Christmas Tree Cutting on Mt. Hood

From our good friends in the Mt. Hood National Forest

|

||||||||||||||||||||||

Displaying blog entries 111-120 of 447

From our good friends in the Mt. Hood National Forest

|

||||||||||||||||||||||

![Should You Update Your House Before You Sell? Ask a Real Estate Professional. [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/16134552/Should-You-Update-Your-House-Before-You-Sell-Ask-A-Real-Estate-Professional-MEM-1046x2648.png)

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

Check out local numbers for Mt. Hood! Only twenty eight properties currently for sale and a two month supply of inventory. It's a great time to have your property for sale on Mt. Hood.

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says:

“. . . don’t expect a housing bust like the mid-2000s, as lending standards in this housing cycle have been much tighter and homeowners have historically high levels of home equity, so there likely won’t be a surge in foreclosures.”

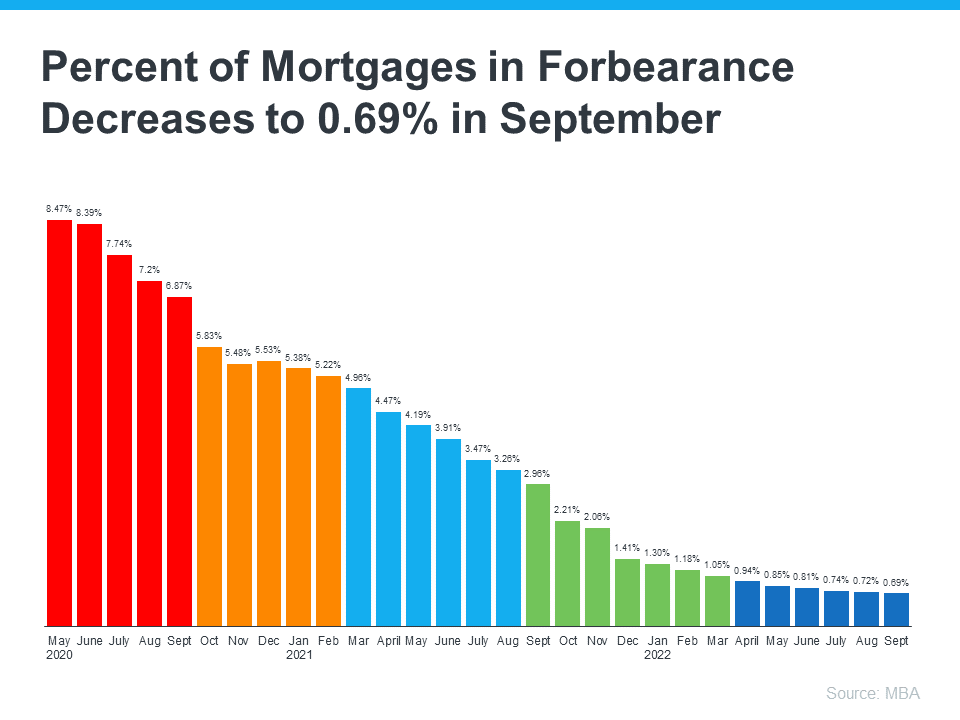

Data from the Mortgage Bankers Association (MBA) helps tell this story. It shows the overall percentage of homeowners at risk is decreasing significantly with time (see graph below):

But even though the volume of homeowners at risk is very low, there is still a small percentage of homeowners who may be coming face to face with foreclosure as a possibility today. If you’re facing difficulties yourself, it can help to understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

But even though the volume of homeowners at risk is very low, there is still a small percentage of homeowners who may be coming face to face with foreclosure as a possibility today. If you’re facing difficulties yourself, it can help to understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

“Typically, default is triggered when a borrower misses a specific number of monthly payments . . . Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property.”

The good news is there are alternatives available to help you avoid going through the foreclosure process, including:

But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment.

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

In today’s real estate market, many homeowners have far more equity in their homes than they realize due to the home price appreciation we’ve seen over the past few years. According to CoreLogic:

“The total average equity per borrower has now reached almost $300,000, the highest in the data series.”

So, what does that mean for you? If you’ve lived in your house for at least a few years or more, chances are your home’s value, and your equity, has risen dramatically. In addition, the mortgage payments you’ve made during that time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains how equity can help:

“Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

To find out how much equity you have, work with a local real estate professional. They can give you an estimate of what your house could sell for based on recent sales of similar homes in your area. You may be able to sell your house to avoid foreclosure.

