Mortgage Delinquencies on Rise?

Are Mt. Hood mortgage delinquencies on rise? Well, yes according to the Mortgage Bankers Association. In fact, since keeping track since 1972, last quarter was the highest first quarter of delinquencies since records have been kept.

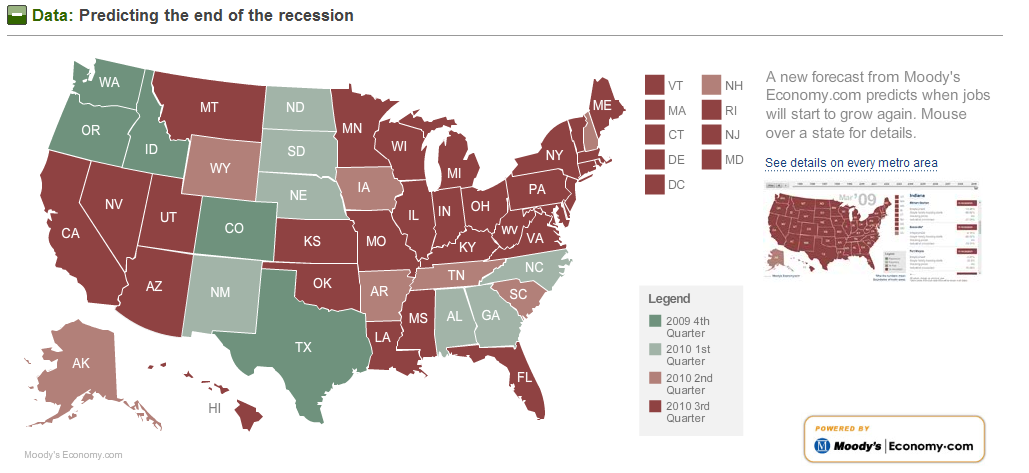

Unemployment and continued area job losses make mortgage payments difficult to meet. Although some reports say Oregon will see some job stability in the fourth quarter of 2009, most of the country is predicted to continue with higher unemployment well into 2010.

Top off the unemployment rates with increased foreclosure rates and the reset of subprimes coming up in '09 and '10 we should see more aftermath of bad loans impacting area homeowners.

Nationally one in ten of homeowners are in trouble with their loans. This seems to be a cascading effect that is inescapable if you have borrowed to the max or taken out home equity loans.

Stay tuned for the impact these events will have on the Mt. Hood market. So far the hardest hit area appears to be Government Camp. Not only did this area escalate in pricing at breakneck speed, like Bend, this market will take a very hard hit adjusting to current market conditions.