Friends,

Tuesday, March 3, 2009 at 3 PM the Villages at Mt. Hood Board of Directors will hold a Special Meeting at the Mt. Hood Village Resort.

This meeting was called to "fact find" and disclose to the community 2 issues:

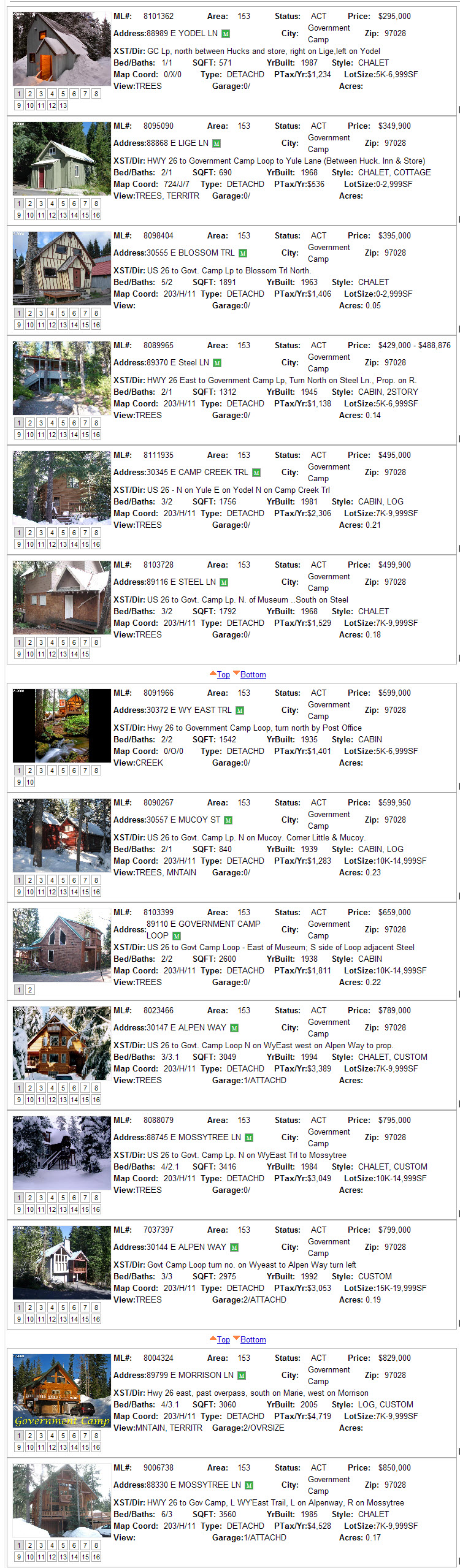

Issue 1. ODOT has awarded a contract to repair the highway 26 slide in downtown Sandy that will involve drilling and blasting 16,000 cubic yards of rock AND dumping 12,000 cubic yards of road spoils in our community. The explosive mining and dumping area is the property along the Salmon River in the vicinity of the Cedar Ridge Property next door to Mt. Hood Village Resort. The access to this property is Miller Road at Milepost 38.06 on Highway 26,

Issue 2: In June of 2006, Clackamas County came to the Villages at Mt. Hood Board of Directors and asked us to endorse a land sale of the Cedar Ridge Property to Western Rivers Conservancy. This 170+/- property sale was explained to us as a way to protect the Salmon River watershed. Recently it has come to light that Clackamas County sold an additional 245 acres of land to the same organization. The additional sale was not disclosed to our community. It appears the timberland was sold for about $5,800 and acre as a private sale, without public disclosure.

Please consider attending this meeting. It is very, very important that we have a stong showing of community interest at this Special Meeting.

How can you help?

1. Attend!

2. Get the word out and get as many people as you can to the meeting!