Homeowners Selling with a Real Estate Agent Just Hit a New High

Displaying blog entries 1-10 of 1972

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

After a stretch where many people felt stuck, 2026 is shaping up to be a year with more balance, more options, and more clarity for people who want to make a move. Not because the market is suddenly “easy,” but because several key conditions are shifting.

Here’s what the experts are saying you have to look forward to.

Danielle Hale, Chief Economist at Realtor.com:

“After a challenging period for buyers, sellers and renters, 2026 should offer a welcome, if modest, step toward a healthier housing market.”

The National Association of Realtors (NAR):

“Top economists have one word to sum up the housing market for 2026: opportunity. Lower mortgage rates and a rising supply of homes are expected to open up the housing market . . . something the real estate industry and potential home buyers and sellers have been waiting for, following three years of stagnation.”

Mark Fleming, Chief Economist at First American:

“. . . for the first time in several years, the underlying forces are finally aligned toward gradual improvement. Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power — even in a higher-rate world. Affordability won’t snap back overnight, but like a ship finally catching a steady tailwind, it’s now sailing in the right direction.”

Mischa Fisher, Chief Economist at Zillow:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

Just remember, while the national outlook is improving, conditions will still be different based on where you live. Some markets will move faster than others. Some will see stronger price growth. Others will remain flat. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Market performance will hinge on local economic conditions, making 2026 one of the most geographically divided markets we’ve seen in years.”

That’s why understanding what’s happening in your specific area is key. The national trends set the stage, but local dynamics determine how they play out for you. And that's why you need an agent.

If you want to talk through what’s expected for our local market and which trends you’ll want to take advantage of, let’s connect.

You may not want to put your homebuying plans into hibernation mode this winter. While a lot of people assume spring is the ideal time to buy a house, new data shows January may actually be the best time of year for budget-conscious buyers.

Kind of surprising, right? Here’s why January deserves a serious look.

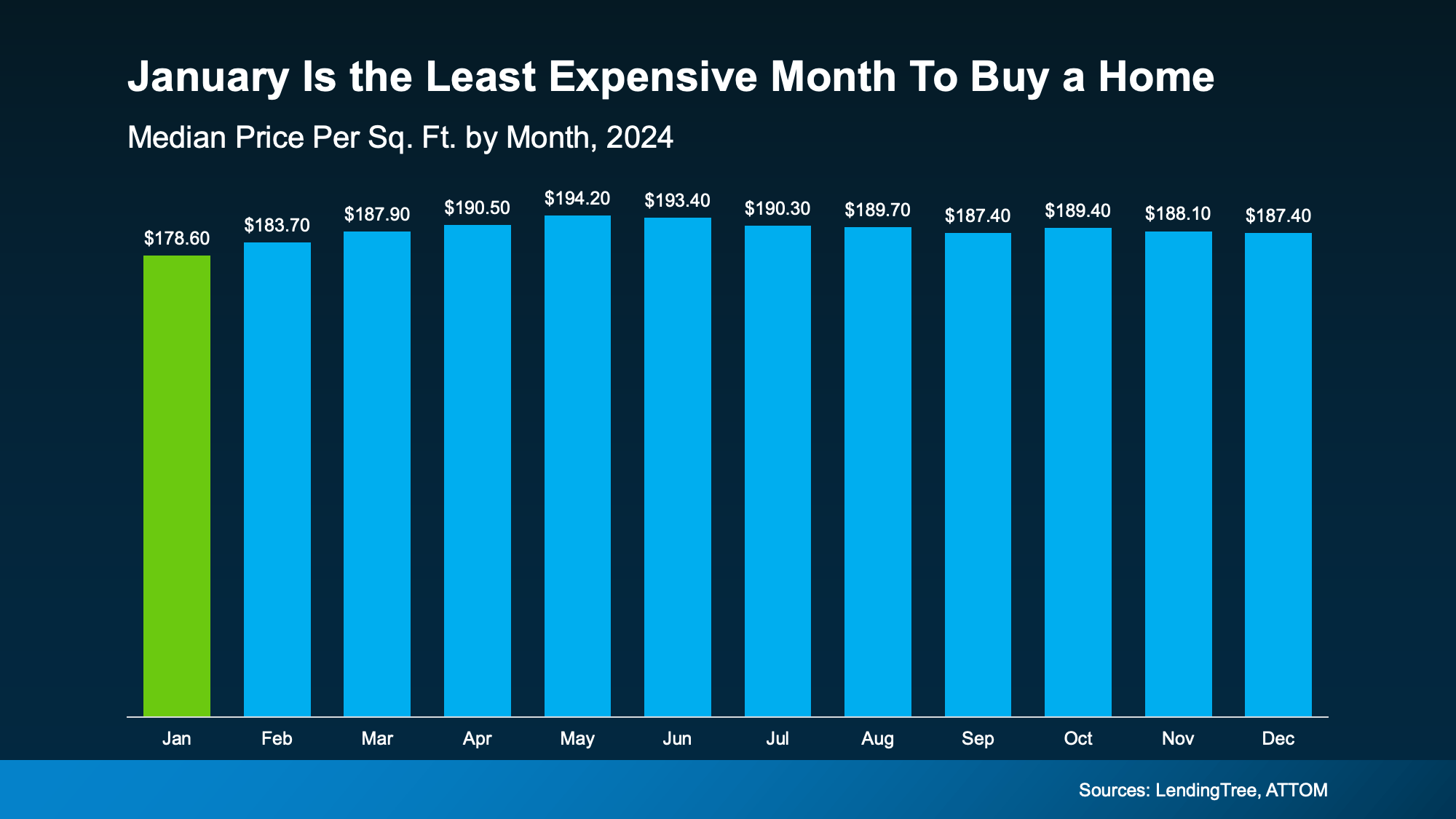

Lending Tree says January is the least expensive month to buy a home. And there’s something to that. January has historically offered one of the lowest price-per-square-foot points of the entire year. But the spring? That’s when demand (and prices) usually peak. And that’s not speculation – it's a well-known trend based on years of market data.

