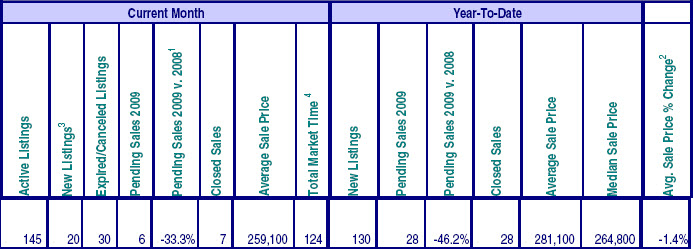

Many buyers in the Mt. Hood area have been trying to obtain loans or existing homeowners are trying to refinance and both groups are running into a few problems with appraisals. If you haven't heard, the appraisal industry-and everyone else- is in an uproar over HVCC (Home Valuation Code of Conduct), which is costing Mt. Hood buyers, sellers and refiancers and everyone a lot of money.

This video explains what is going on. It's a little "loud" but gets the point across. So, if you live in Brightwood, Government Camp, Welches or Rhododendron and you are looking at a refinance or a purchase, be prepared for the fact that you may not only need to pay for one appraisal but two to make your deal fall together.

My own recent experience with the appraisal issue came with a recent transaction. The first appraisal was 30% below the purchase price-out of area appraiser. The buyer passed on a second appraisal and left the transaction.

The second purchaser had their appraisal completed and came in much closer to the purchase price. All this happened within a month's time frame. Now, how can an appraisal completed within one month of each other be off 30%? This is a text book example of getting an appraiser who knew nothing about our area and one that did.

There is an area to sign a petition to get rid of this HVCC on the video page and I would advise everyone to sign the petition and pass it along to your friends. The housing market is in enough trouble as it is when an even bigger elephant in the closet is the HVCC costing extra fees and impacting home values throughout our area!