Inventory Increases on Mt. Hood

Want To Buy a Home On Mt. Hood? Now May Be the Time.

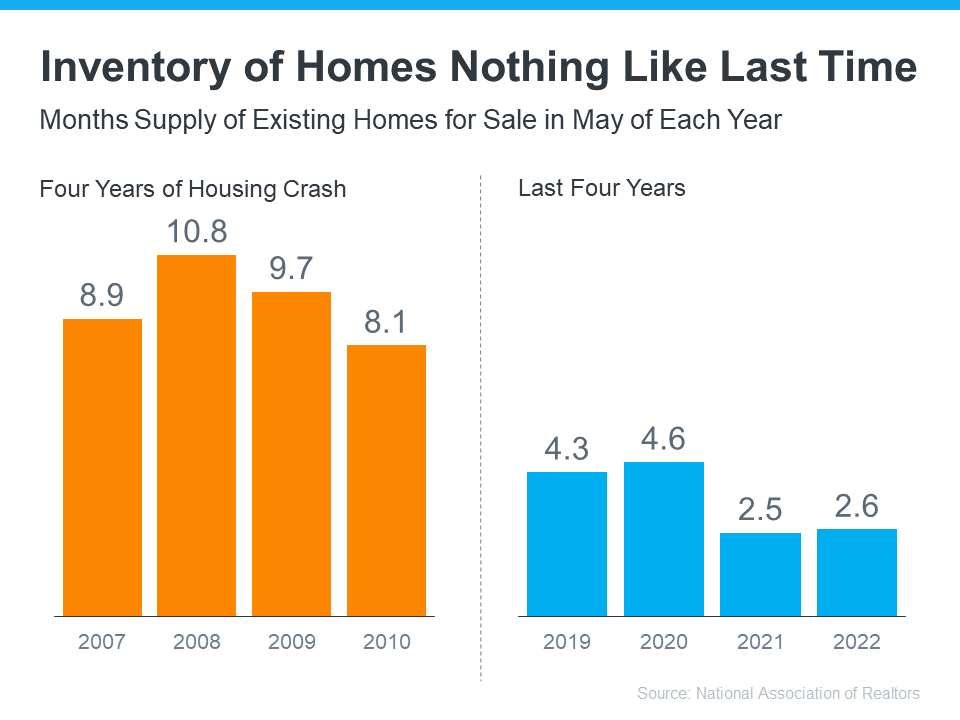

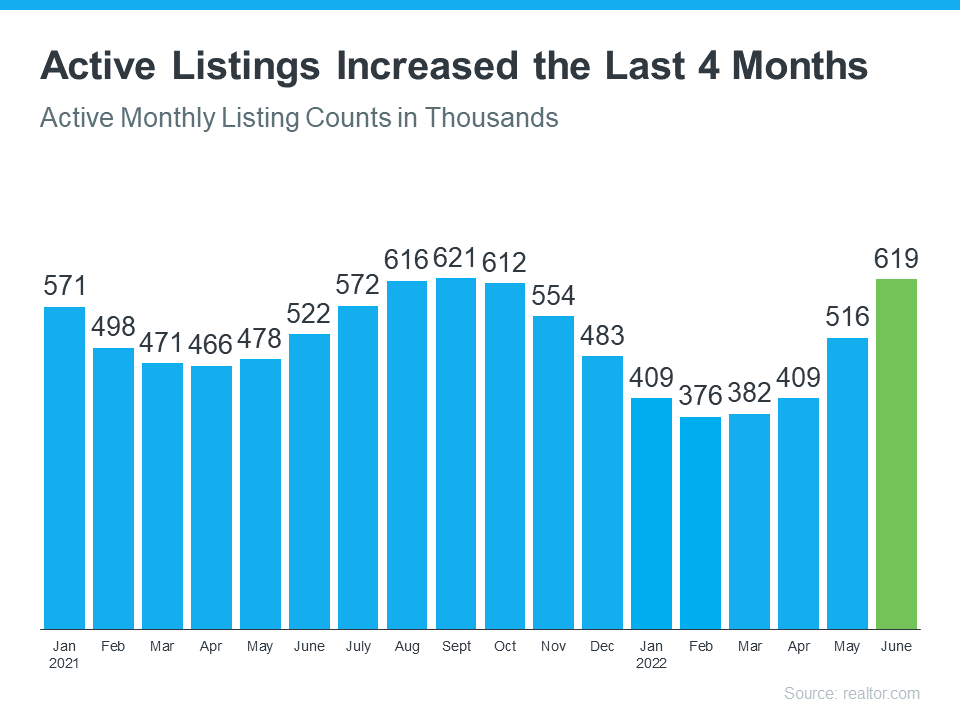

There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic.