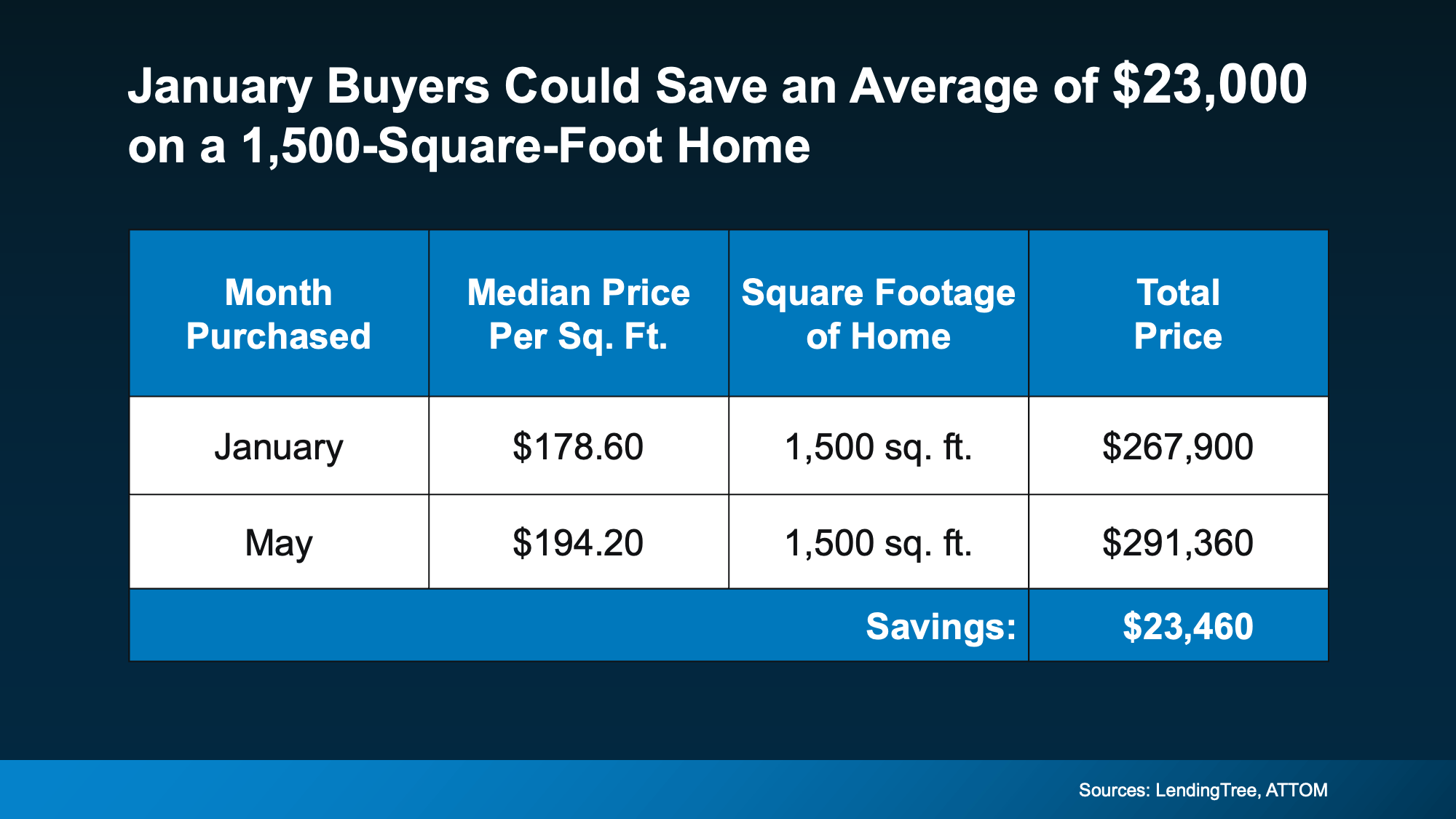

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it's meaningful savings, especially when affordability is still tight for so many households.

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it's meaningful savings, especially when affordability is still tight for so many households.

And why do buyers typically save in the winter? It’s simple. Winter is one of the slowest times in the housing market each year. Both buyers and sellers tend to pull back, thinking it’s better to wait until spring. And that means:

With fewer buyers in the market, you can take your time browsing.

But winter doesn’t just thin out the pool of buyers, it also reveals which sellers truly need to sell. Because fewer people are house hunting during the colder months, sellers who really need to move tend to be more open to negotiating. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions. . . these concessions can end up knocking thousands of dollars off the price of a home.”

This can include everything from price cuts to covering closing costs, adjusting timelines, and more. It doesn’t mean you’ll automatically get discounts on every home. But it does mean you’re more likely to be taken seriously and given room to negotiate.

