Slash Burning in the Mt. Hood National Forest

|

||||||||||||||

|

||||||||||||||

|

Displaying blog entries 1-10 of 1876

|

||||||||||||||

|

||||||||||||||

|

Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from. So, know that if you’ve got moving on your mind, your house can really stand out.

There are several key reasons why there aren’t enough homes to go around and understanding them will help you see why the market is working in your favor if you’re ready to make a move.

1. Underproduction of Homes: For years, the industry hasn’t built enough homes to keep up with demand. As Zillow explains:

“In 2022, 1.4 million homes were built — at the time, the best year for home construction since the early stages of the Great Recession. However, the number of U.S. families increased by 1.8 million that year, meaning the country did not even build enough to make a place for the new families, let alone begin chipping away at the deficit that has hampered housing affordability for more than a decade.”

2. Rising Costs: Building materials, labor shortages, and supply chain disruptions caused by the pandemic have all made it harder and more expensive to build homes. This can either limit or stop new home construction in some areas.

3. Regional Imbalances: Some markets are more affected by the shortage of homes than others. Popular and more desirable areas have more people moving in faster than new homes can be built. The number of new building permits issued doesn’t always keep pace with job growth in these regions, and that leads to even tighter markets and higher prices.

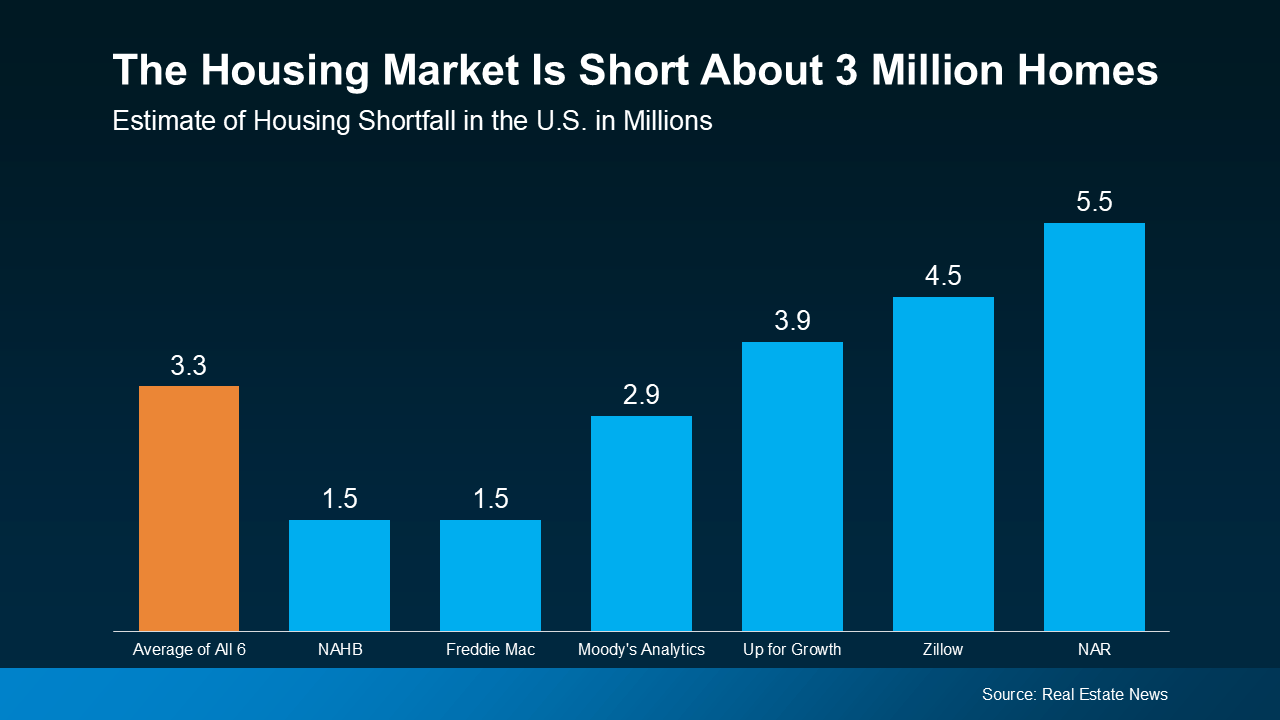

According to estimates from Real Estate News, the U.S. is facing a housing shortfall of roughly 3.3 million homes, based on an average of several expert insights (see graph below):

This shows there’s a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

This shows there’s a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

According to John Burns Research and Consulting (JBREC), over the next 10 years, the U.S. will need about 18 million new homes to meet projected demand, including homes for new households, second homes, and replacements for aging or unusable homes.

