Oregon Trail School Bond Passes

Dr. Shelley Redinger , superintendent of the Oregon Trail School District sends this thank you:

Displaying blog entries 1-10 of 49

Dr. Shelley Redinger , superintendent of the Oregon Trail School District sends this thank you:

Looking to purchase a foreclosure in the Mt. Hood Area? foreclosures are popping up in Welches, Government Camp, Rhododendron and Brightwood.

Foreclosure and Short Sales Info

Over the last 24 months, Oregon went from number 2 to having the 23rd highest foreclosure rate on a national basis. As of September 2008 there have been 2,344 foreclosure filings which equivocate to 1 filing for every 644 housing units. Foreclosure filings are up 26% from August 08 and up 139% from September 2007. The majority of these distressed properties are located in the greater Portland metropolitan area.

In comparison, the state of California, which accounts for ~60% nationally of all foreclosure activity has 69,548 properties with foreclosure filings, equivocating to 1 in every 189 housing units. Washington has 1 foreclosure filing out of every 1,383 housing units.

Below are some comments from our partners that actively work in this arena.

Short Sales - An option for those who have money & the time. A short sale is where a property owner wants to sell their home but they have a higher mortgage debt on the property than the price they can sell the house for. First, seller and buyer must agree on a price and then they go to the lender with comparable homes sales data to support the decline in value plus a compelling story and documentation that proves the seller does not have the funds to pay off the entire mortgage due. Sound simple? Not really. Short Sales on average take 90-120 days to complete if successfully negotiated. Clients and real estate brokers should work with a professional who knows the ropes. Investment property owners who sell under a Short Sale agreement should be aware of the new exclusionary rule coming that will tax all or a portion of the ‘gain’ the home seller realizes from a short sale closing. A big thanks for sharing this information Kim: Kim Dodge at Usher Financial (503) 595.1600

Are we glad October is over? What a wacky month! Between the fluctuating stock market and election news I am more than ready for November! The weekend rain has done a good job of knocking another third of the leaves down for yard clean up. I am having my ususal fall back transition issues and getting my internal clock adjusted. What the hec am I'm doing up this early? I don't know.

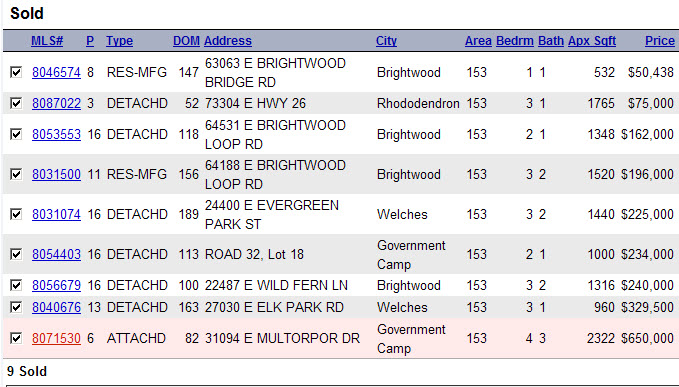

So, here are the numbers! These are the sales for October for Government Camp, Welches, Rhododendron, and Brightwood:

The good news is that Government Camp had another sale over $500,000! This market has been hard hit with few sales of single family homes in the upper price range.

One forest service cabin closed this month. This segment also has lots to choose from and less buyers making it quite competitive. New lease fees are coming up this January so we will see what the increase does to inventory at that time.

Ok, it's on to November and election night is tomorrow. Hopefully once this is settled things will loosen up a bit.

You will love this end of the road seclusion on a super sunny acre with the sounds of the Sandy River out your windows. This well maintained ranch boasts three bedrooms, two baths with 1368 square feet of living space. There is a bonus den or family room with skylight and slider off to the back deck than runs along the entire length of the house. The property borders BLM land so you literally feel like you have a private park out your back door. Walk down to the river and watch the fish go by.

Sit in your living room and listen to the sounds of the river or after a big day on the slopes, hit the hot tub on your covered deck.

This location is closer in to Sandy yet a short drive to the slopes and the Mt. Hood National Forest. The best of both worlds.

Many buyers are searching for foreclosures in Government Camp, Welches, Rhododendron and Brightwood. The Mt. Hood area has relatively few foreclosures compared to other areas near the Portland metro area and Portland itself. The majority of homes that have shown up as foreclosures have been in the Timberline Rim subdivision.