Here’s the real takeaway. When you remove the pressure and frenzy that comes with the busy spring season, it becomes much easier to get the home you want at a price that fits your budget.

But if you wait until spring, more buyers will be in the market. So, waiting could actually mean you spend more and you’d have to deal with more stress.

Now, only you can decide the right timing for your life, but don't assume you should wait for warmer weather before you move.

Buying in January gives you: less competition, potentially lower prices, and more motivated sellers. And those are three perks you’re not going to see if you wait until spring.

If you’ve been thinking about taking the next step, this season might give you more opportunity than you think.

Curious what buying in January could look like for you? Let’s take a closer look at your numbers and the homes that are available in our area.

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage point this year, and that shift is starting to wake up buyers.

Home loan applications have risen. Activity has picked up. And sellers who step in early could benefit from the momentum long before the competition catches on.

Let’s take a look at what’s happening behind the scenes and how you can take advantage of it.

In today’s market, buyer demand is closely tied to what happens with mortgage rates. As rates come down, applications for home loans go up. Rick Sharga, Founder and CEO of the CJ Patrick Company, explains it like this:

“We’re in an incredibly rate-sensitive environment today, and every time we’ve seen mortgage rates drop into the low-to-mid 6% range, we’ve seen an influx of buyers hit the market.”

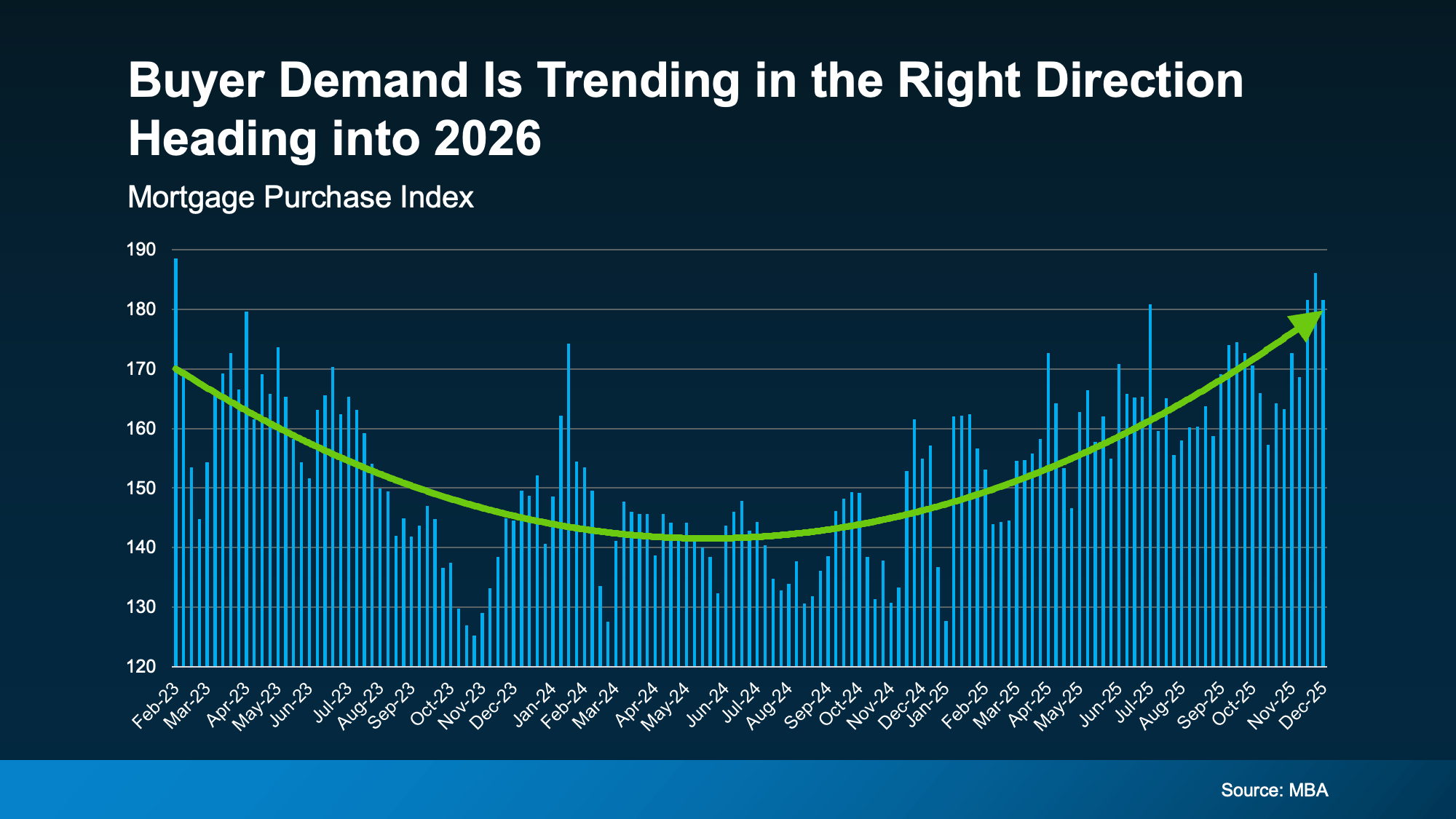

And that’s exactly what the data shows. More people who were sidelined are applying for mortgages again now that borrowing costs have come down. Of course, that’s going to ebb and flow just like rates ebb and flow. But the bigger picture is, there’s been improvement as a whole since rates started coming down.