So, even though more homes are on the market compared to last year, there still aren’t enough of them to go around. This is where you can really win if you’re ready to sell your house.

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers. It’ll take years to climb out of this inventory deficit, and the market is still very tight. So, when buyers are competing for relatively few homes like they are right now, that creates more interest in the houses that are on the market, putting upward pressure on prices and ultimately working in your favor.

And since every market is different, it’s important to work with a real estate agent who understands local trends. They can help you price your house right and create a strategy to attract the right buyers.

While there are more homes for sale than there were at this time last year, there’s still a shortage overall. And this puts you in the driver’s seat as a seller. Let’s connect so you have someone who can help you take advantage of today’s market.

If you’re toying with the idea of selling your house, you’re probably wondering how much it’ll cost. To be honest, the final number will depend on several factors like the offer you accept, if you help with your buyer’s closing costs, how many repairs you tackle, and more.

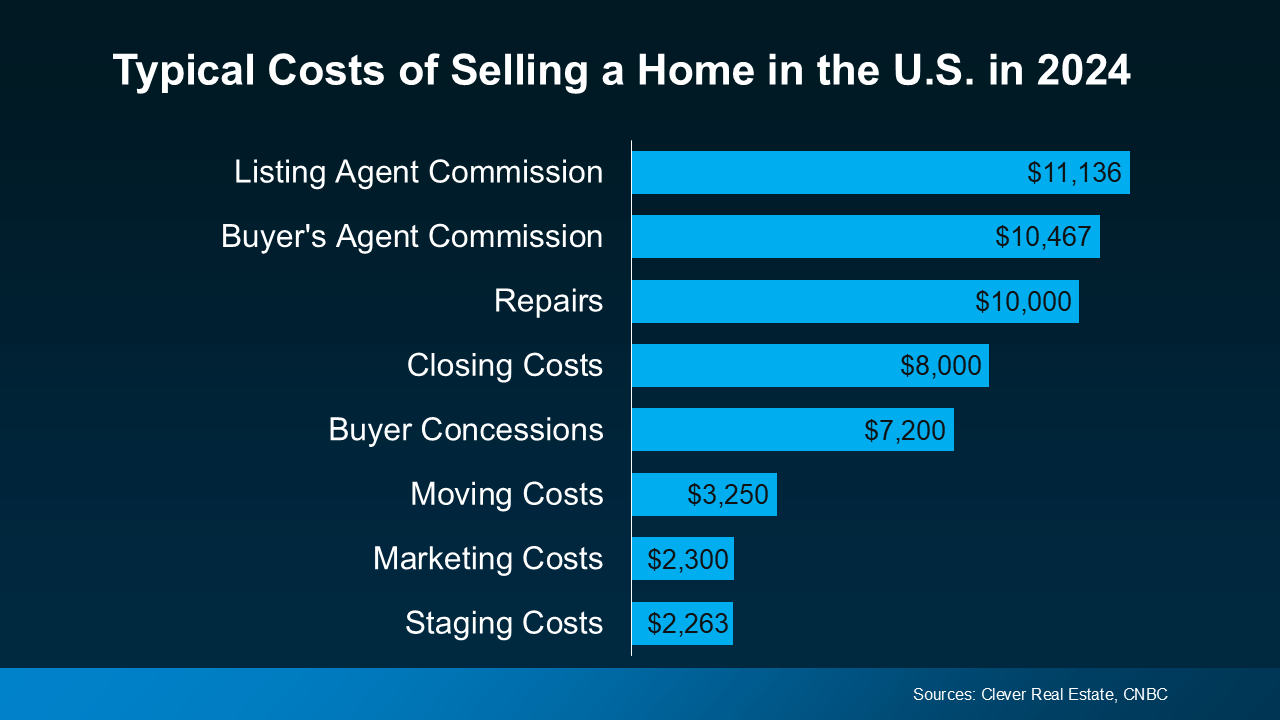

So, to give you a ballpark of what to expect, here’s some information on a few of the expenses you’ll want to be ready for (see graph below):

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

Let’s dive into a few of the costs from the graph above, so you have a bit more context on what they include and where you may be able to save some money, when it makes sense.