If you find out you have to pursue other options, your agent can help with that too. They’ll be able to connect you with other professionals in the industry, like housing counselors, who can look into your unique situation and offer advice on next steps if selling isn’t your best alternative.

If you’re a homeowner facing hardship, let’s connect so you have an expert on your side to explore your options and see if you can sell your house to avoid foreclosure.

As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the location or size of your current home no longer meets your needs, finding a house that better suits your lifestyle may be a top priority for you. But with today’s cooling housing market, is it really a good time to sell your house, or should you wait?

If you’re ready to make your decision, here are three reasons you may want to consider selling before the holidays.

Typically, in the residential real estate market, homeowners are less likely to list their houses toward the end of the year. That’s because people get busy around the holidays and de-prioritize selling their house until the start of the new year when their schedules and social calendars calm down.

Selling now, while other homeowners may hold off until after the holidays, can help your house stand out. Start the process with a real estate professional today so you can get your house on the market and get ahead of your competition.

Even though housing supply has increased this year as buyer demand has moderated, it’s still low overall. That means there aren’t enough homes on the market today, especially as the millennial generation reaches their peak home buying years. As Mark Fleming, Chief Economist at First American, says:

“While not the frenzy of 2021, the largest living generation, the Millennials, will continue to age into their prime home-buying years, creating a demographic tailwind for the housing market.”

Serious buyers will still be looking this winter and your house may be exactly what they’re searching for. If you work with an agent to list your house now, you’ll be able to get in front of the eager buyers who are hoping to make a move before the year ends.

Don’t forget, today’s homeowners have record amounts of equity. According to CoreLogic, the average amount of equity per mortgage holder has climbed to almost $300,000. That’s an all-time high. That means the equity you have in your house right now could cover some, if not all, of a down payment on the home of your dreams.

And as you weigh the reasons to sell before winter, don’t lose sight of why you’re thinking about moving in the first place. Maybe it’s time to buy a house that’s in a better location for you, has the space you and your loved ones have been craving, or simply gives you that sense of home. A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

Mt. Hood inventory is LOW! We only have 32 properties for sale and seven are over a million dollars and six of them are in Mt. Hood Village. Mt. Hood Village is a park with mobile homes with park rent running $700 per month on up. That doesn't leave very many properties to choose from for today's buyers!

If you’re thinking about selling your house so you can find a home that better suits your needs, don’t delay your plans. Let’s connect so you can accomplish your goals before winter.