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

The big takeaway for you is this. Now that rates have come down, buyers are starting to ease back into the game. And that’s turning into real contracts on homes just like yours.

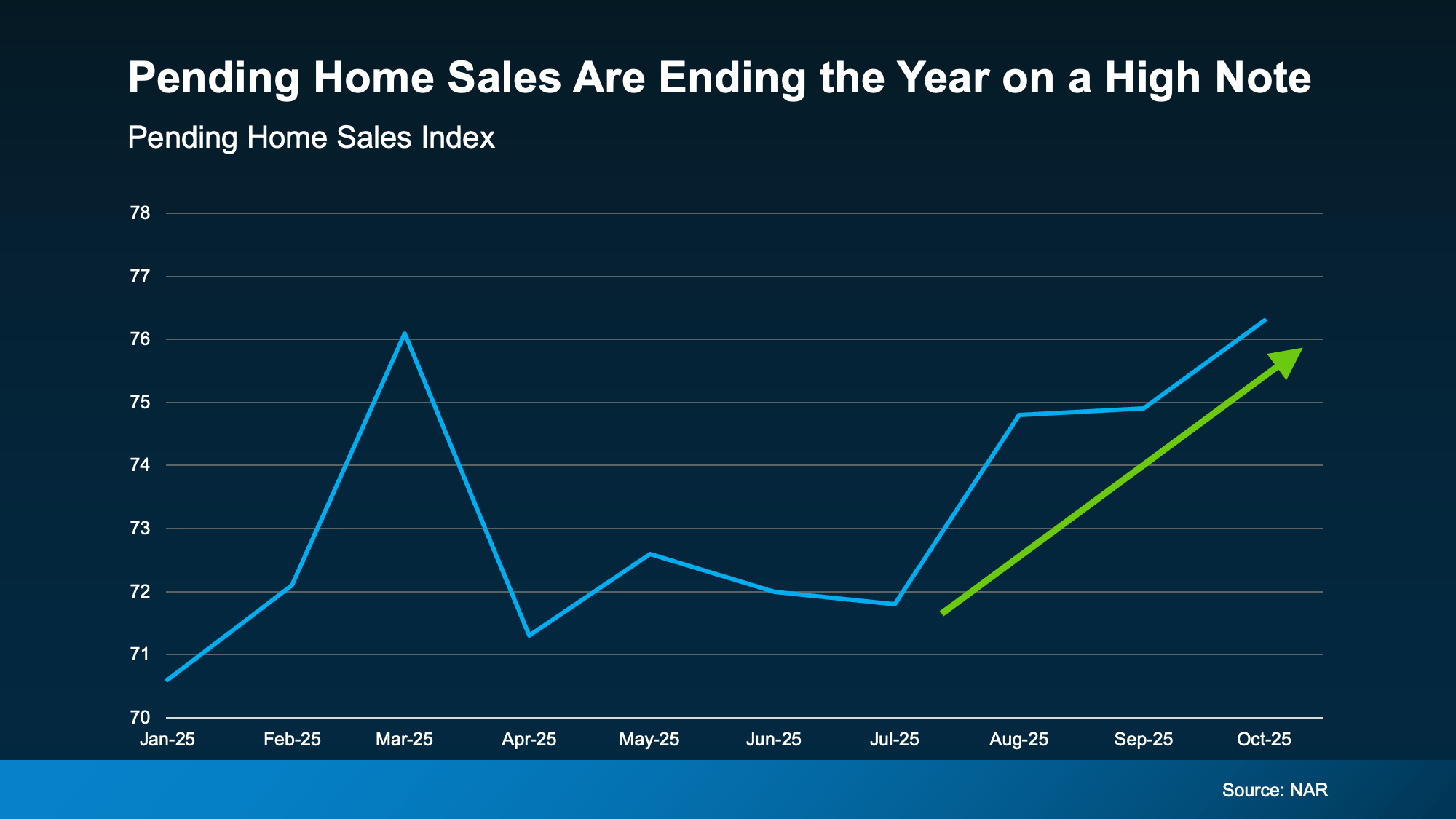

Just to really drive home that this is trending in a good direction, the most recent report from the National Association of Realtors (NAR) shows pending home sales (homes that are under contract) are picking up too. The Pending Home Sales Index is also at the highest it’s been all year (see graph below):

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

Pending home sales are a leading indicator of where actual sales are going. If more homes are going under contract, it’s a good sign more homes will actually close over the next two months, ultimately boosting sales. This could be part of why experts project home sales will inch higher in 2026 than they were in 2025 or in 2024.

Of course, this may ebb and flow a bit as we see some year-end volatility with mortgage rates. But, it shouldn’t be enough to change this overall trend. Expert forecasts say rates should stay pretty much where they are throughout 2026. That means the stage is set for this momentum to continue going into the new year.

Here’s the opportunity. Selling now means:

Whether you’ve been putting off selling because you thought buyers weren’t buying, or you took your house off the market because you weren’t getting any bites, this is your sign to act.

Want to know what's happening with buyer activity in our area, and what it could mean if you want to sell your house in the new year?

Let’s talk about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember...

A great rate won’t make up for a home that no longer works for you. Life changes, and sometimes, your home needs to change with it. And you’re not the only one making that choice.