These are the fees you’ll pay at the closing table to cover various aspects of the sale. You’ll have your own closing costs and you may even offer to pay some of the buyer’s as a concession. As U.S. News Real Estate explains:

“Closing costs are fees that are paid to finalize the transaction and transfer ownership of the home to the buyer . . . Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price, this means that closing costs in 2023 for sellers are about $7,740 to $15,480. . .”

Taxes are going to vary by state and agent commissions depend on what you agree upon upfront. And keep in mind, that the numbers in the chart above are just an example, not exact figures. Not to mention, if you put money toward things like your property taxes, mortgage escrow, etc. as part of your current mortgage payments – there's a chance you’ll get a credit back at closing that can help offset some of these selling expenses.

One optional step some sellers take is having a pre-listing inspection. It gives you an idea of what may pop up later on in the buyer’s inspection – because those are the items a buyer may ask you to toss in a credit (or concession) to cover later on.

This allows you to get a jump on any repairs and tackle them before you list, so your house is set up to impress from the start.

Again, if you want to skip this step, an agent can help. They’ll be able to give you advice on things like paint colors, small cosmetic repairs, what buyers are looking for, and whether it’s worth tackling anything else ahead of time. This will help make sure you’re spending money on things that are most likely to net you a solid return on your investment.

As inventory grows, you may want to take a few extra steps to make sure your house stands out. Staging is an optional way to make sure your house shows well. It can include bringing in rental furniture if the house is vacant or art to warm up the walls. Some staging can even be done virtually once the photos are taken. But, in general, how much does it cost? According to Bankrate:

“Home sellers typically pay somewhere between $782 and $2,817 in home staging costs . . . but the price tag can vary widely.”

If you want to skip this step, you could opt to lean on your agent’s advice for what looks good and what may feel cluttered. A great agent will suggest things like removing a chair to open up the flow of a room, laying down a rug to add warmth to a space, or taking down photographs to de-personalize strategic areas.

If you’re looking to cut down on your costs, you have options. But be careful of where you trim. You may be able to skip staging or a pre-listing inspection since those are optional, but you don’t want to skimp and sell without a pro.

An agent is your go-to expert throughout the transaction. They’ll offer customized advice every step of the way, including how to stage the house and what repairs to tackle. This can help you avoid hiring an outside stager or having to pay for a pre-listing inspection.

But that’s not the only way your agent adds value. They’ll also create tailored marketing and pricing strategies that’ll highlight the house’s best assets and any work you did to get the home show ready. And that can actually help your house sell for more in the long run.

Want a better picture of what you should expect when you sell your house? Let’s have a conversation and walk through it together.

Mortgage rates have hit their lowest point in over a year and a half. And that’s big news if you’ve been sitting on the homebuying sidelines waiting for this moment.

Even a small decline in rates could help you get a better monthly payment than you would expect on your next home. And the drop that’s happened recently isn’t small. As Sam Khater, Chief Economist at Freddie Mac, says:

“Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.”

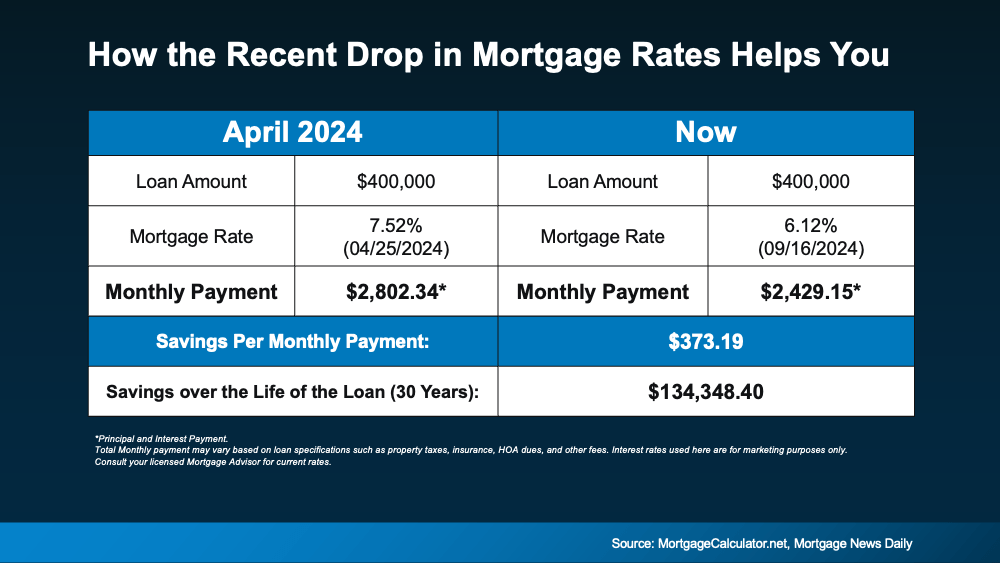

But if you want to see it to really believe it, here’s how the math shakes out. Take a closer look at the impact on your monthly payment.