Most of these foreclosed homes in Timberline Rim are under $300,000 and the majority fall in the low $200,000 range or less. When compared to subdivisions closer in such as in Sandy and the Happy Valley area, we have really not had the hard hits that many of these newer subdivisions have had. Lack of available land to develop with"new subdivisions" in the past couple of years has caused an escape from this problem.

foreclosures do bring values down. Banks price these homes to go out the door. These foreclosure sales will be used as comparable for conventional loans. New lending rules require home sales in the past two to three months to be used as the comparables whether foreclosures or not. They will help establish values for bank loans to buyers.This s the bad news.

The good news is that once the inventory of foreclosed homes are gone, existing home inventory gets adjusted to "market" and gets sold, values will stabilize and eventually we will be back to a more equal market for buyers and sellers.

Sales for Welches, Rhododendron, Government Camp and Brightwood in September hit a total of 10 accroding to the Market Action section of the RMLS, multiple listing service. Pending sales were down 33% and our total sales hit a decline of 11.5% for the year.

On the ground we are seeing an average sale price decline and the upper end of the market from $500,000 on up has disappeared and completely flattened. This comes from a combination of things. A massive inventory, high interest rates for jumbo loans, the credit crunch taking lots of buyers out of this market and slower economic times.

The chief economist for the National Association of Realtors, Lawrence Yun and others see a recession through at least the next three quarters. Some areas of the country have already corrected back to 2002 and 2003 pricing levels. There is no doubt about it, our area needs to make this correction too in order to reduce inventory levels.

The biggest hoop to jump through as a seller and agent is the bank appraisal. foreclosures will be used for comparables and these sale prices will quickly adjust the market downward. This is a difficult pill to swallow for many sellers who are still thinking in terms of 2004 and 2005 but reality will strike so the sooner the adjustment is made the quicker the market will equalize.

It's an incredible time to buy properties if you qualify. Rates are still very low and with the amount of inventory available it's a feast of opportunity. We are fortunate to live in one of the most desirable areas of the country with a predicted quicker recovery than most states. The increased population to Oregon alone makes this a no brainer opportunity.

This is big news for buyers and sellers who are closing real estate transactions in Welches, Government Camp, Rhododendron or Brightwood. Clackamas County, as of November 1st of this year, will be closed on Fridays. Their new hours will be 7:00 AM to 6:00 PM Monday through Thursday. So, keep this in mind if you are recording documents or going to the county with questions or getting building permits.

One of a kind location and a one of a kind cabin. If you've ever dreamed of the perfect Mt. Hood cabin, this might be it. Original 1927 cabin with paned windows, wood floors, stone fireplace and plenty of space with great deck and steps to Still Creek on a private gated road. Ambinace plus with high ceilings, a wide open kitchen and dining area for gatherings, two private bedrooms and a bonus bunk room or play room for kids. Still Creek is one of the top ten Mt. Hood waterways. It's steps away from this cabin.

Enjoy a quick drive to premium ski areas or take a walk through the woods to hiking or mountain biking trails.

This location is very quiet and secluded compared to many. Located in the Mt. Hood National Forest on leased land.

Take a tour of this Mt. Hood Natrional Forest Cabin here

If you are considering using an investor loan to purchase properties in the Mt. Hood area of Brightwood, Welches, Rhododendron and Government Camp consider this, If your lender is selling their loan to Fannie Mae they are going to add on substantial fees to your loan after December 1st. Depending upon your downpayment, these fees could be anywhere from 3 to4% and maybe even greater. Some private mortgage insurers may stop insuring investor loans altogether.

So, if you are an investor you should find your property now and lock your rate in the next six weeks and close before December 1st to insure you don't get caught with higher fees or the inability to buy at all!

If you are looking at condos in the Welches, Rhododendron, Brightwood and Government Camp areas you will need to know the new future lending requirements on Condo projects. This may affect Golden Poles, Thunderhead Lodge, Eidelweiss, Sno-Bird, Collins Lake and Grand Lodges, Fairway Estates, Clear Hills, and Shadow Hawk condo units.

Rules are coming down the pike that if investors own more than 49% of the units, in other words, if they are not owner occupied or second homes, the project may not qualify for convenetional financing.

I am not sure of trhe exact date this may happen but be advised that we may see many owner carried contract sales in the future.

Displaying blog entries 1-10 of 49