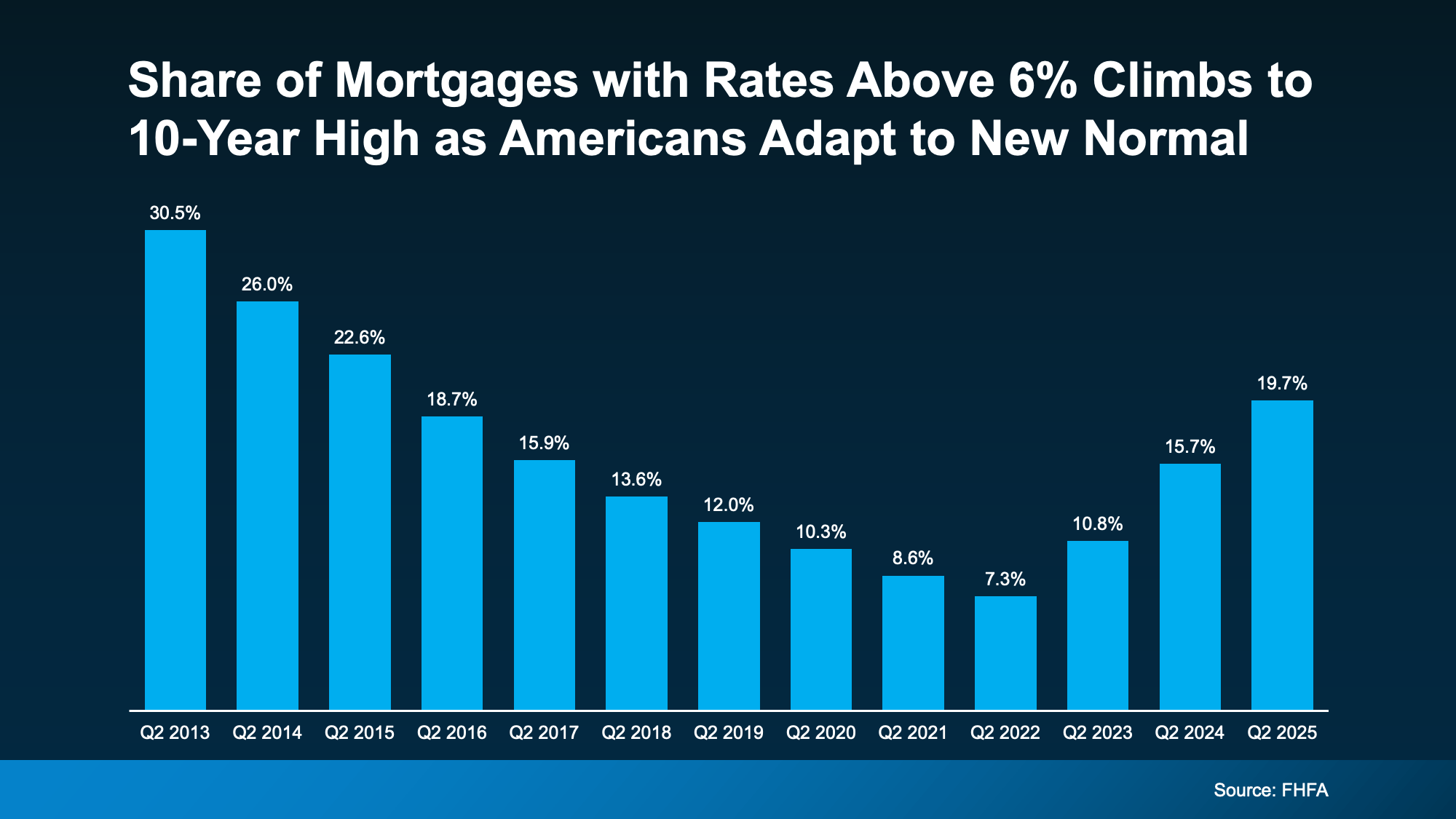

Many homeowners have been frozen in place by something the experts call the lock-in effect. That's when you won't move because you don’t want to take on a higher rate on your next home loan. But data from Federal Housing Finance Agency (FHFA) shows the lock-in effect is slowly starting to ease for some people.

The share of homeowners with a mortgage rate below 3% (the yellow in the graph below) is slowly declining as more people move. And while some of the people with a rate over 6% are first-time buyers, the number of homeowners with a rate above 6% (the blue) is rising as others take on higher rates for their next home:

And while it may not seem that dramatic, it’s actually a pretty noteworthy shift. The share of mortgages with a rate above 6% just hit a 10-year high (see graph below). That shows more people are getting used to today’s rates as the new normal.

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?It’s simple. Sometimes they can’t put their life on pause anymore. Families grow, jobs change, priorities shift, and a house that once fit perfectly may not fit at all anymore – no matter how good their rate was. And that’s okay. As Chen Zhao, Head of Economic Research at Redfin, explains:

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t standstill—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate.”

First American refers to these life motivators as the 5 Ds:

Whatever your reason, here’s what you need to think about. Yes, your low rate is great. But staying put means your life may stay on hold. And maybe that’s not working for you anymore.

According to Realtor.com, nearly 2 in 3 potential sellers have already been thinking about moving for over a year. That’s a long time to press pause on your plans. On your needs. On your family’s goals. So, maybe the question isn’t: “Should I move?”

It’s actually: “How much longer am I willing to stay somewhere that no longer fits my life?”