The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house back in April (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

Going from 7.5% just a few months ago to the low 6s has a big impact on your bottom line. In just a few months’ time, the anticipated monthly payment on a $400K loan has come down by over $370. That’s hundreds of dollars less per month.

Going from 7.5% just a few months ago to the low 6s has a big impact on your bottom line. In just a few months’ time, the anticipated monthly payment on a $400K loan has come down by over $370. That’s hundreds of dollars less per month.

With the recent drop in mortgage rates, the purchasing power you have right now is better than it’s been in almost two years. Let’s talk about your options and how you can make the most of this moment you’ve been waiting for.

Have you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making sure you have someone you can go to for trustworthy information is extra important.

If you partner with a real estate agent, they can clear up some common misconceptions and reassure you by backing them up with research-driven facts. Here are just a few misconceptions they can help disprove.

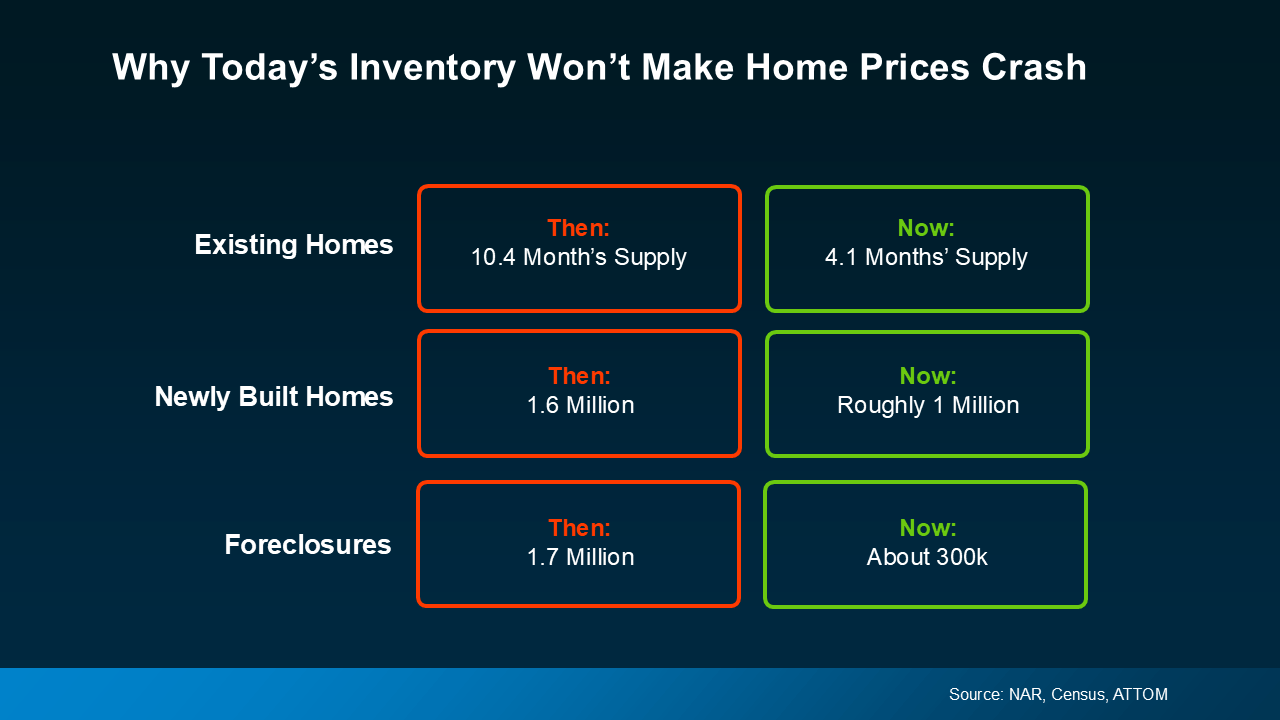

If you’ve heard home prices are going to come crashing down, it’s time to look at what’s actually happening. While prices vary by local market, there’s a lot of data out there from numerous sources that shows a crash is not going to happen. Back in 2008, there was a dramatic oversupply of homes that led to prices crashing. Across the board, there’s an undersupply of homes for sale today. That makes this market a whole different scenario (see chart below):