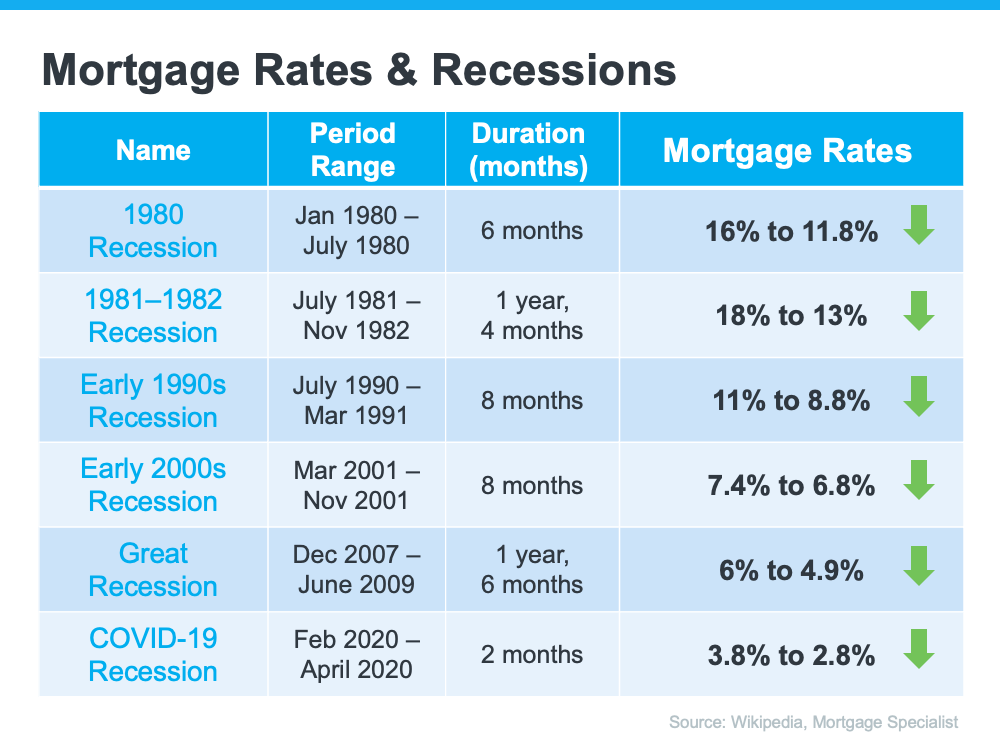

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you:

“This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession. . . They’ll have fewer buyers to compete with.”

Two Reasons There Are More Homes for Sale

The first reason the market is seeing more homes available for sale is the number of sales happening each month has decreased. This slowdown has been caused by rising mortgage rates and rising home prices, leading many to postpone or put off buying. The graph below uses data from realtor.com to show how active real estate listings have risen over the past four months as a result.

Mt. Hood has 36 active listings from Government Camp to Brightwood. This is the most we've seen in a very long time!

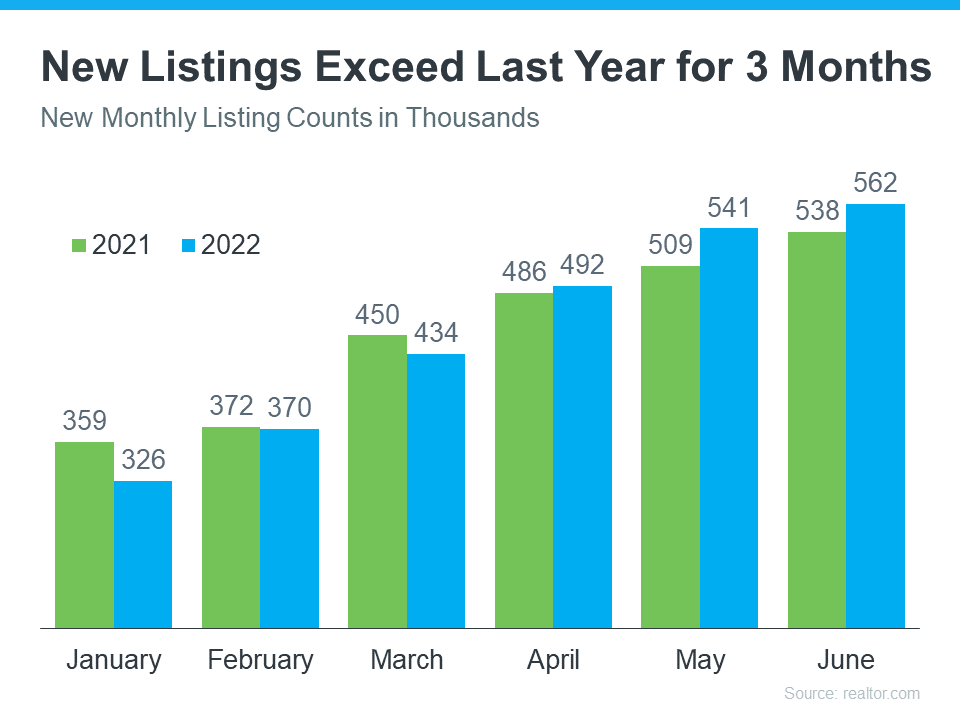

The second reason the market is seeing more homes available for sale is because the number of people selling their homes is also rising. The graph below outlines new monthly listings coming onto the market compared to last year. As the graph shows, for the past three months, more people have put their homes on the market than the previous year.

Bottom Line

The number of homes for sale across the country is growing, and that means more options for those thinking about buying a home. This is the opportunity many have been waiting for who were outbid or out priced last year.

![Great News About Housing Inventory [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/07/21111905/20220722-MEM-1046x2035.jpg)

![Real Estate Consistently Voted Best Investment [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/06/30083243/20220701-MEM-1046x2020.png)

.jpeg)

.jpeg)

.jpeg)