Because we’ve already seen rates come down from their peak earlier this year. And they're expected to ease a bit more in 2026. When you stack that on top of the very real reasons you may need a new home, it may be enough to finally move the needle for you.

Life doesn’t wait for the perfect rate. Maybe you shouldn’t either.

With mortgage rates down from their peak and forecast to dip slightly more in 2026, moving may be more feasible than you think. If you’re ready to see what’s possible in our market, let’s talk.

Whether it’s at a family gathering, your company party, or catching up with friends over the holidays, the housing market always finds its way into the conversation.

Here are the top three questions on a lot of people’s minds this season, and straightforward answers to help you feel more confident about the market.

Yes, more than you could a year or two ago.

The number of homes for sale has been rising over the past few years. According to data from Realtor.com, there have been more than one million homes on the market for six straight months, something that hasn’t happened since 2019 (see graph below):

Many homeowners who held off are realizing the shelves aren’t bare anymore. So, if you hit pause on your home search last year because nothing fit your needs, it may be worth another look. With more homes on the market now, you’re not competing for the same handful of listings like you were a couple of years ago.

And because there’s a bit more to choose from, homes aren’t disappearing the minute they hit the market. That gives buyers more space to breathe, more options to compare, and a little more time to make a confident decision.

Affordability is starting to improve. Finally.

It’s been a tough few years for buyers. But this year brought some much-needed good news:

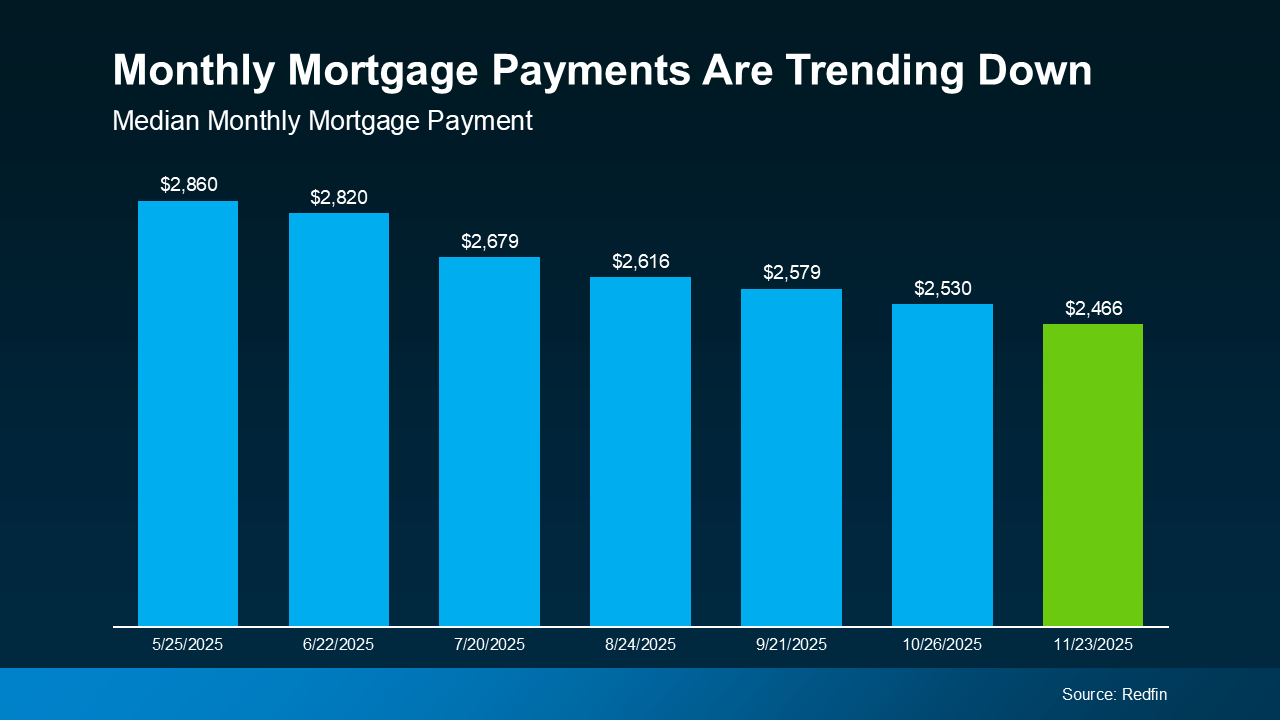

That adds up to a monthly mortgage payment that’s hundreds of dollars lower than it would have been just a few months ago (see graph below):

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

A lot of people worry that the housing market is about to crash, but the data doesn’t point in that direction. Yes, the number of homes for sale has been rising, but it’s still nowhere near the level needed for prices to fall significantly on a national scale. On top of that, homeowners today have a lot of equity and are in a much stronger financial position than they were back in 2008.