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

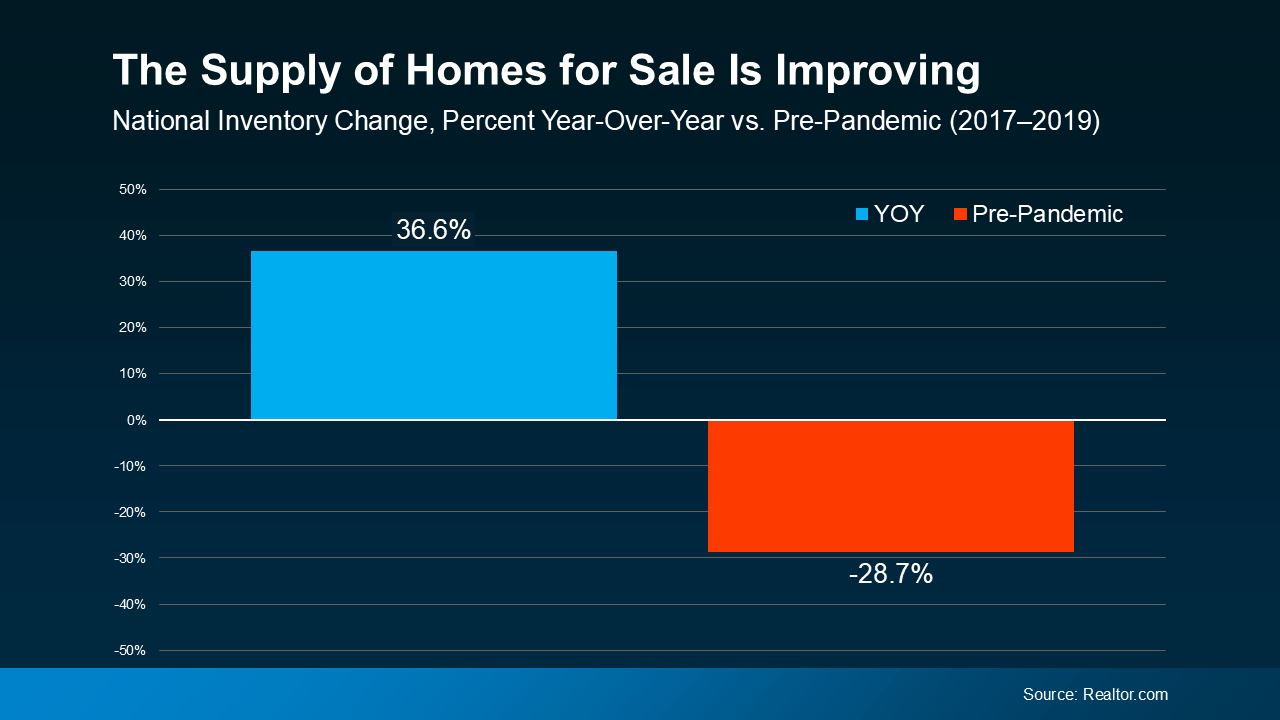

If this nagging fear about finding the right home if you move is still holding you back, you probably haven’t talked with an expert real estate agent lately. Throughout the year, the supply of homes for sale has grown. Data from Realtor.com helps put this into context. While there are still fewer homes on the market than in a more normal year like 2019, inventory is still above where it was at this time last year (see graph below):

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

Many people still believe you need a 20% down payment to buy a home. To show just how widespread this myth is, Fannie Mae says:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

And if you look at the data from the National Association of Realtors (NAR), you can see the typical homeowner isn’t putting down as much as you might expect (see graph below):

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need. And if you’re looking at that graph and you’re more focused on how the number for repeat buyers is closer to 20%, here’s what you need to realize. That’s only because they have so much equity built up in their current house that can be used to make a larger down payment for their next move.

This goes to show you don’t have to put 20% down, unless it’s specified by your loan type or lender. Many people put down a lot less. Not to mention, depending on the type of home loan you get, you may only need to put 3.5% or even 0% down. So, if you’re buying your first home, you likely don’t need nearly as much for your down payment as you may think.

If you put your move on pause because you heard one or more of these myths yourself, it’s time to talk to a trusted agent. An expert agent has more data and the facts, just like this, to reassure you and help break through any misconceptions that may be holding you back.

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts.

Displaying blog entries 1-10 of 1876