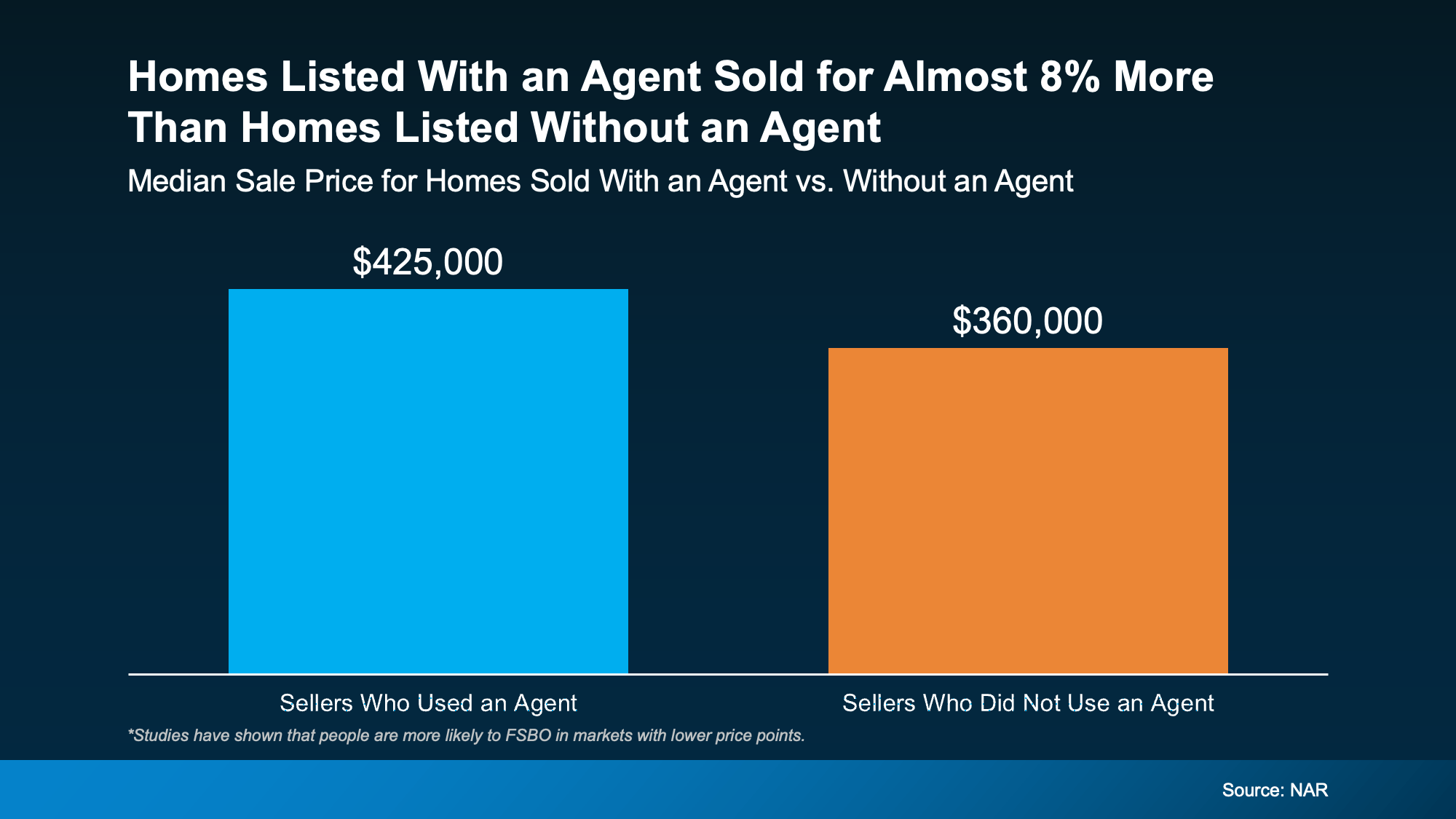

How an Agent Can Help

How an Agent Can Help