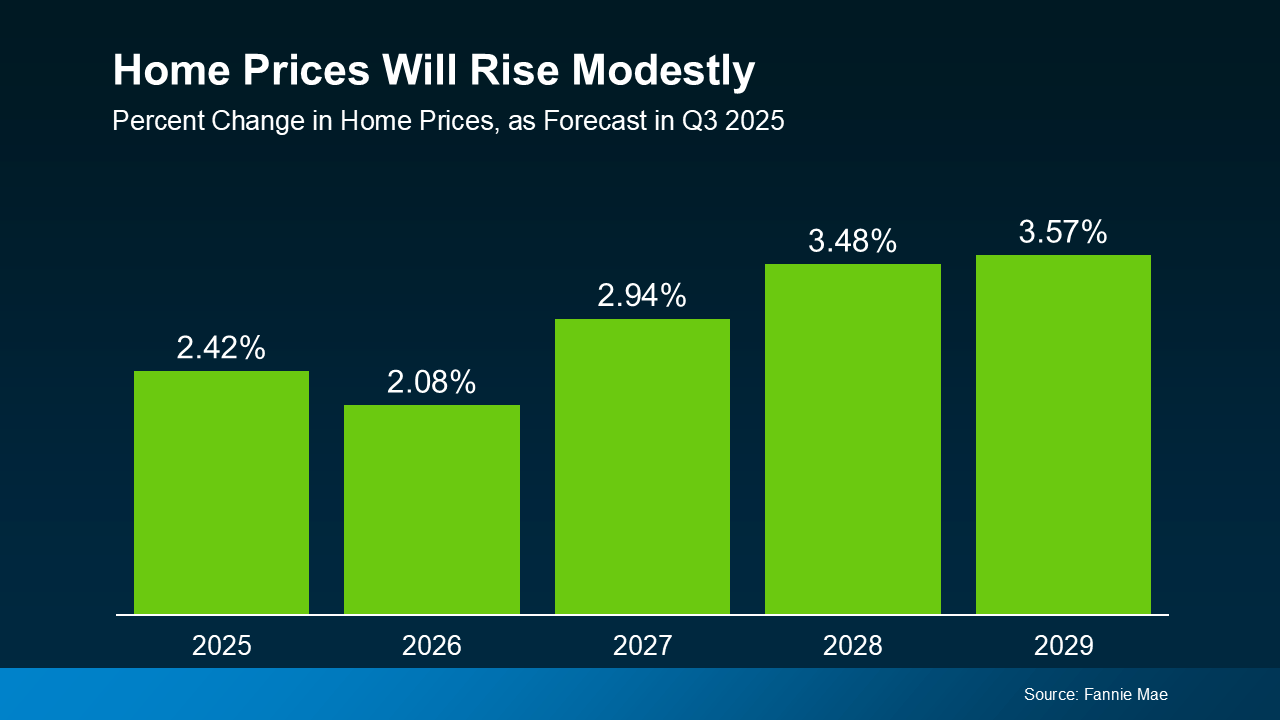

Of course, every local market is a little different. Some areas are still seeing prices climb, while others that saw huge spikes a few years ago are leveling off or seeing small corrections. But overall, the national picture is clear: experts surveyed by Fannie Mae project home prices will keep rising, just at a slower, more normal pace (see graph below):

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

Talk about the housing market can feel loud and confusing, especially when you’re hearing so many different takes. If you want to understand what these trends mean for your goals, let’s connect and walk through it together.

.jpg)

Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while.

Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook.

According to Realtor.com, about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so many things in today’s housing market vary by region, that number is consistent throughout the country. That tells you one thing...

No matter where you live, there’s a chance to score a better deal. You just need to know where to look. And that’s where your agent comes in.

Your agent can help you identify which homes have been on the market the longest. Those are the ones where you’re more likely to get a discount. That’s because the seller may be getting frustrated their house hasn’t sold yet, so they're more willing to play ball.

And since a lot of buyers steer clear of homes that aren’t selling, you may be the only offer they get. So, you can lean in and push for a better deal. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions . . . these concessions can end up knocking thousands of dollars off the price of a home.”

And they’re not the only ones calling out the opportunity you have right now. Bankrate also says:

“During the quieter fall and winter months, when fewer prospective buyers are shopping, home sellers may be more willing to lower their prices, or offer concessions, to attract those prospective buyers who are still looking.”