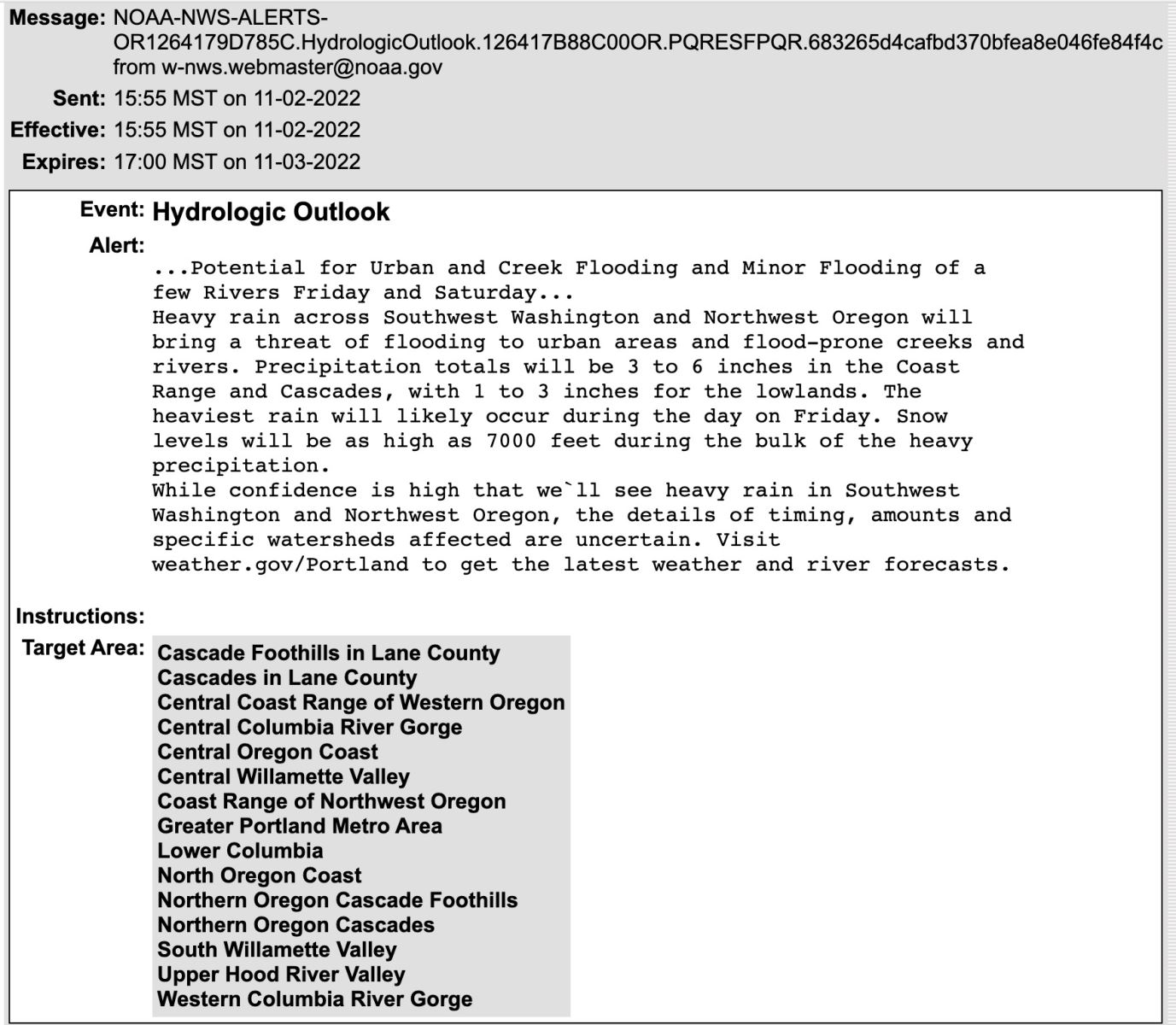

Direct From NOAA, Batten down the hatches and get the raincoat ready for Friday and Saturday!

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might encounter. And to do that, turn to trusted real estate professionals. They can help you plan your finances and prepare your budget.

Here are just a few costs experts say you can expect.

Saving for your down payment is likely top of mind as you set out to buy a home. But do you know how much you’ll need to save? While each situation is different, there’s a common misconception that putting 20% down toward your purchase is required. An article from the Mortgage Reports explains why that’s not always the case:

“The idea that you have to put 20% down on a house is a myth. . . . The right amount depends on your current savings and your home buying goals.”

To understand your options, partner with a trusted real estate professional to go over the various loan types, down payment assistance programs, and what each one requires.

Make sure you also budget for closing costs, which are a collection of fees and payments made to the various people involved in your transaction. Bankrate explains:

“Closing costs are the fees you pay when finalizing a real estate transaction, whether you’re refinancing a mortgage or buying a new home. These costs can amount to 2 to 5 percent of the mortgage so it’s important to be financially prepared for this expense.”

The best way to understand what you’ll need at the closing table is to work with a trusted lender. They can provide you with answers to the questions you might have.

If you want to cover all your bases, you can also consider saving for an earnest money deposit (EMD). An EMD is money you pay as a show of good faith when you make an offer on a house. According to realtor.com, it’s usually between 1% and 2% of the total home price.

This deposit works like a credit. It’s not an added expense – it’s paying a portion of your costs upfront. You’re using some of the money you already saved for your purchase to show the seller you’re committed and serious about their house. Realtor.com describes how it works as part of your sale:

“It tells the real estate seller you’re in earnest as a buyer, . . . . Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront.”

Keep in mind, an EMD isn’t required, and it doesn’t guarantee your offer will be accepted. It’s important to work with a real estate advisor to understand what’s best for your situation and any specific requirements in your area. They’ll help you determine what moves you should make in the homebuying process to have the greatest success.

Budgeting for your home purchase doesn’t have to be scary. Let’s connect so you’ll have an expert on your side to answer any questions you have along the way.

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time.

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home.

Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies.

The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time.

Another difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic:

“The total average equity per borrower has now reached almost $300,000, the highest in the data series.”

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has:

“Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

This goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

Displaying blog entries 111-120 of 447