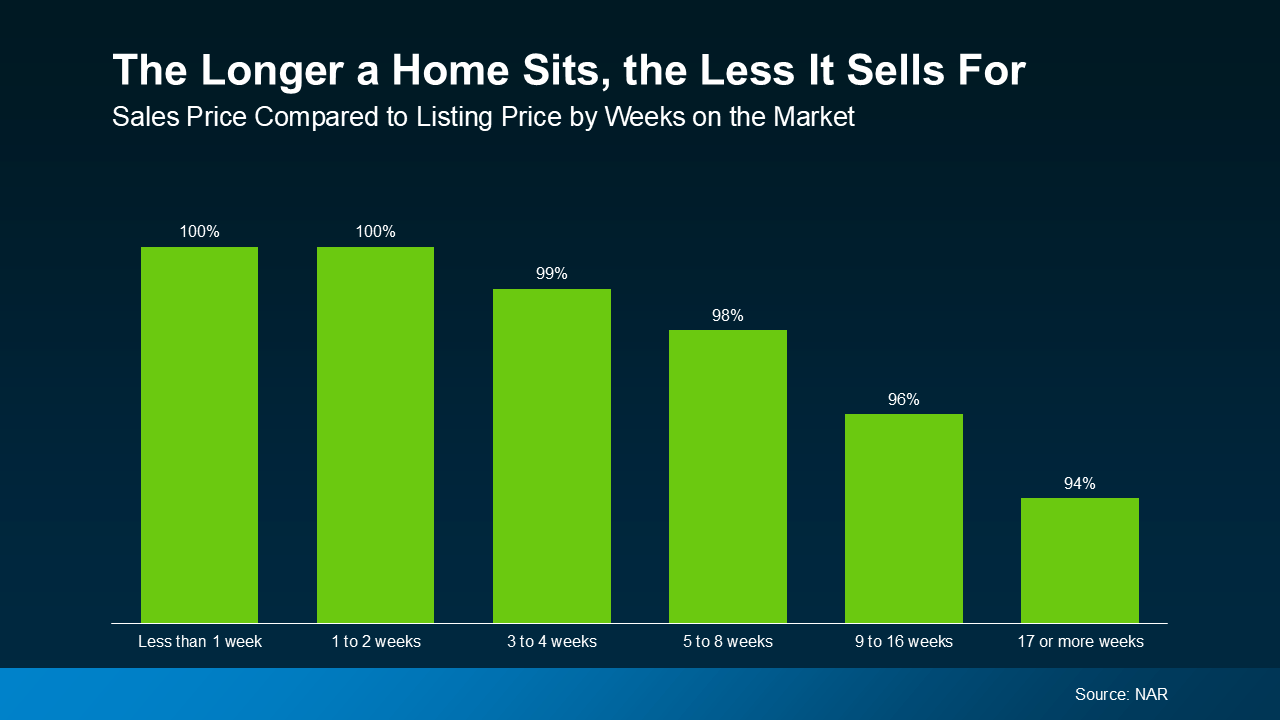

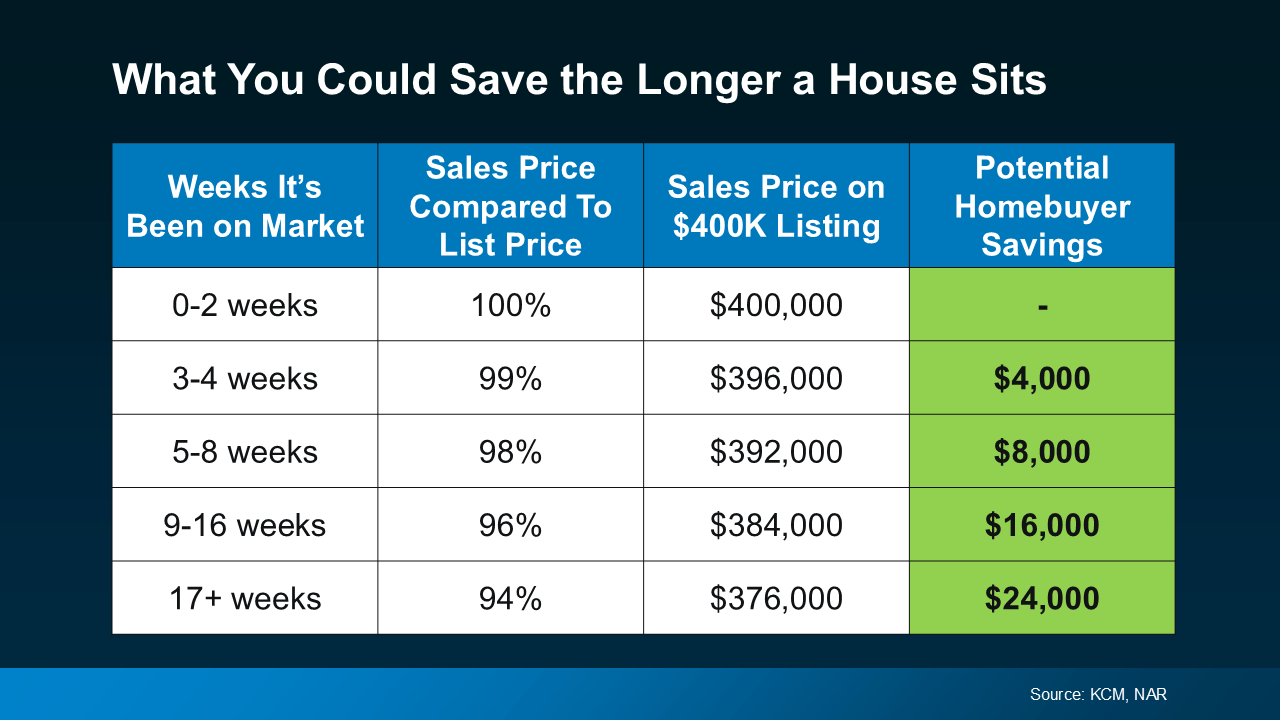

And the proof is in the data. The National Association of Realtors (NAR) shows a clear pattern: the longer a home stays on the market, the lower it tends to sell for compared to the original asking price.

So, if you’re serious about getting as much as you can for your money, focusing on these listings could be your best strategy yet.

So, if you’re serious about getting as much as you can for your money, focusing on these listings could be your best strategy yet.

And while paying 94% of the original asking price may not sound like much of a deal, the savings add up. That’s roughly $24,000 in savings on the median priced home (see chart below):

Zillow sums it up best:

Zillow sums it up best:

“If you’re a buyer who is hoping to strike a deal, look for homes that have been on the market for a while and that may already have lowered prices to entice buyers. You may find a motivated seller who is more willing to negotiate.”

If you want to find the best deal possible on a home right now, start by looking where others aren’t.

With 1 in 5 sellers cutting prices and many growing more flexible by the week, the homes that have been sitting a little longer could be your best opportunity to save.

Let’s talk about where to find them in our area.

Displaying blog entries 1-10 of 1972